Introduction

As the cryptocurrency market continues to evolve, stablecoins have become an important part of the digital currency ecosystem. As the largest stablecoin by market capitalization, Tether (USDT) continues to expand its market share globally, particularly in widespread use among small investors. The rapid growth of USDT not only reflects the demand in the crypto market, but also provides important insights for the future development of stablecoins.

Latest price trend of the stablecoin USDT today

The driving force behind the growth of USDT: small investors and the trend of decentralization

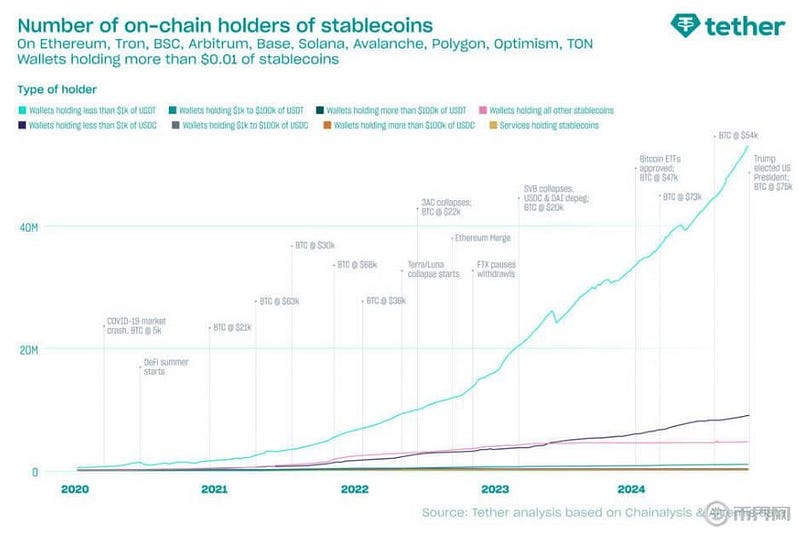

Tether's latest report shows that the number of USDT wallets has grown significantly in the past year. In 2023, the growth rate of USDT reached 71%, which, although slower than the 129% growth in the previous year, still shows strong growth momentum. Especially after the collapse of FTX, users have turned to self-custody solutions, and USDT, as a highly liquid and low-volatility stablecoin, has become the preferred choice for many small investors.

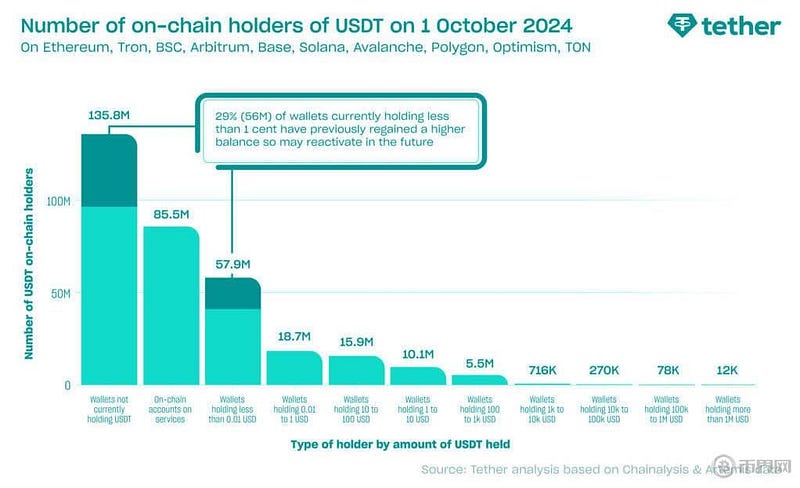

According to Tether's data, the balances of many USDT wallets are less than $1,000, indicating that the main user group of stablecoins is the middle and low-income group and users who are not dependent on the traditional banking system. Nearly 30% of small wallets will be reactivated when funds are sufficient, further proving the status of USDT as a reliable financial tool.

Furthermore, the global applicability of USDT is particularly prominent in emerging markets. Users rely on USDT for savings, transactions, and to cope with financial restrictions, a trend that has been further strengthened in early 2024. Especially in emerging markets such as Asia and Latin America, USDT has become the preferred tool for many users' daily transactions as a convenient digital asset.

The competitive landscape between Tether and other stablecoins

Although stablecoins such as USDC and Dai have experienced peg volatility during some market turmoil, USDT has maintained its market dominance thanks to its strong market share and continued growth. Tether currently accounts for about 97.5% of the market share of all stablecoins and provides support on 25 blockchains. Compared to other stablecoins, the number of on-chain USDT wallets is nearly four times that of its competitors, further consolidating its dominant position in the stablecoin market.

In addition, USDT is not only widely used in decentralized wallets, but also deeply integrated into centralized platforms. Over 86 million accounts have received on-chain deposits, demonstrating the widespread use of USDT on exchanges and other platforms. As the market expands, Tether continues to strengthen its role in the global payment ecosystem.

Multidimensional competition in the stablecoin market: participants and value distribution

The stablecoin market is not just a single domain, it involves multiple key aspects, each with its unique way of value capture. To fully understand the future development of stablecoins, it is necessary to deeply analyze the following important participants and tracks:

1. Settlement Rails

This is one of the most promising areas in the stablecoin market. Settlement rails mainly rely on deep liquidity, low fees, fast settlement, and stable system availability. With the increase in payment demand, Layer 2 solutions and dedicated blockchains will have more room for development. Ultimately, the winners of the settlement rails are likely to become the most valuable participants in the stablecoin ecosystem.

2. Stablecoin Issuers

Currently, major issuers such as Tether and Circle have occupied a dominant market position, but with the development of the market, issuers will face greater compliance pressure and technical requirements. In the future, building efficient infrastructure, improving compliance standards, and optimizing minting/redemption processes will be the key competitiveness of stablecoin issuers.

3. Liquidity Providers (LPs)

The current liquidity providers are mainly OTC and exchanges, and the market is highly commoditized. In the future, liquidity providers focused on stablecoins will face fierce competition from large institutions, so the institutions that can maintain a competitive advantage in this field in the long run will dominate the market.

4. Payment Service Platforms (PSPs)

Payment service platforms play a key role in the application of stablecoins, especially in providing payment solutions for merchants. Platforms with proprietary payment rails and global coverage will have a market advantage. However, without strong compliance capabilities and technical support, these platforms may face the risk of declining profits.

5. Merchant Gateways

Merchant gateways providing crypto payment solutions are facing increasingly greater challenges. Although these platforms help merchants access stablecoin payments, as more payment tools emerge in the market, these platforms need to continuously innovate and provide more added value to stand out.

6. Stablecoin-driven Fintech and Applications

With the maturity of stablecoin technology, more and more fintech products based on stablecoins have emerged. These products can provide users with more convenient payment, savings, and investment tools. In emerging markets, fintech products relying on stablecoins have huge growth potential, while in developed markets, the key to success lies in differentiation and marketing capabilities.

Conclusion

Tether continues to be the leading global stablecoin, with a market capitalization of $138 billion and strong growth momentum on multiple chains. With the dual expansion of USDT in decentralized wallets and centralized exchanges, Tether's market share and user base may continue to grow.

However, as market competition intensifies, the future development of stablecoins will not only depend on issuers and liquidity providers, but also on the innovation of payment service platforms, merchant gateways, and fintech applications, which will be the key factors in determining the market direction.

In general, the stablecoin market is evolving towards a more complex and diversified direction, and Tether will continue to play an important role in the global crypto market. At the same time, the future of stablecoins will depend more on their infrastructure building, compliance enhancement, and market application innovation, all of which will jointly determine their position in the future crypto world.

Through the above analysis, combined with Tether's (USDT) latest report and market trends, we can see that USDT is not just a stablecoin, its success reflects the huge potential and development opportunities that stablecoins bring as part of the global financial system.