Long-awaited. On November 29, the decentralized derivatives exchange Hyperliquid announced the launch of its native token HYPE. After the token was launched, the price of HYPE soared, rising from the opening price of $2 on November 29 to a peak of $9.8 on December 1, an increase of nearly 5 times in less than 3 days.

Compared to other major airdrop projects this year, HYPE's market performance has been truly impressive. In this airdrop, Hyperliquid distributed a total of 310 million tokens, and even at the opening price of $2, the airdrop scale reached $620 million. Among the airdrops this year, it can be said to be one of the largest airdrop projects.

But strangely, in the pre-airdrop period of Hyperliquid, there was little discussion of it on social media by Chinese KOLs, and there were not many Chinese bloggers who "showed off" afterwards. It seems that those KOLs who focus on "farming" collectively missed this real big opportunity.

Airdrop sent to 94,000 addresses, with the highest airdrop reaching nearly $10 million

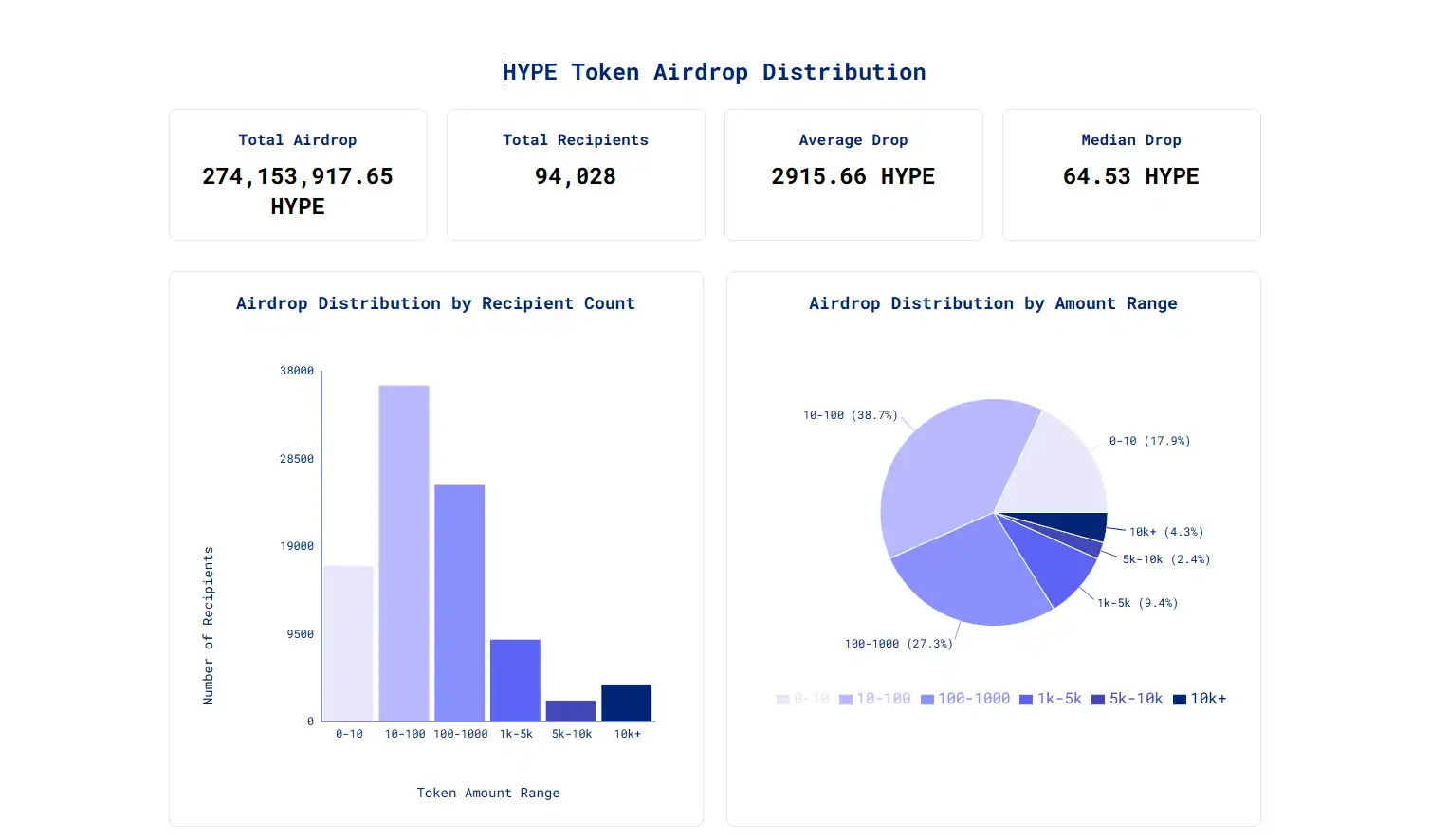

According to data from ASXN Data, Hyperliquid actually airdropped about 274 million tokens (some users missed the opportunity to claim due to not signing the Genesis Event terms). A total of 94,000 addresses received the airdrop, with an average of 2,915 HYPE per address, which is equivalent to $28,500 based on the $9.8 price on December 1. From this perspective, Hyperliquid is indeed one of the largest airdrops of the year.

However, the 2,915 average is the result of the 80/20 rule, with the average being pulled up by the large airdrop recipients, and the median airdrop being only 64.53 tokens. In overall proportion, about 38.7% of users received between 10 and 100 tokens, and 17.9% of users received less than 10 tokens. Therefore, about 56.6% of users received less than 100 tokens. And accounts that received less than 1,000 tokens accounted for 83.9%. Thus, most people did not reach the average of 2,915 tokens, but even with hundreds of dollars, the Hyperliquid airdrop can still buy a part of an Apple phone.

At the individual address level, the highest single address received 970,000 tokens, which, at a price of $9.8, would amount to $9.56 million. This should be the single address with the highest airdrop value in the 2024 airdrop projects (Starknet's largest single address was $360,000, and Jupiter's largest single address was $130,000).

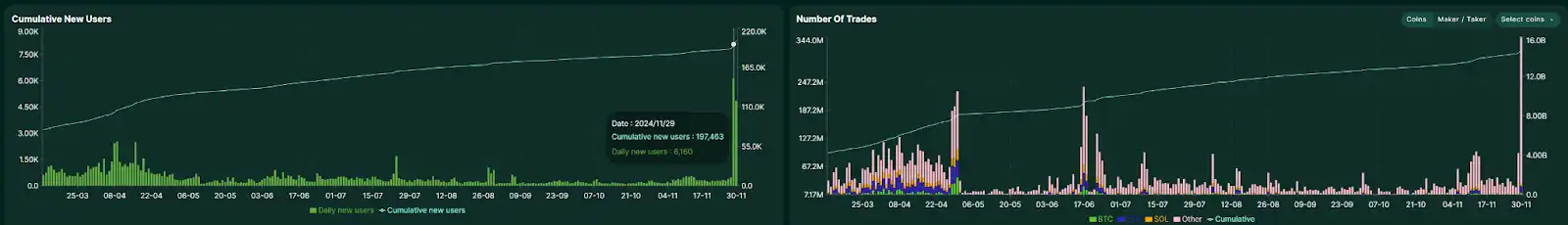

The airdrop brought 10,000 new users in 2 days

Although there was not much social media promotion, the generous airdrop still brought Hyperliquid a lot of new users. From historical data, before the airdrop was released, Hyperliquid's daily new users were basically maintained below 500, mostly around 150 new users. However, on November 29 and 30, the two-day increase in new users was 10,993, even exceeding the new users added in the past month. On November 30, the total number of transactions even broke through 3.44 million, an increase of more than 10 times over the pre-airdrop period.

However, the surge in user activity does not seem to have brought much change in trading volume. The total trading volume on November 29 and 30 was about $1.8 billion and $1.9 billion respectively, without any significant growth. But compared to the cliff-like decline in user numbers after the airdrop of other projects, Hyperliquid's performance is indeed somewhat unconventional.

And Hyperliquid's growth trend has already formed. According to defillama data, Hyperliquid Perp ranks second among all derivative protocols, slightly lower than Jupiter Perpetual. On November 17, Hyperliquid even briefly surpassed Jupiter to become the first. And in July this year, Hyperliquid was ranked fourth, behind GMX and dYdX. As an emerging decentralized derivatives exchange, Hyperliquid's rise has already begun.

Hyperliquid ecosystem tokens collectively soar

As of December 1, HYPE's market capitalization reached a peak of over $3.3 billion, ranking around 44th among all tokens, on par with OKB. ARB's market capitalization is currently around $4 billion, and if HYPE's price continues to rise, it may directly surpass ARB.

For those who received the airdrop, the sharp rise in HYPE is undoubtedly the best tonic. On social media, many KOLs said that compared to those airdrops that raised a lot of money but designed complex rules and user games, Hyperliquid's airdrop is simply the conscience of the year. And some individual users also said that HYPE is currently just a single-chain token that can only be traded on Hyperliquid.

With the heat of HYPE, Hyperliquid seems to have become a new gold mine. In addition to HYPE, other tokens on Hyperliquid have also risen rapidly with this wave of heat. From November 29 to December 1, Hyperliquid's native trading tokens PURR, JEFF, HFUN and others have seen significant increases. Especially JEFF (a MEME coin based on Hyperliquid's founder Jeff), which has seen a nearly 10-fold increase in three days. OMNIX, OMNIX, OMNIX have also seen exponential growth in recent days.

However, how long this strong upward trend can be maintained is still unknown.

So far, Hyperliquid's on-chain deposits and withdrawals still need to be bridged through Arbitrum. More than 60% of the USDC tokens on the Arbitrum chain are held by Hyperliquid addresses. This seems to be a process of mutual achievement, with Hyperliquid bringing sufficient active addresses and active funds to Arbitrum, while Arbitrum provides a stable and inexpensive infrastructure for Hyperliquid before its mainnet launch.

So far, Hyperliquid has not accepted any investment. In the announcement of the Genesis Event, the Hyperliquid Foundation stated that in the token distribution, "there is no allocation for private investors, centralized exchanges or market makers." PANews has previously conducted an in-depth study on Hyperliquid's development philosophy. (Related reading: The top MEME coin with a market capitalization of over $100 million, the L1 public chain Hyperliquid that focuses on derivatives trading, will it be a new MEME mining ground?)

According to Hyperliquid's official information, the Hyperliquid EVM has been launched on the testnet, but the integration with other L1 states has not yet been completed. In the short term, it seems that it cannot transfer assets through cross-chain bridges like other L1s. Additionally, as an L1, Hyperliquid's ecosystem is not yet fully developed, with its own browser and DEX. This route seems to have both advantages and disadvantages. The advantage is that all technical innovations and development focus on improving the performance of the decentralized derivatives exchange, serving to build a decentralized Binance. The disadvantage is that it may be difficult to expand brand influence by expanding the ecosystem.

From the operation of Hyperliquid's official social media, apart from announcements, they hardly post any other content. This is a kind of stubborn simplicity, but in the crypto field that is keen on hype and promotion, it is indeed unconventional.

However, Hyperliquid's recent heat has once again proven that truth - any marketing tricks are nothing compared to the rise in price.