Author: Guosheng Communications Team

summary

At this point in time, we re-evaluate the development trend of AGI and investor expectations. The market takes computing power as the starting point, extends to GPU, optical modules, switches, storage and other tracks, and leverages overseas mapping, looking forward to AI applications, but ignoring the pull on upstream infrastructure when computing power is increased. If applications are the direction with the strongest explosive power, then infrastructure needs to be worked on for a long time, not only liquid cooling, but also the demand for energy, which is the starting point of this article.

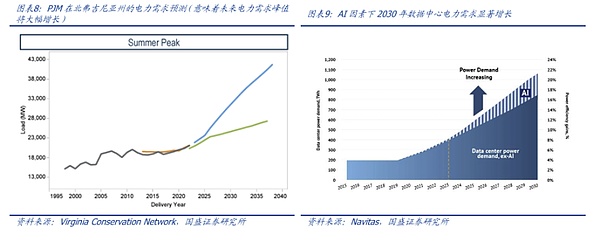

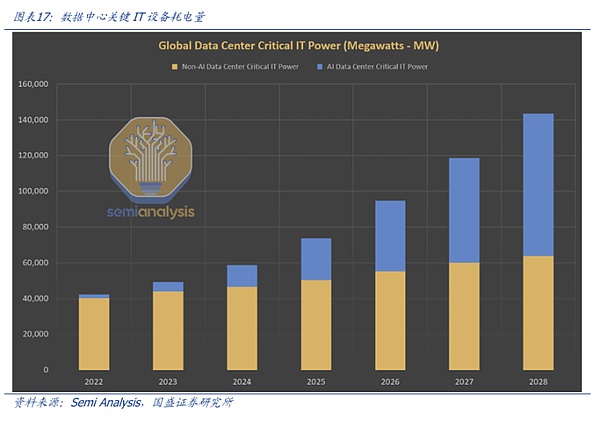

Marginal changes: One of the biggest differences between AIDC and traditional data centers is that the level of electricity consumption has increased significantly. AIDC has the characteristics of large data volume, complex algorithms, and 24/7 instant response, so compared with traditional data centers, AIDC consumes a lot of electricity. With the rapid development of AI, it is expected that AI software that integrates large language models will develop rapidly, and the training needs and reasoning needs will resonate. In the future, the power consumption of data centers will increase significantly. AIDC will become a new generation of "electric tigers", and the proportion of electricity consumed by data centers will further increase. SemiAnalysis predicts that the global data center critical IT power demand will surge from 49GW in 2023 to 96GW in 2026, of which AI will consume about 40GW. Vertiv guides that in the next five years, data center power consumption will increase by 100GW, and global data center power demand will increase to 140GW by 2029.

Dilemma: The U.S. power grid can hardly support the development of AI computing power. Compared with the construction speed of data centers, the current construction speed of the U.S. power grid is relatively slow, and the power generation capacity is limited. Therefore, in the short term, the United States will face the dilemma of power demand under the development of AI. At present, the power supply in the United States faces obstacles such as long infrastructure construction cycle, infrastructure shortage, labor shortage, lack of experience of practitioners, and the need to coordinate multiple stakeholders in the construction of power grids. The rapid development of AI has led to power supply shortages in some areas. North American utility company Dominion Energy said that it may not be able to meet the power demand in Virginia, resulting in the delay of the construction project of the world's fastest-growing data center hub for many years.

Solutions: Short-term - natural gas, medium-term - SMR nuclear power, long-term - controlled nuclear fusion. The rise of AI is leading resource competition to computing power + energy. In the AI-driven digital world, computing power is the basis of iteration and innovation, and energy is the key to supporting the operation of these computing powers. In the short term, natural gas combined with fuel cells provides data centers with flexible and efficient power generation solutions to meet the current needs of rapid expansion. In the medium term, small modular reactors (SMRs) have become a key path to address the power bottleneck of data centers due to their stability and adaptability to distributed deployment. In the long term, controlled nuclear fusion is expected to completely break through the limitations of energy supply and provide unlimited and clean power support for the future computing power ecosystem. In this process, from the continuous innovation of energy technology to the efficient coordination of the computing power ecosystem, it has not only promoted the leap of AI technology, but also reshaped the future pattern of deep integration of energy and computing.

We believe that we are still in a battle of computing power, but looking forward to the next five years, the battle for energy infrastructure may become the mainstream. In the short term, the capital expenditures of CSP giants in the third quarter of this year have all hit new highs, and they tend to be on the computing power side. In the next 5-10 years, combined with the continued increase in AI computing power investment and the current power supply status in the United States, we believe that the current era of electricity parity in the United States is about to end, and the battle for computing power will gradually turn into a battle for energy. The investment plans of computing power giants such as Amazon, Microsoft, and Google in nuclear power projects such as SMR have initially proved this. The participation of IT giants will significantly introduce new technologies and accelerate iterations, and investment opportunities in related energy infrastructure will gradually emerge.

Investment advice: In summary, energy is the next battle in the technological competition. Just as liquid cooling has evolved from optional to mandatory, the upstream infrastructure track of AI is also moving from traditional industries to core technology supporting facilities. Seizing the opportunity for layout is the key to future success. It is recommended to pay attention to the core US stock targets ETN, EMR, SMR, OKLO, NNE, BE, etc. A-shares in nuclear power, natural gas and infrastructure supply chain recommend paying attention to China General Nuclear Power, China Nuclear Power, New Natural Gas, CGN Mining, Jinpan Technology, Invic, Magmet, Nengke Technology, Kehua Data, Eurolink, Yishitong, etc.

Risk warning: technical and regulatory risks, high capital requirements and financing pressure, market demand and competition risks

Investment requirements

Sam Altman, founder of OpenAI, once said in an interview: The two important resources of the future will be computing power and energy. The pursuit of performance by AI has gradually become fierce in the field of computing power, and the core factor of the next stage of competition will initially appear in energy infrastructure.

[From computing power to energy: the next battle in technological competition]

The rise of artificial intelligence has more directly led resource competition to computing power and energy. In the AI-driven digital world, computing power is the basis for iteration and innovation, while energy is the key to supporting the operation of these computing powers. "The two most important resources in the future are computing power and energy." This trend will run through every stage of AI technology development, from algorithm optimization to hardware breakthroughs to the current demand for efficient energy systems.

[Demand for accelerated computing power and hardware limits]

The demand for AI computing power is growing exponentially. Taking NVIDIA H100 GPU as an example, the computing power of 60 TFLOPS is driving the large-scale training of large models, and the surge in computing power has brought huge energy consumption challenges. Vertiv predicts that by 2029, the total installed power demand of global data centers is expected to soar from 40GW to 140GW, and the value of data centers per MW will increase from US$2.5-3 million to US$3-3.5 million. NVIDIA's next-generation product Rubin ultra has a power consumption of more than 1MW per cabinet, which also shows that the increase in AI computing power is exerting unprecedented pressure on the power infrastructure. How fast the calculation is largely dependent on the power size.

[Energy bottlenecks and infrastructure challenges]

The expansion of data centers has exposed the fragility of the power supply system. Elon Musk once pointed out that the production capacity of key electrical equipment such as transformers is difficult to meet the current AI needs, and this shortage of power infrastructure will further amplify the load fluctuation of the power grid, especially during the peak period of AI training, when power demand may instantly exceed the average load by several times. The peak and valley power consumption pattern poses a huge threat to the stability of the energy system. This bottleneck was not obvious in the early stages of AI development, but it will become more and more obvious as the cluster scale expands and AI applications are released. This dilemma can be seen in the implementation process of Sora.

【Energy technology innovation and computing power ecosystem collaboration】

Against the backdrop of rapidly growing demand for computing power, energy bottlenecks are becoming a core obstacle to the development of AI. Nuclear energy, especially small modular reactors (SMRs), has gradually emerged as one of the best solutions for adapting AIDC. Emerging nuclear energy companies represented by OKLO\Nuscale are developing microreactor technology, and cloud service providers such as Google and Microsoft have started the SMR project layout, with the goal of providing continuous and stable computing power support for future data centers through distributed small nuclear power plants. Solutions such as natural gas + fuel cells/clean energy/energy storage are also being actively promoted as one of the options for rapid implementation, and start-ups represented by Bloom Energy are also rising rapidly with the help of the industry's east wind.

From an investment perspective, the market has recognized the importance of computing power, and is eagerly awaiting the implementation of applications, constantly looking for mappings, but has overlooked the importance of AI infrastructure. This is not just an opportunity for liquid cooling and computer rooms. From a broader perspective, the next stage of competition is gradually gathering momentum in various energy fields (natural gas, nuclear power, etc.).

1. "Electricity Tiger" AIDC and Weak Grid

1.1 Power consumption: the next shortcoming of AIDC

1.1.1 Electricity Supply and Demand in the United States

Demand side: Data centers are already "big electricity consumers", accounting for 4% of the electricity consumption in the U.S. In 2023, the total power of U.S. data centers will be about 19GW. Based on this estimate, the annual electricity consumption will be about 166TWh (terawatt hours), accounting for 4% of the national electricity consumption.

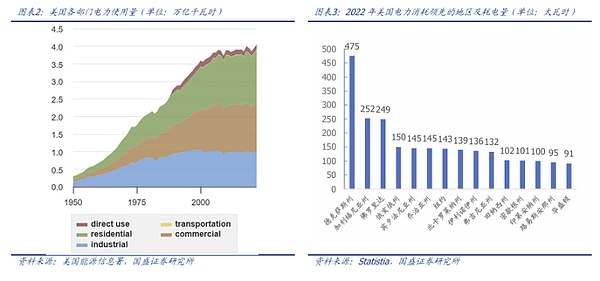

Data centers consume 166 TWh of electricity, which exceeds the annual electricity consumption of New York City and is equivalent to the annual electricity consumption of 15.38 million households. By region, New York consumed 143.2 TWh of electricity in 22 years, Texas consumed 475.4 TWh of electricity, California consumed 251.9 TWh, Florida consumed 248.8 TWh, and Washington consumed 90.9 TWh of electricity. The annual electricity consumption of data centers in the United States exceeded that of New York City. The average annual electricity consumption of each residential user in 2022 is 10791 kWh. According to this estimate, 166 TWh is equivalent to the annual electricity consumption of about 15.38 million households.

*1 TWh = 1000 GWh = 10^6 MWh = 10^9KWh

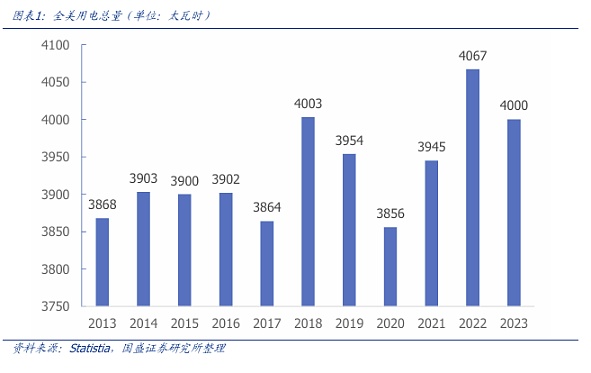

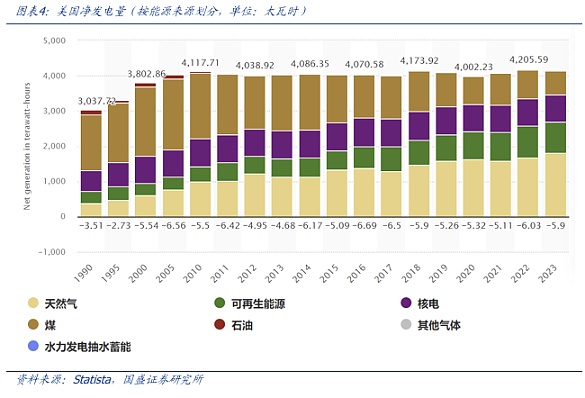

Supply side: The annual power generation in the United States is relatively fixed. At present, thermal power is still the main source. The growth rate of new energy power generation is relatively fast, and the proportion of nuclear energy has further increased. The annual power generation in the United States is about 4000-4300 terawatt hours (TWh), of which thermal power (coal, natural gas, oil) accounts for about 60% in 2023 and is the main source of energy; new energy power generation (wind power, solar energy, etc.) has grown rapidly in recent years and accounts for 21%; nuclear energy accounts for about 19%, and the proportion has further increased.

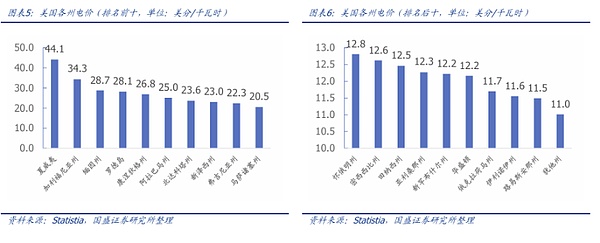

Electricity price: The United States is one of the countries with the lowest electricity prices in the world, and some states have lower electricity prices due to their energy advantages. The electricity consumption structure in the United States is mainly divided into four areas: residential, commercial, industrial and transportation. In September 2024, the electricity price for residential users was US$0.17/kWh (approximately RMB 1.24/kWh, the exchange rate was as of December 13), and the electricity price for commercial users was US$0.135/kWh (approximately RMB 0.98/kWh); the industrial electricity price was US$0.09/kWh, the transportation electricity price was US$0.13/kWh, and the wholesale electricity price in 2023 was US$0.036/kWh. Some states have lower electricity prices due to their energy advantages. As of April 2024, the electricity price in Texas (rich in natural gas and renewable energy) is about $0.147/kWh, Louisiana (rich in energy resources) is about $0.115/kWh, and Tennessee (rich in hydropower resources) is about $0.125/kWh. Some large-scale infrastructures that consume more electricity, such as data centers, are often built in provinces with low electricity prices, and the above-mentioned state capitals have also become the concentration of computing power industries today.

Calculation of annual electricity costs for data centers: Based on the wholesale price of $0.036/kWh, U.S. data centers (before AI is widely used) consume 166TWh of electricity per year, which is estimated to cost about $6 billion.

1.1.2 Marginal Changes: Challenges of AI to the Power Grid

[Challenge 1: A substantial increase in total electricity consumption]

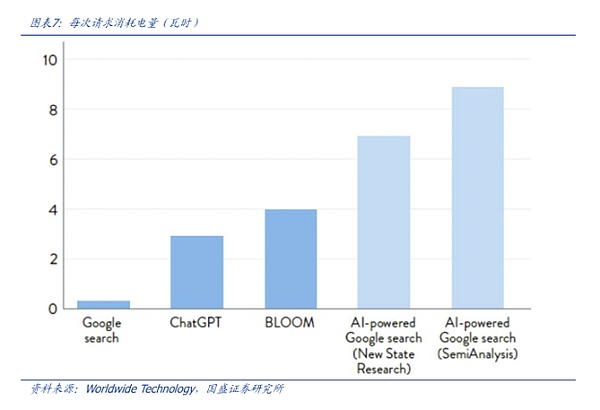

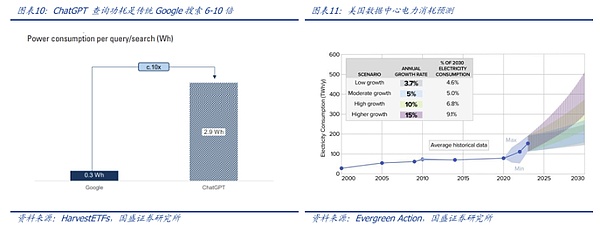

Compared with traditional data centers, AI data centers consume a lot of electricity. The main reasons are the substantial increase in data volume, complex algorithms, and the need for 24/7 instant response. For example, a traditional Google search request consumes about 0.3Wh, while a ChatGPT request consumes 2.9Wh, ten times the former. A paper published in Joule stated that if Google used AIGC for every search, its electricity consumption would rise to 29 billion KWh per year, which would exceed the total electricity consumption of many countries such as Kenya and Croatia. According to the New Yorker magazine, ChatGPT consumes more than 500,000 KWh per day.

[Challenge 2: Intensified electricity consumption fluctuations]

Phenomenon: The current demand of AI data centers (whether training or inference) is highly transient, with huge swings within a few seconds. As the task load of the neural network model increases or decreases, the current demand will fluctuate violently, and the change can even reach 2000A per microsecond.

Principle: 1) Peak load fluctuations: The training and reasoning of AI models require huge computing power, but they do not run continuously. Peak load will appear when model training starts, and basic operation will be maintained during the trough, resulting in fluctuations in power consumption; 2) Dynamic resource scheduling: AI tasks are cyclical. For example, large-scale training requires concentrated resources, while the reasoning stage is relatively dispersed, which makes the power consumption curve more unstable; 3) Real-time response needs: Generative AI and large model applications require low latency and high throughput, which drives real-time expansion of infrastructure and further amplifies power consumption volatility.

Result: Affects grid stability. Grid design is not suitable for large swings. Grids are basically designed for power loads, hoping to see a relatively stable, regular, and slowly changing load. For example, after a power device with a power load of 100GW is connected to the grid, there may be two 200GW transmission lines to supply power. If one of the two transmission lines is normal, it can ensure operation. However, AI power consumption characteristics will have huge swings within a few seconds. Such violent fluctuations may affect the stability of the grid.

[Challenge 3: Greater subsequent electricity demand]

The reasoning of AI data centers consumes more energy than training due to the large number of user requests. At present, Google has announced in the first half of this year that it will add new AI functions to improve the search experience and will launch AI Overviews based on Gemini, which is open to some users for trial; Microsoft has launched a personal AI assistant called Microsoft Copilot and has integrated ChatGPT into Bing. At present, the number of visits to Google's search engine has reached 82 billion times per month, and the number of paying users of Office commercial products has exceeded 400 million. The huge user base means that if the trained large model is integrated into the company's products, the number of user requests will increase significantly, and the number of AI instant responses will surge, resulting in the energy consumption of model reasoning exceeding the energy consumption of training. According to McKinsey estimates, the power load of US data centers may account for 30% to 40% of all new demand by 2030.

Conclusion: With the rapid development of AI, it is expected that AI software integrating large language models will develop rapidly, and the training demand and reasoning demand will resonate. The power consumption of data centers will increase significantly in the future. AIDC will become a new generation of "electricity tiger", and the proportion of electricity consumption in data centers will further increase.

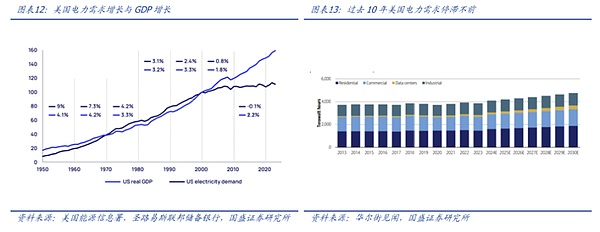

1.2 Real dilemma: The power grid is difficult to support

The economic development structure determines that the North American power grid infrastructure is relatively weak. In the past 20 years, the decoupling speed of US electricity demand from economic growth has accelerated sharply. Since 2010, the US economy has grown by 24%, while electricity demand has remained almost unchanged. In 2023, US electricity consumption even fell by 2% compared with 2022. Its essence is that unlike the domestic economy, which is mainly driven by industry and services, the US economic growth does not rely mainly on electricity or energy consumption, but mainly relies on high-tech industries with low energy consumption. In addition, efficiency improvements (mainly replacing incandescent lamps with fluorescent lamps and LEDs) have offset the electricity demand brought about by population and economic growth, leaving utilities and regulators without expanding the grid or power generation capacity.

Current situation: lack of time, lack of people, lack of infrastructure, lack of experience, and many obstacles.

Lack of time: It takes about two years to build a data center, but the construction of the power grid is much slower. It may take three to five years to build a power station, and it may take eight or even ten years to build a long-distance, high-capacity transmission line. According to the U.S. regional transmission organization MISO, the 18 new transmission projects it is planning may take seven to nine years, while similar projects historically took 10 to 12 years. Based on this, it is likely that the speed of power grid construction will not be able to keep up with the growth rate of AI.

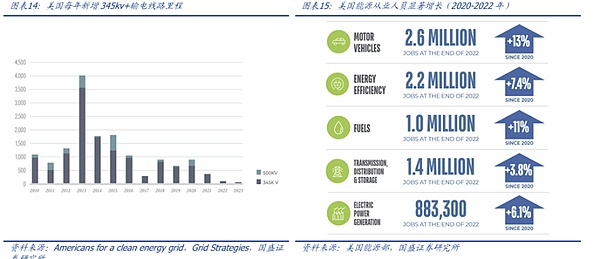

Lack of infrastructure: According to the trend of electricity investment in the United States, from 2016 to 2023, the capital expenditure of U.S. utilities increased significantly, especially in the fields of power generation, distribution and transmission. Grid investment began to accelerate in 2018, mainly due to the boost to electricity demand driven by the return of manufacturing. Against this background, the United States still did not expand the power grid on a large scale. According to a survey report issued by Grid Strategy, the United States installed an average of 1,700 miles of new high-voltage transmission mileage each year from 2010 to 2014, but it dropped to only 645 miles per year from 2015 to 2019.

Lack of people: A tight labor force is also a constraint, especially a shortage of electrical professionals necessary to implement new grid projects. According to McKinsey estimates, the United States could face a shortage of 400,000 specialized workers based on projected data center construction and similar assets requiring similar skills.

Lack of experience: For the United States, the entire power industry has not seen a large-scale increase in electricity demand in the past 20 years, and these 20 years may mean that a whole group of engineers and staff have no experience in building new power grids on a large scale.

Many obstacles: The construction of a power grid requires infrastructure such as power stations and transmission lines, which may require the joint efforts of countless stakeholders to reach a compromise on the direction of the lines and the cost to be borne.

Conclusion: Compared with the construction speed of data centers, the current construction speed of the US power grid is relatively slow, and the power generation capacity is limited. Therefore, in the short term, the United States will face the dilemma of power demand under the development of AI. For example, North American utility company Dominion Energy said that it may not be able to meet the power demand in Virginia, resulting in the delay of the construction project of the world's fastest-growing data center hub for many years. According to Wood Mackenzie, in the power industry, new infrastructure planning takes 5 to 10 years. In addition, most state utility commissions lack regulatory experience in an economic growth environment. It can be inferred that electric energy may become one of the biggest constraints on the development of AI in the next few years. Although the market pays attention to innovative solutions such as controlled nuclear fusion, distant water cannot quench immediate thirst, and it is inevitable to form a comprehensive solution in the short, medium and long term.

1.3 Multi-angle measurement: How much power does AIDC consume?

* Total electricity (GWh) = total power (GW) × time (h)

* Total power (GW) = IT equipment power (GW) × PUE (energy efficiency ratio)

1.3.1 Measurement Angle 1 (conservative): AI Chip

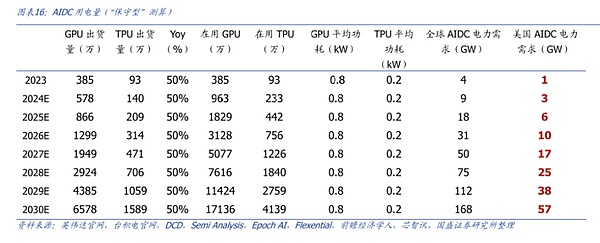

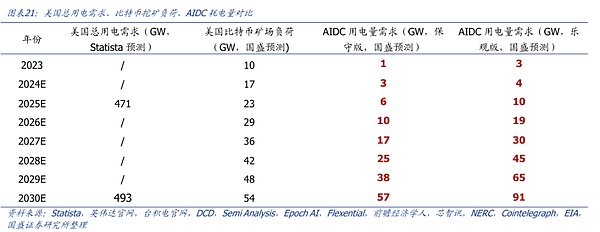

Calculation logic: The first calculation angle is to start from the number of chips, extrapolate to 2030, and then use the number of chips * chip power consumption to predict the total electricity consumption. It does not take into account that the overall power consumption of the server will be greater than the single chip * number, and does not take into account the possible increase in single chip power consumption after future chip upgrades. Therefore, we believe that the first calculation angle is a "conservative" calculation, and the calculation data is the smallest among several methods. The AIDC electricity demand in 2030 is 57GW.

Number of GPUs and TPUs in use: According to DCD reports, the total shipments of GPUs for data centers of NVIDIA, AMD, and Intel are estimated to be 3.85 million in 2023, and the number of TPUs produced for Google in 2023 is expected to be 930,000. Tracing back the supply chain further, TSMC predicts that the year-on-year growth rate of demand for AI server manufacturing will be about 50% from 2024 to 2029. Based on this calculation, the shipments of GPUs in 2030 will be about 65.78 million and the shipments of TPUs will be about 15.89 million. According to NVIDIA's official statement, the average service life of most H100 and A100 is 5 years, so we assume that the number of chips in use in 2030 is the sum of the chip shipments in 26-30 years, so the number of GPUs and TPUs in use in 2030 will be about 171.36 million and 41.39 million.

GPU and TPU power consumption: The maximum power of H100 NVL can reach 800W. It is estimated that there will be 171.36 million GPUs in 2030. Assuming that GPU and TPU energy consumption accounts for 90% of the total energy consumption of IT equipment, assuming that the United States accounts for 34%, the utilization rate is 80%, and the PUE is 1.3, the GPU power demand in the US AIDC in 2030 will be about 54GW (GPU quantity * GPU power consumption * US share * PUE * utilization rate ÷ chip share = 171.36 million * 0.8kW * 34% * 1.3 * 80% ÷ 90% = 54GW);

According to Google's official statement, the average power of the TPU v4 chip is 200W. Combined with the above estimate that the number of TPUs in use in 2030 will be approximately 41.39 million, we estimate that the total power consumption of TPU in 2030 will be approximately 3.3GW (other indicators are assumed to be the same as GPU).

Conclusion from perspective 1: The total power consumption of AIDC in the United States in 2030 will be 57GW. The chip inventory from 2023 to 2026 only considers the chip shipments after 2023, and the other calculation methods are the same as above. The calculation methods from 2027 to 2030 are the same as above. Finally, the power consumption of GPU and TPU is added up to get the power capacity required by AIDC in the United States in 2024-2030, which will reach 3/6/10/17/25/38/57GW respectively.

Assumption 1: The chip growth rate is 50% per year (refer to TSMC’s statement).

Assumption 2: Assume that the average lifespan of a chip is 5 years (refer to the GPU lifespan given by NVIDIA).

Assumption 3: The average power utilization of IT equipment is 90% (taking into account the power consumption of NVSwitches, NVLink, NIC, retimers, network transceivers, etc. in IT equipment, assuming that GPU and TPU account for 90% of the energy consumption, and other IT equipment accounts for 10%).

Assumption 4: Considering that IT cannot run at full capacity and cannot run 24 hours a day, refer to Semi analysis and set the possible utilization rate to 80%.

Assumption 5: PUE is 1.3 (PUE is the total power consumption of the data center divided by the power used by IT equipment).

Assumption 6: The United States accounts for 34% of the world's computing power demand (according to calculations by the China Academy of Information and Communications Technology, the United States' share of the global computing power scale is 34%).

1.3.2 Measurement Angle 2 (Optimistic): Data Center

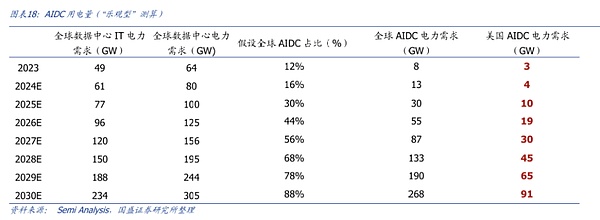

Calculation logic: The second calculation angle is from the perspective of data center construction, referring to the global data center construction progress predicted by a third party (compound growth rate of 25%). At the same time, since the forecast data is up to 2026, we assume that the compound growth rate will remain at 25% from 2027 to 2030, and predict the global data center power demand, and assume the power consumption and proportion of AIDC. Therefore, we believe that the data obtained from this forecast angle is relatively "optimistic", and finally predict that the maximum power demand of AIDC in the United States will be 91GW by 2030.

Research company SemiAnalysis used analysis and construction forecasts of more than 5,000 data centers, and combined this data with global data and satellite image analysis. It is expected that the growth of data center power capacity will accelerate to a compound annual growth rate of 25% in the next few years, and the proportion of AIDC will further increase. In terms of data centers, according to forecast data, the global data center key IT power demand will surge from 49GW in 2023 to 96GW in 2026. We assume that the data center will continue to maintain a compound growth rate of 25% from 2027 to 2030 (refer to the growth rate from 2023 to 2026, which is 25%). Then, by 2029 and 2030, the global data center key IT power demand will increase to 188GW and 234GW respectively. Referring to Semi Analysis data, combined with the booming development of AI computing power and the outbreak of downstream applications, we believe that the proportion of AI in data centers is expected to continue to accelerate in the future. Therefore, we assume that the global AIDC will account for 12%/16%/30%/44%/56%/68%/78%/88% in 2023-2030, respectively, and calculate the growth rates of 2029 and 2030. The global AIDC IT equipment power demand was 65GW and 91GW respectively in 2018.

Conclusion from perspective 2: Assuming the United States accounts for 34% and a PUE of 1.3, the U.S. AIDC power demand will reach 91GW by 2030.

Assumption 1: Given the booming development of AI computing power and the explosion of downstream applications, we believe that the proportion of AI in data centers is expected to continue to accelerate in the future. Therefore, we assume that the global AIDC share will reach 12%/16%/30%/44%/56%/68%/78%/88% in 2023-2030 respectively.

Assumption 2: PUE is 1.3 (PUE is the total power consumption of the data center divided by the power used by IT equipment).

Assumption three: The United States’ demand for computing power accounts for 34% of the world’s total (according to calculations by the China Academy of Information and Communications Technology, the United States’ share of global computing power is 34%).

1.3.3 Summary 1: AIDC accounts for a higher proportion of total electricity consumption in the United States

(1) AI power consumption accounts for an increasing proportion of total U.S. power consumption, and is expected to exceed 10%

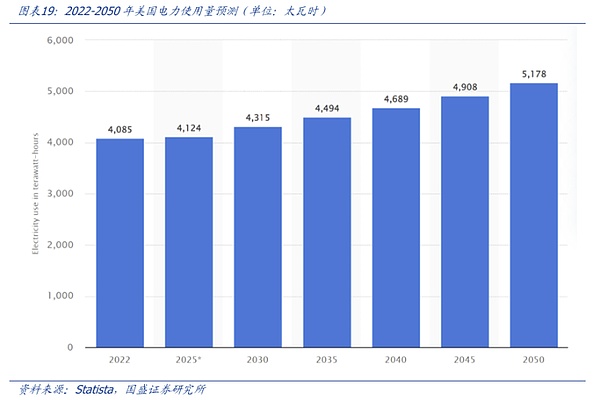

According to Statista's forecast data, the United States will use about 4,085 terawatt-hours of electricity in 2022, and it is expected that the United States' electricity use will continue to rise in the next few decades, reaching 4,315 terawatt-hours (corresponding to 493GW) by 2030 and 5,178 terawatt-hours by 2050. According to our previous "Calculation Angle 1", if the total power consumption of AIDC reaches 57GW in 2030, then the proportion of electricity consumption in the United States will increase to 12% (57GW/493GW), a significant increase from 4% in 2023.

1.3.3 Conclusion 2: AIDC power consumption is expected to be comparable to Bitcoin mining

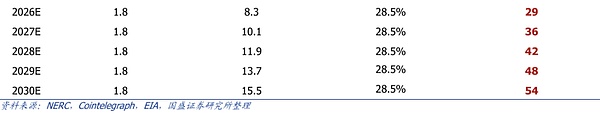

In our report "AI East Wind Has Arrived, Bitcoin Mines Start the Second Growth Curve" released on August 6, 2024, we made assumptions and predictions on the electricity consumption of Bitcoin mines. In this report, we predict that the Texas Bitcoin mine load in 2024/2025/2026/2027/2028 will be 4.7/6.5/8.3/10.1/11.9GW respectively (assuming that the annual new load of Texas Bitcoin mines is 1.8GW). Regarding the share of Texas Bitcoin mine load in the United States, we assume that it remains unchanged at 28.5%. Therefore, we predict that the annual load of US Bitcoin mines will be 17/23/29/36/42GW respectively.

For the sake of comparison, we forecast the data to 2030, assuming: 1) the annual new load of Texas Bitcoin mines is 1.8GW, 2) assuming that the share of Texas mines remains unchanged at 28.5% in 2029 and 2030. Therefore, in 2024/2025/2026/2027/2028/2029/2030, the annual power consumption of US Bitcoin mines will be 17GW/23GW/29GW/26GW/42GW/48GW/54GW respectively.

Conclusion: Under conservative forecasts, the power consumption of AIDC in the United States will surpass the power demand of Bitcoin mining in 2030; under optimistic forecasts, the power demand of AIDC in the United States will exceed that of Bitcoin mining in 2029.

2. How to solve the dilemma: "Natural gas +" is the mainstream in the short term

2.1 Natural gas is the fastest solution in the short term

2.1.1 Substations have become a bottleneck for traditional electricity consumption

[Current Status of Data Center Power Supply]

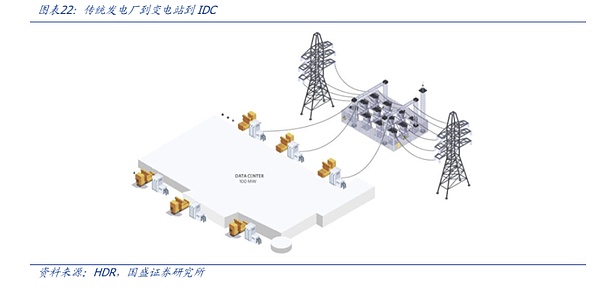

Purchasing electricity and substations: Data centers usually purchase electricity by signing contracts with power companies, which means that the power supply of data centers is the current generated by power stations and transmitted to data centers through the transmission network. However, after the electricity is transmitted over long distances, the voltage usually needs to be adjusted through substations to ensure that the electricity meets the voltage requirements of the data center.

Necessity of substations: Substations convert high-voltage electricity into low voltage suitable for local use. Most power systems need to go through substations for voltage conversion and distribution. Without a local substation, electricity cannot be used directly in the data center.

The construction of substations is difficult, time-consuming and costly: Substation construction usually requires a large amount of capital investment, involving land, infrastructure construction, equipment procurement and manpower reserves, etc. In addition, the construction period of substations is long and they need to meet strict environmental and safety standards.

Conclusion: Under the current electricity purchase method, substations have become a bottleneck restricting AIDC electricity consumption. As the power demand of data centers continues to grow, it takes a long time to build new substations or expand existing substations, and requires a lot of approval and construction time, which may not be able to keep up with the needs of data centers quickly.

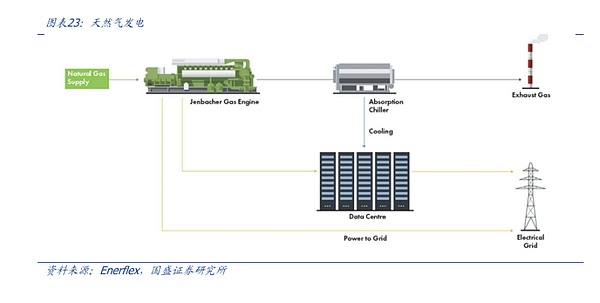

[Natural gas does not require a substation and is the preferred choice for distributed power supply]

Natural gas power generation does not rely on substations. Natural gas power generation generates electricity by burning natural gas. Natural gas power stations are usually connected to data centers through dedicated pipelines, directly transporting natural gas to power generation facilities for combustion and power generation. The generated electricity is then supplied to the data center through the local power grid or dedicated lines. It can usually be completed in power generation facilities near the data center. Unlike traditional power transmission methods, natural gas power generation does not need to pass through high-voltage power transmission networks, so it does not rely on remote substations and power transmission facilities. Natural gas power generation can build small natural gas power stations (such as distributed power generation systems) near data centers, reducing dependence on external power grids and shortening the response time of power supply.

2.1.2 There is a time gap between the rapid development of AI and the implementation of SMR nuclear power

Although nuclear power has advantages in many aspects, the most important demand of the North American computing power market at present is "rapid implementation", quickly lighting up GPUs to obtain computing power, and natural gas has become the current first choice.

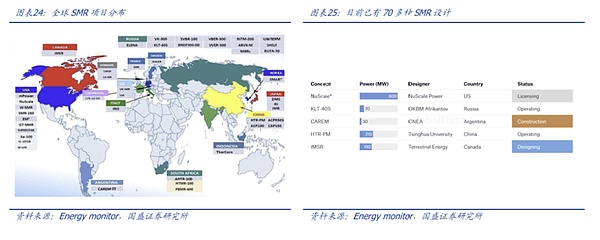

Although the U.S. Nuclear Regulatory Commission approved the nuclear power company Nuscale Power to design the first SMR (Small Modular Reactors) in February 2023, and countries around the world such as China and Russia are competing to put SMR technology into practice, the commercialization of SMR will still take some time, and the safety approval process is complex and time-consuming. It can be seen that SMR has aroused global interest in nuclear energy. The U.S. nuclear fission industry has been boosted by the Inflation Reduction Act, which includes a number of tax credits and incentives, while providing $700 million in funding to the Office of Nuclear Energy to support the development of a domestic supply of high-purity low-enriched uranium (the fuel required for SMR); more than 70 commercial SMR designs are under development worldwide, and two SMR projects are currently operating in China and Russia. But according to U.S. energy regulators, nuclear reactors are extremely complex systems that must meet strict safety requirements and take into account a variety of accident scenarios, and the licensing process is cumbersome and varies from country to country. This means that SMRs require a certain degree of standardization to enter the commercial market, so other solutions need to be found to solve short-term energy shortages.

2.2 "Natural gas + multiple energy" combination is more stable

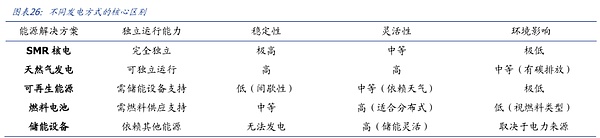

The combination of natural gas + other energy sources is currently the fastest implementation solution that can adapt to the power needs of AI. Compared with SMR nuclear power, an independent solution with high energy density but long deployment cycle, natural gas power generation can be used as a basic energy source to quickly respond to load demand due to its high efficiency and flexibility. At the same time, it can be used in conjunction with renewable energy, fuel cells, and energy storage systems to effectively make up for the lack of intermittency and stability. This multi-energy combination can not only meet the needs of AI data centers for stable power supply, but also provide a balance between carbon emissions and costs, becoming an important choice for the current data center energy strategy.

Collaboration is not a must , but for large-scale AI data centers that need to balance stability, environmental protection, and cost, collaborative use of multiple energy solutions is a more flexible and long-term option. With clear goals (such as low cost and ultra-fast deployment), a single solution can also meet the following requirements:

【Power generation using natural gas only (single solution)】

Advantages: Natural gas power generation can be used as an independent power supply solution, which is suitable for scenarios with high requirements for stable power demand and rapid deployment, especially AI data centers that require high dispatchability.

Limitations: Although it can be deployed quickly, it has high carbon emissions in the long run.

[Necessity of multi-energy synergy]

More stable and secure: AI data centers have extremely high requirements for power continuity (no short-term power outages are allowed), and natural gas + energy storage systems or fuel cells can be used as backup support;

More environmentally friendly: natural gas + wind power, solar energy and other low-carbon energy combinations.

2.3 Natural Gas Solution: Taking xAI as an Example

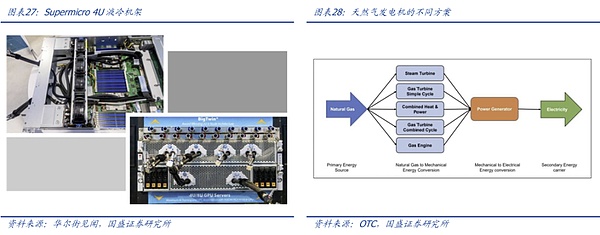

Natural gas power generation technology is mature, with complete supporting equipment and high cost-effectiveness. In the short term, it is the fastest option to solve the AI power shortage problem. Tesla xAI uses natural gas as an emergency power supply. A natural gas generator is a generator that uses natural gas instead of gasoline or diesel. Compared with diesel, natural gas is cheaper to purchase and does not have the problem of "wet accumulation". Therefore, from the perspective of short-term energy solutions, natural gas generators are cost-effective, efficient, and more environmentally friendly compared to other fossil fuel generators such as fuel oil. According to DCD reports, Tesla CEO Musk has purchased 14 mobile natural gas generators from Voltagrid, each of which can provide 2.5 MW of electricity to alleviate the power shortage problem of the data center of his startup xAI.

* Additional details 1: Musk xAI mainly uses NVIDIA H series servers, and the cluster heat dissipation adopts liquid cooling. Each liquid cooling rack in the xAI data center contains 8 NVIDIA H100 GPU servers, a total of 64 GPUs. The dense layout requires that each computing node can dissipate heat efficiently, and traditional air cooling methods are difficult to adapt. Therefore, xAI chose Ultra Micro's liquid cooling solution.

* Additional details 2: xAI data centers also use the Megapack energy storage system. xAI said that when its team was building a computing cluster, it found that AI servers do not run at 100% power all day long, but have many peaks and valleys in power consumption. Therefore, Tesla's battery storage product Megapack was added in the middle to buffer fluctuations, thereby improving the reliability of the overall system and reducing power loss.

2.4 Fuel cells: Taking Bloom Energy as an example

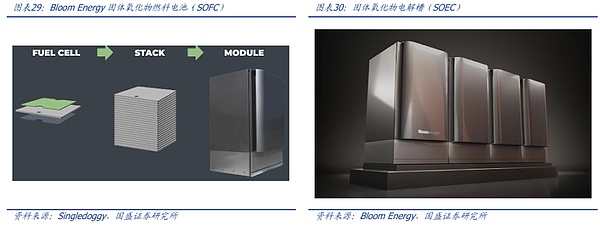

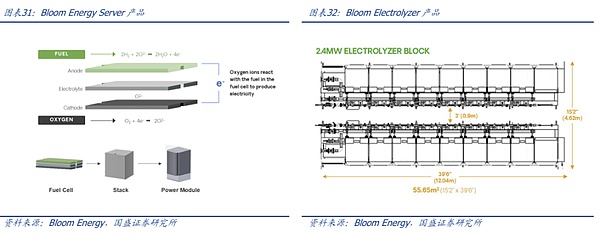

Company Overview: Bloom Energy focuses on developing efficient, low-emission energy technologies and is committed to promoting global energy transformation through innovative solid oxide fuel cells (SOFC) and solid oxide electrolyzers (SOEC) technologies. As a leading clean energy company, the company is committed to providing sustainable and reliable energy solutions for high-demand areas such as industry, commerce, and data centers through its advanced hydrogen and fuel cell technologies. Founded in 2001, the company is headquartered in California, USA, and is expanding its business globally.

Core technologies: The company's core technologies include solid oxide fuel cells (SOFC) and solid oxide electrolyzers (SOEC). The SOFC system provides efficient power output when using 100% hydrogen, with an electrical efficiency of up to 65%, far exceeding traditional energy systems. Bloom Energy's fuel cell system can also integrate combined heat and power (CHP) technology, making the total energy efficiency as high as 90%, thereby effectively reducing energy consumption and carbon emissions. In addition, SOEC technology can be used for efficient hydrogen production and is one of the key technologies in the clean energy transition.

Product application: The company's products are widely used in many fields, including industrial power supply, commercial energy management and data center energy solutions. Especially in the field of data centers, with the increasing demand for energy efficiency and carbon neutrality goals, Bloom Energy's fuel cell technology is more efficient and low-emission. Its hydrogen solutions can not only meet large-scale energy needs, but also provide enterprises with reliable backup power to ensure the continuity and stability of operations. At present, Bloom Energy's market has covered North America, Asia, Europe and other regions. Especially in cooperation with SK Ecoplant in South Korea, Bloom Energy's hydrogen fuel cell project is expected to go online in 2025. In addition, the company has announced a gigawatt fuel cell procurement agreement with AEP to power AI data centers.

3. Mid-term plan: SMR nuclear power stands out

3.1 Why nuclear power: more suitable for AI

3.1.1 Characteristics of AIDC: Distributed and High-density

Compared with traditional IDC data centers, AIDC computing centers have two most significant differences, which are also important characteristics of AIDC.

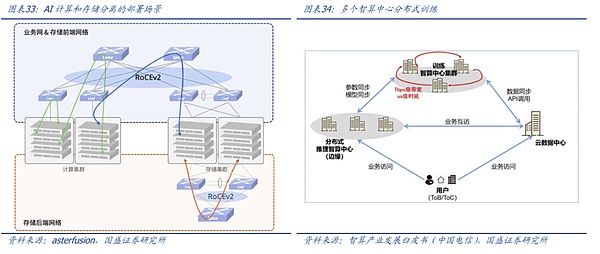

[AIDC Feature 1: Distributed Deployment]

AI's application scenarios and task requirements determine that AIDC needs to be deployed in a distributed manner. AIDC differs significantly from traditional IDC in terms of computing requirements, application scenarios, and resource consumption. AIDC tasks are usually computationally intensive, especially large-scale deep learning, machine learning, and data analysis tasks in the AI field. A single computing node cannot carry all tasks. Therefore, AIDC needs to split computing tasks into multiple small tasks and distribute them to multiple nodes for parallel computing through a distributed computing framework. This requires data centers or computing nodes in multiple geographical locations to work together.

【AIDC Feature 2: 24-hour high-density computing】

The persistence and high load of AI computing tasks determine that AIDC must operate at high load 24 hours a day, and has higher requirements for power resources and cooling support. AI model training is often a long-term process that requires continuous computing support, so AIDC usually performs long-term continuous computing tasks; the load of traditional IDC generally fluctuates according to business needs, and many applications do not require such long-term, uninterrupted computing support. Therefore, AIDC's high-power computing hardware requires strong power supply and cooling support around the clock.

The distributed deployment + high-density computing characteristics of AIDC determine that other energy sources are difficult to adapt to, and small nuclear power SMR best meets the power supply needs.

Thrust - Other energy sources are not suitable for AI needs, and stability and geographical location are difficult to meet AIDC:

Hydropower has obvious seasonality and cannot meet the large-scale stable power supply demand. In addition, the geographical location with abundant water resources is fixed, which makes it difficult to meet the distributed deployment requirements of AIDC. Hydropower also requires distribution networks to transmit electricity, which has a high overall cost and even higher new construction costs and time.

Thermal power has high fuel costs and strict carbon emission restrictions. Even if carbon emission quotas are purchased, the overall cost of thermal power will be higher. Therefore, it is not suitable for AIDC, which requires a lot of electricity. At the same time, thermal power also faces the problem of high costs caused by the distribution network.

Although other new energy sources (such as solar energy and wind energy) are clean, their power generation capacity is greatly affected by weather conditions and geographical restrictions. Their intermittent and unstable nature makes it impossible for them to ensure the stable operation of AIDC around the clock under high load. In addition, the conversion efficiency of some new energy sources, such as photovoltaics, is still low, and the subsequent operation and maintenance costs are high. From the perspective of cost-effectiveness, they are not suitable for AIDC.

Attractiveness - SMR nuclear power has stronger comparative advantages, and its modular design is suitable for distributed deployment, while also meeting the environmental protection requirements of reducing carbon emissions. The modular characteristics of SMR technology enable it to be flexibly applied in distributed deployment scenarios, and modules can be flexibly added or reduced according to the needs of different regions, ensuring that the power supply of AIDC distributed data centers is not affected by geographical location, weather, and energy price fluctuations. In addition, nuclear power, as a clean energy source, is in line with the global trend of reducing carbon emissions and is suitable for AIDC's demand for green energy. Therefore, nuclear power SMR is suitable as the main power supply source for AIDC.

3.1.2 Nuclear power SMR has the fastest landing speed

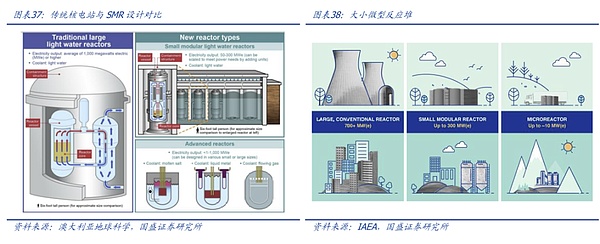

What is SMR - a modular, smaller, and more easily deployable nuclear reactor. SMR (Small Modular Reactor) is a new development in nuclear energy technology. SMR is a type of nuclear power plant, but it is significantly different from traditional nuclear power plants. SMR is a small, modular nuclear reactor designed to provide smaller-scale power output and is built with modular components for easy factory production and transportation. Generally, the output power of SMR is smaller than that of traditional large nuclear reactors. Before the emergence of AIDC, SMR was often used in remote areas, small islands, military bases far away from the power grid, or as a supplementary source of industrial electricity.

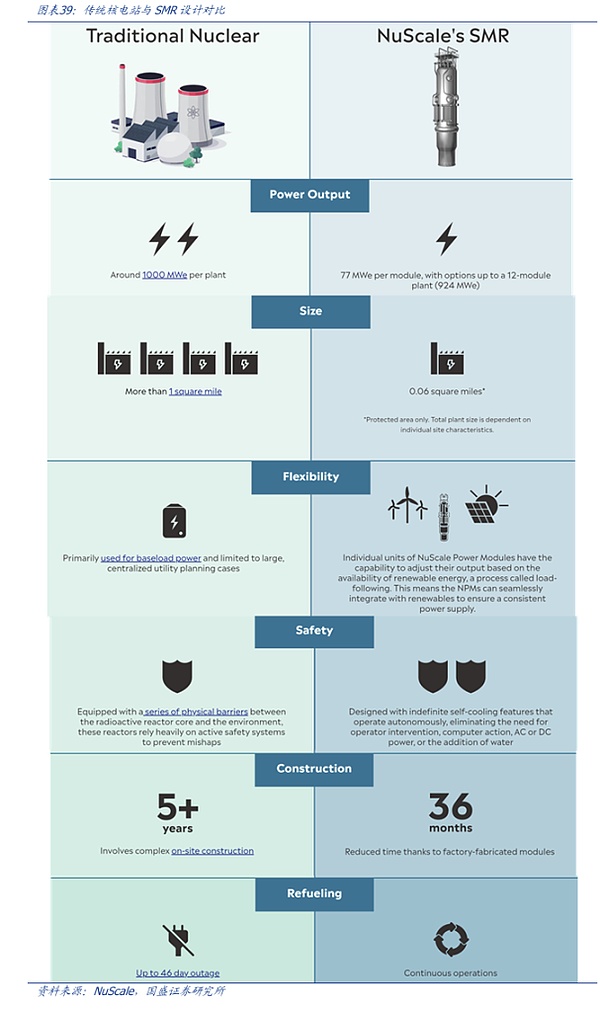

Compared with traditional nuclear power plants, SMR has the following characteristics: small scale, short construction time, lower (construction and maintenance) cost, higher safety, cleaner and greener, and longer life:

Small module output power: The output power of SMR is smaller than that of traditional nuclear power plants, usually between tens and hundreds of megawatts, while the scale of traditional nuclear power plants is usually more than 1,000 megawatts. For example, a single NuScale SMR module can provide 77MW of electricity, and a maximum of 12 modules can provide 924 MW of electricity;

Shorter construction time: Because SMR uses a modular design, it allows for factory prefabrication and rapid assembly. For example, NuScale's SMR nuclear power plant only takes 36 months (3 years), while the construction period of traditional nuclear power plants is usually longer and may take more than five to ten years.

Small footprint: Traditional nuclear power plants occupy a large area, usually larger than 1 square mile (approximately 2.6 square kilometers), while modular SMRs usually occupy a smaller area. NuScale predicts that the SMR nuclear power plant will occupy an area of 0.06 square miles, which is close to the area of a small park.

Lower cost: The construction cost of traditional nuclear power plants is usually high and is affected by economies of scale, but the construction cost of SMRs is relatively low, partly because of the standardized and modular design, which enables the modules to be mass-produced, reducing the construction and maintenance costs of individual reactors.

Higher safety: SMR designs often have higher passive safety features and disaster resistance, and can automatically shut down when a fault occurs without the need for human intervention. SMR reactors are also smaller in size, so they are safer and more reliable.

Cleaner: SMR uses advanced reactor design, which can use fuel more efficiently and reduce the generation of nuclear waste, which is more in line with the requirements of clean energy;

Longer life: SMR is designed to last for decades without the need to change fuel, which is much longer than traditional power generation methods. For example, Nuscale's SMR is designed to have a lifespan of up to 60 years.

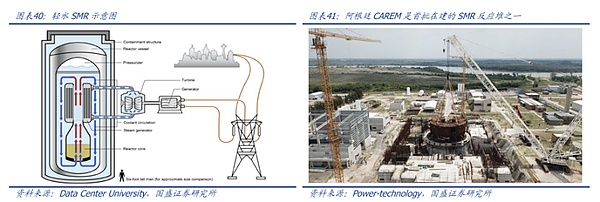

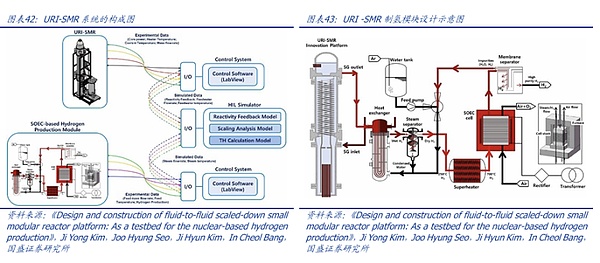

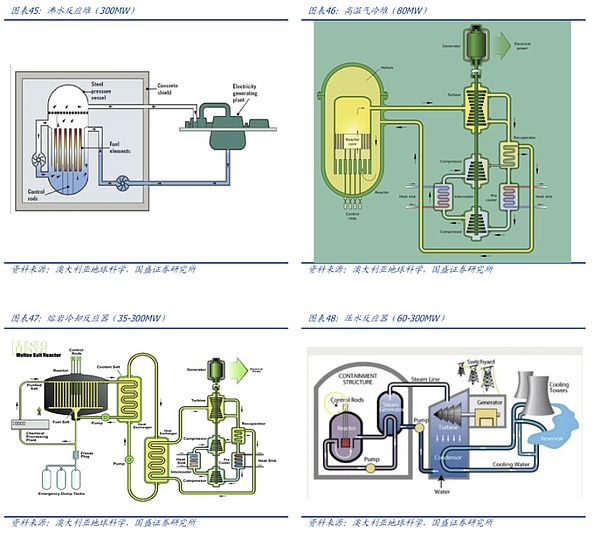

The principle of SMR is basically the same as that of large nuclear reactors, which still generates heat energy through nuclear fission reactions to form steam, which in turn drives generators to generate electricity. (1) Nuclear fission reaction: Like traditional nuclear power plants, the core of SMR is a nuclear reactor, which generates heat through nuclear fission reactions. Fissionable materials such as uranium-235 (such as uranium or plutonium) in the reactor absorb neutrons and undergo fission. The fission process releases a large amount of heat energy and neutrons. (2) Heat exchange and steam generation: The heat generated by the fission reaction in the reactor can be used to heat the coolant. The coolant flows in the nuclear reactor, takes away the heat and transfers it to the steam generator or directly transfers the heat to water through a heat exchanger to form steam. (3) Steam-driven generator: The generated steam is introduced into the turbine, which drives the generator through its rotation. The generator then converts mechanical energy into electrical energy and supplies it to the power grid or users. (4) Cooling system and safety mechanism: SMR usually adopts a natural circulation cooling system or a passive safety system, which uses natural physical processes (such as thermal convection) to keep the reactor cool, thereby reducing dependence on external electricity and equipment. These systems can automatically shut down the reactor and cool it down when a fault occurs.

SMRs are made of standardized components, usually multiple modules, that can be assembled and deployed quickly. (1) Reactor core: contains nuclear fuel, undergoes nuclear fission, and generates a large amount of heat energy; (2) Cooling system: removes heat from the reactor core through circulating coolant. The coolant can be liquid metal (such as sodium), gas (such as carbon dioxide or helium), or water. Some SMR designs use natural convection or passive safety systems, which do not rely on external power to maintain cooling, thereby enhancing the safety of the system; (3) Steam generator: transfers the coolant after heat exchange to water to generate steam, which is introduced into the turbine to drive power generation; (4) Turbine and generator: convert mechanical energy into electrical energy; (5) Control system: SMR uses a digital control system, and some also introduce AI technology; (6) Safety system: uses a passive safety system, that is, the system can automatically cool the reactor without external power or operator intervention. Common designs include natural convection cooling, heat storage devices, etc. These designs can maintain the safety of the reactor through physical principles (such as thermal convection or gravity) in the event of an emergency; (7) Nuclear waste disposal system: stores or handles nuclear waste and radioactive materials.

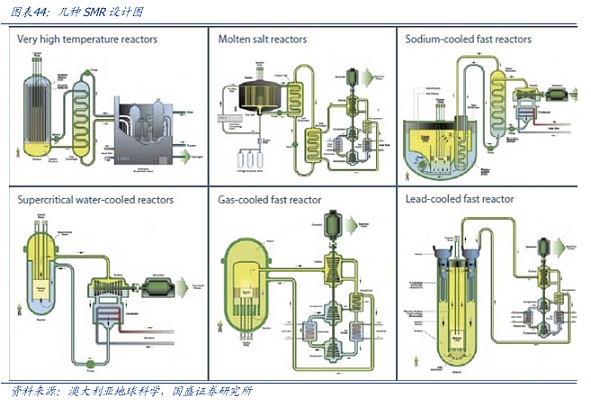

At present, there are several different technical routes for small modular reactors (SMR). The most mainstream is the light water reactor (LWR-SMR) because the technical basis is mature and easy to obtain regulatory approval. As of 2021, countries around the world have proposed more than 70 different SMR nuclear power schemes, including pressurized water reactors, helium-cooled reactors (HTGRs), high-temperature gas-cooled practice reactors, and sodium-cooled fast neutron reactors (SFRs). About half of these schemes are light water reactor reactions, which have evolved from second-generation nuclear power technology. They have high technical continuity and can be quickly commercialized. However, due to the Fukushima nuclear power plant problem in 2011, the technology tree selection for nuclear power has become more complicated, and safety concerns about light water reactors have become more prominent. Safer non-light water reactor schemes are favored, and high-temperature gas-cooled reactor schemes are gradually becoming popular:

Light water reactor (LWR-SMR): Based on mature light water cooling technology, such as NuScale's design, the most mainstream and close to commercialization;

High temperature gas-cooled reactor (HTGR): uses inert gas (such as helium) for cooling, suitable for high temperature process heat requirements, such as the domestic Huaneng high temperature gas-cooled reactor;

Liquid metal cooled reactors (such as sodium cooled reactors): such as the Natrium reactor developed by TerraPower, which has efficient heat dissipation capabilities;

Molten Salt Reactor (MSR): uses high temperature molten rock as cooling. Fast Neutron Reactor (FNR): uses fast neutrons to produce high-efficiency fission fuel, such as the Russian BREST reactor.

3.3 Current status and industry chain of SMR nuclear power

3.3.1 Cloud giants vigorously deploy nuclear power

Due to the shortage of electricity, cloud giants have deployed SMR nuclear power. On the one hand, data centers have huge demand for electricity. SMR provides long-term stable clean energy and can reduce dependence on traditional power grids. On the other hand, in the long run, SMR can reduce the risk of electricity price fluctuations, optimize long-term operating costs, and help companies achieve their carbon neutrality commitments:

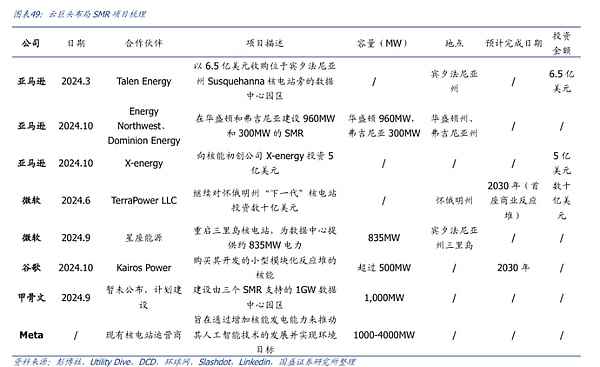

Amazon: As early as March this year, it began looking for nuclear power support solutions and acquired the Talen Energy data center park next to the Susquehanna Steam Electric Station nuclear power plant in Pennsylvania for US$650 million. In October this year, it announced three major nuclear power investment agreements, cooperating with Energy Northwest and Dominion Energy to build 960MW and 300MW SMRs in Washington and Virginia respectively. It also led the US$50 billion C-1 round of financing for nuclear energy startup X-energy.

Microsoft: The company also supports nuclear power. In June, Bill Gates said he would continue to invest billions of dollars in the "next generation" nuclear power plant in Wyoming, USA, through his startup TerraPower LLC. The first commercial reactor is expected to be completed in 2030. In September, it reached a strategic agreement with Constellation Energy to restart the Three Mile Island nuclear power plant to provide 835 megawatts of electricity for Microsoft's data centers.

Google: In October, it said it had agreed to buy nuclear energy from small modular reactors being developed by a startup called Kairos Power to develop more than 500MW of electricity, with the first reactor expected to be operational by 2030.

Oracle: Founder Larry Ellison said in September that Oracle plans to build a 1GW data center campus supported by three SMRs;

Meta: is actively soliciting proposals from nuclear power developers to advance its artificial intelligence technology and achieve environmental goals by increasing nuclear power generation capacity, with plans to add 1 to 4 gigawatts of U.S. nuclear power generation capacity in the early 2030s.

The huge power gap caused by AI data centers and the urgent power requirements faced by CSP have made the trend of the SMR nuclear power industry more and more obvious. It is expected that more SMR layouts will be announced in the future.

3.3.2 SMR Nuclear Power Upstream and Downstream

The SMR nuclear power industry chain covers all aspects from upstream fuel uranium mines, midstream R&D and construction, downstream operations and waste treatment. Relatively speaking, upstream design and manufacturing have high thresholds for professionalism and technical barriers, so upstream manufacturers have higher bargaining power. The downstream operation and maintenance link is a link with high profits because of its long and stable operation cycle, which can bring long-term cash flow. The profit margin of the midstream project construction link is subject to factors such as construction costs, project cycles and engineering risks, and the profit margin is relatively less stable than that of the upstream or downstream.

[Upstream: Raw materials and processing]

The upstream industrial chain mainly involves the supply of basic raw materials, key equipment and nuclear fuel required for nuclear energy development, mainly including uranium mining and uranium enrichment.

(1) Uranium mining and processing

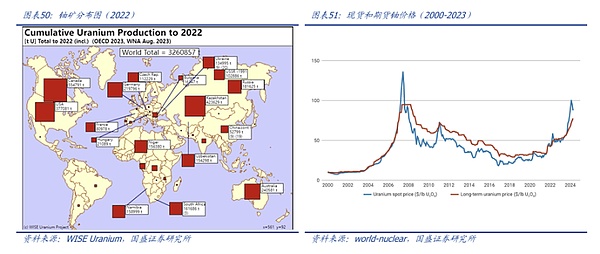

Uranium mining: The global uranium supply market is highly concentrated. The United States relies mainly on imports for uranium. Global uranium mining is mainly dominated by Kazakhstan, Canada and Australia.

Major uranium mining countries and typical companies engaged in local mining: Kazakhstan's Kazatomprom, Canada's Cameco and Orano (formerly Areva, a French company that mines uranium globally) and Denison Mines, Australia's BHP and Rio Tinto, Russia's Rosatom, etc. In addition, there are also some uranium mining companies in the United States, such as Energy Fuels (NYSE: UUUU), Uranium Energy (NYSE: UEC), etc.

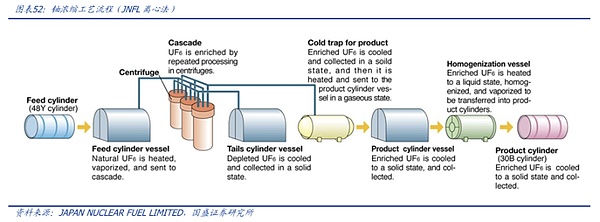

Uranium processing: Uranium enrichment technology has very high requirements for safety, cost and technology, so it is mainly dominated by several multinational companies. Natural uranium is mainly composed of uranium-235 and uranium-238. When neutrons collide with uranium-235, huge energy is released through fission reactions. Uranium-238 has a smaller fission property than uranium-235. Natural uranium contains only about 0.7% uranium-235, so isotope separation (uranium enrichment) is required to increase its content to 3% to 5% for use as fuel for light water reactors. Enrichment methods include gas diffusion, laser enrichment and centrifugation.

* Centrifuge principle: Uranium hexafluoride, a gaseous uranium compound, is fed into the rapidly spinning rotor of a centrifuge to separate U-235 and U-238, with the heavier isotope U-238 being pushed outwards while the lighter isotope U-235 gathers in the center of the rotor. The gas with a higher concentration of U-235 is extracted and fed into another centrifuge. Repeating this process several times can produce uranium with a higher U-235 content.

Major uranium enrichment companies: Centrus Energy (NYSE: LEU, United States, dominates the global market), Orano (France, with both mining and processing), Rosatom (Russia), Urenco (Europe).

(2) Nuclear fuel assembly manufacturing

The fuel used in SMR reactors includes uranium fuel rods, fuel elements and control rods, and the components must meet specific standards to ensure the safe and efficient operation of the reactor.

Participants: Such as Westinghouse, Orano, etc., providing nuclear fuel assemblies and technical support.

(3) Reactor component manufacturing

Reactor components are important components of SMR, including reactor pressure vessels, cooling systems, control systems, cores and other related facilities. These components require h