Source: JinSe Data

Although the trade and tax policies of President-elect Trump pose an imminent threat to the bond market, Wall Street is still inspired by the Federal Reserve, predicting that the yield on short-term U.S. Treasuries will decline by 2025.

The forecasts of the strategists are largely consistent, believing that the 2-year Treasury yield, which is more sensitive to the Federal Reserve's interest rate policy, will decline. They believe that within 12 months from now, the yield will decline by at least 50 basis points from the current level.

"While investors may be short-sighted in focusing on the pace and magnitude of rate cuts next year, investors should step back and recognize that the Federal Reserve will still be in easing mode in 2025," the team led by David Kelly of JPMorgan Asset Management said in the company's annual outlook.

U.S. bond watchers expect short-term bond yields to decline by 2025

However, the Federal Reserve indicated at this month's meeting that it will reduce the number of rate cuts next year, which could make the yield trajectory more complex.

Currently, the median forecast of Federal Reserve officials shows that the magnitude of rate cuts in 2025 will only be 50 basis points, roughly in line with Wall Street's forecast for the trajectory of 2-year Treasury yields, but also poses the risk that the Federal Reserve will pause its easing cycle. After Federal Reserve Chairman Powell fully attributed the responsibility for potentially pausing further rate cuts to inflation, the yield curve steepened sharply on Thursday, reaching its highest level since June 2022, as investors reconsidered the benefits of holding longer-dated bonds.

"As the prospect of an easing cycle fades, the front end of the curve will also flatten. Any steepening will be driven by the long end of the curve," said Tracey Manzi, senior investment strategist at Raymond James.

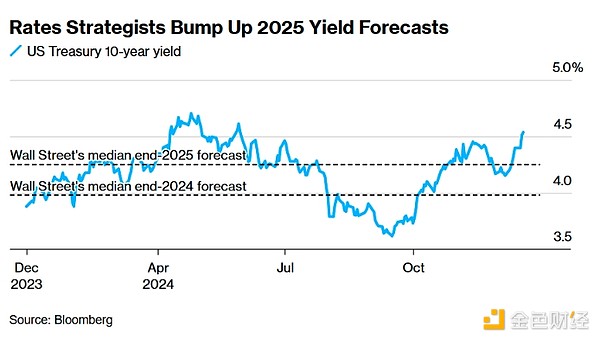

The median of 12 strategists' forecasts is that the 2-year Treasury yield will decline by about 50 basis points to 3.75% in a year. For the longer 10-year Treasuries, the strategists believe that the yield of around 4.52% last Friday will reach 4.25% by the end of 2025, about 25 basis points lower than the current level.

"No matter how you analyze it, whether it's real growth, inflation expectations or term premium, long-end bonds will be under pressure," said Noel Dixon, macro strategist at State Street. He has long forecast that the 10-year Treasury yield could rise above 5% by 2025.

The factors they consider include not only different views on how fiscal policy may evolve, but also the Federal Reserve's management of the Treasuries it holds. The Federal Reserve's end of balance sheet reduction (quantitative tightening) may reduce bond supply and stimulate demand.

In a report, the team led by Anshul Pradhan of Barclays wrote: "Even if the Federal Reserve may continue to lower the policy rate, thereby lowering front-end yields, many factors still exist that suggest long-term yields will continue to rise: high neutral rates, increased rate volatility, inflation risk premium, and large net issuance in the face of price-sensitive demand."

Bloomberg Intelligence strategists Ira F. Jersey and Will Hoffman believe that "a steady-state economy in early 2025 may lead the Federal Reserve to raise rates slowly and potentially cap rates at 4%. It would take a major economic shift for the 10-year Treasury yield not to hover between 3.8% and 4.7%."

In addition, Trump's tariff and tax policies will unfold in the coming weeks, which could disrupt Wall Street's outlook.

"Higher tariffs and tighter immigration controls suggest economic growth will slow, but inflation will rise," Pradhan said.

Currently, Morgan Stanley and Deutsche Bank hold the most bullish and bearish views on the bond market, respectively. Morgan Stanley believes that "there are downside risks to economic growth" and investors will face an "unexpected bull market." The company expects the Federal Reserve's pace of rate cuts to be faster than other banks, and therefore expects the 10-year Treasury yield to fall to 3.55% by December next year.

Deutsche Bank, on the other hand, predicts that the Federal Reserve will not cut rates in 2025. The team led by Matthew Raskin expects the 10-year Treasury yield to rise to 4.65% due to strong economic growth, low unemployment, and high inflation.

They wrote in a note: "We expect the main catalyst for our view is that people will realize that inflation and labor market conditions require the Federal Reserve to take a more hawkish path than is currently priced in."