Author: Jack Inabinet, Bankless; Compiled by Tong Deng, Jinse Finance

President-elect Donald Trump promised to end the Biden administration's anti-crypto campaign and "fire" U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler on his first day, winning the hearts of the crypto industry.

Although Trump has not yet proposed a replacement for Gensler, and his ability to remove the incumbent SEC commissioners seems legally questionable, crypto participants are nonetheless euphoric at the prospect of a new SEC chair quickly easing one of the industry's biggest regulatory pain points.

Commissioners Hester Peirce and Mark Uyeda may have bowed out of the race for the chairmanship, but they have been outspoken advocates for digital asset freedom and regulatory restraint during their tenure at the SEC.

Today, we explore Peirce and Uyeda's official statements, hoping to understand what a crypto-friendly SEC under Trump leadership might look like.

Proposed Token Safe Harbor

The day before Gary Gensler was confirmed as SEC chairman in April 2021, Commissioner Peirce began considering digital assets.

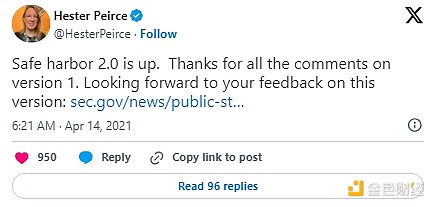

Recognizing that the new SEC chairman would propose a new enforcement priority agenda, Peirce attempted to steer the dialogue towards how to craft securities regulations to accommodate blockchain-based tokens by publishing an updated Token Safe Harbor proposal on GitHub.

Peirce's updated proposal aims to provide a three-year federal securities registration exemption or safe harbor for decentralized application developers. It incorporates significant revisions based on feedback from the crypto community, securities lawyers, and the public on her previous draft from February.

Under Trump leadership, a crypto-friendly SEC is expected to prioritize providing crypto transparency, while actively soliciting industry feedback to craft regulations that balance the needs of emerging decentralized applications and the agency's urgent mandate to protect the investing public.

Non-Fungible Foolishness

"Stoner Cats" is a collection of 10,320 Non-Fungible Tokens (NFTs) that were minted in July 2021 for 820 ETH; the proceeds from this sale will be used to fund the production of an animated series also called "Stoner Cats", featuring Hollywood stars such as Mila Kunis, Ashton Kutcher, and Chris Rock. In exchange for the purchase, Stoner Cats NFT holders will receive exclusive access to the series, unspecified future entertainment content, and an online community.

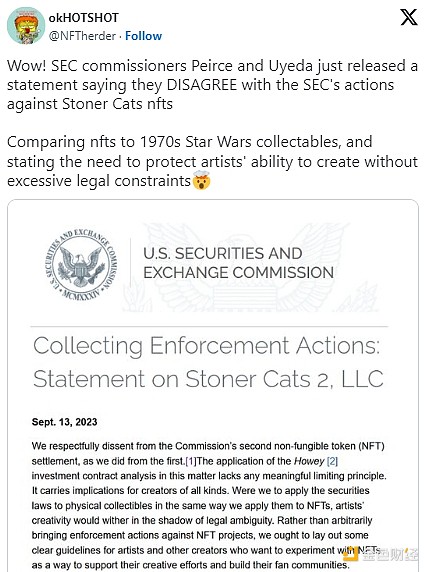

While the SEC ultimately settled with the Stoner Cats entity over an unregistered securities offering, Commissioners Peirce and Uyeda, the sole Republican commissioner, dissented from this enforcement action.

Commissioners Peirce and Uyeda acknowledged that NFT creators should not get a free pass from securities regulation, but they felt the SEC's application of securities regulation in this case would only lead to legal ambiguity.

Under Trump leadership, a crypto-friendly SEC is expected to provide comprehensive guidance on how to apply securities regulations to NFTs; to replace the legal uncertainty of hypothetical tokenized Pokémon cards, it should clarify when digital assets can be exempt from securities regulation.

Token Tension

In March of this year, the U.S. Securities and Exchange Commission (SEC) most recently took enforcement action against a crypto company, resolving allegations against the crypto exchange ShapeShift for allegedly acting as an unregistered securities broker-dealer in its online crypto asset trading platform.

Although ShapeShift became a peer-to-peer decentralized exchange in 2021, for over six years, ShapeShift had acted as a brokerage intermediary, fulfilling inventory orders, and serving as the counterparty to all crypto transactions occurring on its platform.

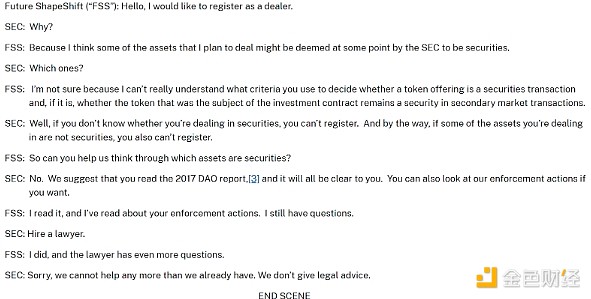

While Commissioners Peirce and Uyeda did not question the allegation that ShapeShift operated as an unregistered securities broker-dealer prior to 2021, in a joint dissent, they expressed concerns about the ambiguity created by the SEC's enforcement action.

To qualify as an unregistered securities broker-dealer, ShapeShift must have facilitated securities sales. The SEC was unwilling (or unable) to identify the relevant securities or how the sales of these securities created investment contracts, creating an untenable environment for the secondary trading of crypto assets.

Under Trump leadership, a crypto-friendly SEC is expected to clarify which tokens qualify as securities, eliminating the threat of ambiguous misconduct facing crypto-native exchanges like Coinbase, while approving registered broker-dealers to list such assets alongside existing products.

Imminent Issues

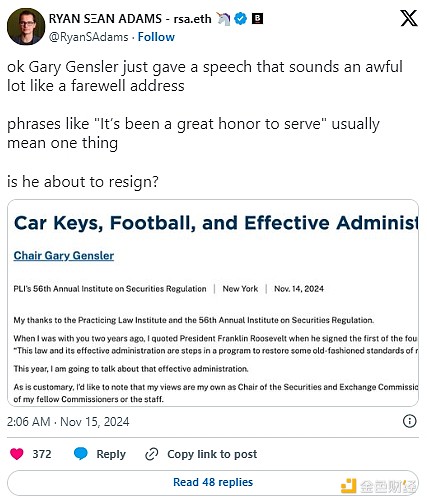

Decades of precedent suggest that Chairman Gensler will resign and cede control of the SEC to Trump appointees, but his term runs until 2026, and it is entirely unclear whether President Trump could summarily dismiss Gensler before then without protracted litigation.

However, it is noteworthy that many within the crypto industry have interpreted Gensler's recent November 14th speech as an informal resignation notice, with the chairman stating he is "very honored to serve".

As an independent regulatory agency, the U.S. Securities and Exchange Commission enjoys significant autonomy from the executive branch, and while Trump grandly promised on day one to "fire" Chairman Gensler, murky case law may support the view that SEC commissioners can only be removed "for cause" and not simply "at will".

Although the SEC chairman has discretion over the agency's budget and oversees its staff, they require a majority of the commission to appoint executive department heads, and each commissioner has an equal voice in the agency's procedural votes that guide how the SEC interprets and enforces securities legislation.

Commissioners are appointed by the U.S. President and confirmed by the Senate for five-year terms, but the terms are staggered to ensure that one member can be removed each June 5th, and while commissioners can be reappointed for an additional 18 months after their term expires to prevent vacancies, no more than three of the five commissioners may belong to the same political party at any given time.

While Commissioner Crenshaw's term expired on June 5th of this year, she continues to serve at the SEC and has been renominated by President Biden to fill the resulting vacancy.

If this vacancy persists until the Trump inauguration, he could easily fill the Republican Senate seat of his choosing to consolidate a pro-crypto majority on the SEC. Unfortunately, the Democratic-controlled Senate still has ample time to confirm Crenshaw's additional 5-year term, and the Biden administration can always resort to a sneaky recess appointment after December 20th.

Even if Gensler does not resign and Crenshaw's reappointment is confirmed, President Trump could still exert his influence on the SEC by designating the reluctant Peirce and Uyeda.

Although in this case there will be no clarification of the rule-making activities, the acting chairman has gained control over the SEC staff, empowering them to revoke the controversial SEC staff accounting bulletin 121, accept requests for no-action letters, suspend or terminate ongoing enforcement investigations and litigation, and solicit public feedback as a first step in the future cryptocurrency rule-making process.