Author: Joyce

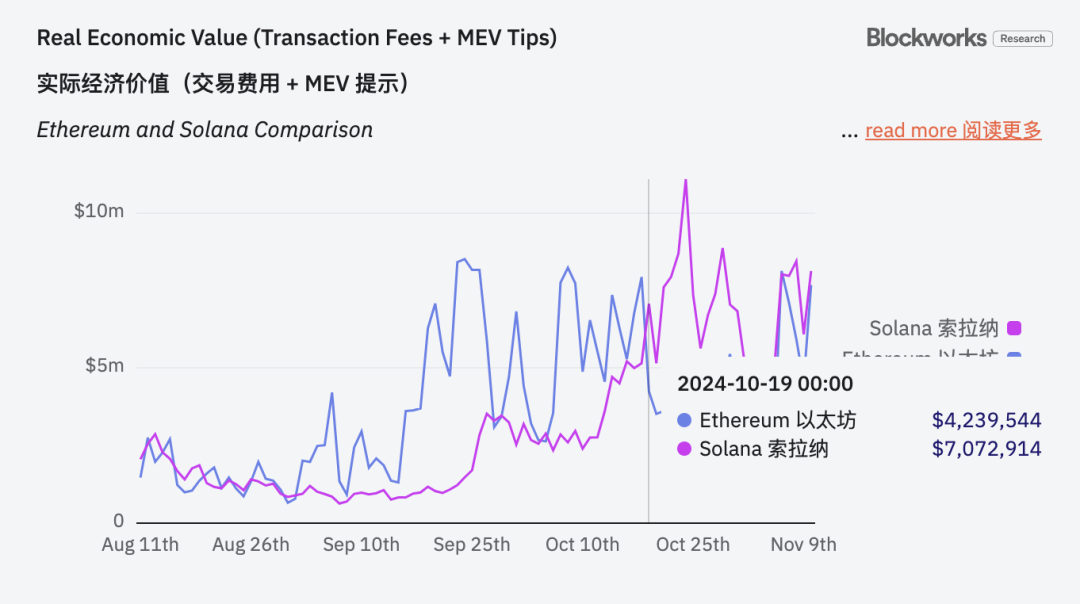

Recently, with the launch of Meme projects such as Goat, Pnut, and Act on Binance, the Solana ecosystem has ushered in a new wave of enthusiasm. According to Blockworks Research data, after October 19, 2024, Solana's daily on-chain fees have consistently exceeded Ethereum's, and on October 24, the revenue even exceeded $10 million. The hot Meme sector has led to a continuous influx of funds into the Solana ecosystem, making it the hottest ecosystem in the industry.

It must be said that Solana is indeed the hottest chain in this bull market. Previously, more than half of the star projects in the DePin craze came from the Solana ecosystem, and now there are wave after wave of Meme crazes, which is quite lively.

So, where does the high revenue we currently see in the Solana ecosystem mainly come from? How long can this booming state be sustained?

Overview of Solana's on-chain fees

Similar to Ethereum, Solana's on-chain revenue includes basic transaction fees, MEV tips, and so on. After Ethereum's EIP1599 proposal, all the basic Base fees are burned, and the MEV tips are directly rewarded to the validator nodes. Solana also has a similar burning mechanism, where the basic transaction fees are burned at a fixed ratio (initially set at 50%), and the remaining fees are distributed to the validators.

Therefore, when comparing the on-chain revenue of Ethereum and Solana, all the burned basic transaction fees are also included.

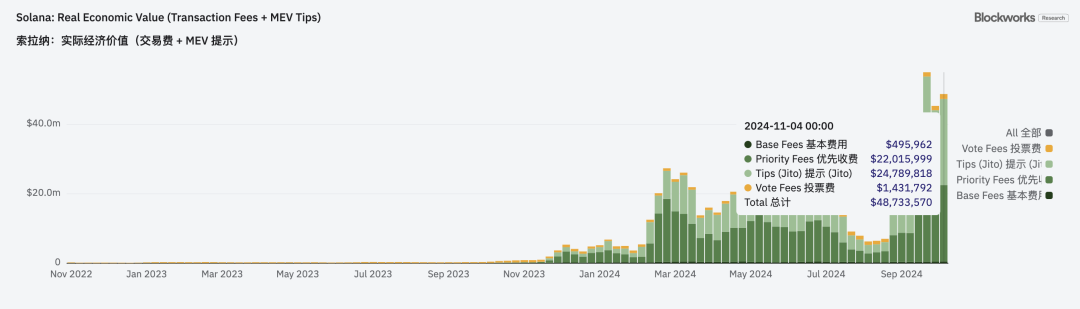

Specifically, Solana's on-chain revenue includes basic fees, priority transaction fees, tips (Jito), and voting fees, as shown in the following figure.

From the trend of Solana's daily on-chain fees shown in this figure, compared to the other two items, the changes in basic transaction fees and voting fees are not too large, but the priority transaction fees and tips have seen rapid growth since March of this year.

So, what are these two fees? Priority transaction fees are easy to understand, which are the fees paid by users to speed up their transactions, usually added directly during the transaction. Tips (Jito) are the additional fees paid by users to the validators, generally used for MEV-related transactions, and are paid directly.

The rapid growth of these two fees both means that the activity of the Solana network has increased, the DeFi activity has increased, leading to more network congestion, and users are more willing to increase the priority transaction fees to speed up their transactions, while the opportunities for validators to capture MEV by optimizing the transaction order have also increased.

So, what specific DeFi transactions are on the Solana chain, and are they completely driven by Meme?

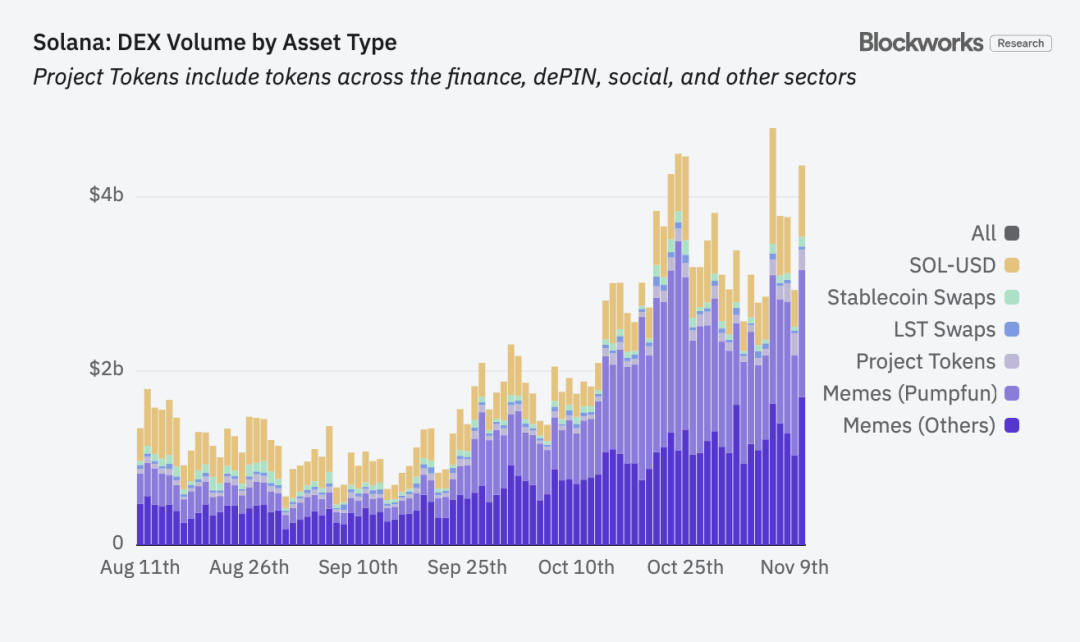

From the data in the above figure, it is not difficult to see that the main transactions on the Solana chain include Meme (Pumpfun), Meme (others), project Tokens, LST Tokens, stablecoins, and SOL transactions, among which project Tokens include not only the above-mentioned categories, but also DePin, SocialFi, and others.

In the past two months, the trading volume of all Meme has increased from 48% to 74%, of course, the significant decrease in the proportion of other trading volumes does not mean that the trading volume has decreased. During the market uptrend, the trading volume of project Tokens, LST, stablecoins, and SOL on the Solana chain has also increased significantly, but the growth of Meme is really too exaggerated, increasing by 667% in the past two months, so the proportion of other transactions has decreased significantly in comparison.

This also confirms the data above, because the rapid growth of Meme trading volume, and the belief that "time is money" in Meme trading, users are naturally more willing to pay priority transaction fees. The more active the on-chain transactions, the more opportunities for MEV.

Active Dapps on the Solana Chain

1) DEX

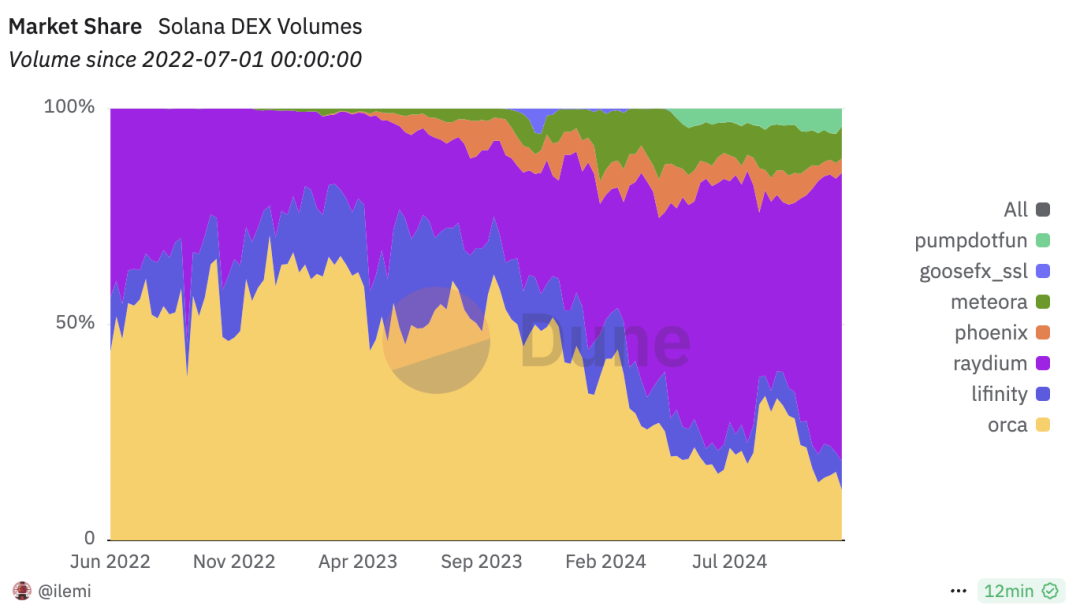

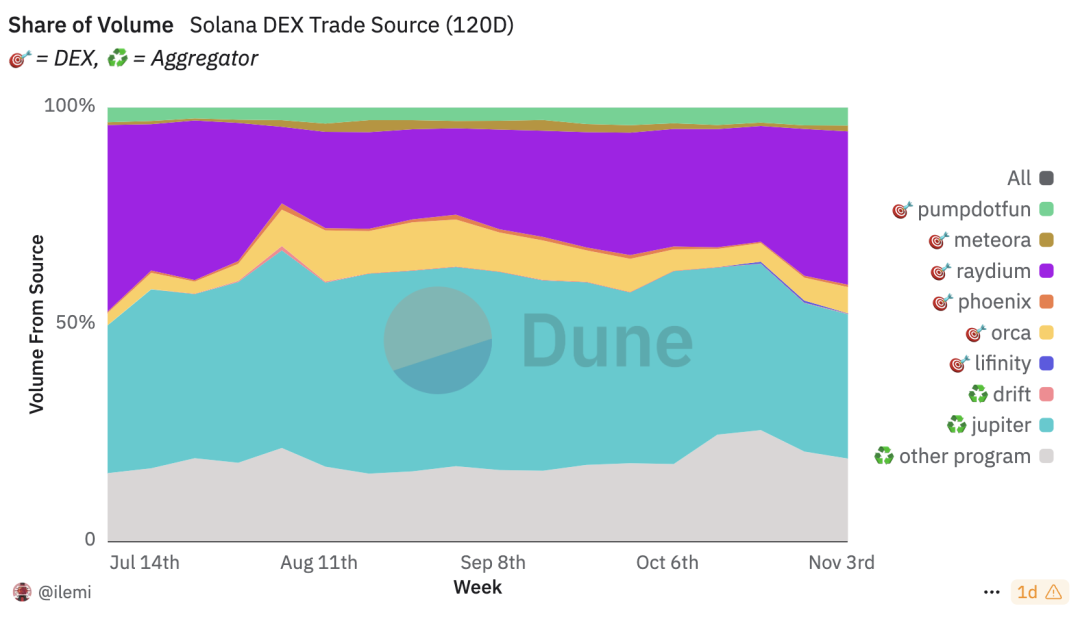

Currently, Meme trading is the main activity on the Solana chain, so the various DEXes are the most active Dapps. Among the DEXes in the Solana ecosystem, the hottest one is Raydium, and the data in the figure shows that, benefiting from the Meme explosion, Raydium, which is deeply integrated with Meme, now accounts for 63.5% of the entire Solana ecosystem's trading volume. Meanwhile, Orca, which initially dominated the Solana ecosystem, has seen its market share constantly squeezed by the explosion of Meme trading volume, dropping from over 60% to around 15% currently.

PumpFun, as a Meme launch platform, its built-in Meme trading function has also accounted for nearly 5% of the trading volume in this wave of Meme craze, and the trend is gradually increasing.

Market share of Solana ecosystem DEXes, source: Dune.com

2) Aggregator DEXes and Trading Bots

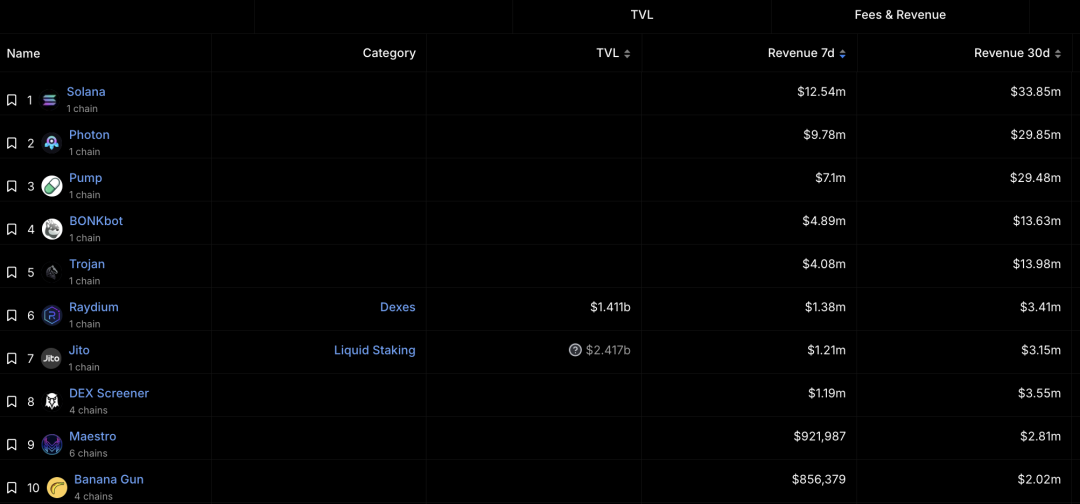

In addition to direct trading on DEXes, the aggregator DEXes and trading bots in the Solana ecosystem are also very active. The figure below shows the market share of Solana ecosystem DEXes by trading source, and the latest data shows that Jupiter accounts for 33% of the trading volume, and other protocols (including trading bots) account for 19%.

Market share of Solana DEXes by trading source, source: Dune.com

As the largest aggregator DEX in the Solana ecosystem, Jupiter's TVL has recently hit a new high of $1.57 billion, and Jupiter has been very active recently:

First, on October 2, the proposal for "using the unclaimed 230 million JUP to extend and fund the ASR" was passed, extending the active staking rewards (ASR) for another year;

Then on October 8, it launched a mobile app, supporting Apple Pay, credit cards and other payment methods, which is considered a new fiat on-ramp;

On October 17, it also launched the Solana Meme Coin terminal "Ape Pro", focusing on MEV protection and improving sandwich attacks in transactions.

With a series of actions, the JUP token price has also been very strong.

In addition to the aggregator trading platforms, the trading bots in the Solana ecosystem are also very active, contributing over 10% of the trading volume, with the top four earners being Photon, Trojan, BONKbot, and Banana Gun. Photon's revenue in the past 30 days has reached $29.85 million, making it the second largest protocol in the Solana ecosystem after the Solana main chain.

Ranking of Solana ecosystem protocol earnings, source: defillama

3) Other Dapps

Although in the entire Meme season, the DEXes, aggregator DEXes, and trading bots around Meme are very hot, with the hot Solana chain and the rising SOL price, the staking, re-staking, lending, and leveraging protocols in the ecosystem have also been driven. Here are some of the currently popular Dapps.

Jito

Jito is currently the DApp with the highest TVL in the Solana ecosystem, with a TVL of over $3 billion, accounting for more than one-third of the entire Solana ecosystem TVL. Jito supports users to deposit Solana or Solana's LST Token for restaking, and the biggest feature of Jito compared to other staking protocols is its MEV suite, which extracts MEV revenue from transactions in the Solana ecosystem and distributes this revenue to stakers, thereby increasing the income of stakers.

Currently, Jito's restaking deposits have reached a hard cap of $25 million, indicating that the second phase will raise the cap to meet the staking needs of more users.

Kamino

Kamino is the top-tier stablecoin and LST asset yield platform in the Solana ecosystem, and it also integrates lending, liquidity provision, and leverage functions. The TVL of the entire protocol has reached $2 billion.

Kamino supports a one-click automatic compound concentrated liquidity strategy, making it convenient for users to maximize their returns by controlling their lending capital. Additionally, it is expected to launch Lend V2 in the fourth quarter of this year, which will allow the creation of different lending markets without permission, meeting the needs of a wider range of users, as well as introducing an automated single-asset lending vault that aggregates liquidity across markets, with the aim of becoming the base layer of Solana's on-chain finance.

Marinade

Marinade is also a liquid staking protocol in the Solana ecosystem, with a current TVL of $1.79 billion, ranking fifth. However, as a liquid staking protocol, Marinade's protocol rewards are far less than Jito's. Recently, Marinade has been actively promoting its Solana staking service for institutional investors, and the TVL has increased by nearly 50% in the past month and a half.

Summary

The MEME craze has indeed driven the entire Solana ecosystem to be hot, with the most direct manifestation being the on-chain yields and user activity of Solana.

However, the current MEME is ultimately a product of a specific period under the bull market, and once the bear market arrives, if the MEME trend does not continue, how Solana's ecosystem can maintain its leading advantage as a public chain is something that needs to be considered. Just like the once-popular NFT trend, after the feast, it's a mess. Can Solana leverage the heat of MEME to build a healthier ecosystem yield structure?