China's economic reform and opening-up policy introduced a pragmatic economic approach that emphasizes practical results rather than ideology. This approach is known as "socialism with Chinese characteristics", and although its specific meaning is constantly evolving, it basically refers to an economic model led by the central government and incorporating elements of a market economy.

Drawing on this flexible economic policy concept, we can also interpret the U.S. economic system from a new perspective. I will call it "capitalism with American characteristics", a concept that is particularly evident in recent economic policies.

The U.S. economic system is no longer pure capitalism. Since the early 19th century, U.S. economic policy has oscillated between different ideologies. The establishment of the Federal Reserve in 1913 and the implementation of the New Deal in the 1930s were adjustments to pure capitalism.

After the outbreak of the COVID-19 pandemic in 2020, the U.S. government implemented large-scale fiscal stimulus measures, directly distributing funds to the public. This approach was comparable in scale to the New Deal era, with the U.S. printing 40% of the existing U.S. dollars between 2020 and 2021. This policy has been continued in subsequent administrations, leading to a significant change in the government's balance sheet.

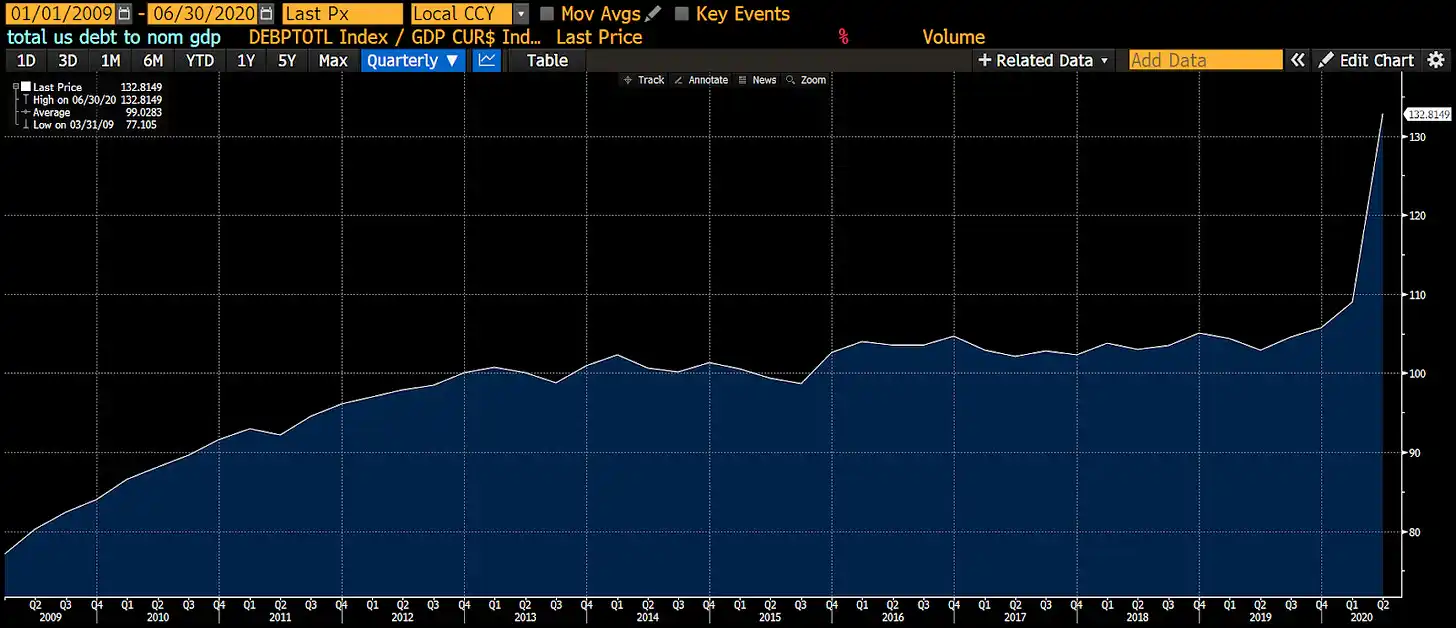

In short, the rich have invested the government's massive subsidies in financial assets, but these transactions have not generated substantial economic activity. As a result, trillions of dollars in debt funds have flowed to the wealthy who own financial assets, causing the debt-to-nominal GDP ratio to continue to rise.

However, due to the growth in the supply of goods and services not keeping up with the growth in purchasing power, inflation has become increasingly severe. The wealthy who hold government bonds are dissatisfied with these policies that favor the general public, as they have experienced the worst investment returns since 1812.

To address this situation, the wealthy have introduced their "white knight" - Federal Reserve Chairman Powell. He began raising interest rates in early 2022 to curb inflation. At the same time, the general public hopes to continue receiving relief checks, but this policy has become taboo.

If Trump limits immigration from so-called "dirty, messy, and chaotic countries", this will further stimulate domestic economic activity, and the government will also be able to obtain more revenue from corporate profits and personal income taxes. To fund these projects, the government deficit may be maintained at a relatively high level, and the Treasury will raise funds for the government by selling bonds to banks.

Who will oppose this seemingly "magical" era of American prosperity?

Those who hold long-term bonds or savings deposits will be the losers. The yields on these investment instruments will be deliberately suppressed, below the nominal growth rate of the U.S. economy. If wage growth cannot keep up with inflation, low-income groups will also be harmed.

For those who consider themselves wealthy, don't worry. Here's an investment suggestion (not financial advice): When the government passes legislation to provide funding for specific industries, carefully research and invest in stocks in these areas. Instead of keeping your funds in fiat currency bonds or bank deposits, consider purchasing gold (a traditional anti-inflation tool) or Bitcoin (a new generation of financial hedging tool).

Next, I will explore in detail how quantitative easing policies targeting the rich and the poor affect economic growth and money supply. Then, I will predict how the exemption of banks from the Supplementary Leverage Ratio (SLR) may once again create the possibility of "quantitative easing for the poor" on an unlimited scale. Finally, I will introduce a new index to track the credit supply of U.S. banks and demonstrate the performance of Bitcoin relative to other assets considering the bank credit supply.

Money Supply

First, I must express my sincere appreciation for Zoltan Pozar's "Ex Uno Plures" series of papers, the insights from which will be crucial in the following article.

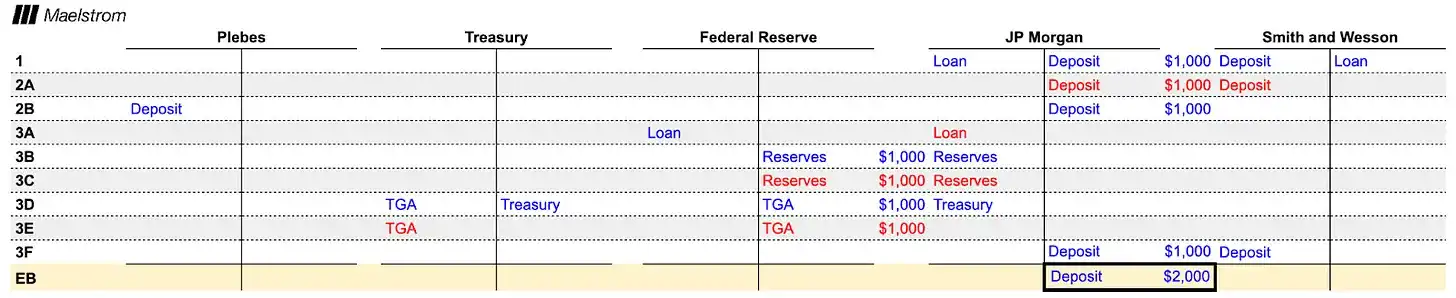

Next, I will present a series of hypothetical accounting ledgers. In the T-account, the left side represents assets, and the right side represents liabilities. Blue entries indicate an increase in assets, and red entries indicate a decrease in assets.

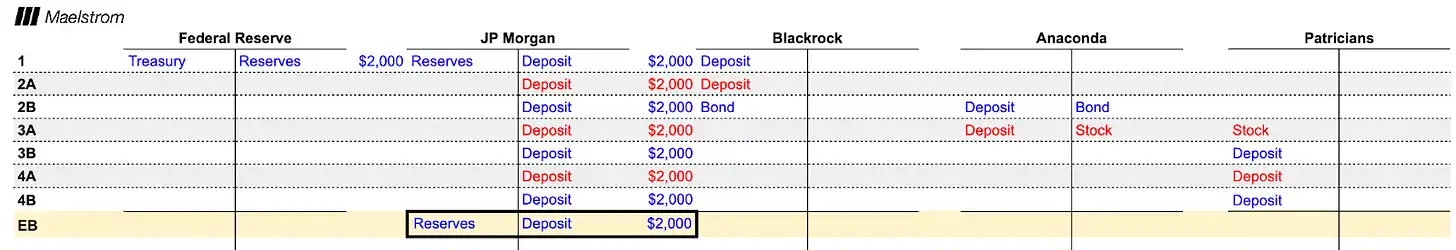

The first example focuses on how the Federal Reserve's quantitative easing (QE) purchases of bonds affect the money supply and economic growth. To make the content more engaging, this example and the subsequent ones may be somewhat exaggerated.

QE Targeted at the Wealthy

Suppose you are Powell, in the midst of the US regional banking crisis in March 2023. To unwind a bit, you go to the tennis club at 370 Park Avenue in New York City to play squash with a billionaire finance friend. This friend - let's call him Kevin - is a traditional finance big shot, and he angrily tells you: "Jay, I have to sell my beachfront mansion. All my money is in Signature Bank, and obviously, I don't qualify for federal deposit insurance because my deposits exceed the limit. You have to do something. You know Bunny has to stay in the city all summer, and she's simply unbearable."

Jay replies, "Don't worry, I'll fix this. I'll implement a $2 trillion quantitative easing (QE) program. The announcement will come on Sunday night, you know the Fed always has your back. Without your contributions, who knows what America would become. Imagine if the financial crisis put Biden in trouble, giving Trump a chance to retake power - that would be disastrous. I still remember in the early 80s, when Trump stole my girlfriend at Dorsia, that bastard."

The Fed has introduced the Bank Term Funding Program, which is different from direct QE, to address the banking crisis. But please allow me some artistic license in this example. Now let's see what happens to the money supply after the Fed implements $2 trillion in QE. All numbers will be in billions of dollars.

- The Fed purchases $200 billion in Treasuries from BlackRock, paying with reserve balances. JPMorgan, acting as the intermediary bank, receives $200 billion in reserve balances and credits BlackRock with a $200 billion deposit. The Fed's QE allows the banks to create deposits, ultimately becoming money.

- Losing the Treasuries, BlackRock CEO Larry Fink naturally wants to reinvest this money in other interest-bearing assets. He has recently taken an interest in tech companies and decides to invest the $200 billion in a new social app called Anaconda, which has attracted a large user base of 18-45-year-old males, causing their productivity to plummet. The company issues debt to buy back shares, not only boosting earnings per share but also driving up the stock price, attracting passive index investors like BlackRock to continue buying its shares. As a result, the wealthy sell their shares and end up with $200 billion in deposits.

- The wealthy Anaconda shareholders temporarily do not need to use this money, so they purchase art at the Miami Art Fair as "art patrons." The buyers and sellers belong to the same economic class, and the funds circulate between accounts without generating any real economic activity. The Fed's $2 trillion in QE injection into the economy ultimately only increased the bank deposits of the wealthy, without creating any actual growth or jobs. This type of QE targeted at the wealthy has pushed the debt-to-nominal GDP ratio higher from 2008 to 2020.

Let's look at Trump's decisions during the pandemic. Back in March 2020, when COVID-19 broke out, his advisors suggested "flattening the curve" by locking down the economy and only allowing "essential workers" to continue working.

Trump: "What? I'm supposed to shut down the economy because some quack doctors are making a big deal out of this flu?"

Advisor: "Yes, Mr. President. I remind you that the primary victims of COVID-19 are the elderly, like yourself. Additionally, if infected people require hospitalization, the medical costs will be high, so you need to lock down non-essential workers."

Trump: "That will cause an economic collapse. Just send money to everyone to shut them up. Have the Fed buy the debt issued by the Treasury to fund these subsidies."

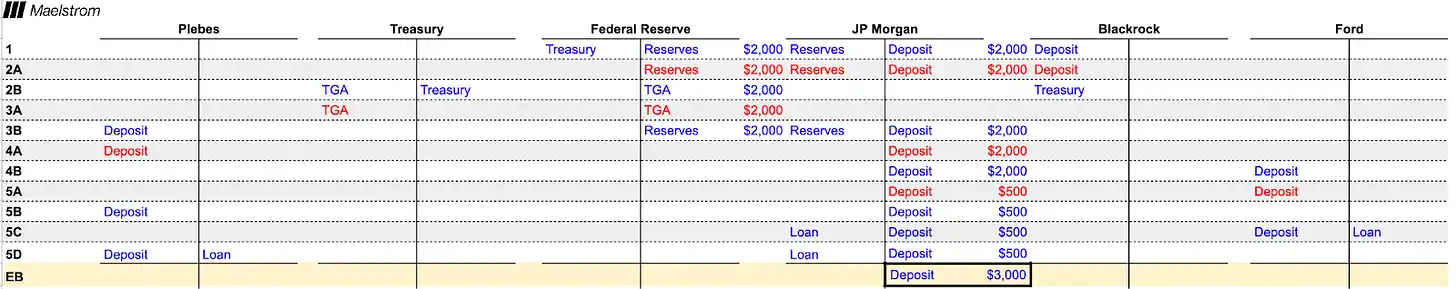

QE Targeted at the Poor

Next, let's analyze how quantitative easing (QE) targeted at low-income groups works using the same accounting framework.

- The Fed implements QE by purchasing $200 billion in Treasuries held by BlackRock, paying with reserve balances, but this time the Treasury is also involved. To fund Trump's economic stimulus checks, the government needs to raise funds by issuing Treasuries, which BlackRock purchases instead of corporate bonds.

- JPMorgan assists BlackRock in converting bank deposits into Fed reserve balances to purchase the Treasuries. The Treasury receives a deposit in its General Account (TGA) at the Fed, akin to a checking account.

- The Treasury then distributes the stimulus checks to the public, reducing the TGA balance while increasing the Fed's reserve balances, which become regular people's bank deposits at JPMorgan.

- The public uses the stimulus money to buy new Ford F-150 pickup trucks, not considering electric vehicles because that's just "un-American" consumption, leading to a surge in oil consumption.

- In the process of selling these trucks, Ford does two things: first, it pays employee wages, transferring deposits from Ford's account to the employees' accounts. Second, Ford applies for a loan from the bank to expand production, creating new deposits and increasing the money supply.

- Ultimately, the public also wants to take a vacation and applies for personal loans from the bank. Given the strong economy and their stable, high-paying jobs, the bank is happy to provide the loans. These personal loans, like Ford's loan, create additional deposits.

The final deposit or money balance reaches $300 billion, $100 billion higher than the initial $200 billion injected by the Fed through QE.

This example shows that QE targeted at the general public can effectively stimulate economic growth. The Treasury's stimulus checks encourage the public to buy trucks, creating demand for goods that allows Ford to pay wages and apply for loans to expand production. The well-paid employees also meet the bank's credit standards, enabling further consumption. Each $1 of debt generates more than $1 of economic activity, which is a favorable outcome for the government.

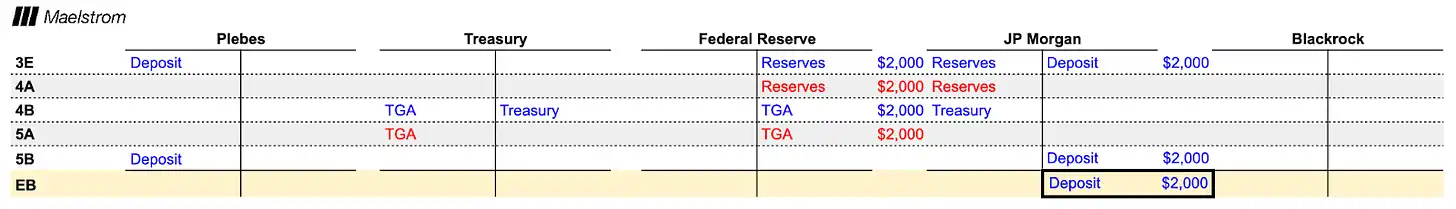

I would like to further explore how banks can provide virtually unlimited financing to the Treasury.

Let's continue the analysis from step 3 above.

- The Treasury prepares to issue a new round of economic stimulus checks and needs to raise funds by auctioning Treasuries. As a primary dealer, JPMorgan uses the Fed's reserve balances to purchase these Treasuries, which increases the Treasury's balance in the TGA at the Fed.

- Similar to the previous example, the Treasury then mails out the stimulus checks, and these funds become regular people's deposits at JPMorgan.

When the Treasury issues Treasuries purchased by the banking system, it converts the Fed's reserve balances (which have no practical use in the real economy) into regular people's bank deposits, which can be used to purchase goods and services, thereby stimulating economic activity.

Government Incentives for Corporate Production

Let's analyze through a T-account example how the government can encourage corporate production of specific goods and services through tax cuts and subsidies.

Imagine a scene of "American hegemony" in a movie: ammunition is about to run out. The government quickly passed legislation, promising subsidies for ammunition production. Smith & Wesson obtained a military ammunition supply contract, but its production capacity was insufficient. To meet the demand, they applied for a $100 billion loan from JPMorgan Chase to expand production. After reviewing the government contract, the loan officer at JPMorgan Chase unhesitatingly approved the loan - this loan actually created $100 billion out of thin air.

After Smith & Wesson built the new factory, they started paying wages, and these wages ultimately became deposits in employees' accounts at JPMorgan Chase. In this process, the bank-created funds were transformed into deposits of ordinary people. Since ordinary people have a higher propensity to consume, this further stimulated economic activity.

Next, the Treasury Department issued $100 billion in new debt to fund the subsidies. JPMorgan Chase wanted to bid, but lacked sufficient reserves. So they applied for a loan from the Federal Reserve's discount window, using Smith & Wesson's corporate debt as collateral. After obtaining the reserves, JPMorgan Chase purchased the Treasury bonds. The Treasury Department then paid the subsidies to Smith & Wesson, and this money returned to JPMorgan Chase's accounts, becoming deposits.

This process vividly demonstrates how the U.S. government, through industrial policy, guides the banking system to inject funds into the market, while cleverly using the assets generated by loans as collateral to finance the Federal Reserve's purchase of Treasury bonds.

Constraints

At first glance, the Federal Reserve, the Treasury Department, and the banks seem to be operating a "monetary magic machine" that can achieve the following effects:

- Provide asset appreciation opportunities for the wealthy, although this has limited impact on the real economy.

- Inject funds into the accounts of ordinary people through the banking system, stimulating the consumption of goods and services.

- Guarantee profits for specific industries, allowing companies to use bank loans to expand their business and thus drive economic activity.

However, can this money creation be done without limit? The answer is no. Each debt asset of the bank requires expensive equity capital support. Different asset types have corresponding risk-weighted asset charges, even for assets considered risk-free, such as Treasury bonds and central bank reserves, which also require the payment of equity capital costs. Therefore, after reaching a certain critical point, banks will find it difficult to continue bidding for U.S. Treasury bonds or issuing corporate loans.

The reason for setting equity capital requirements is that when borrowers (whether governments or companies) go bankrupt, someone has to bear the losses, and the bank's shareholders should bear this part of the risk. If the bank is unable to bear these losses, it will go bankrupt. Bank failures not only affect depositors, but also impede the entire credit expansion system - and credit expansion is the crucial pillar for maintaining the current fiat currency system.

When bank capital is depleted, the central bank becomes the last resort, and has to create new money to exchange for the bank's loss assets.

Let's return to reality.

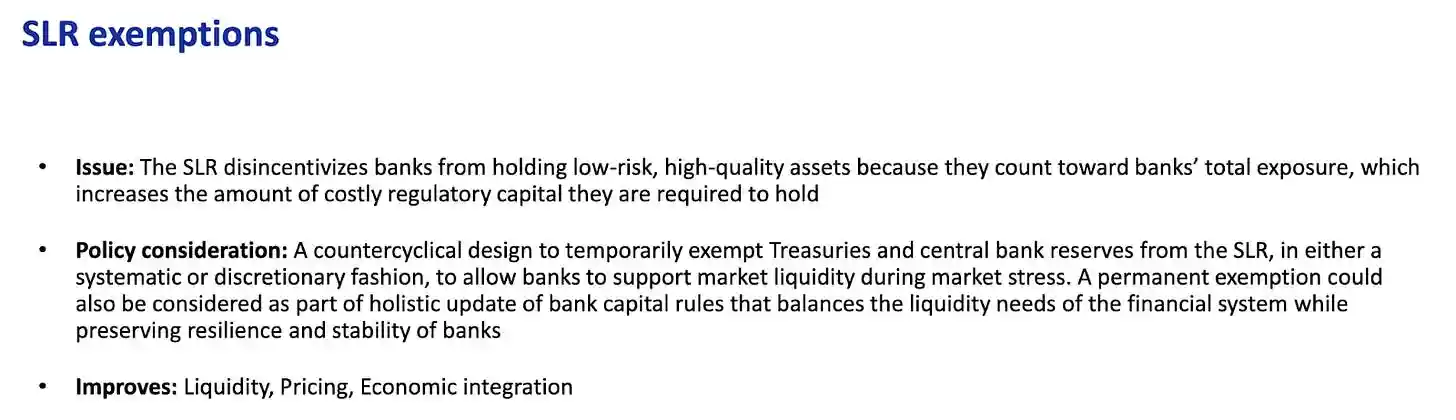

Suppose the government wants to create unlimited bank credit, then they must change the rules to exempt Treasury bonds and certain "approved" corporate bonds (such as investment-grade bonds, or bonds issued by industries like semiconductors) from the Supplementary Leverage Ratio (SLR) constraint.

If Treasury bonds, central bank reserves, or approved corporate bonds are exempted from the SLR constraint, banks can purchase unlimited amounts of such debt without bearing the expensive equity capital cost. The Federal Reserve has the authority to grant this exemption. In fact, they did so from April 2020 to March 2021.

At that time, the U.S. credit market was nearly stagnant. The Federal Reserve needed banks to lend to the U.S. government again to support Treasury bond issuance, as the government was about to disburse trillions of dollars in stimulus funds but did not have enough tax revenue to pay for it. This exemption was very effective, leading banks to massively purchase Treasury bonds. However, it also had side effects: as Powell raised interest rates from 0% to 5%, the prices of these Treasury bonds plummeted, ultimately leading to the regional banking crisis in March 2023. This once again proves an old economic truth: there is no free lunch in this world.

In addition, the level of bank reserves also limits their willingness to participate in Treasury auctions. When banks believe their reserves at the Federal Reserve have reached the Lowest Comfortable Level of Reserves (LCLoR), they will stop participating in the auctions. Interestingly, the specific value of this LCLoR is often only determined in hindsight.

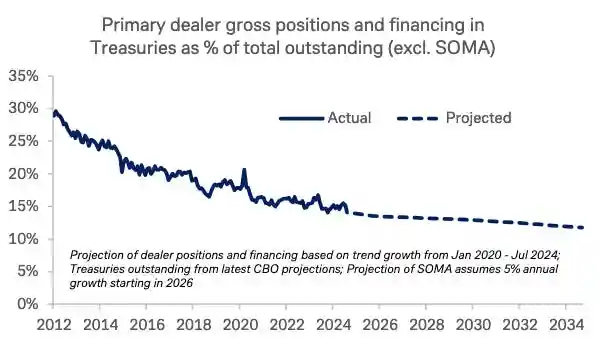

This is a chart from the "Financial Resilience of the Treasury Market" report published by the Treasury Borrowing Advisory Committee (TBAC) on October 29, 2024. The chart shows that the proportion of Treasury bonds held by the banking system is approaching the Lowest Comfortable Level of Reserves (LCLoR). This is a problem because the Federal Reserve is conducting Quantitative Tightening (QT), and some surplus countries' central banks are either selling Treasury bonds or no longer reinvesting their net export earnings in U.S. Treasury bonds (de-dollarization). In this case, the marginal buyers of Treasury bonds are gradually becoming more speculative bond trading hedge funds, whose buying behavior is unstable.

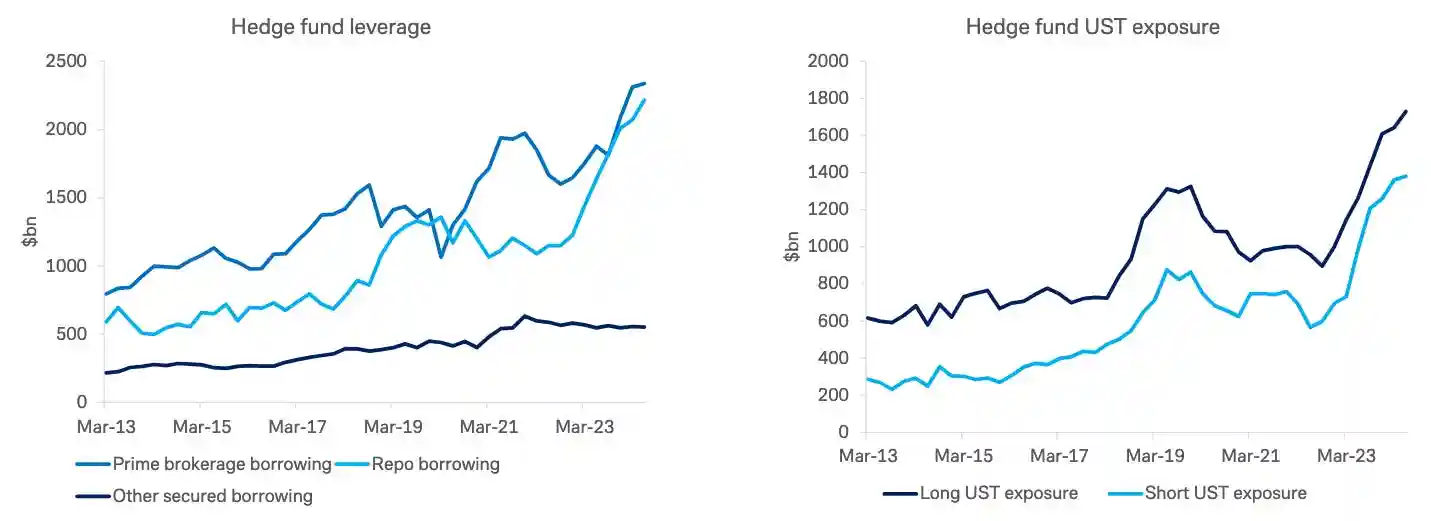

This is another chart from the same report. As shown, hedge funds are filling the gap left by banks' purchases of Treasury bonds. However, hedge funds are not "real money" buyers, but are engaging in arbitrage transactions: they purchase low-priced cash Treasury bonds, while short-selling Treasury futures contracts.

The cash-side transactions are financed by the repo market. Repo is the exchange of an asset (such as a Treasury bill) for cash for a certain period. In the repo market, the overnight financing cost using Treasury bonds as collateral depends on the available capacity of commercial banks' balance sheets. As balance sheet capacity decreases, repo rates rise.

If financing costs increase, hedge funds can only increase their purchases if Treasury bonds further depreciate relative to futures. This ultimately leads to a decline in Treasury auction prices and a rise in yields, which is not the result the Treasury Department wants to see, as it hopes to issue more debt at increasingly lower costs.

Due to regulatory constraints, banks are unable to purchase enough Treasury bonds and cannot provide low-cost financing for hedge funds' Treasury bond purchases. Therefore, the Federal Reserve must once again grant banks an SLR exemption, which not only can improve the liquidity of the Treasury bond market, but also allow unlimited Quantitative Easing (QE) to be directed towards the productive sectors of the U.S. economy.

If you are still unsure whether the Treasury Department and the Federal Reserve have recognized the need to relax bank regulations, the TBAC clearly lists the necessary measures on page 29 of this report:

Within the "Trumponomics" framework you described, we need to focus on the expected growth in bank credit. Based on the previous example, we know that QE targeting the wealthy works through increasing bank reserves, while QE targeting the general public works through increasing bank deposits. Fortunately, the Federal Reserve publishes weekly data on the entire banking system, including reserves and other deposits and liabilities.

I have created a custom Bloomberg index that combines reserves and other deposits and liabilities, labeled as <BANKUS U Index>.

This is my custom index for tracking the quantity of U.S. bank credit. I believe this is the most important monetary supply indicator. As you can see, this index sometimes leads Bitcoin, such as in 2020; and sometimes lags behind Bitcoin, such as in 2024.

However, more importantly, the performance of assets when bank credit supply contracts. Bitcoin (white), the S&P 500 index (yellow), and gold (green) have all been adjusted according to my bank credit index. These values are indexed to a base of 100, and the chart shows that Bitcoin has performed outstandingly, rising over 400% since 2020. If you can only do one thing to cope with fiat currency depreciation, it is to choose Bitcoin. This mathematical conclusion is irrefutable.

The Way Forward

Trump and his monetary policy assistants have clearly stated that they will pursue a policy of weakening the US dollar and provide the necessary funds to bring American industry back home. Given that the Republican Party will control the three branches of government for the next two years, they will be able to pass Trump's economic plan without effective opposition. Notably, I believe the Democratic Party will also join the money printing army, as what politician can resist the temptation to distribute free benefits to voters?

The Republicans will first pass legislation to incentivize key commodity and material producers to repatriate production. These measures will be similar to the Chip Act, Infrastructure Act, and Green New Deal passed by the Biden administration. As companies utilize government subsidies and loans, bank credit growth will surge. For those investors who consider themselves able to pick stocks, they can consider buying shares of listed companies that the government hopes to support.

At some point, the Federal Reserve may relax the requirements, at least exempting Treasuries and central bank reserves from the SLR (leverage ratio). Once this happens, the path to unlimited quantitative easing (QE) will be wide open.

The combination of industrial policy legislation and SLR exemptions will lead to a surge in bank credit. I have shown that the monetary velocity of this policy is higher than the traditional quantitative easing of the wealthy regulated by the Federal Reserve. Therefore, we can expect Bitcoin and cryptocurrencies to perform as well as, or even better than, the period from March 2020 to November 2021. The real question is, how much credit will be created?

The COVID stimulus policies injected about $4 trillion in credit, and the scale of this round will far exceed that. The growth rate of defense and healthcare spending alone exceeds the nominal GDP growth rate. As the United States increases defense spending to cope with the multipolar geopolitical environment, these expenditures will continue to grow rapidly.

By 2030, the proportion of Americans aged 65 and over will reach its peak, meaning that healthcare spending growth will accelerate from now until then. No politician dares to cut defense and healthcare spending, as they will be quickly voted out. All of this means that the Treasury will be busy injecting debt into the market quarter after quarter just to keep the system running. I have previously shown that the monetary velocity of quantitative easing combined with fiscal borrowing is greater than 1. This deficit spending will increase the nominal growth potential of the United States.

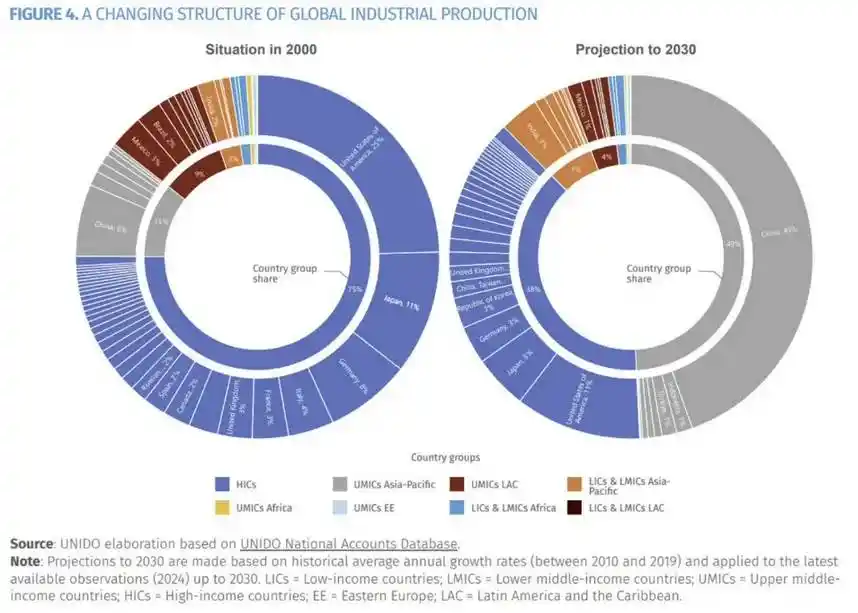

The goal of bringing American businesses back home will cost trillions of dollars to achieve. Since 2001, when the United States allowed China to join the World Trade Organization, the United States has voluntarily ceded its manufacturing base to China. In less than thirty years, China has become the world's factory, producing the highest quality and lowest-priced goods.

Even those companies that hope to diversify their supply chains to other so-called cheaper countries find that due to the deep and effective supplier integration of China's eastern coastal regions, even if Vietnam's hourly wages are much lower, these companies still need to import intermediate products from China to produce the final goods.

All of this suggests that rebalancing the supply chain back to the United States will be a massive task, and if it must be done for political considerations, it will be extremely expensive. I am referring to the need to provide trillions of dollars in cheap bank financing to shift production capacity from China to the United States.

To reduce the debt-to-nominal GDP ratio from 132% to 115%, the United States spent $4 trillion. Assuming the United States further reduces this ratio to 70% (the same as September 2008). Using linear extrapolation alone, this means that $10.5 trillion in credit needs to be created to achieve this deleveraging process. This is why Bitcoin can break through $1 million, as the price is determined by the marginal price.

As Bitcoin's circulating supply decreases, the most fiat currency in history will not only be chased by Americans, but also by Chinese, Japanese, and Western Europeans who will flock to this safe-haven asset. I suggest you hold it long-term and maintain your holdings. If you are skeptical of my analysis of the impact of quantitative easing on the poor, you only need to read the economic history of China over the past thirty years to understand why I call the emerging "American hegemonic economic system" a "Chinese-style American capitalism".