Author: BitpushNews

On Tuesday, the cryptocurrency market continued the correction trend.

Bitpush data shows that BTC reached a high of $95,000 in the early trading session, but then came under continuous pressure. In the afternoon, the bulls tried to rebound, but encountered bearish resistance at $94,800, and even briefly fell below $91,000. At the time of writing, the trading price of BTC is $91,646, down 2% in 24 hours. The Altcoin market performed even more weakly, with over 90% of the top 200 tokens by market cap recording declines.

Currently, the overall market cap of cryptocurrencies is $3.14 trillion, and BTC's dominance is 57.3%.

In the US stock market, the S&P, Dow Jones, and Nasdaq indices all closed higher, up 0.57%, 0.28%, and 0.63% respectively.

The possible reason for the decline is the overheated leverage market

Part of the reason for the decline in BTC may be due to the excessive leverage trading in the market, and when the market fluctuates, these leveraged positions will be forcibly liquidated, leading to further price declines.

Data analysis platform IntoTheBlock expressed a similar view, believing that the correction in BTC "can be attributed to" the rise in funding rates, ultimately leading the market to be biased towards bearishness. However, as the funding rates return to normal levels, further deleveraging should be limited.

Cryptocurrency futures market analyst Byzantine General also pointed out that in terms of trading volume, the current price trend of BTC is similar to some previous local tops. He said, "BTC is likely to experience a period of sideways consolidation. However, during this time, some other cryptocurrencies may perform well."

From a technical perspective, BTC may retest the liquidity area around the psychological level of $90,000, and may even further decline to $85,000.

This is because BTC rose very rapidly from November 6 to November 22, without any obvious imbalance between buying and selling, and such a rapid rise is usually accompanied by a subsequent correction to balance the supply and demand relationship. Therefore, BTC may retrace to previous support levels or even lower levels to digest the previous gains.

In addition, with the Relative Strength Index (RSI) falling below 50 for the first time since November 6, it is expected that the bears will dominate the price trend in the coming week, which may cause BTC to consolidate below $95,000.

Cryptocurrency research analyst CoinSeer believes that the important support for BTC is in the $85,000-$88,000 range, and once it breaks below, it may trigger large-scale cascading liquidations.

TradingView analyst TradingShot wrote: "The sharp correction in BTC yesterday caught the market off guard. There are a few fundamental reasons behind this: one is the fading of the post-election euphoria, and the other is the psychological pressure of the $100,000 level. However, there is a more important technical reason that has been overlooked."

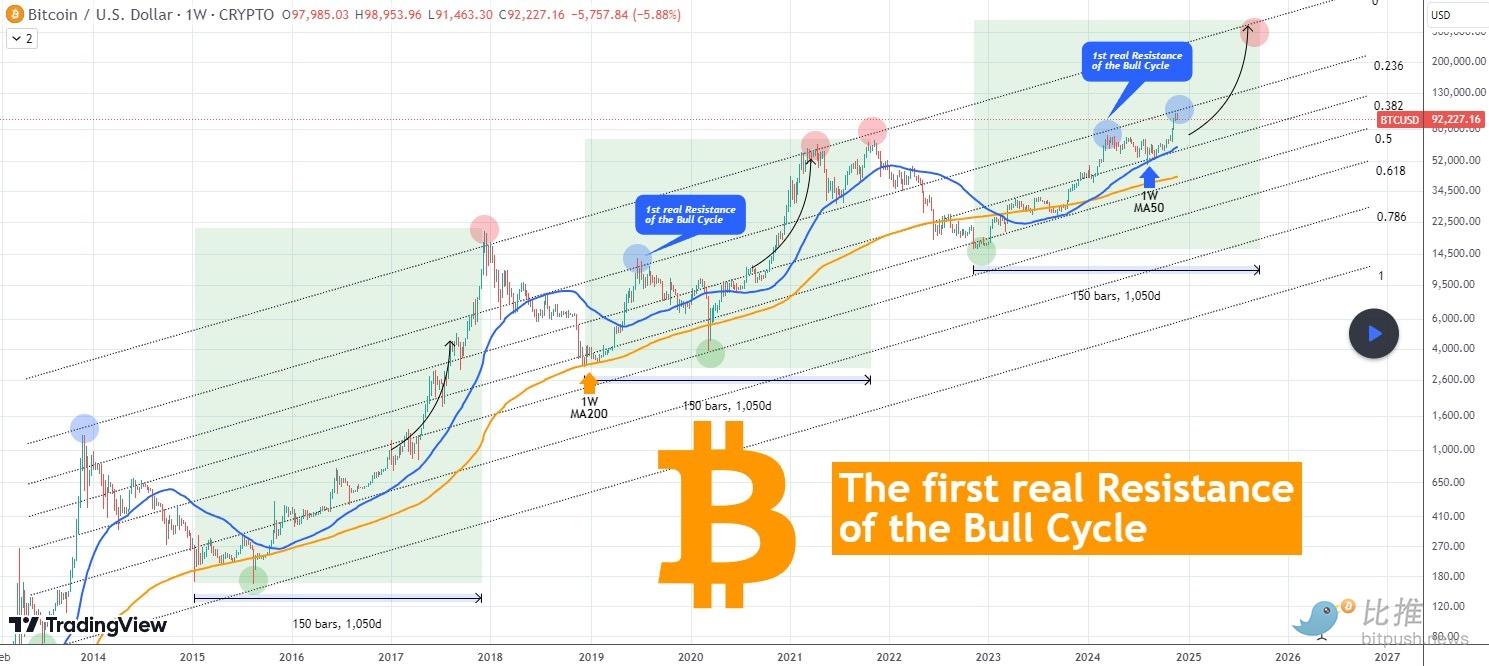

The analyst pointed out: "As shown in the chart, there is a Fibonacci channel that has existed in the past three cycles (including the current one). This channel started from the strong rebound at the top in December 2013. The top of that cycle was exactly at the 0.236 Fibonacci level, and this level has acted as a resistance in the bull markets of June 24, 2019 and May 11, 2024."

TradingShot said that the recent correction is because BTC has touched the "first true resistance of the bull market cycle".

He explained: "This is the Fibonacci trend line that has recently (November 22) acted as a resistance. We can call this the 'first true resistance of the bull market cycle' because this is the first major resistance level encountered by the bull market cycle before the final top. In the past two cycles, the tops have occurred at the 0.0 Fibonacci level, which is the top of the channel (the red circles in the chart). The red dot at the end of 2025 is not a forecast, but for comparison purposes."

TradingShot also observed: "The duration of each previous bull market cycle has been around 150 weeks (1050 days), and if this pattern repeats, the top may appear in late September or early October."

He pointed out: "Trying to capture the top and sell is much better than giving an exact price target. It is also interesting that although BTC is technically facing resistance, the current uptrend started from the low on August 5, 2024, which is exactly on the 1-week MA50 (blue trend line). Technically, as long as this trend line remains valid, the cyclical bull market wave should be able to remain intact."