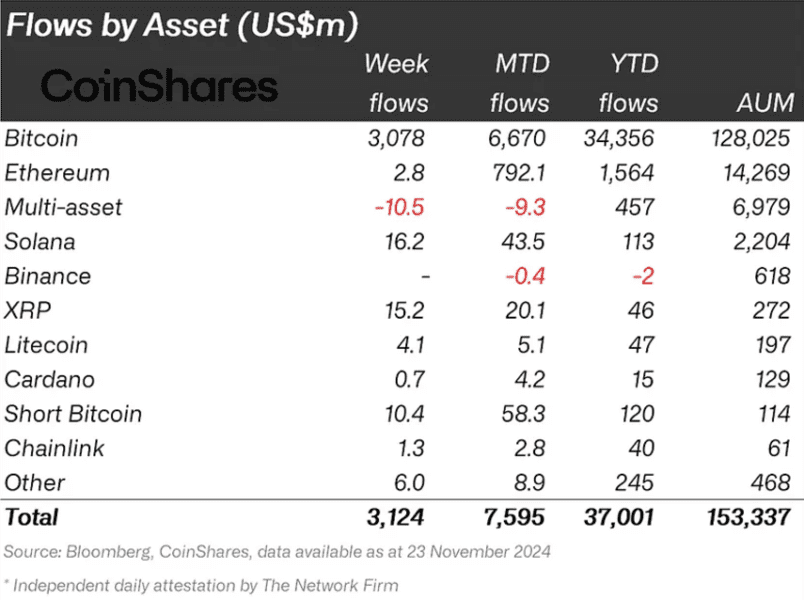

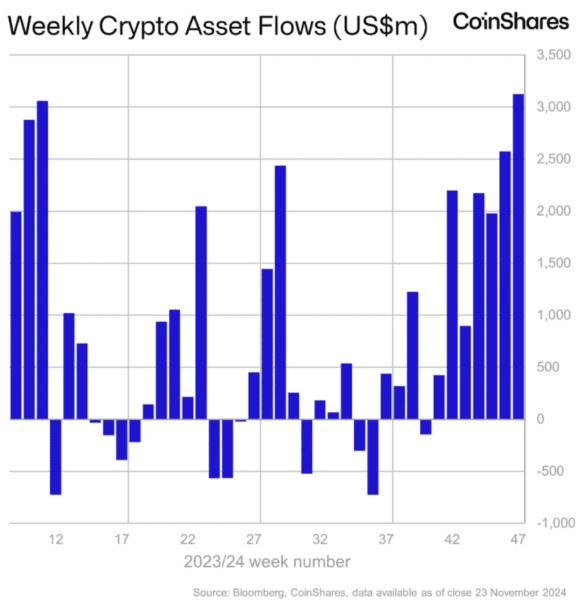

According to the report released by the digital asset management company CoinShares on Monday, digital asset investment products saw record-breaking inflows of $3.13 billion last week, bringing the year-to-date net inflows to a record-breaking $37 billion, driven primarily by Bitcoin, far exceeding the $309 million inflows in the first year of the launch of the US gold ETF.

The net inflows for Bitcoin-related investment products were around $3.07 billion, and at the same time as Bitcoin hit a new all-time high (around $99,600), there was also $10.4 million in inflows to short Bitcoin investment products, with a monthly net inflow of $58 million, the highest since August 2022.

In the Altcoin investment product space, Solana saw net inflows of $16.2 million last week, higher than Ethereum's $2.8 million, but still significantly behind Ethereum in year-to-date data. XRP, Litecoin, and Chainlink also saw notable net inflows of $15.2 million, $4.1 million, and $1.3 million, respectively. Multi-asset investment products, on the other hand, saw net outflows for the second consecutive week, totaling $10.5 million.