Source: cryptoslate

Compiled by: Blockchain Knight

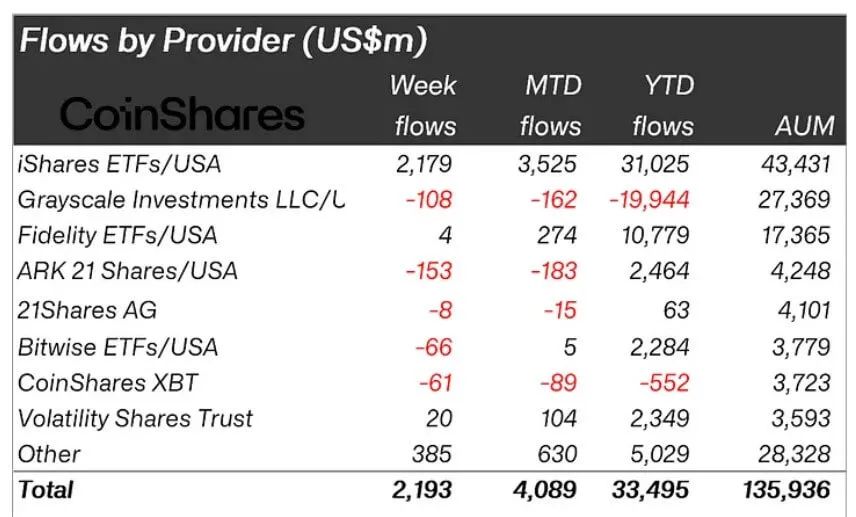

Last week, digital asset investment products saw inflows of $2.2 billion. This reflects a broader market uptrend following Trump's victory in the US presidential election.

A few days ago, the digital asset market saw inflows of $3 billion, a peak, bringing the total assets under management (AUM) to a historic high of $138 billion.

BTC's record-breaking price performance during this period led to outflows of around $866 million, with net inflows of $2.2 billion.

According to CoinShares data, since the rate cut in September, the total inflow of funds has reached $11.7 billion. So far this year, the total inflow of funds has reached $33.5 billion.

CoinShares research chief James Butterfill explained: "The recent surge in activity seems to be driven by two factors: loose monetary policy and the Republican Party's landslide victory in the recent US election."

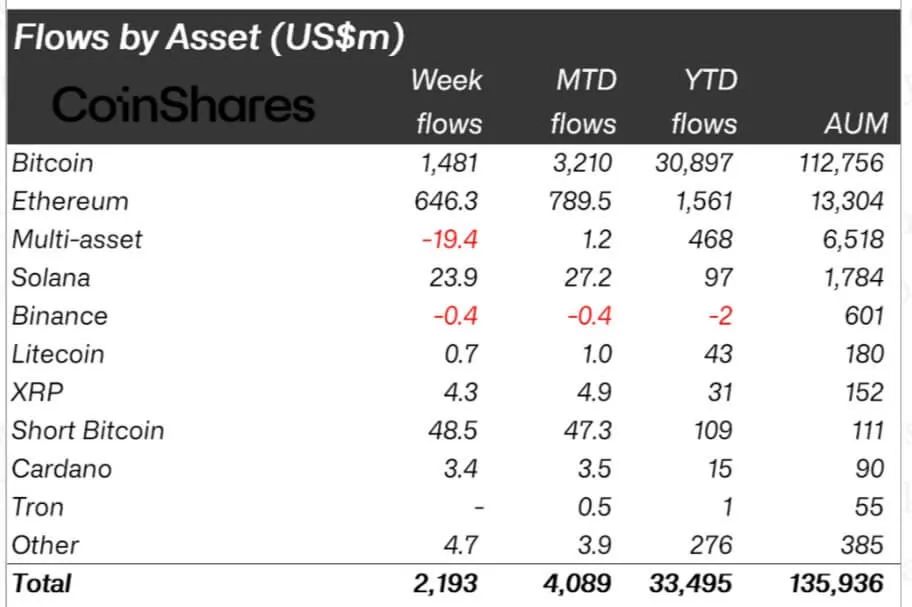

BTC's dominance remains strong, with inflows of $1.48 billion.

The large inflows are related to the excellent performance of US spot trading ETF products, which continue to attract significant attention from retail and institutional traders.

According to CoinShares data, BlackRock's IBIT and Fidelity's FBTC saw inflows of $2.1 billion and $40 million respectively.

On the other hand, the Ark 21 Shares fund saw outflows of $153 million, exceeding Grayscale's outflows of $108 million this week.

Meanwhile, BTC's record-breaking price performance above $90,000 has attracted short traders, who invested $49 million in short BTC products.

In addition, the bullish market sentiment also seems to have influenced people's interest in Ethereum, which also attracted a large inflow of $646 million (equivalent to 5% of its AUM).

Butterfill linked these inflows to the election results and the proposed Beam Chain network upgrade.

Inflows for other assets, including Solana, XRP, and Cardano, were relatively smaller, at $24 million, $4.3 million, and $3.4 million, respectively.