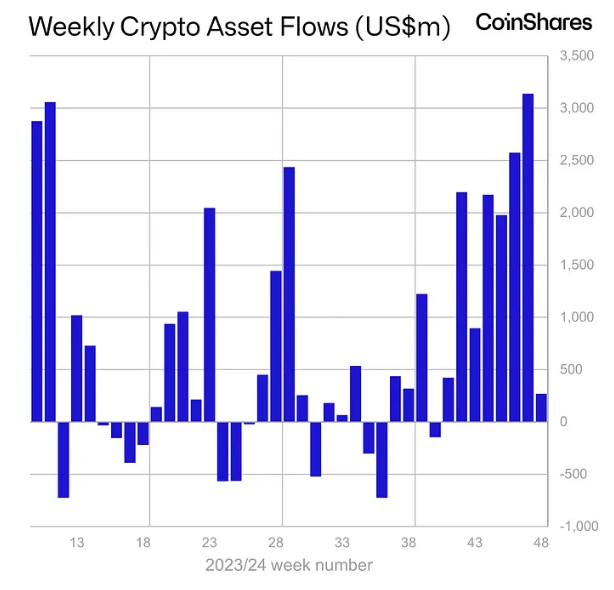

Cryptocurrency investment inflows have declined sharply last week to $270 million. This indicates a slowdown following consecutive strong activity.

The inflows since the beginning of the year have reached $37.3 billion, reflecting continued institutional interest in cryptocurrencies despite market volatility.

Decrease in Cryptocurrency Inflows...Profit-Taking

Bitcoin experienced a significant outflow of $457 million last week. This represents the first notable retreat since early September. This occurred after the positive flow of digital asset investment products as BTC set new highs. Specifically, cryptocurrency inflows reached $3.12 billion the previous week.

Macroeconomic trends also played a role. Two weeks ago, inflows reached $2.2 billion. This was due to the Republican victory in the US election and the Federal Reserve's more accommodative stance boosting investor sentiment.

However, the momentum seems to be weakening. After the initial post-election rally, inflows have been correcting. Last week's figure reflects a significant retreat compared to the $1.98 billion seen immediately after the election. CoinShares' James Butterfill explains that Bitcoin's approach to the psychological $100,000 level has triggered profit-taking.

"We believe Bitcoin has tested the psychological $100,000 level and profit-taking has occurred." - James Butterfill, CoinShares wrote.

Meanwhile, experts are divided on the outlook for Bitcoin. Pessimistic analysts like former Wall Street quant Tone Vays predict further declines.

Vays has decided to close all his long positions at $97,800. This reflects the caution among seasoned traders. He is skeptical about Bitcoin's ability to maintain the $100,000 breakthrough this year.

"I don't think it's possible to maintain $100,000 this year. I hope I'm wrong, or I'll buy below $90,000! I may even consider shorting." - Tone Vays expressed.

However, more optimistic views also exist. FundStrat's Tom Lee predicts Bitcoin will reach $250,000 by the end of 2025 according to his forecast. But Lee's team acknowledges the possibility of a short-term pullback, with some expecting a drop to $60,000.

Robert Kiyosaki, the author of Rich Dad Poor Dad, agrees with this view, but emphasized that the decline would be a buying opportunity for long-term accumulation.

"Bitcoin is not reaching $100,000. This means BTC could crash to $60,000. If that happens, I won't sell." - Robert Kiyosaki stated.

While Bitcoin experienced outflows, Ethereum recorded a significant inflow of $634 million. This indicates a renewed investor confidence in the asset. Ethereum's inflows since the beginning of the year have reached $2.2 billion, and the sentiment shift is supported by traders shifting to altcoins amid Bitcoin's short-term uncertainty.

The cryptocurrency exchange-traded product (ETP) market saw a decrease in trading volume, falling to $22 billion last week from $34 billion the previous week.

Despite the introduction of options on US ETFs, the impact on the overall market volume was limited. This development raises concerns about the sustained level of institutional interest in these financial products.