BTC once reached nearly $89,000 last (13th) night, a maximum correction of over 17.4% from the historical high of $108,100 set on December 17. Regarding this correction, the cryptocurrency exchange Bitfinex released the latest Alpha Report in the early morning of today (14th), pointing out that the reason is the surge in US Treasury yields and the continued outflow of BTC spot ETFs, which have led to an increasingly cautious market sentiment.

BTC May Continue to Consolidate in the Coming Months

The report points out that the downside space for BTC in the short term may be limited, but judging from the current market reaction, the market may enter a more widespread volatility pattern in the next few weeks to months, and experience consolidation amid the changing overall economic environment.

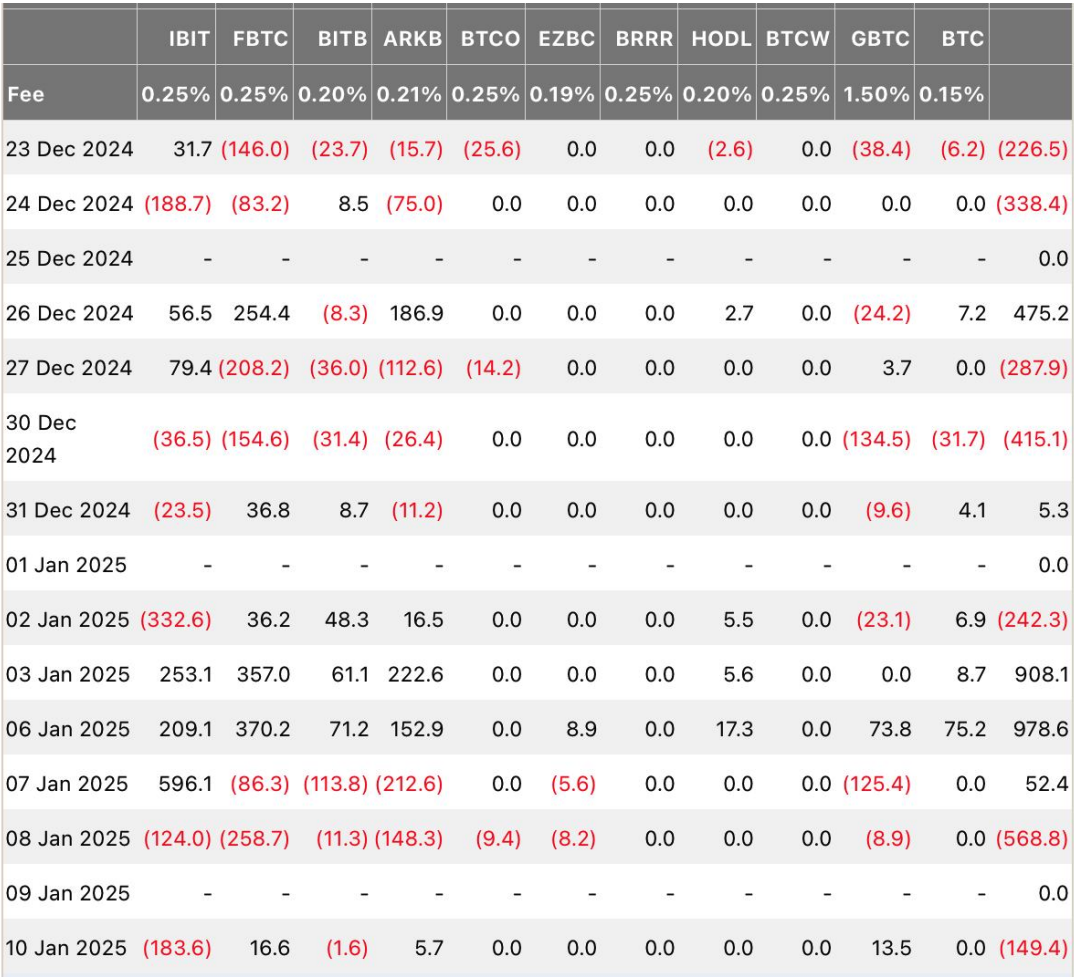

Pressure from ETF Capital Outflows

The outflow of capital from BTC spot ETFs is a major source of selling pressure. The report mentioned that in the past 12 trading days, there were 7 days of net outflows, and the outflow scale on January 8 and 10 alone reached $718 million, in sharp contrast to the net inflow of nearly $2 billion in early January.

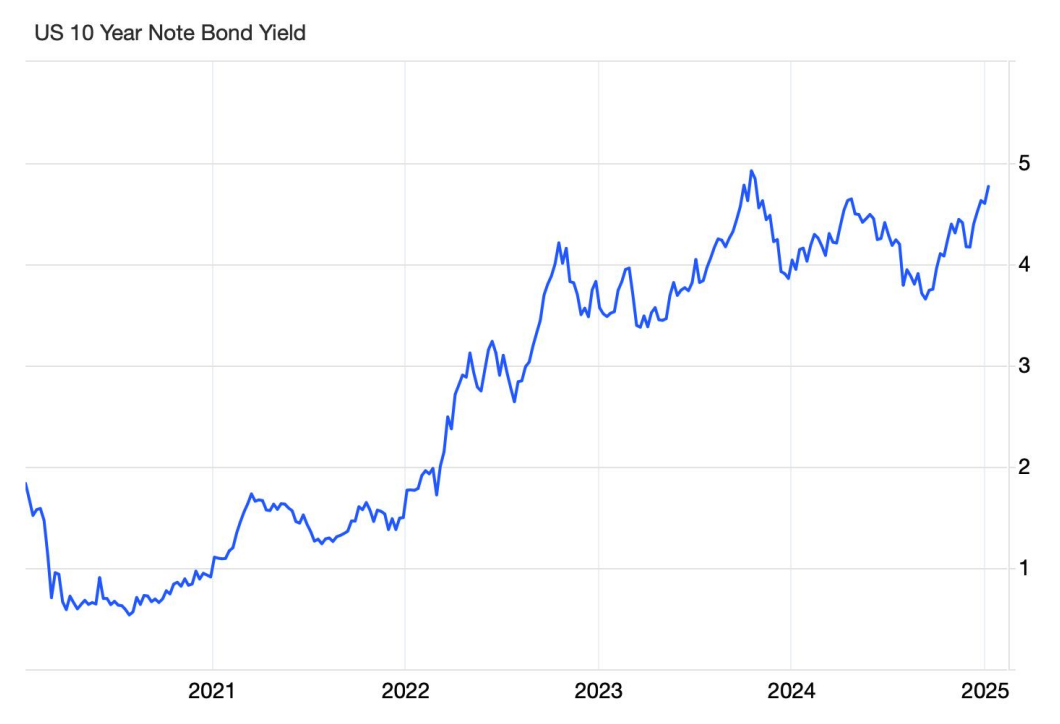

Surging Yields Withdrawing Capital

Another source of pressure is the rapid rise in US Treasury yields, especially the 10-year Treasury yield, which has recently risen to 4.79%, a new high in 14 months. The report analysis points out:

"The last time the 10-year yield broke above 4.6% was in April 2024, when the BTC price peaked at $73,000 and was unable to reach that level again in the following seven months. The current surge in yields will draw institutional capital away from riskier assets like BTC, and also suppress capital inflows into ETFs."

US DOJ Approval to Sell BTC Exacerbates Pressure

Bitfinex added that historically, BTC has reacted quickly to surging yields, and this time the US Department of Justice's approval to sell $6.5 billion in seized BTC, as well as the much stronger-than-expected job market data, have further exacerbated the negative impact on the market.

"The news of the DOJ's approval to sell BTC caused the BTC price to drop 7.2%, exacerbating market concerns about potential volatility. This event challenges the pro-crypto sentiment that previously supported BTC's rise to an all-time high, and reintroduces regulatory uncertainty, highlighting the delicate interplay between policy decisions and market sentiment."

Optimistic Factors

Looking ahead, Bitfinex is not entirely pessimistic. The institution points out that despite the pressure from the overall economic environment, BTC has still shown relatively strong performance, rising 42% since the US election, far outperforming the stock market, which has erased its post-election gains.

Although BTC may face greater price volatility in the short term as the Fed hints at fewer rate cuts and market liquidity tightens. However, Bitfinex believes that under the leadership of the new President Trump, the market's optimistic sentiment towards crypto regulation may still limit further BTC declines, allowing BTC to maintain a strong position in the long run.

In addition, Bitfinex said that the seasonal "new year, new money" effect at the beginning of each year usually brings momentum for a market rebound. This phenomenon has appeared many times in both traditional and crypto markets, and may be a highlight of the early-year market performance.

Further Reading: Analysts: BTC's "January Sell-Off" After Halving is a Normal Phenomenon, BTC Must Rise During Chinese New Year?