Here is the English translation of the text, with the terms in <> retained as is:

From a historical perspective, the valuation of s seems to follow a four-year cycle, with prices first rising and then falling, repeating this pattern. Grayscale Research believes that investors may be able to track the coin cycle by observing various chain-based indicators and other measurement methods, which can provide a reference for risk management.

The coin field is gradually maturing: new coin and spot exchange-traded products (ETPs) have expanded market access, and the new US Congress may provide a clearer regulatory environment for the industry. For these reasons, the valuation of coin assets may ultimately exceed the four-year cycle pattern that often appears in the early market history.

That said, Grayscale Research believes that the combination of various indicators is still consistent with the mid-stage of the cycle. As long as this asset class continues to be supported by fundamental factors (such as the adoption of applications and broader macroeconomic conditions), the bull market may extend until 2025 or beyond.

Similar to many physical commodities, the price of coin does not follow a strict "random walk". Instead, the price exhibits statistical momentum characteristics: uptrends tend to follow uptrends, and downtrends tend to follow downtrends. Viewed over a longer time scale, the recurring coin cycles of upswings and downswings result in a cyclical fluctuation around the historical upward trend (see Chart 1).

Chart 1: coin price characteristics exhibit cyclical fluctuations around an upward trend

Each past price cycle has had unique driving factors, and there is no reason to believe that future price returns will completely replicate past experiences. Furthermore, as coin matures and is increasingly accepted by a wider range of traditional investors, and as the impact of the four-year halving event on supply gradually diminishes, the cyclical fluctuations in coin prices may change or even disappear. However, studying past cycles may provide investors with a reference for the typical statistical behavior of coin, which can benefit risk management decisions.

Measuring Momentum

Chart 2 shows the price performance of coin during the upward phase of each past cycle. The prices are indexed to 100 at the cyclical low points (marking the starting point of the upward phase) and tracked to their peaks (marking the end of the upward phase). Chart 3 presents the same information in tabular form.

coin's earliest price cycles were shorter and steeper: the first cycle lasted less than a year, and the second cycle lasted about two years. In these two cycles, the price rose more than 500 times from the previous cycle's low point. The subsequent two cycles each lasted nearly three years. In the cycle from January 2015 to December 2017, coin's price rose over 100 times, while in the cycle from December 2018 to November 2021, coin's price rose about 20 times.

After peaking in November 2021, coin's price fell to a cyclical low of around $16,000 in November 2022. The current upward phase has since begun from that point and has continued for over two years. As shown in Chart 2, the current price uptrend is relatively close to the trajectories of the past two cycles, both of which then continued for about another year before peaking. In terms of the magnitude of the gains, the current cycle's return of around 6 times is notable, but still lags behind the gains of the past four cycles. In summary, while we cannot be certain that future performance will be consistent with past cycles, coin's history suggests that the current bull market may further extend in both duration and magnitude.

Checking Key Indicators

In addition to measuring the price performance of past cycles, investors can also use various chain-based indicators to assess the maturity of the coin bull market. Common indicators include measures of the extent of coin's appreciation relative to the cost basis of buyers, the scale of new capital inflows into coin, and the level of coin prices relative to miner revenues.

One popular indicator is the MVRV ratio, which is the ratio of coin's market value (MV, measured by the price in the secondary market per coin) to its realized value (RV, measured by the price per coin at the time of its last on-chain transaction). The MVRV ratio can be seen as the extent to which coin's market value exceeds the overall cost basis of the market. In each of the past four cycles, the MVRV ratio has reached at least 4 (see Chart 4). The current MVRV ratio is 2.6, suggesting that the current cycle may still have upside potential. However, the peak MVRV ratio in each cycle has been lower than the previous cycle, so this indicator may not necessarily reach 4 before the price peaks this time.

Other on-chain indicators measure the extent of new capital entering the coin ecosystem - a framework often referred to as "HODL Waves" among seasoned coin investors. Price increases may be driven by new capital entering coin at slightly higher prices than the existing long-term holders' cost basis. While there are many specific indicators to choose from, Grayscale Research prefers to use the ratio of the amount of coin that has moved on-chain in the past year to the total coin circulating supply (see Chart 5). In the past four cycles, this indicator has reached at least 60%, meaning that during the upward phase of a year, at least 60% of the circulating supply has changed hands on-chain. The current value is around 54%, suggesting that more coin may need to change hands on-chain before the price peaks.

Furthermore, the cyclical indicators around coin miners are also worth monitoring. Miners are professional service providers who provide security to the coin network. For example, a common metric is the ratio of the total market capitalization of miners (MC, the US dollar value of all coin held by miners) to the "thermal cap" (TC, the value of coin accumulated by miners through block rewards and transaction fees). The intuition is that when the value of miners' assets reaches a certain threshold, they may choose to realize their gains. Historically, when the MC/TC ratio has exceeded 10, the price has typically reached a peak in that cycle (see Chart 6). The current MC/TC ratio is around 6, suggesting that we are still in the mid-stage of the current cycle. However, similar to the MVRV ratio, the peak value of this indicator has been declining in each cycle, so the price may peak before the MC/TC ratio reaches 10.

There are many other on-chain indicators, and the calculations of these metrics may vary slightly across different data sources. Furthermore, these tools can only broadly indicate the current price upswing's position relative to the past, and do not guarantee that the relationship between these indicators and future price returns will be the same as in the past. Nevertheless, overall, the common indicators of the coin cycle remain below the levels seen at past price peaks, suggesting that if the fundamentals continue to be supportive, the current bull market may persist.

Looking Beyond Bitcoin

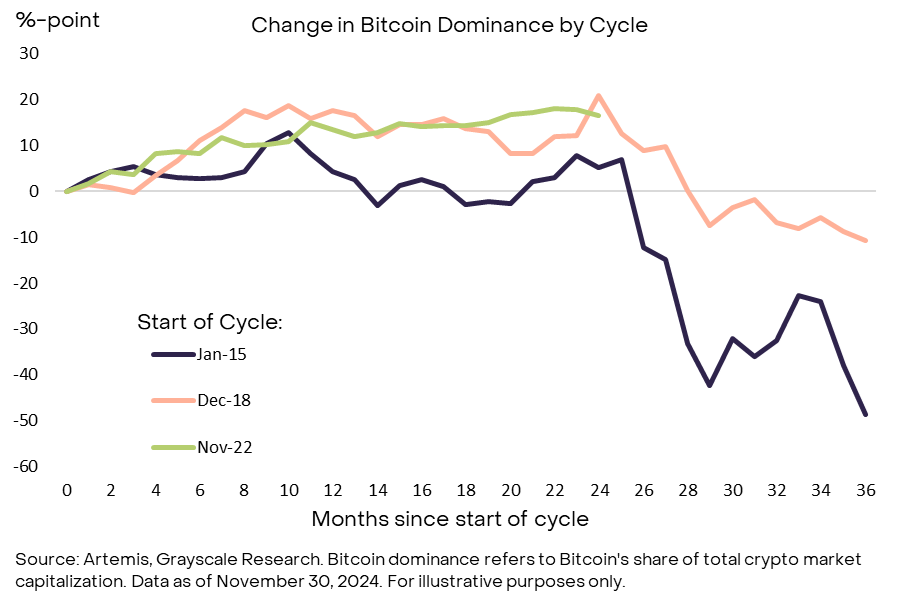

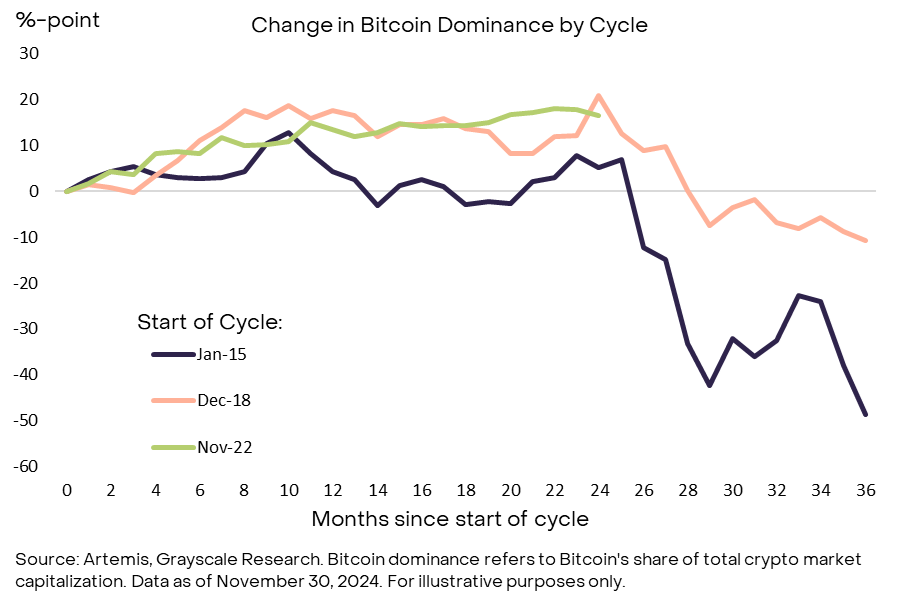

The crypto market is far more than just Bitcoin, and signals from other areas of the industry may provide guidance on the state of the market cycle. We believe these indicators will be particularly important in the coming year, as the relative performance of Bitcoin and other crypto assets warrants attention. Over the past two market cycles, Bitcoin's dominance (i.e., Bitcoin's share of total crypto market capitalization) peaked around two years after the start of the bull market (see Exhibit 7) [3]. Bitcoin's dominance has recently started to decline, similar to its performance around the third year of the prior two cycles. If this trend continues, investors should consider a broader set of indicators to assess whether crypto valuations are nearing a cyclical peak.

Exhibit 7: Bitcoin's dominance declined in the third year of the past two cycles

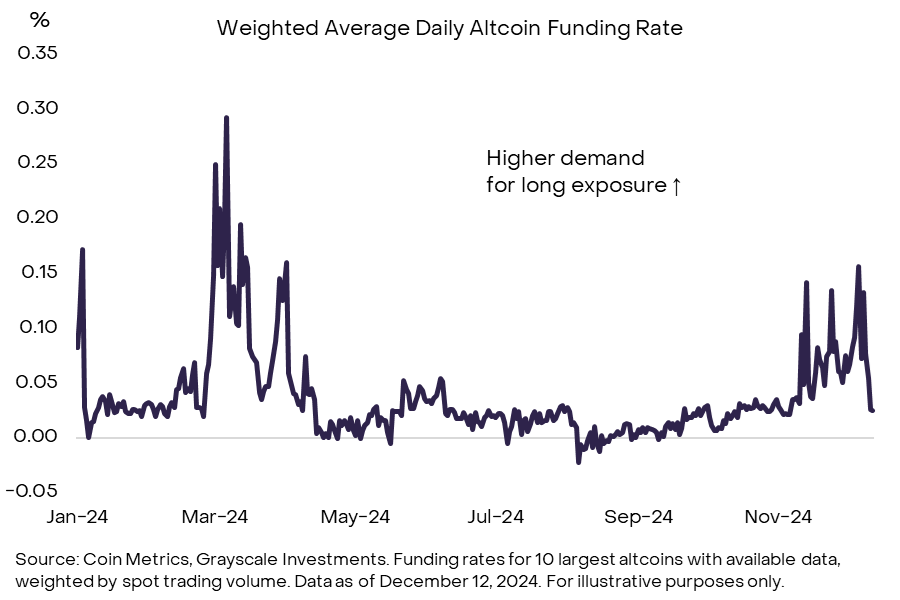

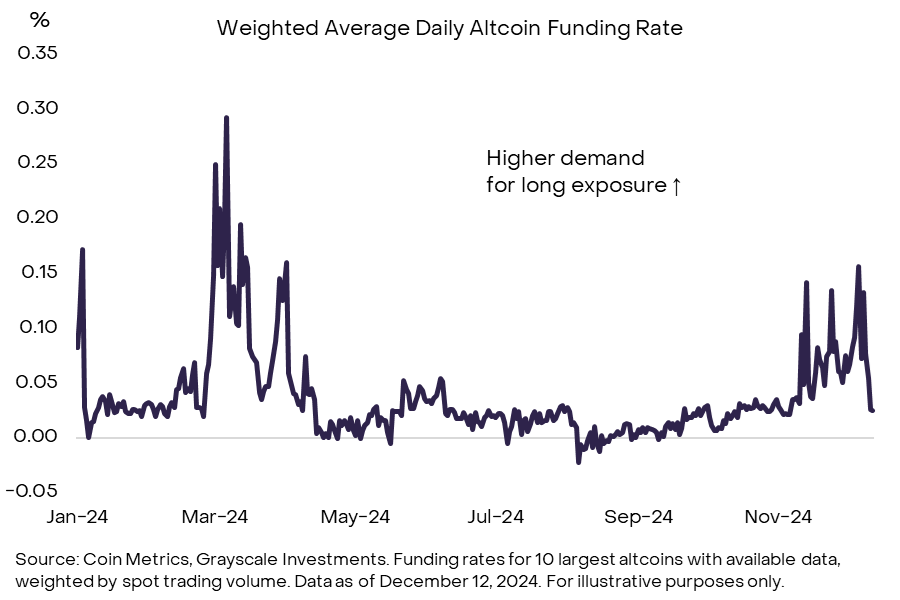

For example, investors can monitor funding rates, the ongoing cost of holding long positions in perpetual futures contracts. Funding rates tend to rise when speculative traders demand increased leverage on long positions. Therefore, the overall level of funding rates in the market can reflect the degree of speculative long positioning. Exhibit 8 shows the weighted average funding rate for the top 10 crypto assets by market capitalization (i.e., major "Altcoins") [4]. Currently, funding rates are significantly positive, indicating demand from leveraged long investors, although funding rates have pulled back somewhat in the recent market decline. Moreover, even at local highs, funding rates remain below levels seen earlier this year and the peaks of the prior cycle. Therefore, we believe the current levels are consistent with a moderate level of speculative long positioning, rather than the extreme highs typically associated with a mature market cycle.

Exhibit 8: Funding rates indicate a moderate level of speculative long positioning in Altcoins

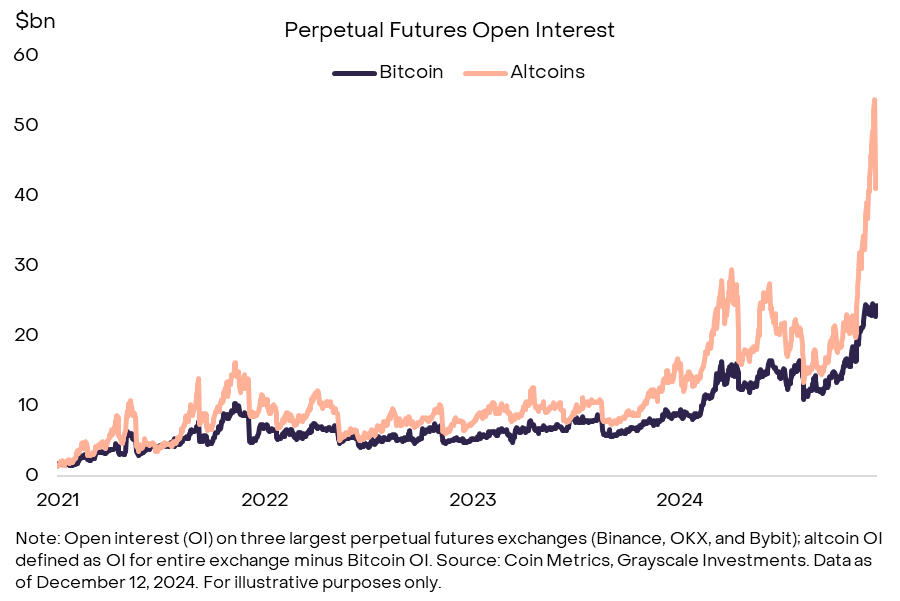

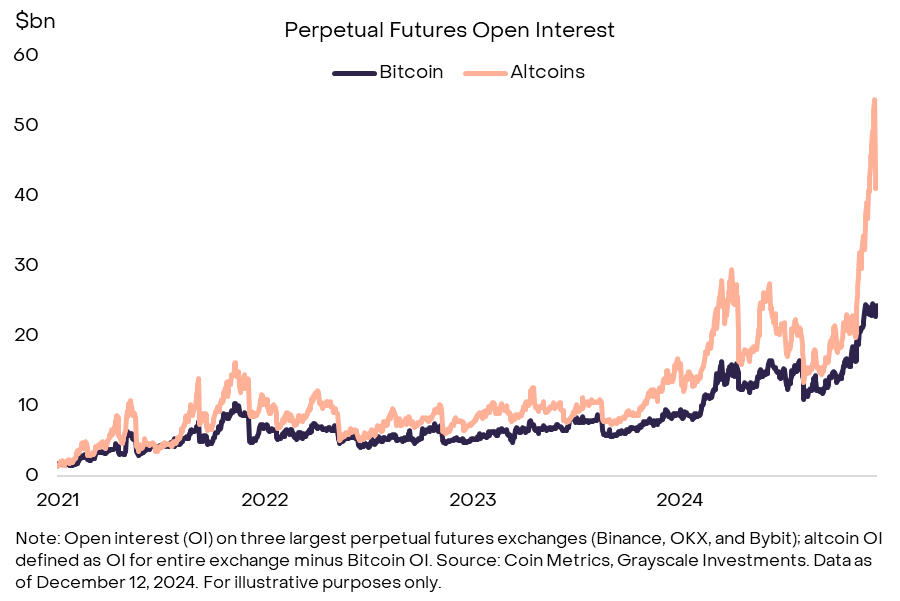

In contrast, Altcoin perpetual futures open interest (OI) has reached relatively high levels. Prior to the large-scale liquidations on Monday, December 9th, Altcoin OI across the top three perpetual futures exchanges approached $54 billion (see Exhibit 9). This suggests a high level of speculative long positioning across the market. After the wave of liquidations earlier this week, Altcoin OI has declined by around $10 billion, but remains at elevated levels. Elevated speculative long positioning is consistent with a late-stage market cycle, so continued monitoring of this indicator may be crucial.

Exhibit 9: Altcoin open interest remained elevated prior to the recent wave of liquidations

Looking Ahead

Since the birth of Bitcoin in 2009, the digital asset market has come a long way, and this crypto bull market differs from the past in several ways. Most importantly, the approval of Bitcoin and Ethereum spot ETPs in the U.S. has brought $36.7 billion of net capital inflows, integrating these assets into more traditional investment portfolios [5]. Additionally, we believe the recent U.S. election is likely to provide a clearer regulatory framework, helping digital assets find a long-term footing in the world's largest economy - a stark contrast to the past, when the long-term viability of the crypto asset class was repeatedly questioned. For these reasons, the valuations of Bitcoin and other crypto assets may no longer follow the typical four-year cycles seen in their early history.

At the same time, Bitcoin and many other crypto assets can be viewed as digital commodities, and may therefore still exhibit some degree of price momentum. An assessment of on-chain indicators and Altcoin market positioning data may provide investors with useful inputs for risk management decisions. Grayscale Research believes the current combination of indicators is consistent with the mid-stage of the crypto market cycle: MVRV ratios are well above cyclical lows, but have not yet reached levels typically associated with past market peaks. Provided the fundamentals remain supportive (such as continued adoption and a favorable macroeconomic environment), we see no reason why this crypto bull market cannot extend into 2025 and beyond.

[1] In a financial markets context, a random walk refers to the idea that asset prices evolve in an unpredictable way, in which information of past events holds no information about future results.

[2] Free Float Bitcoin supply defined by Coin Metrics as tokens active at least once in last five years.

[3] Exhibit 7 only shows the two most recent cycles, because the Altcoin market was not sufficiently developed before that point.

[4] Defined as the largest tokens by market capitalization after Bitcoin with available data. No data was available for TON, so next largest asset DOT included instead.

[5] Source: Bloomberg, Grayscale Investments. Data as of December 11, 2024.