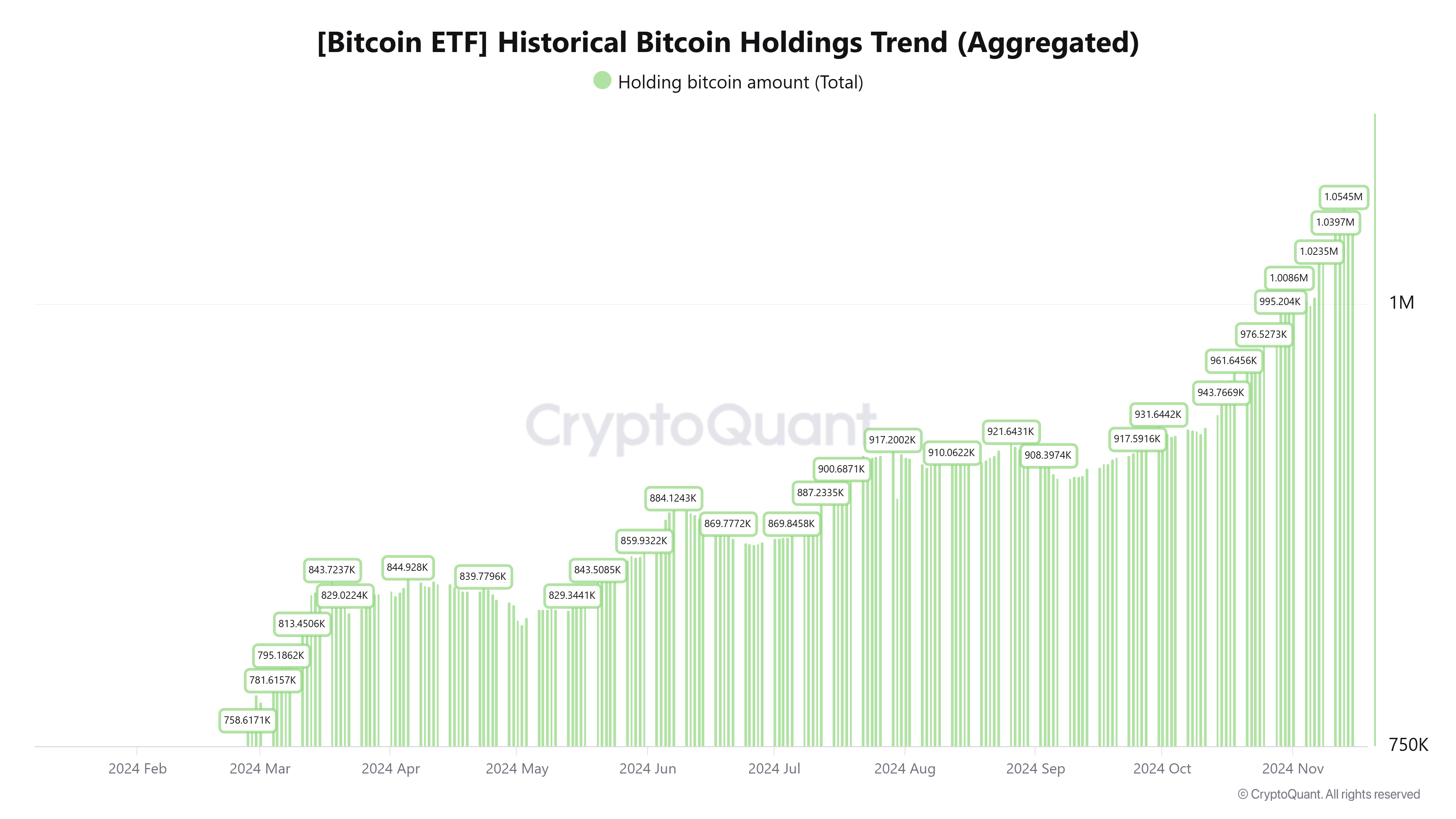

The rise of spot Bitcoin ETFs is reshaping the cryptocurrency market. Cryptoquant analyst MAC_D revealed that these funds currently account for 5.33% of the total Bitcoin supply that has been mined. This is a significant increase from the 3.15% recorded in January.

This translates to an additional 425,000 BTC added in 10 months, emphasizing the growing demand for physically-backed Bitcoin ETFs.

Bitcoin Spot ETF Accumulation, a Driver of Price Appreciation

The analyst emphasized that there is a strong correlation between the accumulation of BTC by spot ETFs and their price movements. This trend was particularly pronounced during the sharp Bitcoin price rallies in March and November, which were driven by ETF inflows and a positive market sentiment.

"The trading volume of spot ETFs has increased from 629,900 BTC to 1,054,500 BTC, an increase of 425,000 BTC. This has grown from 2.18% to 3.15% to 5.33% in just 10 months. When we saw the sharp price increases in March and November, it is clear that there is a strong correlation between the increase in accumulation and the price," the analyst explained in a post on X.

Indeed, in March, US-listed Bitcoin ETFs saw net inflows of around $4 billion, with trading volume nearly tripling to $111 billion compared to February. During the same period, Bitcoin's price surpassed $73,777 on Coinbase, reaching an all-time high at the time.

Similarly, in November, Bitcoin hit a new record high of over $93,265 on Binance as Donald Trump's re-election and expectations of crypto-friendly regulation boosted the market.

"The more Bitcoin is accumulated in spot ETFs, the stronger the price becomes," MAC_D added.

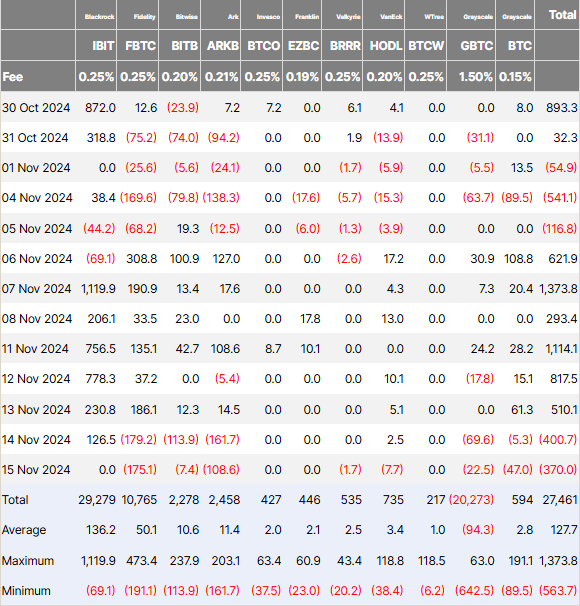

BlackRock's iShares Bitcoin Trust (IBIT) continues to dominate the spot ETF market. Recent data shows the fund holds over $40 billion in assets and has recorded over $3 billion in net inflows since November 6th.

The overall US Bitcoin ETF market had a mixed performance this week, but IBIT added $2 billion in net inflows, further cementing its leadership.

Early in the week, US Bitcoin ETFs recorded $2.4 billion in inflows. However, due to redemptions on Thursday and Friday, the weekly net inflow was reduced to $1.6 billion.

Bitcoin Spot Options Approval Also a Positive Development

The increasing adoption of Bitcoin ETFs is closely tied to the evolving regulatory framework. Recently, the US Securities and Exchange Commission (SEC) approved Bitcoin ETF options. This aligns with the recent progress made by the Commodity Futures Trading Commission (CFTC) in authorizing spot Bitcoin options trading.

Additionally, the SEC and CFTC have approved the listing of environmentally-friendly 7RCC Bitcoin and carbon credit futures ETFs. These developments have further legitimized spot Bitcoin ETFs and made them more appealing to institutional investors. This regulatory support has been crucial in attracting capital to the market and building trust.

Optimism around a positive regulatory environment under the new US administration has also buoyed the inflows into Bitcoin ETFs. This has raised expectations for policies supporting the digital asset industry and accelerated the adoption of Bitcoin through ETFs. BeInCrypto recently reported that Bitcoin ETFs are now included in the portfolios of 60% of the top US hedge funds.

The role of macroeconomic factors, such as Federal Reserve policy and the US elections, cannot be overlooked. As the Fed's tightening policy has eased, risk assets like Bitcoin have regained attention.

Going forward, analysts predict that the increasing adoption of physical Bitcoin ETFs could pave the way for Bitcoin to be recognized as a reserve asset. If the US government embraces this trend, ETF inflows are expected to further increase, solidifying Bitcoin's position in the global financial system.

Meanwhile, as the proportion of Bitcoin held by physical ETFs increases, they are exerting a broader influence on the cryptocurrency market. These funds, controlling over 5% of the Bitcoin supply, can stabilize liquidity and reduce market volatility.

However, concerns have been raised that institutional control over Bitcoin goes against the original spirit of decentralization.

"Doesn't this undermine the whole purpose of decentralization? BlackRock will be the largest holder, and it doesn't get more centralized than that," joked a X user.