Author: Chandler, Foresight News

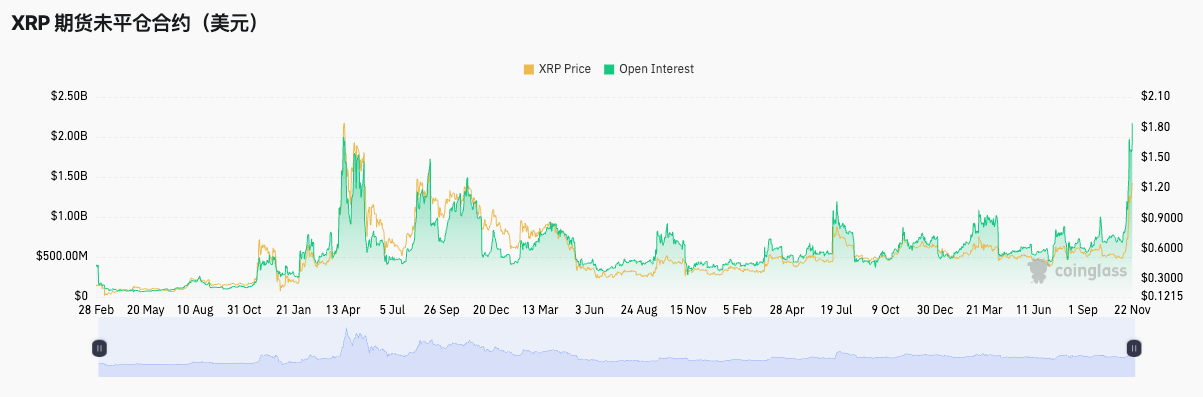

The price of Bitcoin has hit new highs, breaking through the $99,000 mark, driving the entire cryptocurrency market to become more active. Old-school altcoins have also begun to emerge, with XRP being particularly eye-catching. According to Bitget market data, on November 22, XRP broke through $1.4 USDT, with the current price at $1.416 USDT, a 24-hour increase of over 30%.

Compared to the frenetic meme market, old-school altcoins seem to be quietly gaining, not attracting as much attention as meme coins, but accumulating market attention with steady gains.

According to Kaiko data, as of November 18, the weekly trading volume of altcoins has surged to over $300 billion for the first time since 2021. Among them, DOGE, XRP, SOL and PEPE account for 60% of the total trading volume.

Since November, XRP has quietly risen from around $0.5 to a high of $1.435, a 182.4% increase, reaching a new high in over three years; ADA has risen from $0.33 to $0.9, an increase of nearly 170% this month; XLM has risen from $0.09 to $0.294, an increase of over 220%, etc. These signs seem to indicate that old-school altcoins are gradually emerging from their doldrums and reshaping their position in the market with their actual performance.

If this trend continues, the revival of old-school coins and the active trading of hot tokens may lead to a more widespread "altcoin season" in the future market.

Gary Gensler officially announces his resignation, the years-long litigation may come to an end

The recent strong rise of XRP is the result of the interweaving of multiple factors.

On July 13, 2023, when the court ruled that the sale of XRP on digital trading platforms was not considered a security, Ripple achieved a partial victory. However, the court ruled that XRP sold by Ripple to institutional investors was an unregistered security. In addition, the court also ruled that the personal XRP sales by Garlinghouse and Larsen did not constitute violations. On August 7, 2023, the court made a final judgment, requiring Ripple to pay a $125.0351 million civil penalty and prohibiting the company from further violating the Securities Act.

On October 3, the US SEC stated that it was appealing the previous decision of the US Second Circuit Court of Appeals regarding the Web3 payment company Ripple, with an SEC spokesperson saying that "the district court's ruling in the Ripple case conflicts with decades of Supreme Court precedent and the securities laws, and we look forward to presenting our arguments in the Second Circuit."

But with Trump's election victory, this regulation may be eased.

On November 22, according to the US SEC website, SEC Chairman Gary Gensler will officially step down on January 20, 2025, and the market has begun to have high expectations for changes in the future regulatory environment, with the litigation against companies like Ripple likely to be softened, settled or even withdrawn.

Gary's long-term harsh regulation of the cryptocurrency industry, especially Ripple, has kept XRP in a double bind of legal and market difficulties. Now, this regulatory stance may show signs of relaxation, giving the market an opportunity to re-evaluate the value of XRP.

From the data, according to CoinGlass data, the open interest (OI) of XRP futures contracts has reached a record high of nearly $2.44 billion. This data reflects the unprecedented speculative enthusiasm of the market for XRP. Open interest refers to the total number of active futures or options contracts that have not been closed or settled, and is generally seen as an important indicator of market activity and trading enthusiasm.

Institutions are actively positioning for ETFs

In addition to the easing of regulation, multiple institutions have also started applying for XRP ETFs.

On October 2, a Bitwise spokesperson confirmed that Bitwise has submitted an XRP ETF application, which has been officially submitted on the Delaware government website. According to its S-1 registration filing with the US SEC for its XRP ETF, the XRP custodian will primarily use cold storage to store the trust's assets, and will transfer a limited amount of assets to hot storage as needed to facilitate efficient basket creation and redemption.

A week later, the cryptocurrency investment firm Canary Capital filed an application with the US SEC to register a XRP spot ETF called "Canary XRP ETF". The plan is to provide investors with an investment channel without the need to hold XRP directly, while using the CME's CF Ripple index as the price tracking benchmark. Its founder Steven McClurg said that the positive changes in the regulatory environment and investors' demand for diversified crypto assets are the main reasons driving this application.

On October 16, Grayscale Investments filed an application with the US SEC to convert its mixed crypto fund Digital Large Cap Fund (GDLC) into an exchange-traded fund (ETF). As of September 30, the fund is mainly composed of Bitcoin, accounting for 74.7%, followed by Ethereum, accounting for about 18.55%, with the remaining portion composed of SOL, XRP and AVAX. The company has previously converted its Bitcoin and Ethereum funds into ETFs.

On November 2, 21Shares filed an application with the US SEC for an XRP ETF called "21Shares Core XRP TRUST".

These successive applications indicate that XRP's market position as a crypto asset is steadily recovering, reflecting the market's confidence in XRP's future potential. After the legal dispute between Ripple and the SEC made stage-wise progress, the market's concerns about the legality of XRP have been somewhat alleviated. And against the backdrop of the successive approvals of Bitcoin and Ethereum ETFs, the wave of XRP ETF applications is undoubtedly an important signal of the industry's forward progress.

Is the return of altcoins expected?

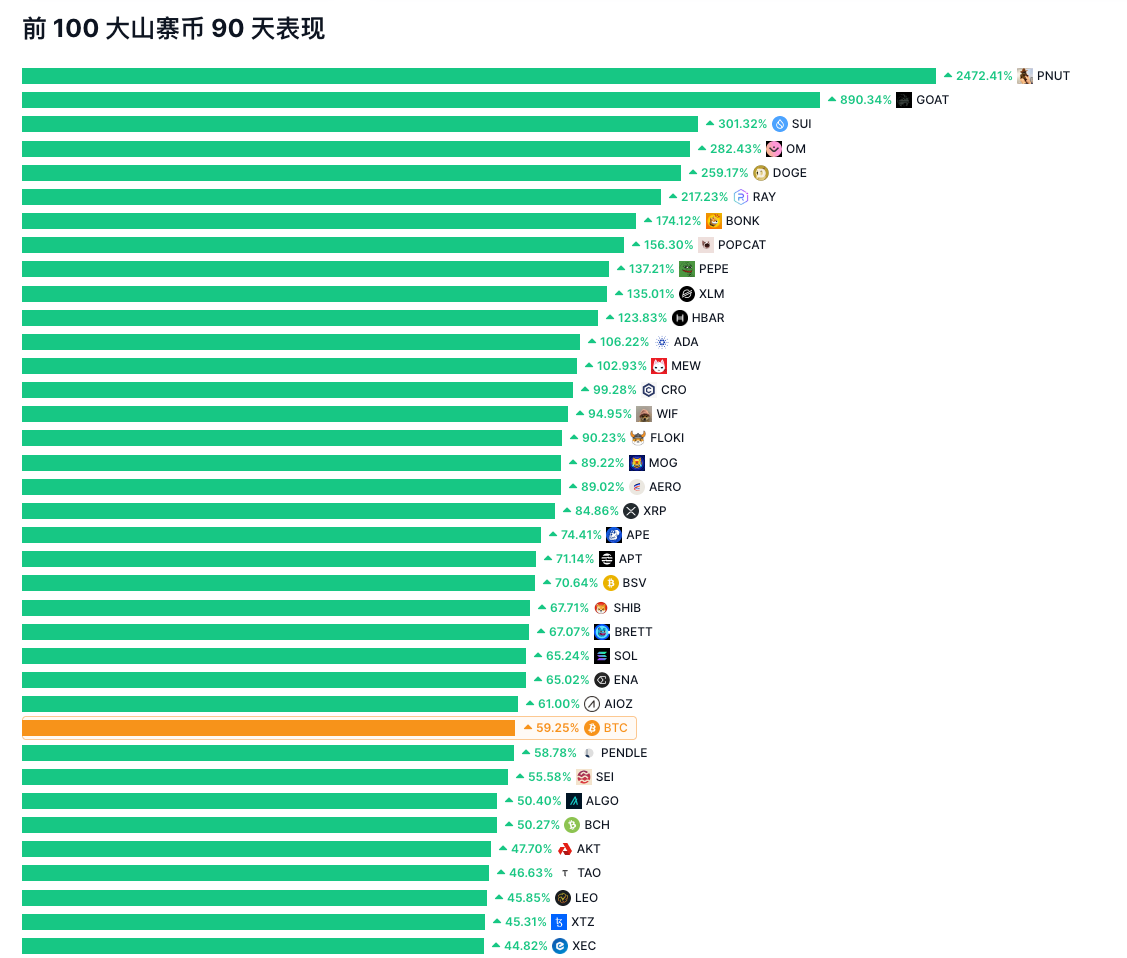

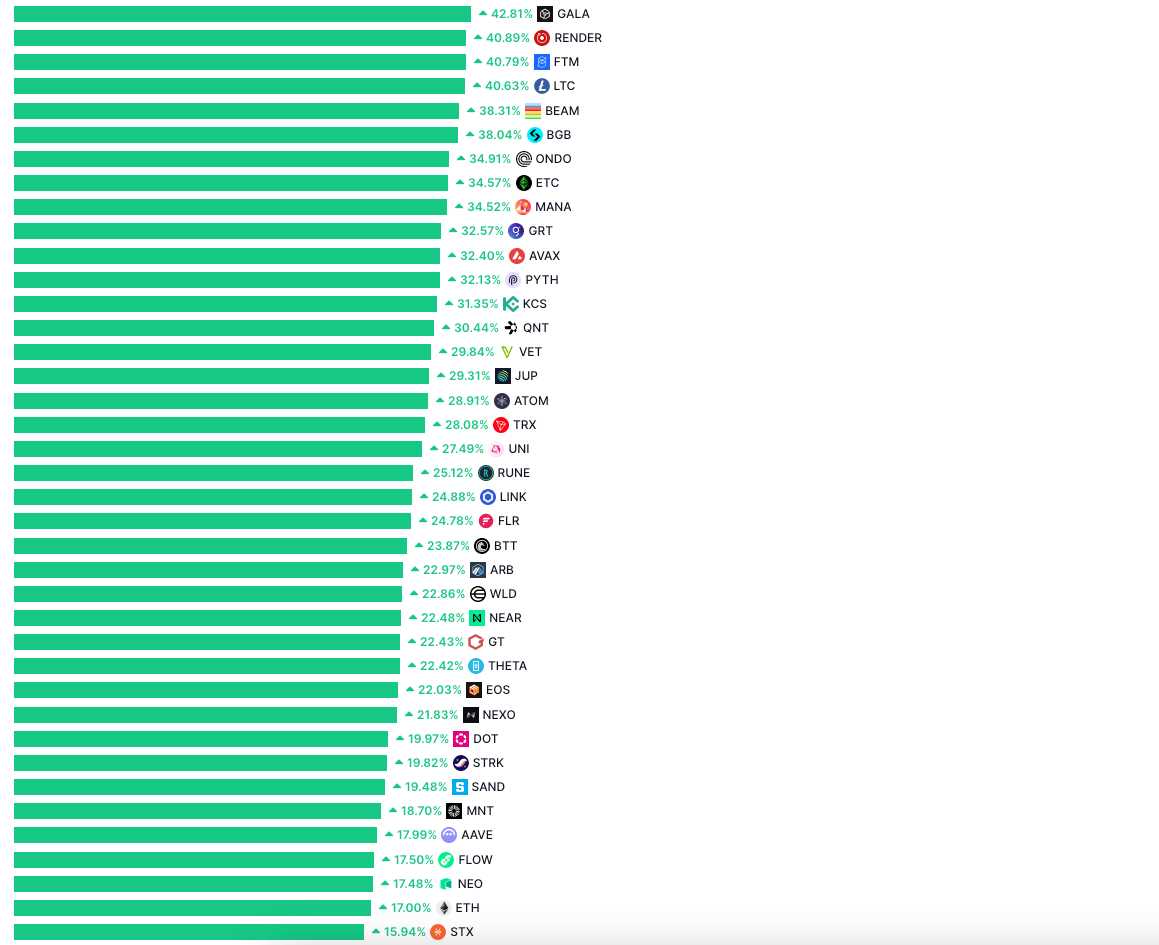

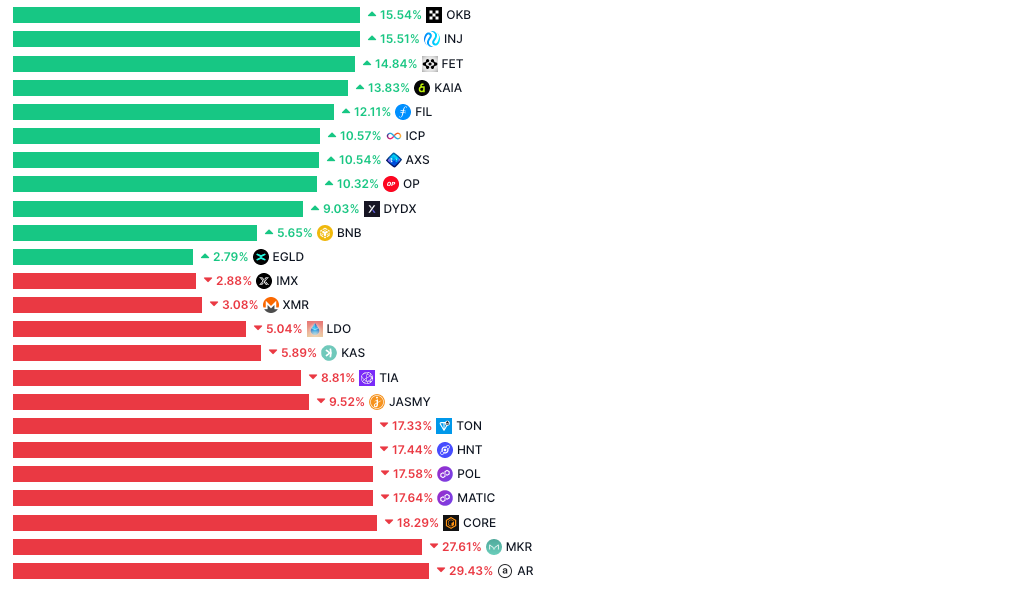

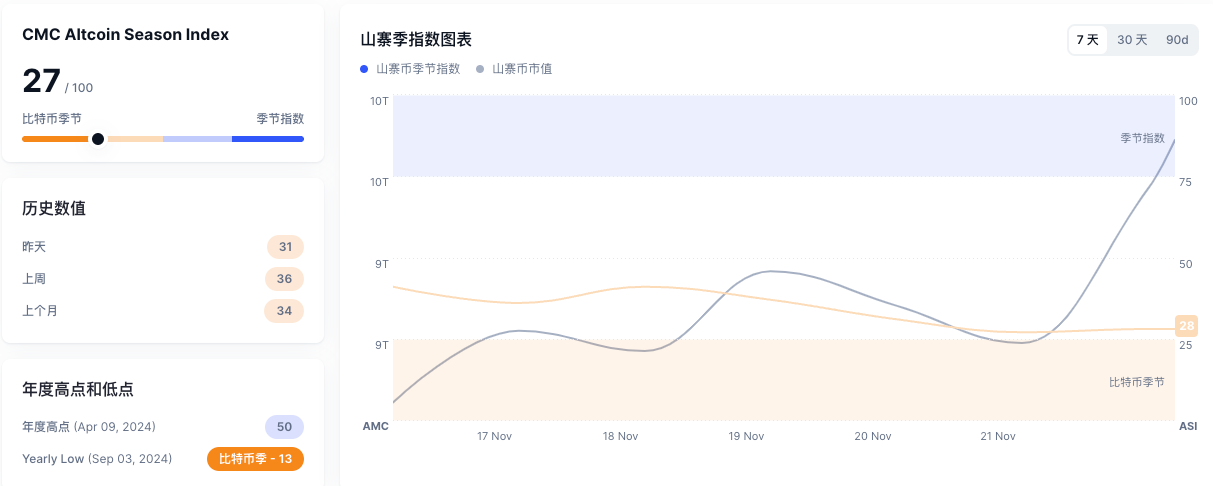

The CMC Crypto Altcoin Season Index is a real-time indicator used to determine whether the current cryptocurrency market is in a season dominated by altcoins. The index, based on the performance of the top 100 altcoins relative to Bitcoin over the past 90 days, provides detailed charts and indicators to track market trends and the market cap share of altcoins.

Looking at the chart and index data, the CMC Crypto Altcoin Season Index currently shows 27/100, indicating that the market is still mainly dominated by Bitcoin, and altcoins have not yet fully entered a dominant position. But the trend of change over the past 7 days is worth noting. The Altcoin Season Index has gradually risen from the low point on the 17th, and significantly jumped to 28 on the 21st, indicating that the market's interest in altcoins is recovering.

Looking at historical data, although the current index is far below the annual high of 50, it has rebounded significantly from the low of 13 at the beginning of the month. This upward trend may mean that market funds are gradually rotating from mainstream assets like Bitcoin to the altcoin sector. Especially against the backdrop of the strong performance of old-school altcoins like XRP and ADA, this trend may be further strengthened.

At the same time, the market cap of altcoins is also steadily growing, although the growth rate has not yet reached a level that can completely overturn the market pattern, but its gradual stabilization and slight upward trend reflects the subtle changes in market sentiment. Investors are beginning to re-evaluate the value of altcoins and gradually shifting their attention to these assets.

If this trend can continue and maintain a stable upward trend in the coming weeks, the altcoin season may finally arrive.

However, looking at the performance of the Top100 over the past 90 days, meme coins, with their high speculative nature and social driving force, are still difficult to dislodge from their market position in the short term.