ETH, which has been performing poorly since the beginning of the year, saw a strong rebound last week. The rebound continued this week, and on December 5, the Ethereum price briefly broke through $3,900, and the ETH/BTC exchange rate rose by more than 10% during the week.

VX: TTZS6308

As ETH warms up, ecosystem projects are showing an explosive trend, leading all Altcoins. Which assets belong to the "Ethereum Beta" and are worth watching?

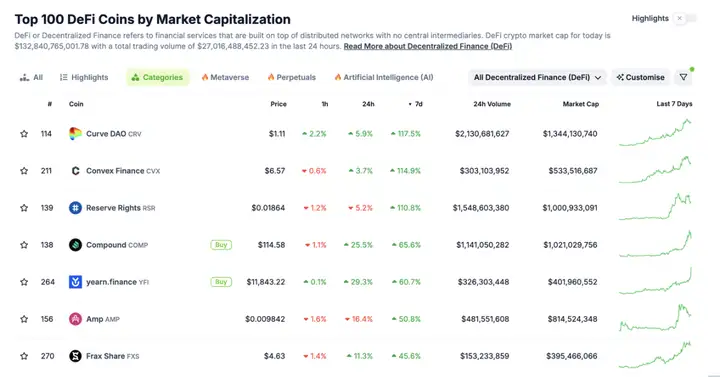

DeFi Sector

CRV

The DeFi sector rose nearly 20% last week, with the Curve DAO token CRV leading the way. Curve is the DeFi infrastructure, and DeFi is the core use case of the blockchain, and institutions are rushing in.

CVX

CVX is the largest holder of tokens such as CRV and FXS, and has the right to the corresponding protocol's earnings. As the underlying token prices rise, the intrinsic value of CVX also rises.

RSR

RSR itself is a stablecoin concept, but its main market driver for the rise is that Trump nominated Paul Atkins as the new SEC chairman, and Paul Atkins is also an advisor to the RSR token, so RSR surged by more than 100% in 24 hours after the news was released.

FXS

Frax Finance is the second largest holder of CVX. At the same time, it has the L2 chain Fraxtal, the stablecoin product FRAX, the dual-token staking product (sfrxETH, frxETH), and the lending product... It has everything. Frax has the opportunity to form a self-sufficient DeFi ecosystem flywheel. The ultimate form is a decentralized on-chain central bank (of course, it is still far away).

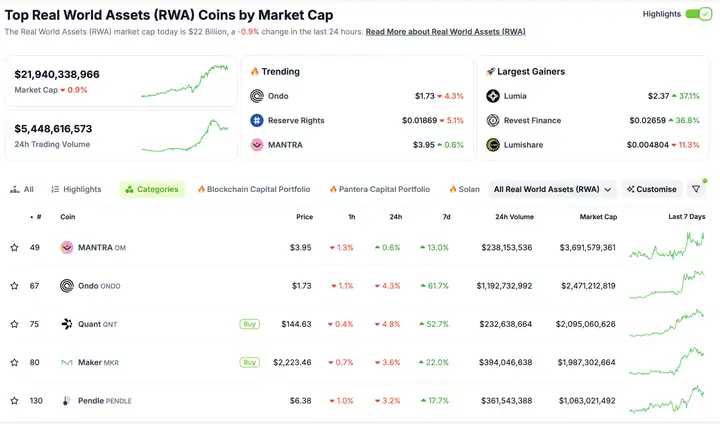

RWA Sector

OM

OM is a Layer 1 public chain built with the Cosmos SDK, focusing on compliant RWA, and as an old coin listed on Binance, it surged more than 150 times last year.

ONDO

Although the TVL and the data of the product USDY are not impressive, ONDO has "won by rising" and firmly established its position as the RWA leader. Its FDV of over 10 billion dollars rose by more than 60% in a week.

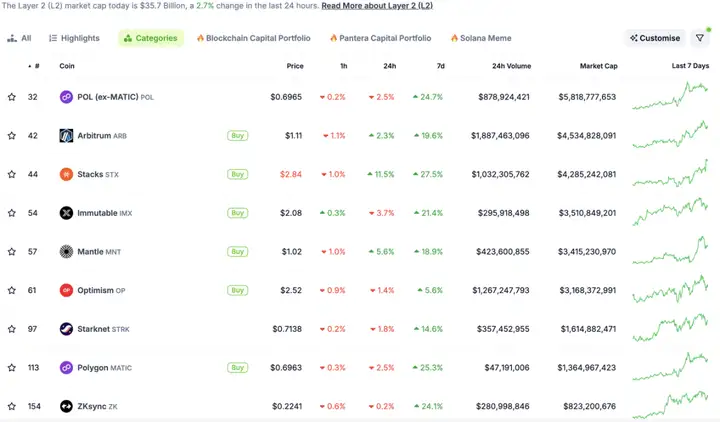

Layer 2 Sector

The Layer 2 sector rose by an average of more than 17% last week, with major market cap projects such as POL and ARB seeing significant gains. Arbitrum's TVL has exceeded $20 billion, setting a new high, and Mantle's TVL has also exceeded $2.1 billion, setting a new high.

It is worth noting that the Stacks token STX is a Bitcoin Layer 2 (smart contract layer) token, and its rise is no weaker than that of Ethereum Layer 2.

GameFi, Metaverse Sector

The "metaverse" concept also warmed up last week, with leading projects such as SAND, AXS, and MANA seeing impressive gains.

In the Layer 2 sector, the Immutable token IMX rose by more than 20% during the week, and ILV, which rose by more than 22%, also reflected the recovery of the GameFi track.

The current crypto market is experiencing an unprecedented and violent bull market. This time, the performance of Altcoins is more dazzling than ever, from BNB to XRP, Ethereum, and many other projects, the entire market is undergoing a profound transformation. Led by Bitcoin, Altcoins have taken the lead, kicking off a wave of skyrocketing prices.

This is not just a reconfiguration of capital, but also a reshaping of the crypto market landscape. In the next few years, we will witness the rise of more Altcoins, and their technological innovation, market application, and institutional support will bring unprecedented growth to the crypto market. For us, this is a golden age full of opportunities. Grasping this violent bull market may become a turning point for wealth. And this may also be the last crazy bull market for retail investors.

BTC hits a new all-time high, Altseason ready to launch

The final breakthrough in price requires the catalysis of external conditions. Continuous inflow of funds is the material support for the bull market. After BTC breaks through the $100,000 mark, Altseason will gradually open up. After Altseason opens up, the market will gradually show: 1. ETH breaks through its historical high; 2. The market is generally bullish; 3. The market's main line of action is gradually recognized.