It's official:

For the first time in history, Ukraine just used long-range US missiles to strike INSIDE Russian territory.

As a result, markets globally are moving sharply after a clear escalation of war.

Here's how markets are reacting to the initial headlines.

(a thread)

Ukraine used the US Army Tactical Missile System (ATACMS) to strike Russia today.

This comes just hour after the Biden Administration authorized the use of long-range missiles to strike inside Russia.

Putin has just updated Russia's nuclear doctrine and markets are worried.

As a result, gold prices are surging AGAIN today as gold continues to serve as the global hedge.

Now up nearly $100 from their low last week, gold is rising even with a stronger US Dollar.

Goldman Sachs just said they see gold rising above $3000 in 2025.

Volatility is rising.

On Friday, we posted the below alert for our premium members at $2550 after buying the dip in gold.

Geopolitical risk premiums were priced-out and gold's technical pullback was overdone.

Subscribe to gain instant access to our alerts at the link below:

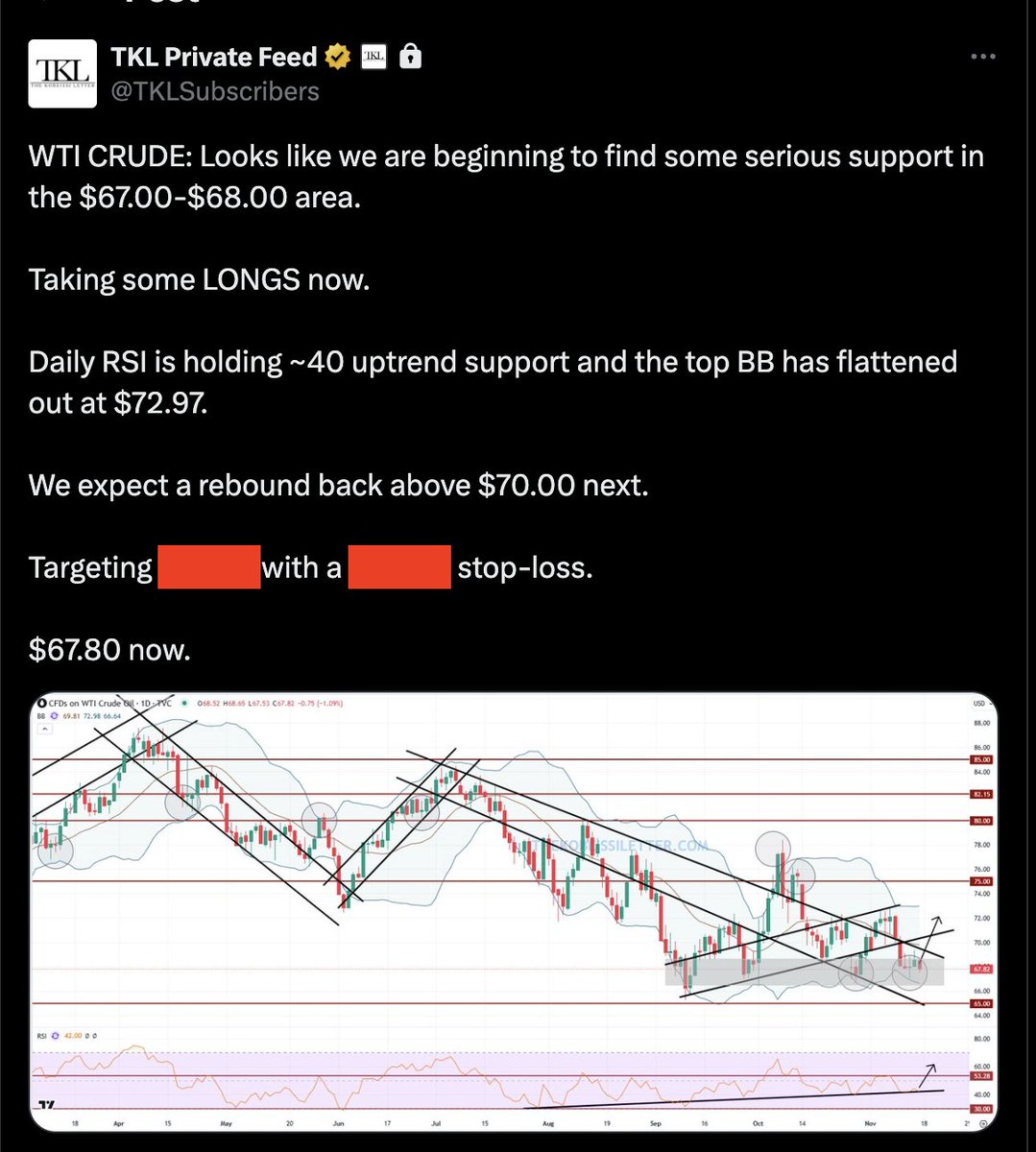

Yesterday, oil prices surged back toward $70.00 on news that the strikes would be allowed.

We have seen a cycle of geopolitical risk premiums being priced-in and out of oil prices this year.

This has created a tradable range in the $65 to $75 zone for WTI crude prices.

We also traded this on our premium member feed as seen below.

We first took shorts at $72.75 down to $67.00, then longs last Friday and called for $70.00+.

Subscribe at the link below to learn how we identify tradable ranges in various asset classes:

Dow Jones Industrial Average futures dropped over 200 points on the news of the strike.

Markets are beginning to price-in potential oil supply disruptions and elevated geopolitical tensions.

Unfortunately, markets are suggesting end of the war is out of sight for now.

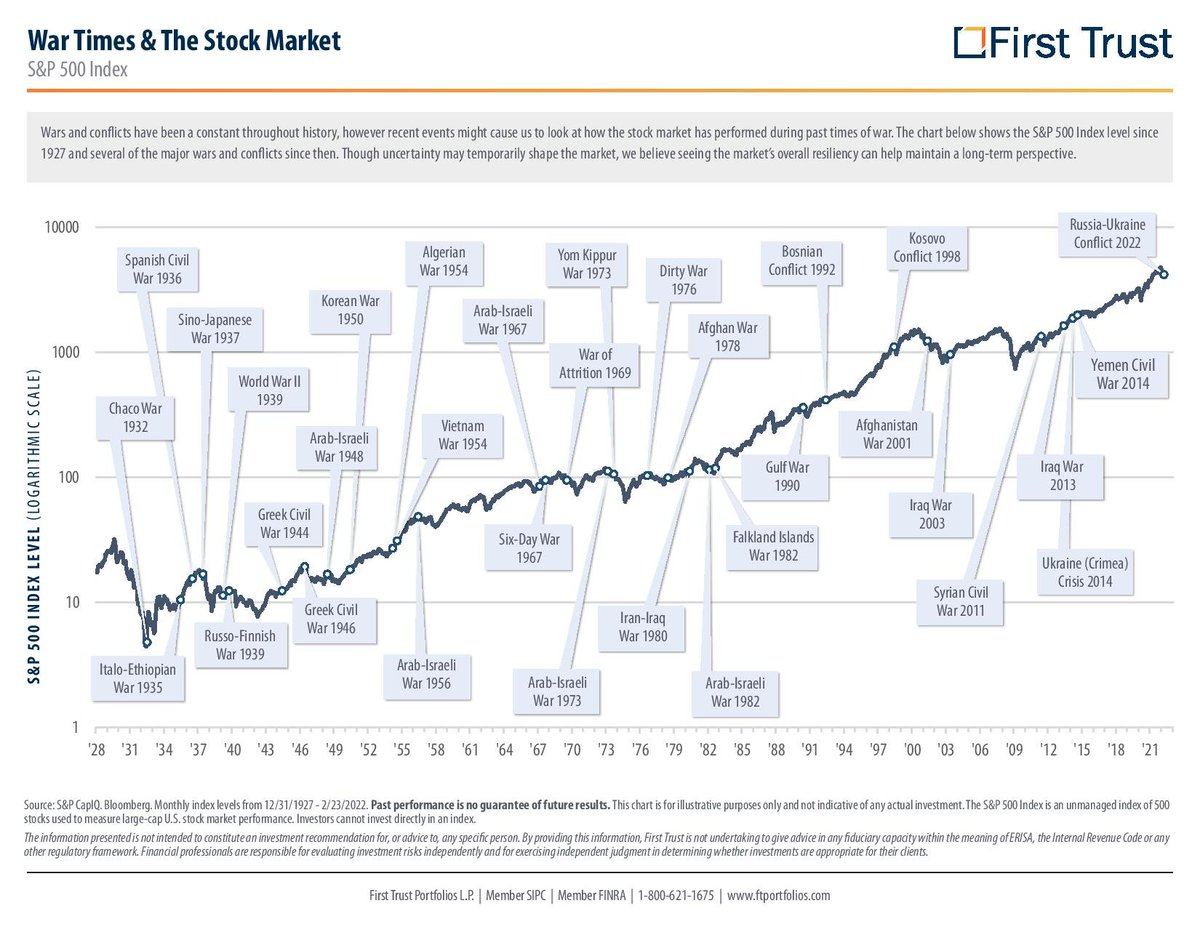

Historically, markets have seen hundreds of wars and the data points to market resiliency.

Wars almost always result in near-term volatility, but the dip is ultimately bought.

However, the prospect of nuclear weapons being used is not something we have seen in modern history.

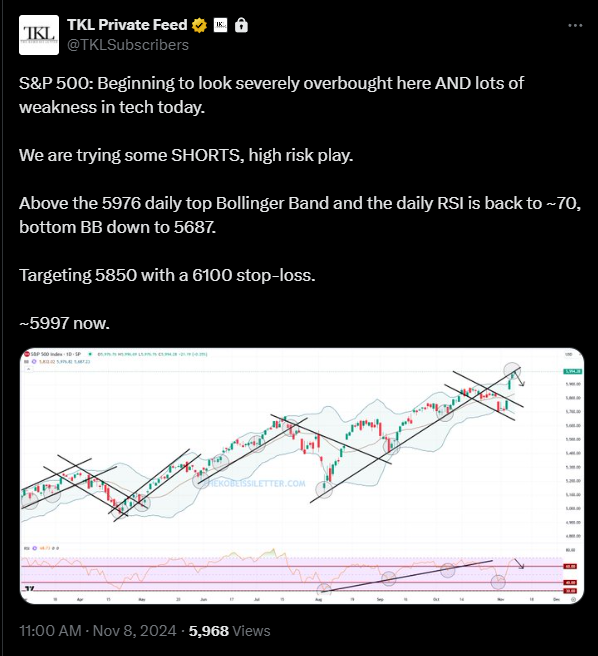

It also comes as market was severely overbought.

2 weeks ago, we took shorts in the S&P 500 at 6,000 and called for 5850.

Technical pullbacks have been rare since September, but they are necessary for a healthy uptrend.

Our premium clients are playing both sides of the trade.

Minutes ago, Russia’s Defense Ministry confirmed that Ukrainian forces hit a military site in Bryansk.

6 US-made missiles were launched and Putin has already expanded Russia's nuclear doctrine.

The question now becomes, how will Russia respond?

We are tracking the situation real-time and continue to break down the market implications of this move.

As we have been saying for weeks now, expect heightened volatility in 2025.

Subscribe now at the link below to access our analysis and alerts:

Lastly, we are watching the bond market which is reacting to the headlines.

Not even Fed rate cuts were able to get the 10-year note yield to drop.

It's now down 10 bps since the approval of these strikes.

Follow us @KobeissiLetter for real-time analysis as this develops.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content