Why Bitcoin Experienced a Pullback

At 1 AM last night, the price of Bitcoin dropped to as low as $95,734, but has since rebounded to $97,900 as of the time of writing. Nevertheless, the price correction is not unexpected, as small fluctuations are normal during the process of setting new all-time highs.

After setting new highs for several consecutive days and coming within $200 of the $100,000 mark, the price of Bitcoin stagnated and retreated from the Friday peak. Initially, Bitcoin fell to $98,000 on Sunday, but further selling pressure pushed the price below $96,000. Since Friday, Bitcoin's market capitalization has shrunk by over $60 billion, falling below $1.9 trillion.

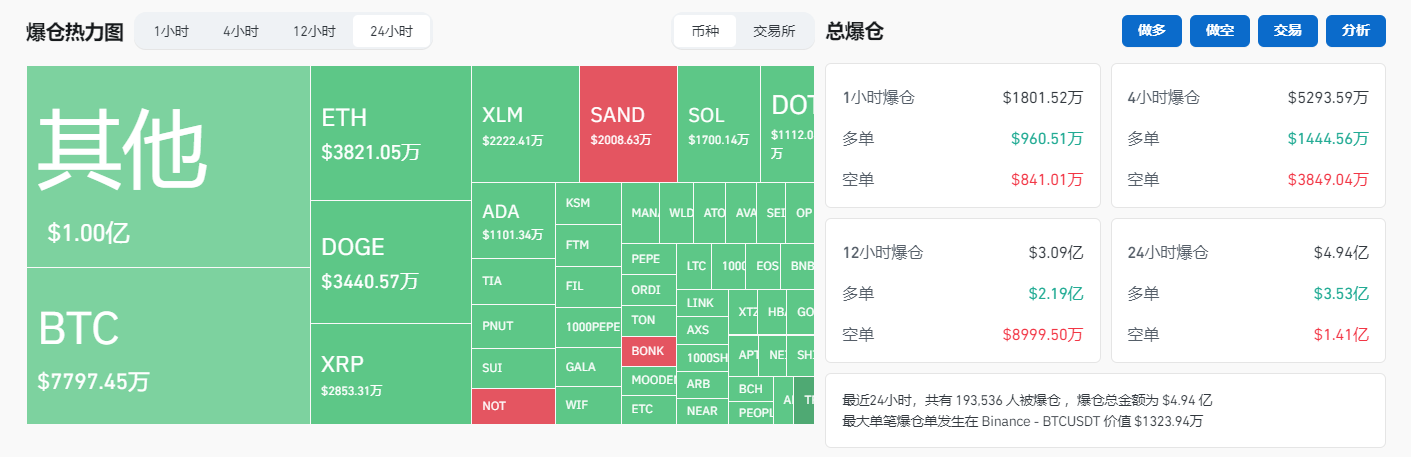

Liquidation Amounts Approach $500 Million

The market volatility has dealt a heavy blow to over-leveraged traders. In the past 24 hours, nearly 200,000 market participants have been liquidated, totaling nearly $500 million. The majority of the liquidated positions were long, valued at $353 million.

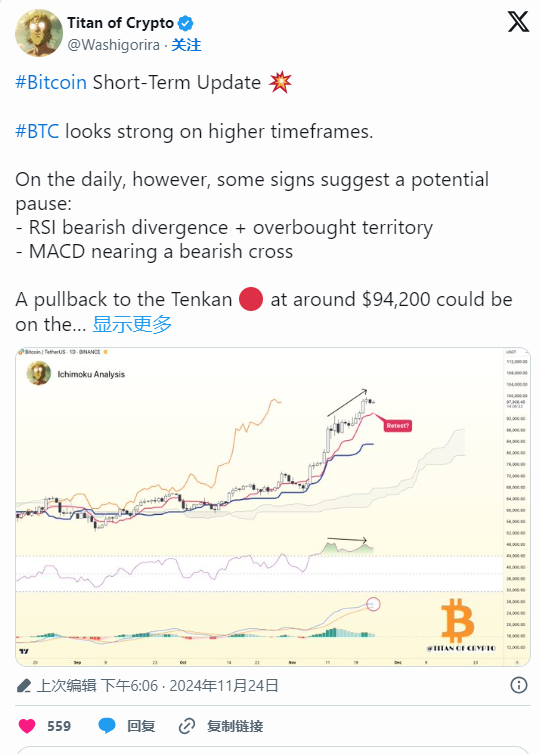

Titan of Crypto analyzed this phenomenon and pointed out that Bitcoin's price plummeted quickly after Iran issued retaliatory statements against Israel. As of the publication of this article, Bitcoin's price has fallen below $96,000, and this volatility has also affected the performance of Altcoins: Ethereum retreated from $3,326, DOGE fell 11%, XRP dropped 16%, and ADA also declined 14%.

Analysts' Views on Bitcoin's Decline

In a post on November 23, analyst Ali Martinez shared an interesting prediction on Bitcoin's potential price trajectory. He pointed out that the TD Sequential indicator has issued a sell signal on Bitcoin's 12-hour chart, suggesting the price may decline further.If Bitcoin experiences this adjustment, the price could drop to $91,583 or even further to $85,610. He also stated that the sell signal would only be considered invalid if Bitcoin's closing price is above $100,535.

Peter Brandt Identifies Consistent Characteristics of Bull Cycles

Veteran trader Peter Brandt emphasized that there are two clear patterns in Bitcoin's previous bull market cycles:

First, bull markets are typically characterized by parabolic price increases, but the intensity of each rally weakens as the cycle progresses;

Second, after breaking out of the parabolic pattern, Bitcoin often experiences a significant correction, typically retracing around 80% (±5%) from the all-time high.

Brandt also shared Bitcoin's current parabolic trajectory, and although the pattern is relatively clear, the trend may change as the market evolves. If this pattern is validated, Bitcoin's rally may continue into January. However, based on the chart's forecast, a more substantial correction could occur in 2025.

Macroeconomic Events' Impact on BTC

Geopolitical tensions in the Middle East have had a profound impact on Bitcoin's performance.

In early October, after Iran launched missile strikes against Israel, Bitcoin's price plummeted significantly, once again demonstrating that geopolitical turmoil often prompts investors to turn to traditional safe-haven assets like gold, rather than Bitcoin.

Additionally, macroeconomic events in the United States have continued to influence Bitcoin's price movements. Recently, the US labor market has remained strong, with the latest employment report exceeding expectations, indicating that the Federal Reserve may continue to raise interest rates. Historically, lower interest rates have been beneficial for Bitcoin, as investors tend to seek higher-risk assets to generate higher returns.

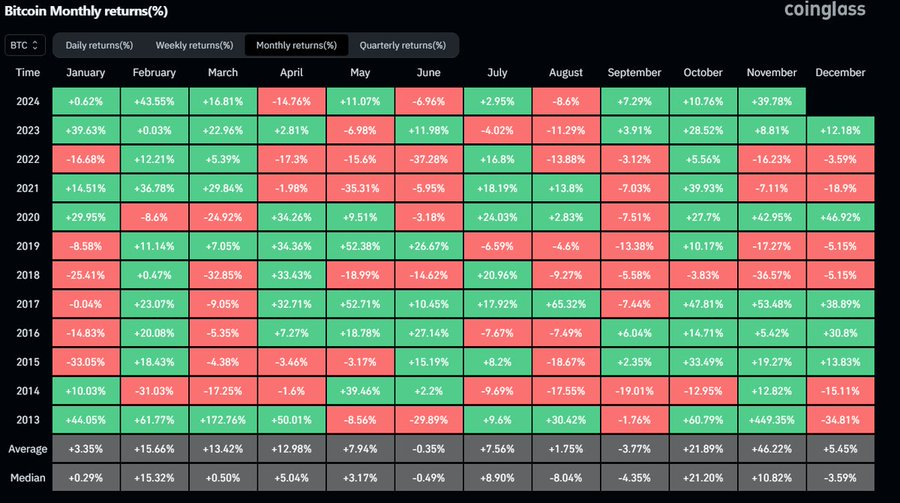

Outlook Remains Optimistic

Nevertheless, the medium-term outlook remains optimistic. Although there may be volatility in the short term, historical data suggests that the prospects for December may continue to improve. Even in a bullish trend, Bitcoin often experiences corrections. Considering Bitcoin's recent price movements, as well as factors such as the market excitement following Trump's election and the inflow of ETFs, the upward price trend is highly likely to continue.