As the second-to-last week of December approaches, Bitcoin is nearing its quarterly high for the year, while the Ethereum Layer 2 ecosystem is also rapidly expanding. At the same time, recent macroeconomic data has sparked both optimism and caution in the market, providing a complex backdrop for crypto investors.

This article will take you through the important economic events of Week 51 and analyze the potential impact of each macroeconomic indicator on the cryptocurrency market. We will review the key data releases from last week, focusing on which Altcoin sectors performed well or poorly, and look ahead to the market trends in the coming days. Finally, you will gain practical insights to help you navigate the market volatility this week with a comprehensive strategy.

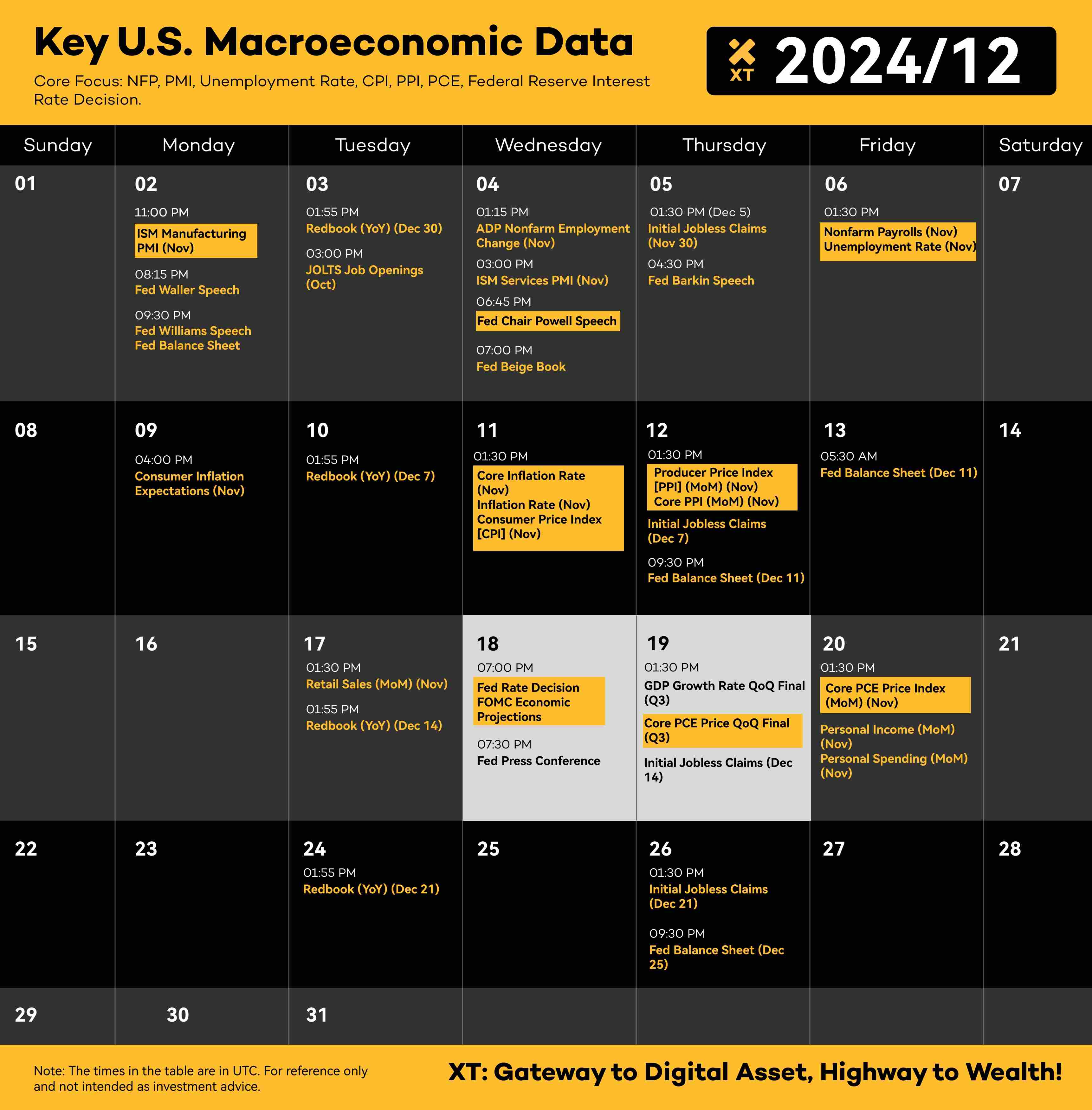

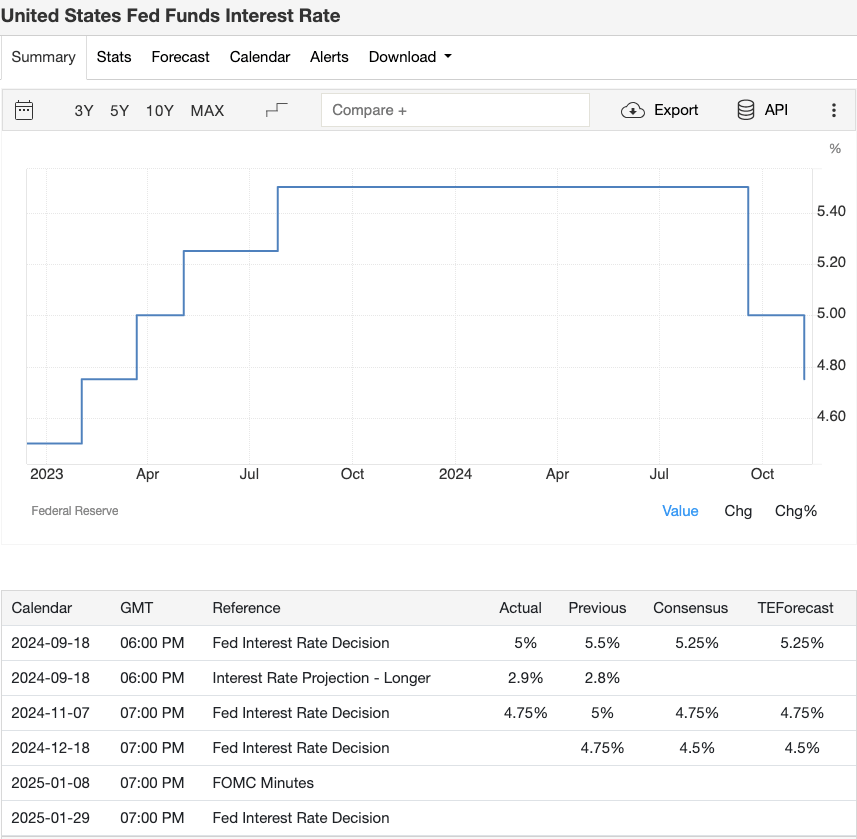

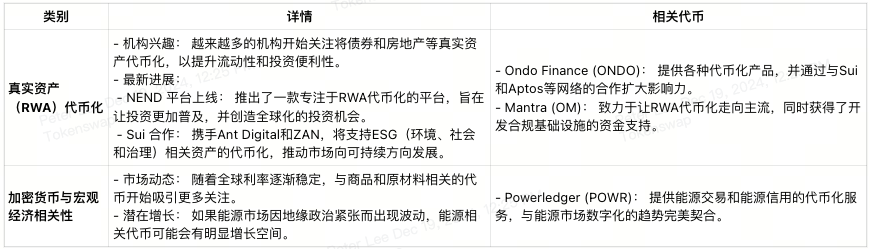

Highlights of the December 2024 Economic Calendar

Image source: Follow @XTexchange on X https://x.com/XTexchange

Key dates and potential impacts:

This Week's Expectations

Monday, December 16 (China Industrial Production, Retail Sales): Relevance: China's industrial activity and consumer spending can provide clues about the global economic health. Slowdown could weaken risk appetite, while better-than-expected data may support a broader rebound in risk assets, including cryptocurrencies.

Tuesday, December 17 (UK Unemployment Rate, German IFO Business Climate, Canada Inflation Rate, US Retail Sales): Relevance: The UK job market and German business confidence surveys reflect the resilience or fragility of the European economy. Canada's inflation rate reading and US retail sales data will reveal the North American economic trends. Positive data may boost investor confidence and increase demand for cryptocurrencies.

Wednesday, December 18 (UK Inflation Rate, US Building Permits): Relevance: The UK inflation data may influence the Bank of England's policy stance. Meanwhile, US building permits, as a leading economic indicator, robust or improving data may support the stock market and risk sentiment, indirectly benefiting cryptocurrencies.

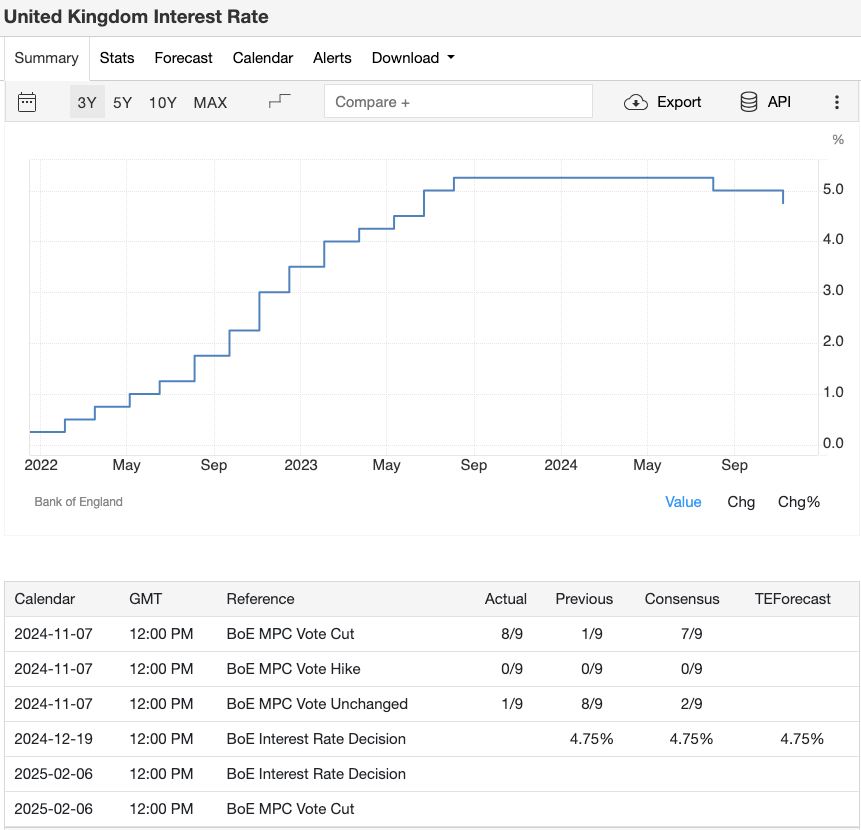

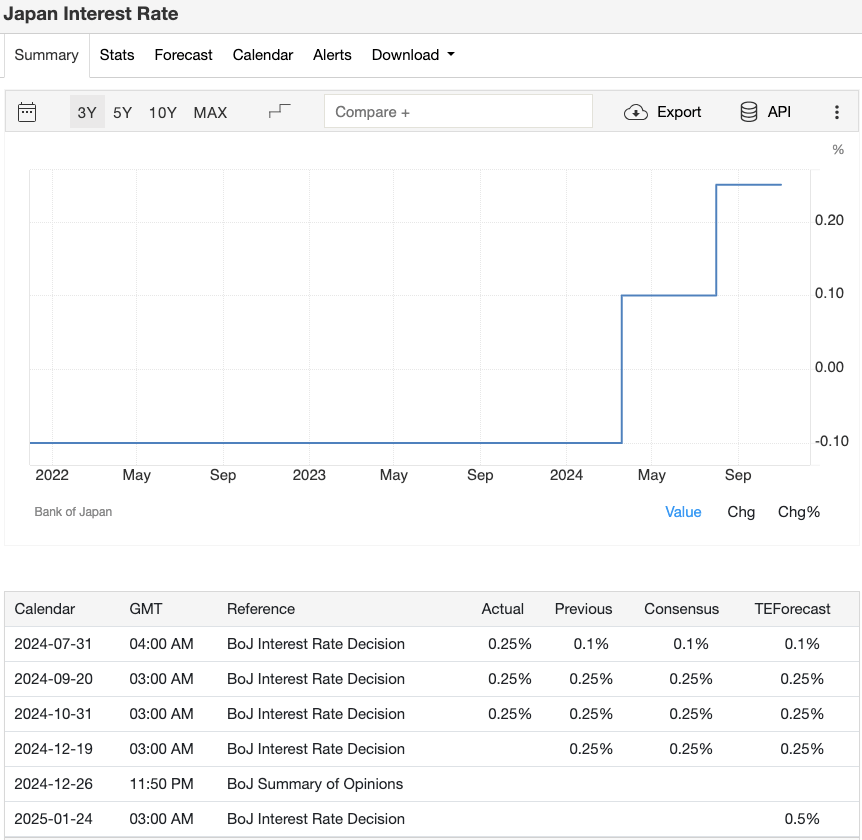

Thursday, December 19 (US FOMC Rate Decision, Bank of Japan Rate Decision, Bank of England Rate Decision, US GDP Growth Rate QoQ Final): Relevance: This is the most important day of the week. The Fed's rate decision and its economic projections will be key to market direction. Similarly, the decisions by the Bank of Japan and Bank of England, along with the final US Q3 GDP, will shape the global liquidity conditions. Cryptocurrencies typically react strongly to the implications of monetary easing or tightening.

Friday, December 20 (Japan Inflation Rate, UK Retail Sales, US Core PCE Price Index, Personal Income and Spending): Relevance: Japan's inflation data and UK retail sales provide the final pulse check on the global macroeconomic landscape before the weekend. The US core PCE price index (the Fed's preferred inflation gauge) and personal income and spending data may influence rate expectations, thereby affecting market sentiment, including the cryptocurrency market.

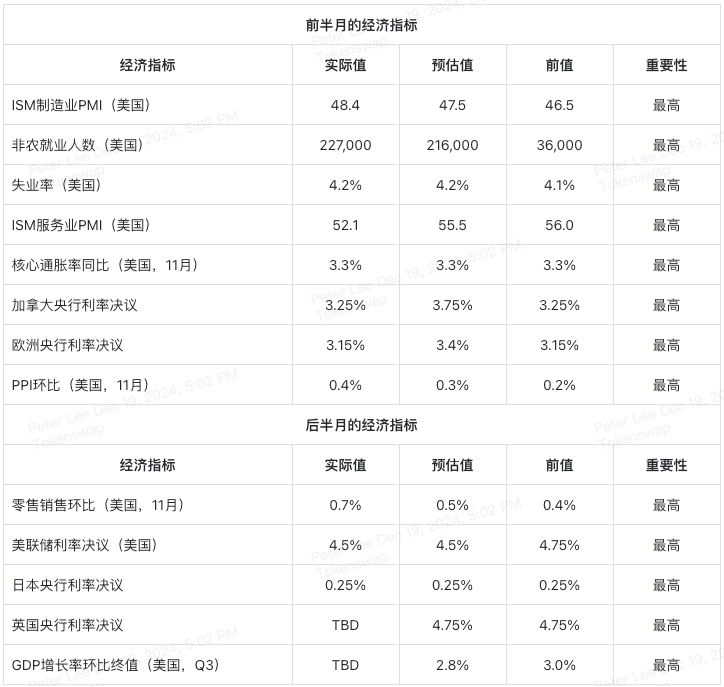

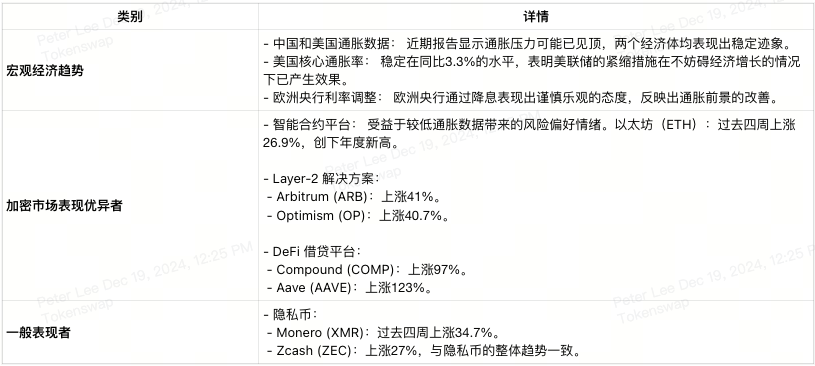

Macroeconomic Review: Last week, inflation data from China and the US moderated slightly, reinforcing the view that inflationary pressures may have peaked. The US core inflation rate stabilized at 3.3% year-over-year, indicating that the Fed's tightening policies have been effective without stifling economic growth. Meanwhile, the ECB's rate cut demonstrated a cautiously optimistic outlook, reflecting an improvement in the inflation outlook.

Impact on Crypto Market:

Top Performers: Smart contract platforms, Web3 infrastructure projects, and Ethereum Layer 2 solutions performed strongly last week, with DeFi lending platforms seeing triple-digit growth. Investors interpreted the lower inflation data as a signal to increase risk asset allocations.

Average Performers: Privacy coins faced some headwinds due to regulatory concerns, dampening interest from certain niche market investors.

This Week's Economic Data Analysis

In-Depth Analysis:

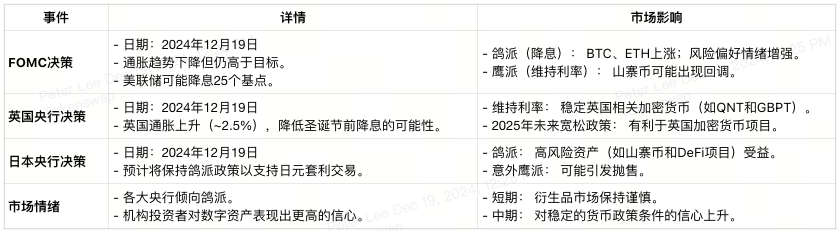

FOMC Decision (Thursday):

With inflation trending down but still above the Fed's target, the market will parse the Fed's language for signs of a more dovish tilt next year. A dovish bias may once again boost the crypto market, while hawkish signals could dampen the uptrend.

UK and Bank of England Decision:

The UK's inflation data and the Bank of England's subsequent rate decision will determine whether a dovish path is confirmed, or trigger volatility in the Pound and UK-related crypto markets.

Bank of Japan Decision:

The BoJ's stance may impact Yen carry trades and global risk appetite. If the BoJ maintains a dovish policy, high-risk assets (such as cryptocurrencies) may indirectly benefit.

Market Sentiment: Early analyst commentary suggests that the major central banks are leaning slightly dovish. Institutional investors are showing higher confidence in holding digital assets, expecting monetary policy to become more predictable. While the short-term derivatives market remains cautious, medium-term options indicate a gradual increase in confidence.

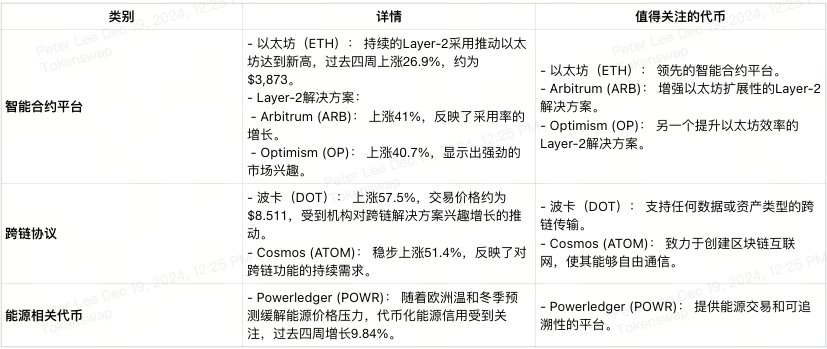

Best-Performing Crypto Sectors This Month

Performance Highlights:

Smart Contract Platforms: Ethereum's continued Layer 2 adoption has driven price increases in Ethereum itself and its Rollup tokens.

Cross-Chain Protocols: Cross-chain bridges and interoperability tokens are gaining momentum as institutional interest grows, reflecting the demand for a more interconnected blockchain ecosystem.

Macroeconomic Relevance:

Energy-Related Tokens: Projects related to energy efficiency or tokenized energy credits have garnered some attention, correlating with the dynamics in traditional energy markets. As forecasts of a mild European winter eased energy price pressures, these tokens have performed better.

Noteworthy Sector Trends

Emerging Opportunities:

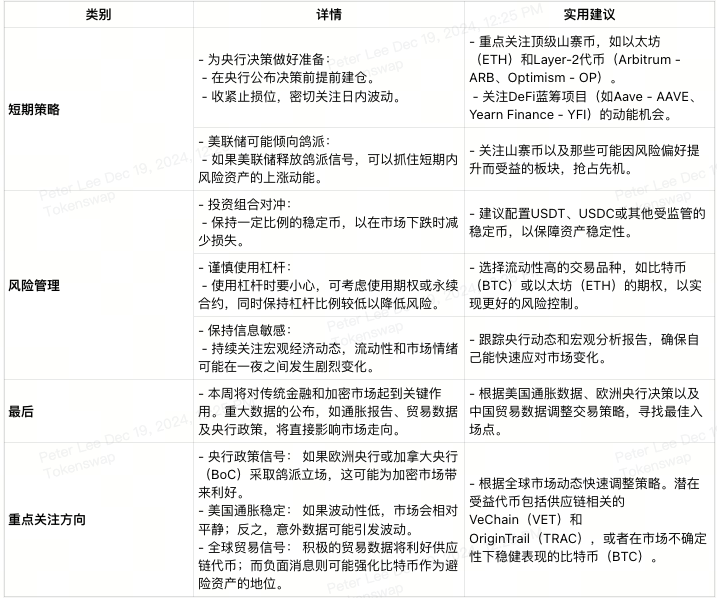

Real-World Asset (RWA) Tokenization: Institutional investors indicate that if central bank policies remain stable, tokenized bonds and real estate may attract more capital inflows, injecting new vitality into the market.

DeFi Insurance Protocols: As macroeconomic volatility gradually subsides, some investors are starting to focus on DeFi insurance protocols as a safety net against platform risks.

Crypto-Macro Correlation:

Against the backdrop of stabilizing global interest rates, tokens related to commodities and raw materials are gradually gaining market attention. If energy markets become volatile due to geopolitical tensions, these tokens may become a focal point.

Next Week Outlook: Week 52 Expectations

Preview: Due to the year-end holidays, economic activity is expected to be relatively quiet next week. However, traders will still closely monitor any surprise announcements or policy signals. Eurozone inflation data and US consumer indicators may set the tone for the January market trends.

Market Forecast:

If this week's central bank decisions confirm a stable rate environment, there may be more capital inflows into Altcoins and Non-Fungible Token (NFT) markets next week.

However, if central banks unexpectedly deliver hawkish signals, market enthusiasm may cool down.

Strategies and Risks

Short-term strategy:

If you are an active trader, you can gradually build positions before the central bank's decision announcement on Thursday. Remember to tighten your stop-loss and pay attention to intraday volatility.

If the Federal Reserve shows a dovish tendency, you can seize the short-term upward opportunities of top Altcoins and DeFi blue-chip projects.

Risk management:

Maintain a certain proportion of stablecoins as defensive assets to cope with sudden market declines.

Be cautious when using options or perpetual contracts, and try to reduce the leverage ratio to cope with the risks of major events such as central bank decisions.

Always pay attention to macroeconomic dynamics, as market liquidity and sentiment may change at any time.

Finally

The macroeconomic calendar of the 50th week is an important challenge for both the traditional and crypto markets. Inflation data, central bank decisions, and trade data will be the core drivers of market sentiment and capital flows. From the stable inflation in the US to the interest rate adjustments by the European Central Bank, and the trade data in China and the UK's GDP, each data point may change the market landscape.

Key focus points:

Central bank policy: If the European Central Bank or the Bank of Canada (BoC) releases dovish signals, high-risk crypto assets may benefit.

US inflation: If the data remains stable, the market will be relatively calm; but if there are unexpected changes, it may trigger violent market fluctuations.

Global trade data: China and Germany's trade data can reflect the strength of demand. Positive data may drive the rise of supply chain tokens, while negative news may strengthen Bitcoin's position as a safe-haven asset.

Advance planning and focusing on important data points are the keys to responding to market changes. Understanding market trends and adjusting strategies in a timely manner can help seize opportunities and avoid risks.