Written by: BitpushNews

Black swan events in politics can happen anytime.

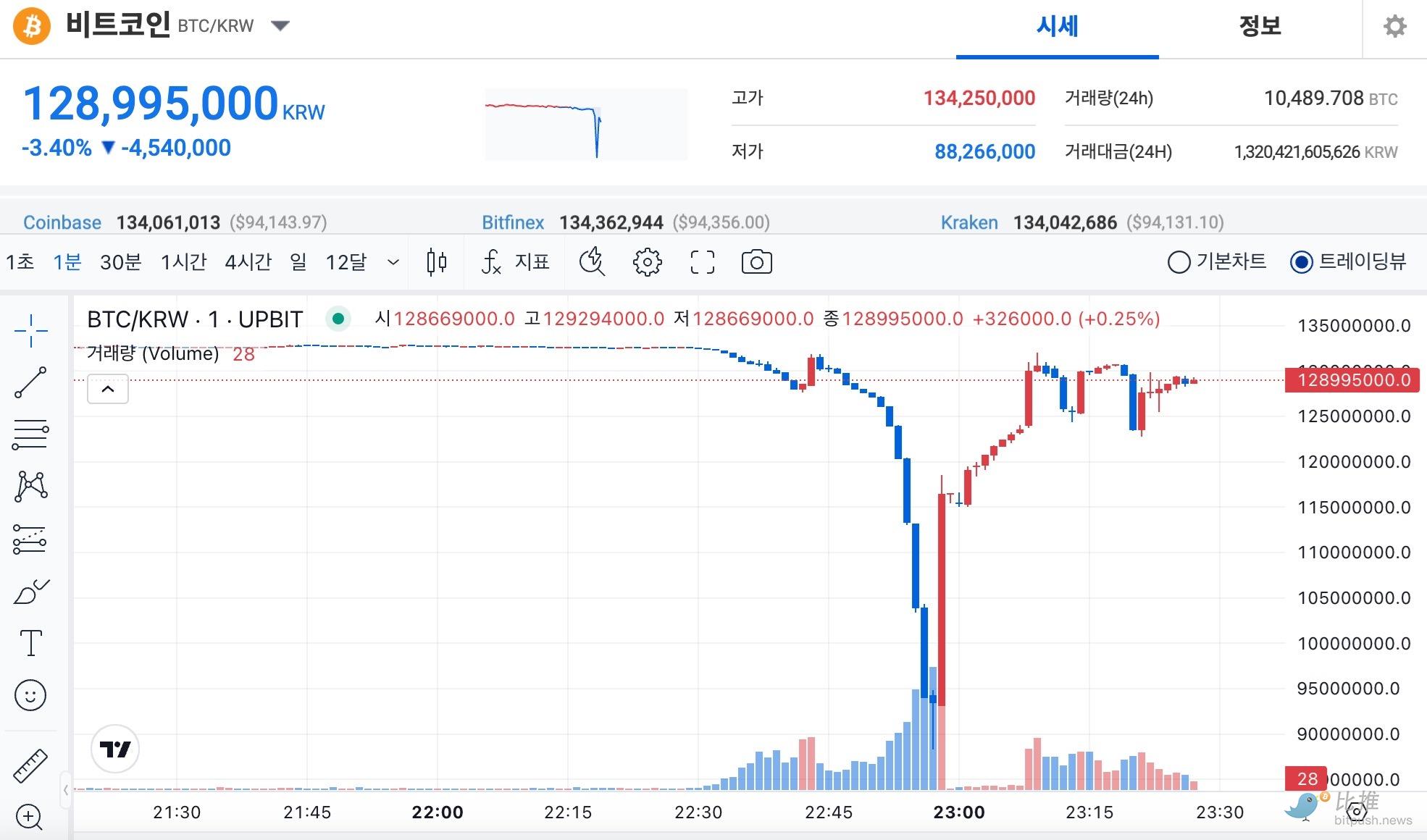

Affected by the martial law crisis in South Korea, the Korean won and Korean stocks plummeted, and the BTC price on Upbit, the largest crypto exchange in South Korea, once plunged to $61,600. Upbit data shows that after the martial law news broke out, the exchange rate of Bitcoin against the Korean won (KRW) plummeted from 130 million won to 93.6 million won, a drop of nearly 33%. Major Altcoins on the platform also saw double-digit declines, including the recently surging XRP, as well as tokens like Shiba Inu and Dogecoin.

Whales seize the opportunity to buy the dips

This event created arbitrage opportunities for savvy traders.

Unlike in the past few years, when smart money could buy Bitcoin at lower prices on Hong Kong and North American exchanges and then sell it at a "kimchi premium" in South Korea, this time the situation can be reversed.

According to Lookonchain, as the Korean market plunged, many whales transferred large amounts of USDT to the Upbit exchange to snap up tokens at discounted prices.

Data shows that within an hour of the South Korean president announcing the emergency martial law, large traders transferred over $163 million in USDT to Upbit. Lookonchain stated on X: "Many whales have transferred large amounts of USDT to Upbit, possibly to look for bottom-fishing opportunities." Due to the influx of panicked sellers and bottom-fishers, Upbit announced that its app and open API services were temporarily suspended due to increased traffic and experienced delays.

In the early hours of the 4th local time, Yoon Suk-yeol announced the lifting of martial law, just over 6 hours after he had announced its implementation the previous night. The BTC price on Upbit has rebounded slightly, currently around $88,600 as of the time of writing.

Juan Leon, a senior investment strategist at Bitwise, said in a statement that the discount on Bitcoin prices at South Korean exchanges reflects the "stagnation" of liquidity within centralized venues. He stated that while Bitcoin is a 24/7 decentralized asset, disruptions can still occur when "special circumstances in a particular location" suddenly impose restrictions.

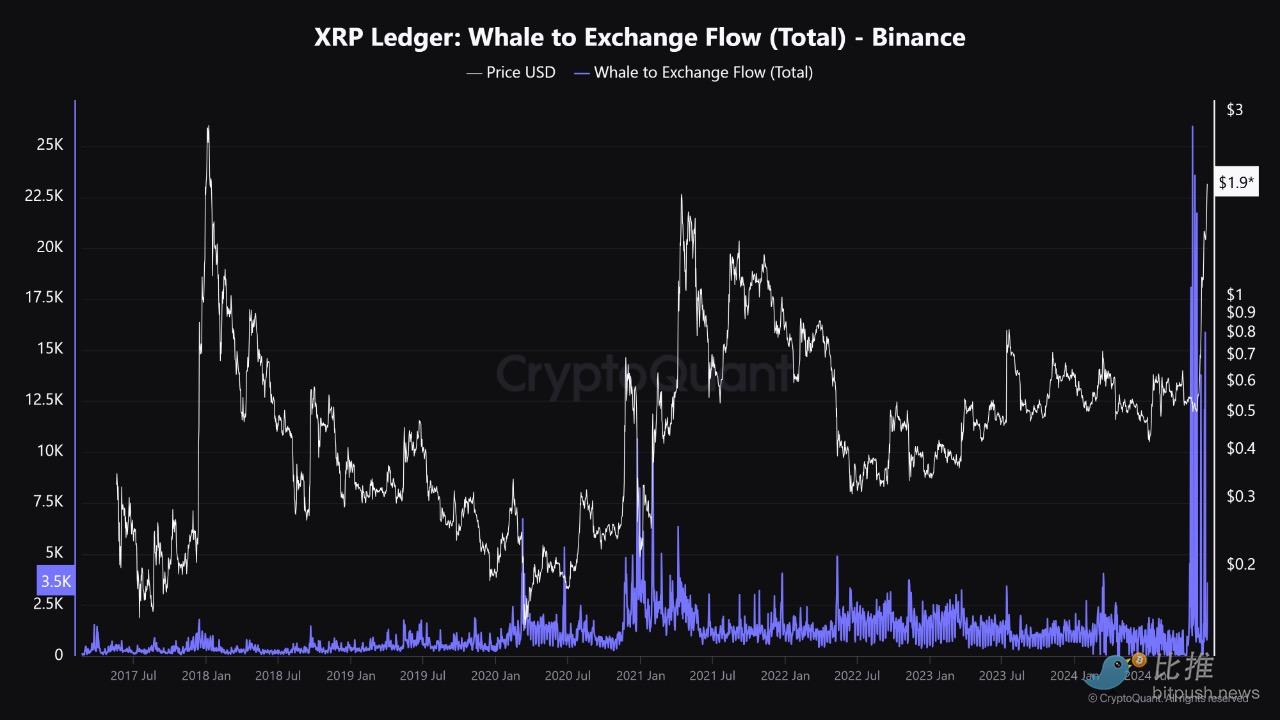

XRP whale activity surges to an all-time high

Bitpush data shows that the XRP token price has surged 4-fold in the past month, making it the third largest crypto asset by market cap.

CryptoQuant data shows that XRP whale activity has reached an all-time high. CryptoQuant analyst Woominkyu pointed out that historically, a significant surge in whale XRP trading activity "is closely related to XRP price peaks". These transactions have recently seen a sharp increase, pushing the coin price to around $2.6, indicating that whales may be "preparing for potential profit-taking or increased market activity".

Analysts believe that the momentum of XRP's price is driven by the launch of the Ripple stablecoin, potential pro-crypto changes in SEC leadership, and the expected approval of a spot XRP ETF. At least 5 companies, including Grayscale, WisdomTree, Bitwise, 21Shares, and Canary Capital, have recently applied to list spot XRP ETFs in the US.