This mechanism achieves a single and homogeneous LST among all validators without relying on external software or hardware.

Written by: Cairo & Diego, ethresear.ch

Compiled by: Pzai, Foresight News

Independent validators are crucial to the security, decentralization, and censorship resistance of Ethereum. They operate independent nodes distributed around the world that cannot be easily compromised. However, they face some key challenges:

- High participation threshold: The 32 ETH staking requirement is daunting for many potential participants.

- Opportunity cost: The capital locked up is clearly much more than the capital that could potentially be lost (Slashed) due to validator misbehavior.

- Limited liquidity: Independent validators cannot easily collateralize their own stake and obtain leverage while operating a validator.

To address these issues, we propose the SOLO protocol, which supports the permissionless minting of liquid staking tokens (LST) for the portion of the stake that validators are unlikely to lose, even in the event of Slashing. After the Pectra upgrade, this can mint up to 96.1% of the stake, unless there is a major Slashing event and prolonged inactivity penalties. This will reduce the entry cost for independent validators to just 1.25 ETH. The protocol will also enable independent validators to effectively borrow to collateralize the otherwise illiquid portion of their stake.

Our mechanism achieves a single and homogeneous LST among all validators, without relying on governance, trusted hardware (e.g., SGX), or a permissioned set of operators. The protocol leverages Pectra's EIP-7002 (triggering consensus layer withdrawals from the execution layer) and EIP-7251 (increasing the flexibility of multi-node staking limits by adjusting the "maximum effective balance").

To address the potential reduced cost of a 51% attack on Ethereum and prevent the dominance of individual validators, the protocol uses an economic anti-concentration mechanism to dynamically limit the achievable leverage, disproportionately hindering large validators, aiming to prevent any single entity from gaining excessive control over Ethereum through the protocol.

Background

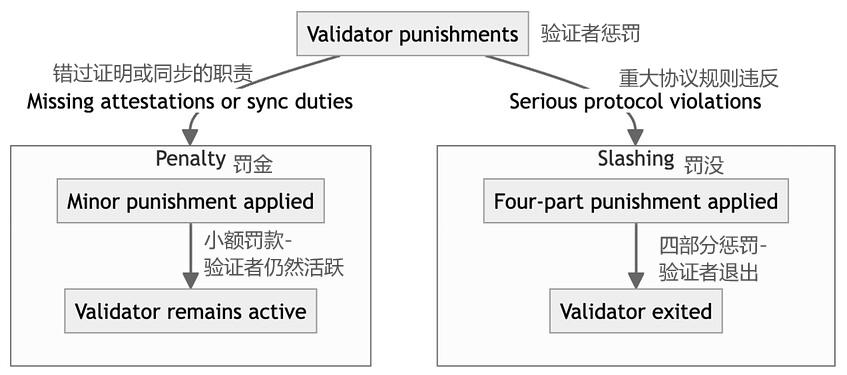

Ethereum's protocol uses two types of negative incentives for validators: penalties and Slashing. Missing attestations and committee duties will incur penalties. They are relatively mild, and validators can recover from a day's downtime and have about a day's normal operation.

However, Slashing is more severe. It applies to serious protocol violations, such as proposing or attesting to multiple blocks for the same slot. This penalty consists of four parts:

- Initial penalty: After Pectra, this will be 1 ETH Slashed out of every 4096 ETH of effective balance. For a 32 ETH validator, the loss would be 0.00781 ETH.

- Correlated penalty for large-scale Slashing events: Usually zero, but this penalty could potentially wipe out a validator's entire balance if one-third or more of the total stake was Slashed in the 18 or so days before and after the validator's Slashing. At 1% of the total stake being Slashed, the correlated loss for a 32 ETH validator could be up to 0.96 ETH.

- Penalty for missed attestations: Ethereum will automatically invalidate all attestations from a Slashed validator until they become withdrawable, which happens 8192 epochs later. For today's 32 ETH validator, this penalty amounts to 0.0564 ETH.

- Inactivity leak penalty: If the chain does not finalize, a Slashed validator will incur additional costs. A 32 ETH validator would suffer a 0.0157 ETH loss for a 128 epoch leak.

If up to 1% of the total stake is Slashed, and the inactivity leak does not exceed 128 epochs, Slashing a 32 ETH validator would result in a maximum loss of around 1.04 ETH - only 3.25% of the balance.

This means that, apart from special large-scale Slashing events, the majority of ETH held by individual independent validators is not at risk, even if the validator can engage in arbitrary misconduct.

Prior Work

In this context, many projects have explored the practice of LST:

- Justin Drake proposed an LST mechanism for independent validators that relies on trusted hardware (SGX) to prevent Slashing penalties.

- Dankrad Feist proposed a two-tier staking system with separate slashable and non-slashable fund layers.

- Lido allows ETH holders to "lend" their ETH to node operators without letting those node operators steal their funds. Their "community staking module" supports permissionless participation by independent stakers with posted collateral.

- Rocket Pool enables independent validators to borrow up to 24 ETH for every 8 ETH they provide. But they also have to stake RPL tokens (at least 10% of the borrowed amount) and share validator rewards proportionally.

- frxETH allows individual anonymous validators to borrow up to 24 ETH for every 8 ETH they provide, but the borrowed ETH can only be used to create new validators.

SOLO offers unique advantages for independent validators:

- Allows validators to create validators with as little as 1.25 ETH.

- Supports minting a single, homogeneous LST for any validator, without relying on trusted hardware, governance, a permissioned set of operators, or additional token staking.

- Compensates LST holders for the time value of their ETH and default risk through a market-based interest rate.

- Requires no changes to Ethereum beyond Pectra's EIP-7002 and EIP-7251.

- Dynamically offsets the potential risk a 51% attack poses to Ethereum, using a mechanism that disproportionately hinders large validators from accumulating excessive stake.

Protocol Overview

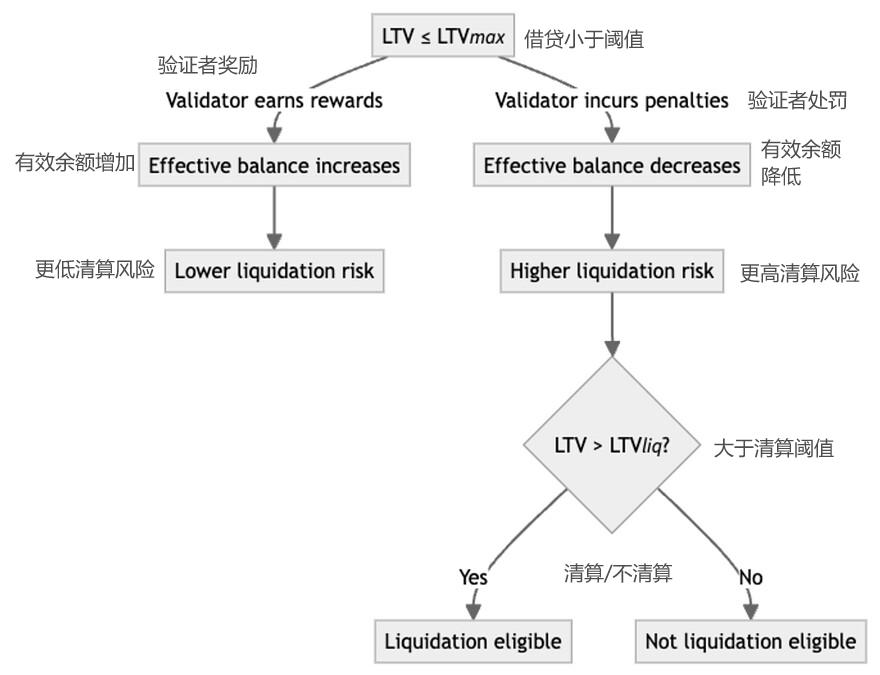

The mechanism draws inspiration from synthetic stablecoin systems like RAI. Node operators act as borrowers, minting a token called SOLO against the ETH staked by validators, while SOLO holders act as lenders. If a validator's SOLO "debt" becomes too high relative to their stake, they will be liquidated and forced to withdraw. A dynamic interest rate compensates SOLO holders for the time value of the underlying ETH and default risk, keeping the token trading close to 1 ETH.

The protocol defines a loan-to-value (LTV) ratio, where the collateral is the validator's effective balance on the Ethereum consensus layer, which dynamically changes due to SOLO minting, financing, penalties, or validator rewards. The liquidation threshold is below the maximum allowed LTV and below 100%.

We can estimate the maximum LTV to be 96.1% and the liquidation threshold to be 96.4%.

Minting and Burning

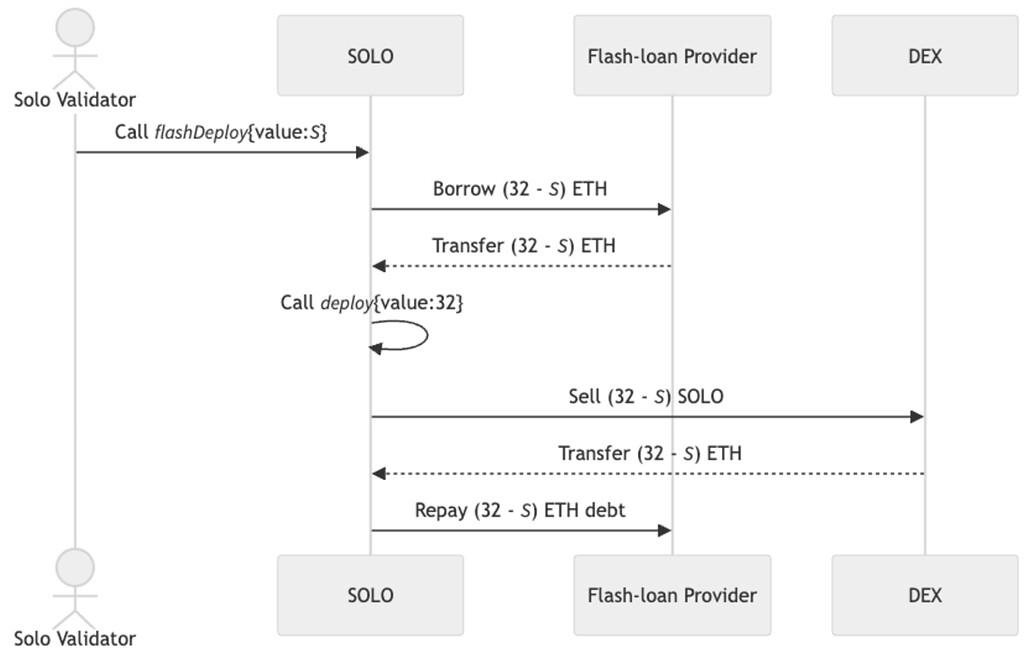

To mint SOLO, the validator's withdrawal credentials must point to a proxy contract controlled by the protocol. Operators can register validators by calling the register function. They can then call mint to mint SOLO against a validator. The protocol also provides a deploy function to atomically transfer 32 ETH, deploy a new validator through Ethereum's deposit contract, set the withdrawal credentials to the proxy contract, and mint SOLO.

On the exit side, operators trigger a full exit by either voluntarily triggering an exit on the consensus layer or calling the withdraw function. Partial withdrawals can only be triggered through withdraw, ensuring the liquidation threshold is not breached. Like liquidations, these functions rely on EIP-7002. Once the withdrawal is complete, the operator calls the Claim function to receive the ETH from the stake.

Liquidation and Slashing

When a validator's collateral ratio falls below 1, the validator is eligible for liquidation, and liquidation occurs when its LTV exceeds the liquidation threshold. Once eligible, anyone can trigger the liquidation process by calling the liquidate method on the validator. This call will then trigger the validator's withdrawal. After the withdrawal is complete, the contract will auction the received ETH to SOLO to repay the validator's debt. Any excess ETH can be returned to the validator (or retained by the protocol as a liquidation fee). In addition to the slashing compensation, SOLO holders will bear the bad debt cost. At the end of the slashing process, the protocol receives any remaining stake from the slashed validator. The protocol then auctions the ETH to acquire SOLO to pay off the debt of the slashed validator, following a process similar to liquidation.

Funding Rate

We suggest using a dynamic, market-based funding rate. SOLO minters (borrowers) pay this rate to SOLO holders (lenders). It works by proportionally increasing the debt, with SOLO holders benefiting through continuous token Rebase (similar to Lido's stETH). If the SOLO price falls below 1 ETH, the funding rate will rise, making SOLO holding more attractive. If the SOLO price rises above 1 ETH, the funding rate will decrease, making SOLO holding less attractive. In the extreme case where the SOLO price remains below 1 ETH, the funding rate will eventually rise to a very high level, causing all positions to be liquidated. A lower bound of 0% can be set, with no negative adjustments. To prevent the possibility of persistent de-pegging, where the SOLO trading price remains above 1 ETH even when the funding rate is 0%, the protocol allows for the unlimited 1:1 minting of SOLO against native ETH as long as the funding rate is 0%. Then, anyone can redeem this SOLO for the ETH at a 1:1 ratio until the funding rate rises above 0% again.

In practice, any increase in the protocol's returns may trigger a surge in SOLO demand, causing the funding rate to rise. The reverse is also true. Due to the low threshold, this self-balancing mechanism becomes more efficient. Nevertheless, SOLO allows validators to deploy the borrowed funds to higher-yielding areas while still operating their validators - if these returns, combined with validator rewards, exceed the cost of capital, this could be a potentially profitable strategy.

Validators (Anti-Centralization Mechanism)

The scheme adopts a flash loan model, allowing users to directly deploy validators through DEX and flash loan services. For a maximum LTV of 96.1%, the minimum required amount is around 1.25 ETH, significantly reducing the cost for independent validators.

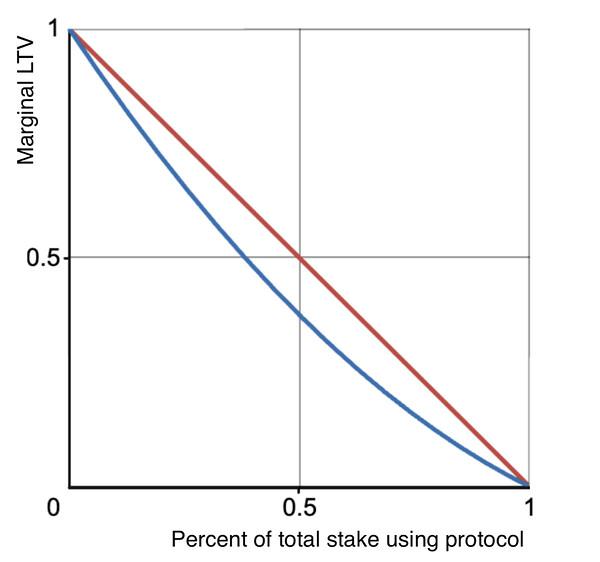

By lowering the cost of creating validators, the protocol promotes the proliferation of decentralization and small-scale validators, but it may also reduce the cost of accumulating large amounts of stake, potentially enabling a 51% attack on Ethereum. While in theory both attackers and honest users can benefit from the protocol, colluding attackers are more likely to effectively leverage this advantage. To offset this risk, we propose an anti-centralization mechanism: a dynamic leverage adjustment that automatically reduces the maximum LTV as the protocol's share of total ETH stake grows.

Consider the "marginal LTV" of an individual validator - the ratio of the amount of SOLO they can mint against each new unit of ETH they put up as collateral. For anyone who has not yet used the protocol, their marginal LTV is equal to the maximum LTV. But for any staker who has already used the protocol (especially large-scale protocols), the calculation is different. Due to the anti-centralization mechanism, each additional collateral unit they deposit increases the LTV of all their existing stake, requiring them to deposit additional collateral to support their existing SOLO debt. This means that this large validator's marginal LTV is actually lower than a smaller validator's marginal LTV. Users who have already used a large amount of collateral in the system face a lower marginal LTV than smaller users. The diagram below illustrates the two effects of the anti-centralization mechanism. The red line represents the marginal LTV for small stakers considering using SOLO, as a function of the percentage of total stake using SOLO. The blue line shows the marginal LTV for a staker who already controls half the SOLO share.

Importantly, this mechanism does not rely on any identity-based anti-sybil mechanism. Attackers cannot avoid it by distributing their holdings across multiple validators or by consolidating large amounts of ETH into a single validator. This anti-centralization mechanism provides economic disincentives for large stakers to accumulate SOLO shares through SOLO.

SOLO addresses the key challenges faced by independent validators: high entry barriers and limited liquidity of their stake. Overall, we believe this mechanism can make solo validation more attractive.