What is the XRPL?

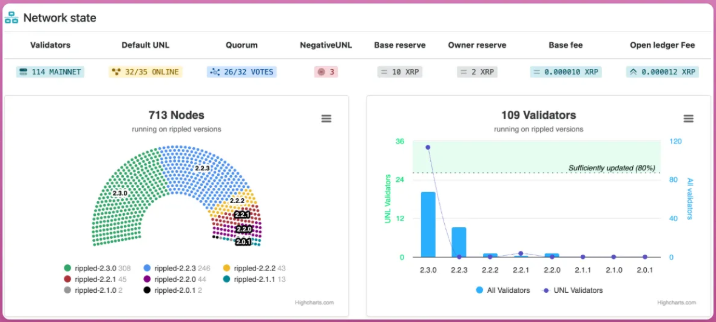

The XRPL claims to be a blockchain built for speed and efficiency. But it's not particularly fast, decentralized, or efficient (as you'll see, the efficiency part is debatable). The XRPL doesn't use PoW or PoS consensus mechanisms. It uses a federated consensus mechanism, where validators reach consensus on transactions without mining or staking. Here's how it works: Over 109 validators process transactions, with 31 trusted validators forming a Unique Node List (UNL) to reach consensus. Source: xrpscan

In practice, around 31 trusted UNLs run the XRP Ledger. These include Arrington XRP Capital, Bifrost Wallet, Ripple itself, XRPscan, and others. You can find the live UNL list here or on XRPscan (which is more user-friendly).

They claim any entity can run and publish a UNL, and these UNLs are chosen based on reliability. But relying on a UNL also introduces centralization risks, as Ripple and the XRP Ledger Foundation have significant influence over the default UNL. Reportedly, Ripple Labs needs to approve these UNLs.

The name "federated consensus" is quite fitting.

You might expect XRP to be fast, since it only relies on a few validators.

But that's not the case. Transaction confirmations take 3 to 5 seconds. Solana, on the other hand, is leagues ahead in terms of node count, transaction speed, and the smart contract capabilities you'll see.

The upside is that transaction fees are almost zero, costing only 0.00001 XRP per transaction.

Source: xrpscan

In practice, around 31 trusted UNLs run the XRP Ledger. These include Arrington XRP Capital, Bifrost Wallet, Ripple itself, XRPscan, and others. You can find the live UNL list here or on XRPscan (which is more user-friendly).

They claim any entity can run and publish a UNL, and these UNLs are chosen based on reliability. But relying on a UNL also introduces centralization risks, as Ripple and the XRP Ledger Foundation have significant influence over the default UNL. Reportedly, Ripple Labs needs to approve these UNLs.

The name "federated consensus" is quite fitting.

You might expect XRP to be fast, since it only relies on a few validators.

But that's not the case. Transaction confirmations take 3 to 5 seconds. Solana, on the other hand, is leagues ahead in terms of node count, transaction speed, and the smart contract capabilities you'll see.

The upside is that transaction fees are almost zero, costing only 0.00001 XRP per transaction.

What are Trust Lines, Reserves, Negative Balances, and Rippling

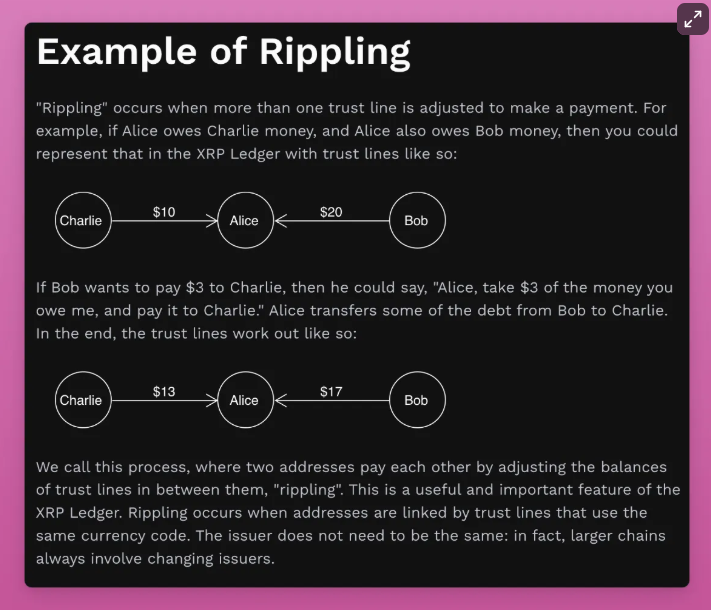

When you create an XRPL wallet (to trade XRP meme coins), you'll notice some unusual things. First, you need at least 10 XRP to activate an account. Additionally, the XRPL requires you to hold a 2 XRP reserve for each token in your wallet (so if you hold 20 meme coins, you need to "reserve" 40 XRP). There's currently a governance vote underway to reduce these requirements by 10x. You can find the current requirements under the "Base Reserve" and "Owner Reserve" tabs on XRP Scan. This is because balances work through "trust lines" in a different mechanism. This is the most complex part, so bear with me."A trust line is a structure in the XRP Ledger used to hold fungible tokens. Trust lines enforce the XRP Ledger's rules that you can't force someone to hold a token they don't want. This safeguard is necessary to enable the XRP Ledger's applications in areas like community credit."—From Ripple's documentationEssentially, through trust lines, no one can be forced to hold a token they don't trust, preventing spam, and allowing for features like freezing, authorization, and "no Ripple" flags to control unnecessary balance adjustments. Trust lines are the foundation of the token system on the XRPL. They connect two accounts and define the balances between them, enabling the issuance and transfer of tokens. When an issuer creates a token, their balance may go negative, representing the amount they've issued, while holders' balances become positive. For example, if the issuer sends out 100 tokens, their trust line balance is -100, and the recipient's balance is +100. Rippling (the origin of the Ripple name) takes this further, allowing token balances to flow between connected accounts during payments. It's like a passive exchange system, allowing atomic settlement of funds without the issuer's involvement. For instance, if Alice owes Bob $10, and Bob owes Charlie $10, Rippling allows Alice to pay Charlie directly, adjusting the balances through the trust lines.

Remember why Ripple designed it this way!

It's like a "double-entry bookkeeping" system for "efficient" net settlement, aimed at serving real-world assets, stablecoins, tokenized commodities, and cross-border payments.

This means issuers have more control over the use of assets.

For compliance (think stablecoins), authorized trust line issuers can enable the "Require Auth" flag, limiting token ownership to only approved accounts. This feature makes the XRPL suitable for KYC/AML-regulated assets.

The decentralization purists may be eager to criticize this.

If you understand how it works, you may not want to enable Rippling, as your balances could be adjusted. Users can enable or disable the Rippling feature.

Enabling Rippling:

If you want to allow balances to flow through your account as part of payment paths.

This is typically used by accounts acting as intermediaries, like market makers or exchanges (not sure if they earn fees, I guess not?)

Disabling Rippling:

If you want to prevent your balances from being used in payment paths.

This is usually done by regular users to protect their balances from accidental adjustments.

As mentioned, each trust line (e.g., the one you open between your wallet and a meme coin issuer) requires a 2 XRP reserve to be locked in your wallet.

If you're feeling confused, you can refer to Ripple's explanations.

Remember why Ripple designed it this way!

It's like a "double-entry bookkeeping" system for "efficient" net settlement, aimed at serving real-world assets, stablecoins, tokenized commodities, and cross-border payments.

This means issuers have more control over the use of assets.

For compliance (think stablecoins), authorized trust line issuers can enable the "Require Auth" flag, limiting token ownership to only approved accounts. This feature makes the XRPL suitable for KYC/AML-regulated assets.

The decentralization purists may be eager to criticize this.

If you understand how it works, you may not want to enable Rippling, as your balances could be adjusted. Users can enable or disable the Rippling feature.

Enabling Rippling:

If you want to allow balances to flow through your account as part of payment paths.

This is typically used by accounts acting as intermediaries, like market makers or exchanges (not sure if they earn fees, I guess not?)

Disabling Rippling:

If you want to prevent your balances from being used in payment paths.

This is usually done by regular users to protect their balances from accidental adjustments.

As mentioned, each trust line (e.g., the one you open between your wallet and a meme coin issuer) requires a 2 XRP reserve to be locked in your wallet.

If you're feeling confused, you can refer to Ripple's explanations.

EVM Sidechain: Running Ethereum on the XRPL

The XRPL doesn't have a full-fledged virtual machine like Ethereum's EVM, Solana's SVM, or Aptos' Move VM. Instead, it uses lightweight Hooks based on WebAssembly for basic transaction logic. Hooks are not as powerful as smart contracts. They're more suitable for simple automation tasks, like rejecting transactions when balances are too low. However, the XRPL does have a native AMM (Automated Market Maker), allowing for liquidity provision and cross-token trading. More on how to operate this later. So while the XRPL supports basic programmability, it can't compete with Ethereum in the complex DeFi or dApp space - at least not in its native implementation. For this reason, Ripple is developing an EVM sidechain, currently in testing and expected to launch in the coming months. XRP will serve as the fuel token. Alpha: The EVM<>XRPL bridge is supported by Axelar, so if it succeeds, Axelar may become a big winner here. In short, XRP is getting modular! It will be interesting to see if the sidechain can gain enough traction. Alright, the dry part is over, and you've made it through. Now for the exciting stuff.How to Buy Meme Coins on the XRP

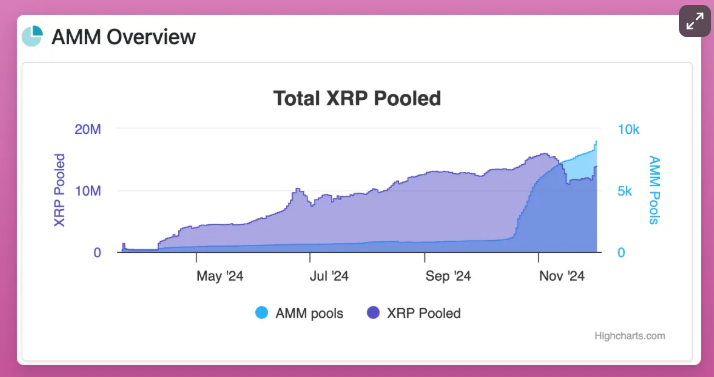

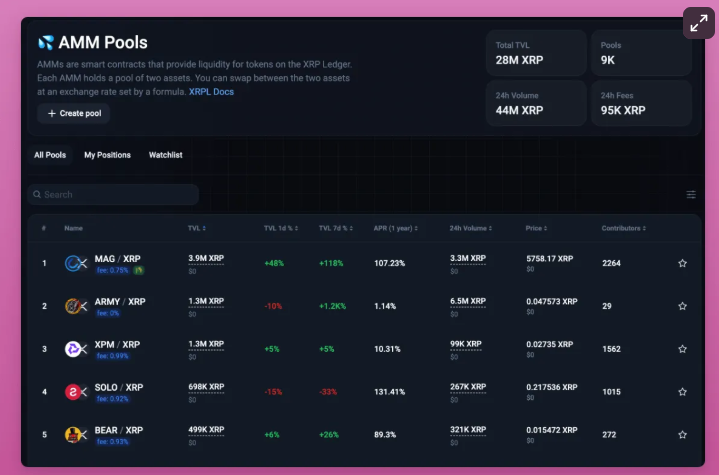

A surprising fact is that the Ripple Ledger has a native AMM (Automated Market Maker), a sort of "embedded AMM" where you can trade... mostly meme coins. While its TVL (Total Value Locked) is still quite low, trading volume has been rising due to the meme coin craze. Around 14 million XRP are deposited in the AMM pools, so we're definitely in the early stages (or maybe too late, since XRP's market cap has surpassed Solana).

While its TVL (Total Value Locked) is still quite low, trading volume has been rising due to the meme coin craze. Around 14 million XRP are deposited in the AMM pools, so we're definitely in the early stages (or maybe too late, since XRP's market cap has surpassed Solana).

You can check the amount of XRP locked in each pool on XRP Scan.

You can check the amount of XRP locked in each pool on XRP Scan.Please note that XRP Scan provides readable data on transactions, analytics, and validators. You can track whale wallets, token concentration data, and meme coin trading based on data is possible.

The simplest way to start trading meme coins:

1. Visit the First Ledger website. It allows you to create a wallet on Telegram or a browser and locally store your keys. Also, try using the Xaman wallet on your mobile device. It works well, and you can import your keys into both wallets to see which one you prefer.

2. Buy XRP from a CEX (centralized exchange), or many people recommend using Simpleswap to bridge different assets to XRP. I haven't tried it, but if you want to use it, you can share my referral link.

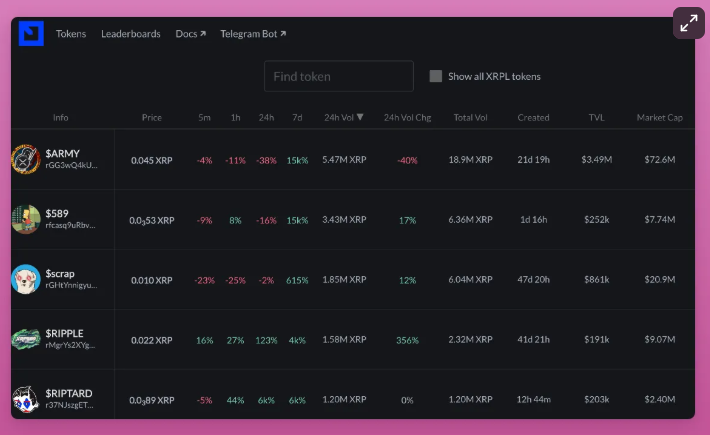

You can sort meme coins on the First Ledger token page. You'll see new tokens being created every minute.

Note! Most meme coins have a highly concentrated supply. You'll see 10 wallets holding over 40% of the total supply. To make token distribution more fair, projects like Pump dot fun are indeed needed on the XRPL.

Pro tip: Sort tokens by 24-hour trading volume, market cap, number of holders, or creation date. My intuition is that the earliest created, highest trading volume, and most-held tokens will perform better than the most recently created ones. However, the strategy is up to you.

A more advanced platform is xMagnetic.

You can discover tokens, provide liquidity, and view statistics. I recommend using the Xaman wallet in conjunction with xMagnetic. Sologenic DEX is another option, but it didn't work well for me.

Now you're ready to explore the "degen" realm of Ripple. The question is: are you willing to do so?