After more than a month, the new Lanchpool from Binance has finally arrived. However, unlike many people's expectations, this new project launch was not as popular as usual, and many old-timers, including the author, missed the pump.

The reason for this is that Usual is issuing a stablecoin, and many old-timers will instinctively associate it with the algorithmic stablecoin that was hugely popular in the last bull market. Whenever they hear the word "algorithmic", they will think of the projects that collapsed. Even today, the author still remembers the time when he rushed to buy the algorithmic stablecoin with hundreds of Gas, and then there was no "then".

In fact, Usual is completely different from the algorithmic stablecoin that people understand. Their stablecoin is 1:1 backed by real-world assets (RWA) and fully compliant, which is fundamentally different from the previous algorithmic stablecoins.

According to the official introduction, Usual is a multi-chain infrastructure that integrates the tokenized real-world assets (RWA) of Blackrock, Ondo, Mountain Protocol, M0, and Hashnote, and converts them into a permissionless, on-chain verifiable and composable stablecoin USD0.

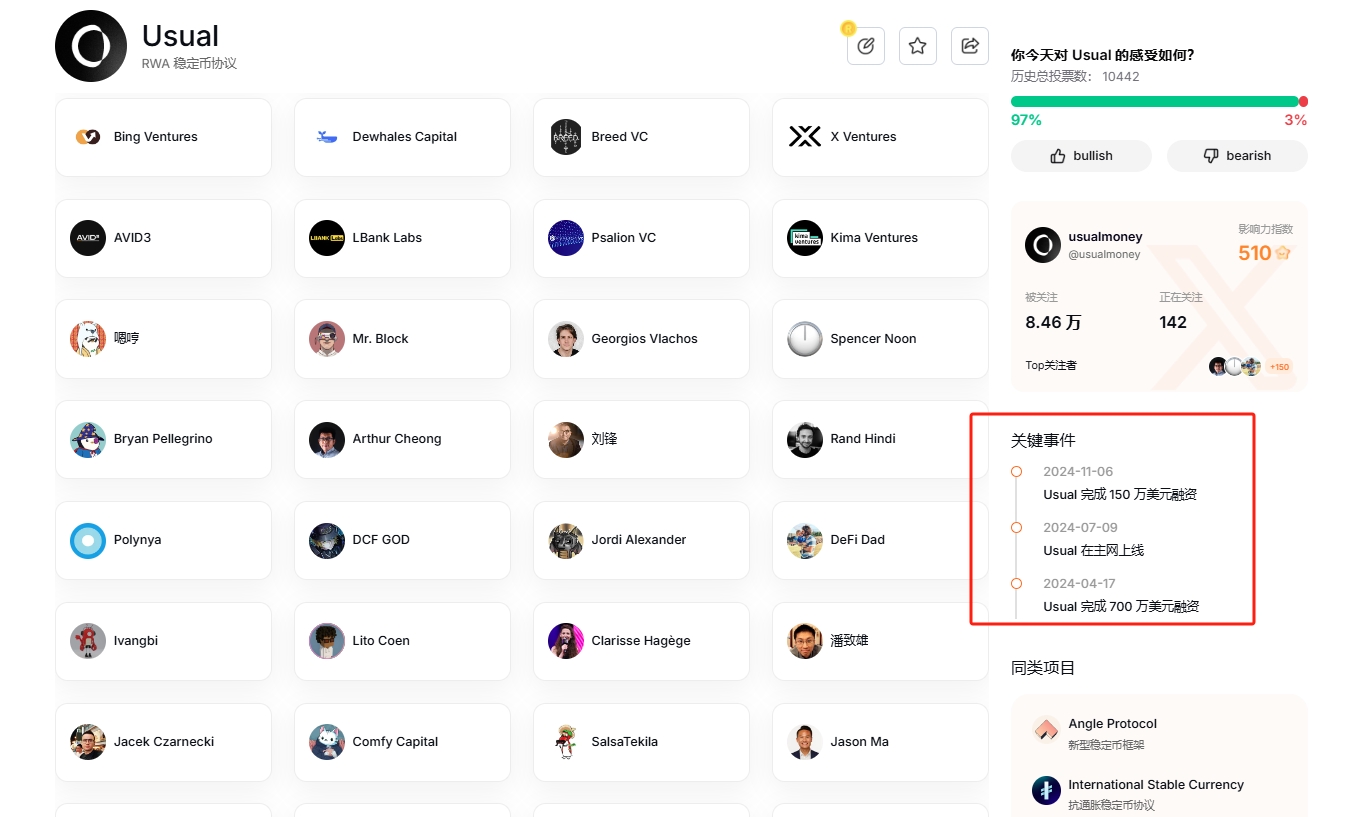

In April this year, Usual announced the completion of a $7 million financing round, led by IOSG and Kraken Ventures, with participation from GSR, Mantle, Starkware, Flowdesk, Avid 3, Bing Ventures, Breed, Hypersphere, Kima Ventures, Psalion, Public Works and X Ventures.

Seven months later, Usual announced a new $1.5 million financing round, with participation from Comfy Capital, early crypto project investor echo, and Breed VC founder Jed Breed, with the specific valuation undisclosed.

That is to say, the total financing amount publicly disclosed by Usual is only $8.5 million, which is obviously not on the same scale as those projects that have raised hundreds of millions or even over a billion dollars. However, while most people were busy with those top-tier projects, Usual went straight to Binance, and if you haven't participated in it before, you can now participate in the Lanchpool mining.

Although we missed the pump, we can't miss the research on the Usual project, after all, they have really made it to the top, and they are quite capable.

1. Founder: Former Political Advisor to the French President

Usual CEO Pierre Person was a member of the French National Assembly, mainly working on monetary policy, and also served as a political advisor to French President Emmanuel Macron.

In 2022, this guy founded Usual, aiming to rebuild a stable feedback mechanism through decentralized data, so that users can have more data ownership.

To date, the total TVL of the Usual platform has exceeded $370 million.

2. USD0: The First Liquid Deposit Token

USD0 is the first liquid deposit token (LDT) provided by Usual, supported by real-world assets (RWA) on a 1:1 basis with ultra-short maturities, ensuring its stability and security. At the same time, as an RWA stablecoin that aggregates various US Treasury token assets, USD0 can be minted in two different ways:

1. Direct RWA deposit: Users deposit eligible RWA into the protocol and receive an equivalent amount of USD0 in return;

2. Indirect USDC/USDT deposit: Users deposit USDC/USDT into the protocol and receive USD0 in return. This indirect method involves third-party collateral providers who provide the necessary RWA collateral.

3. $USUAL: 90% of the total supply allocated to the community.

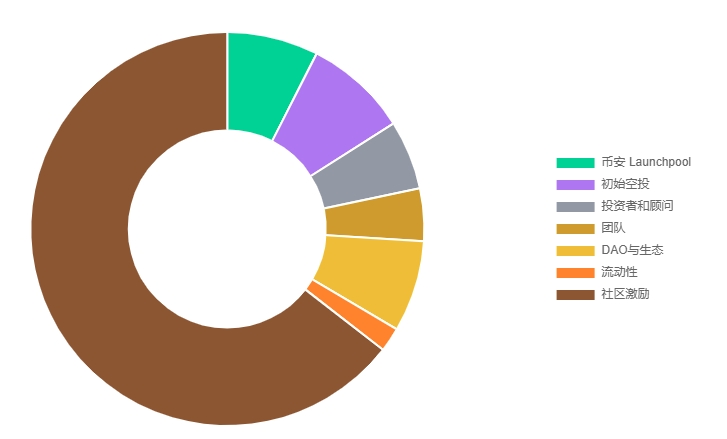

The total supply of $USUAL is 4 billion, with an initial circulation of 12.37%, of which 7.5% is the Binance Launchpool allocation.

The official documentation emphasizes that 90% of the token supply will be allocated to the community, and 10% to insiders (team, advisors, investors), ensuring fair distribution to users and genuine participation.

As the official governance token, $USUAL holders will have actual revenue, future revenue, and infrastructure ownership of the platform protocol in the future.

It is worth noting that USUAL is deflationary, just like the Bitcoin halving mechanism, the earlier the participation in the distribution, the more tokens will be obtained.

For more project information, please refer to the Binance research report: