Author: Stacy Muur

Compiled by: TechFlow

We are in the midst of a token issuance and TGE (Token Generation Event) frenzy, but not all issuances are worth participating in. So how do you determine if a project is worth paying attention to? I'll use @KintoXYZ as an example and share my analysis framework.

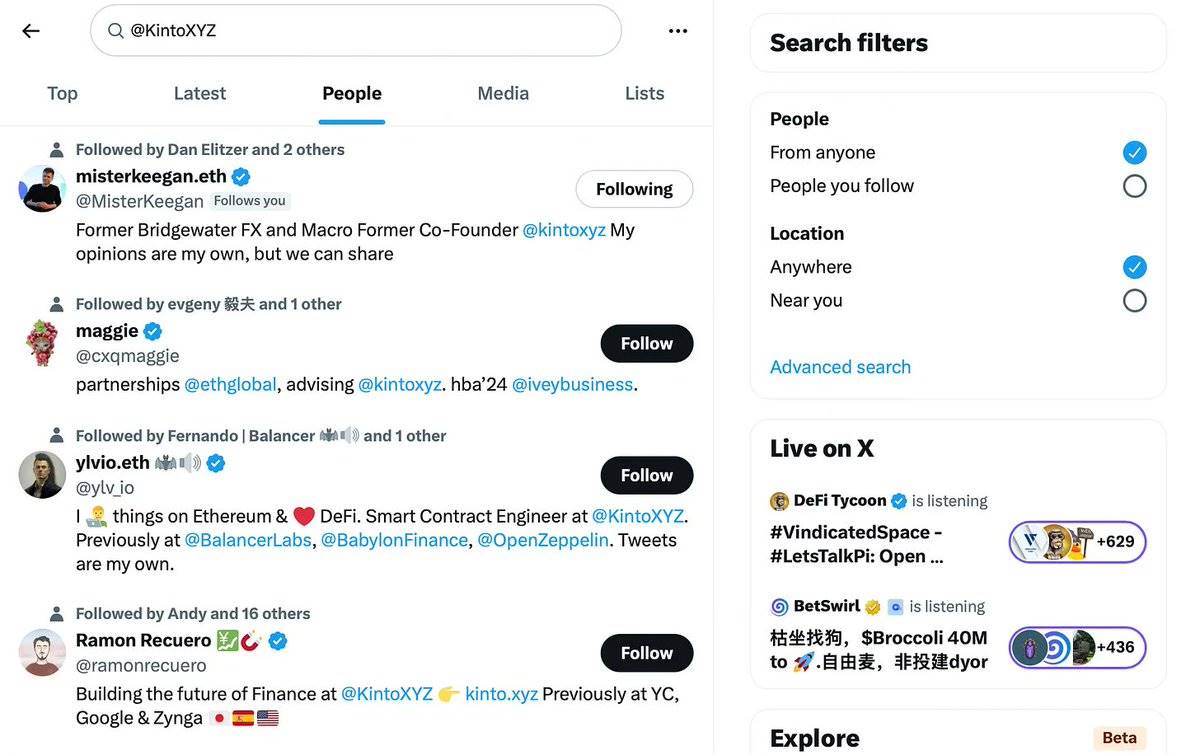

Looking back, token issuances in 2016 provided massive investment opportunities. By 2017, the ICO craze had reached its market peak, similar to the AI hype last December.

Nowadays, token issuance is more like a high-stakes gamble. While it can occasionally bring 10x returns, this is just an exception. According to Cryptorank data, only 30% of token issuances in January this year achieved positive returns. Within this 30%, there are indeed some hidden value projects.

So how do you determine if a token issuance is worth your attention? In this article, I'll use Kinto as an example to explain my analysis method.

Step 1: Analyze the Product

In simple terms, when analyzing a token issuance, you need to break down the protocol into multiple components and evaluate them from the perspectives of maturity, demand, and innovation.

For product analysis, I mainly focus on the following aspects:

Concept (Narrative)

Product Status

Data Metrics and Market Performance

Competitive Advantages

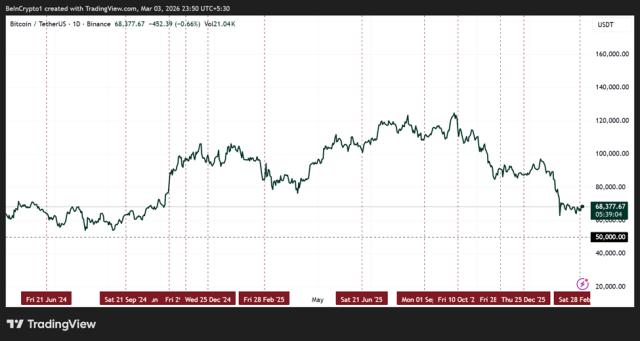

When analyzing the concept, you can refer to the Gartner Hype Cycle:

(Original image from Stacy Muur, compiled by TechFlow)

If the protocol is in the following stages:

Near the Innovation Trigger: 5 points (e.g., this week's BNB meme)

Near the Peak of Inflated Expectations: 0 points (e.g., new AI agents or new chain-based AI agent launch platforms)

Near the Trough of Disillusionment: 1 point (e.g., many current DePIN/GameFi protocols)

Slope of Enlightenment: 3 points (e.g., many RWA protocols are now at this stage)

Plateau of Productivity: 1 point (e.g., most DeFi protocols are currently at this stage)

Why do protocols in the Trough of Disillusionment and Plateau of Productivity only get 1 point? Because when a concept enters the Trough of Disillusionment, it is either forgotten or revived in a new form (e.g., ERC404). And in the Plateau of Productivity stage, the concept tends to be neutral, contributing little to the protocol's propagation.

Similarly, we score the following parameters (0-5 points):

Is the protocol already a leader in its category by TVL? 5 points.

Is it still in the testnet stage? 2 points.

Are there many competitors, with some clear and well-known leaders? 1 point.

You can ask more questions as needed, but make sure to record all questions and answers to calculate the average score later.

Case Analysis of Kinto

As mentioned earlier, I will use Kinto as an example to illustrate the process of analyzing a token issuance.

Here's a quick overview of the product to help you understand its core features.

Kinto is an institutional-grade modular exchange, positioned as an intermediary layer between traditional bank accounts and Web3 wallets, focused on providing users with secure on-chain financial services.

Kinto is an institutional-grade modular exchange, situated between traditional bank accounts and Web3 wallets, dedicated to delivering secure on-chain financial access.

In simple terms, Kinto connects the traditional finance and blockchain worlds, with features including:

Implementing KYC, AML, and fraud monitoring at the blockchain layer;

KYC that is more private and secure than centralized exchanges (CEXs), as user data is not stored, and users can freely choose their KYC provider;

Transactions can only be executed by verified participants, achieving Sybil protection;

Each user is equipped with a smart contract wallet driven by Account Abstraction, which users barely perceive;

Kinto is the first protocol to introduce chainless swaps, chainless lending, and chainless perpetual contracts, achieved through @HyperliquidX;

As a 100% KYC Ethereum Layer 2 protocol with built-in insurance, Kinto significantly reduces regulatory and financial risks.

It's important to note that although Kinto has implemented KYC, it is still a decentralized, user-owned, and non-custodial protocol.

In simple terms, Kinto is a product that combines on-chain wallet and exchange functionalities, with built-in KYC, AML, and traditional financial asset support.

You might think that Kinto is a competitor to Hyperliquid, but that's not the case. Instead, Kinto provides users with a direct access point to Hyperliquid, while also supporting cross-chain borrowing on Aave and allowing users to swap assets on any AMM across Ethereum, Arbitrum, Base, and other chains. Its positioning is as an abstraction layer for DeFi.

From the end-user's perspective, Kinto's functionality is similar to a wallet with centralized exchange (CEX) features, such as supporting fiat on-ramps. At the same time, it operates entirely on-chain, is decentralized and permissionless, and is Gas-free -- all of which are already live.

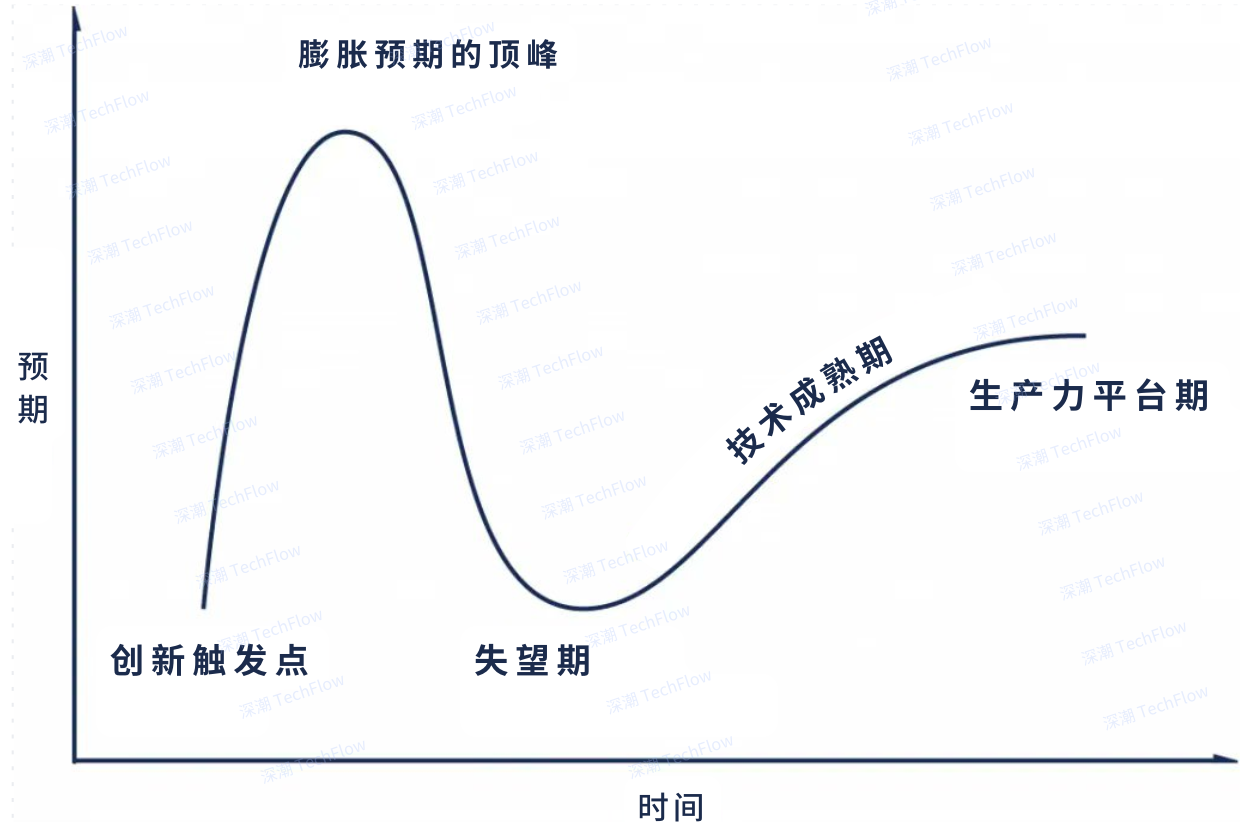

(Original image from Stacy Muur, compiled by TechFlow)

Now, let's use the analysis framework to answer a few key questions:

What is Kinto's positioning?

Kinto is positioned at the intersection of infrastructure and trading, with core concepts including "institutional-focused," "financial ecosystem," "chainless," and "aggregator." This positioning does have a certain degree of novelty; apart from Kinto, I haven't personally seen other products attempting to build a DeFi chain with KYC. However, how will the demand for this solution compare to centralized competitors? And can it outcompete Particle's Universal Accounts (which are also rapidly developing) in the chainless domain? These questions will require time to validate. Therefore, I will give Kinto 3 points, and this score may increase as activity volume grows.

What is Kinto's development stage?

Kinto has been live on the mainnet since March 2024. According to L2Beat data, its TVS (Total Value Staked) is $47 million. However, its recent 30-day transaction count is not very high, at only 34K, with a total of 147K wallets. In this aspect, I will give Kinto 4 points.

How is Kinto's trading performance?

In addition to traditional Web3 assets, Kinto also provides a wide range of popular traditional finance assets. This feature sets it apart from both centralized exchanges (CEXs) and decentralized exchanges (DEXs), with supported assets including Nvidia, Meta, Uber, and S&P 500, among others. This diversity can attract a specific type of user, so in this category, I gave Kinto a high score of 5 points.

The more specific the questions, the more accurate the final product score will be. It's important to ensure that the weight of each question is similar, or the final score may lose its precision.

In the case of Kinto, my final product score is 3.6.

Step 2: Evaluate Professional Capabilities

When evaluating professional capabilities, I will consider all factors that may impact the product's success from the perspectives of human resources, technical strength, and business development (BD). The key areas that need attention include:

Team: Evaluate the past experience, transparency, social media activity, and developer involvement of the team members.

Venture Capital (VC): Venture capital is not only an important way to raise funds, but also a key to establishing connections with other projects and industry opinion leaders.

Funding Amount: Sufficient funding is crucial for team recruitment and product development.

Partners: A wide network of partners can significantly improve user onboarding efficiency.

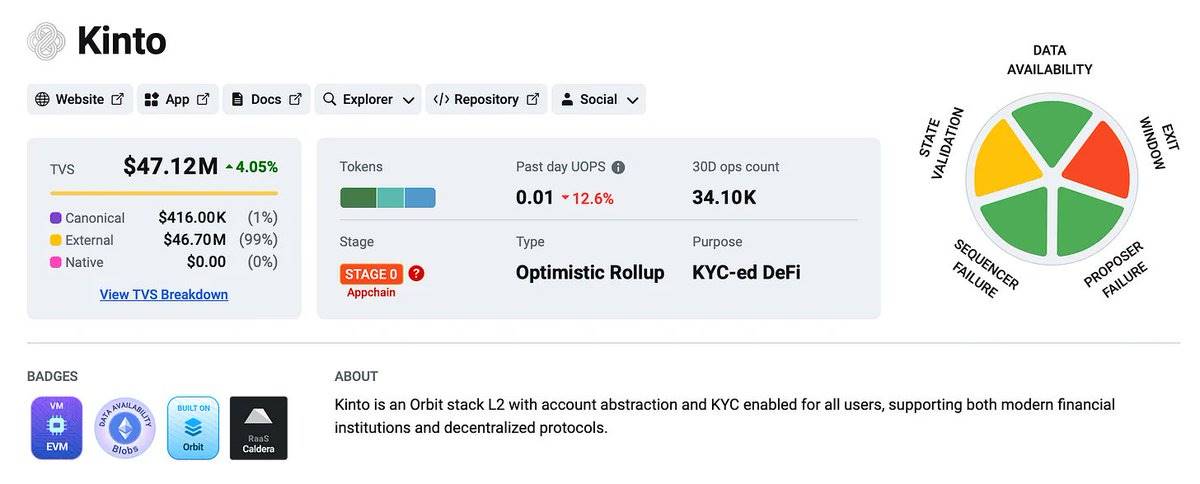

Using Kinto as an example, I would like to explain a few important evaluation points. Many people have difficulty finding team information, but the method is quite simple. You can just search for the brand name on X (Twitter) and LinkedIn to browse the personal profiles of the team members and evaluate their professional capabilities.

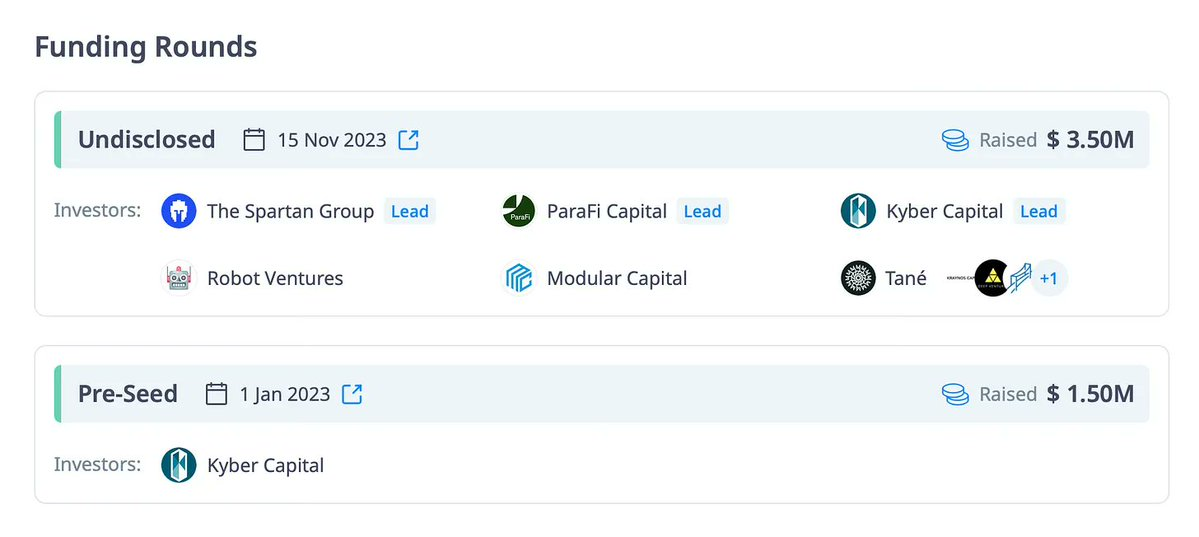

When evaluating the financing rounds, there are a few key points worth noting:

Whether the lead VC continues to participate in subsequent financing rounds (e.g., Kyber Capital) is a positive signal of investor confidence.

On the Cryptorank platform, venture capital firms are graded based on their activities, and you can also check the performance of their other portfolio projects for reference.

The more projects you analyze in this way, the higher your research efficiency will be, allowing you to quickly identify potential risks and opportunities.

Among Kinto's partners, there are some notable protocols worth paying attention to, such as Caldera, Socket, and Arbitrum.

My ratings for Kinto are as follows:

Team: 5 points

Venture Capital: 4 points

Funding: 4 points

Partners: 4 points

Average score: 4.25

Step 3: Token Economics (Tokenomics)

Token economics is one of the most challenging aspects of analyzing a project, especially after the disappointing launches of many low-liquidity and high fully diluted valuation (FDV) projects.

In this section, we need to focus on the following aspects:

Whether the TGE (Token Generation Event) FDV is reasonable (the previous analysis of the product and team is very important in assessing the reasonableness of the FDV).

The circulating token supply.

The token distribution model.

The design of the lock-up period and release schedule.

Supply and demand utility.

Short-term and medium-term inflation.

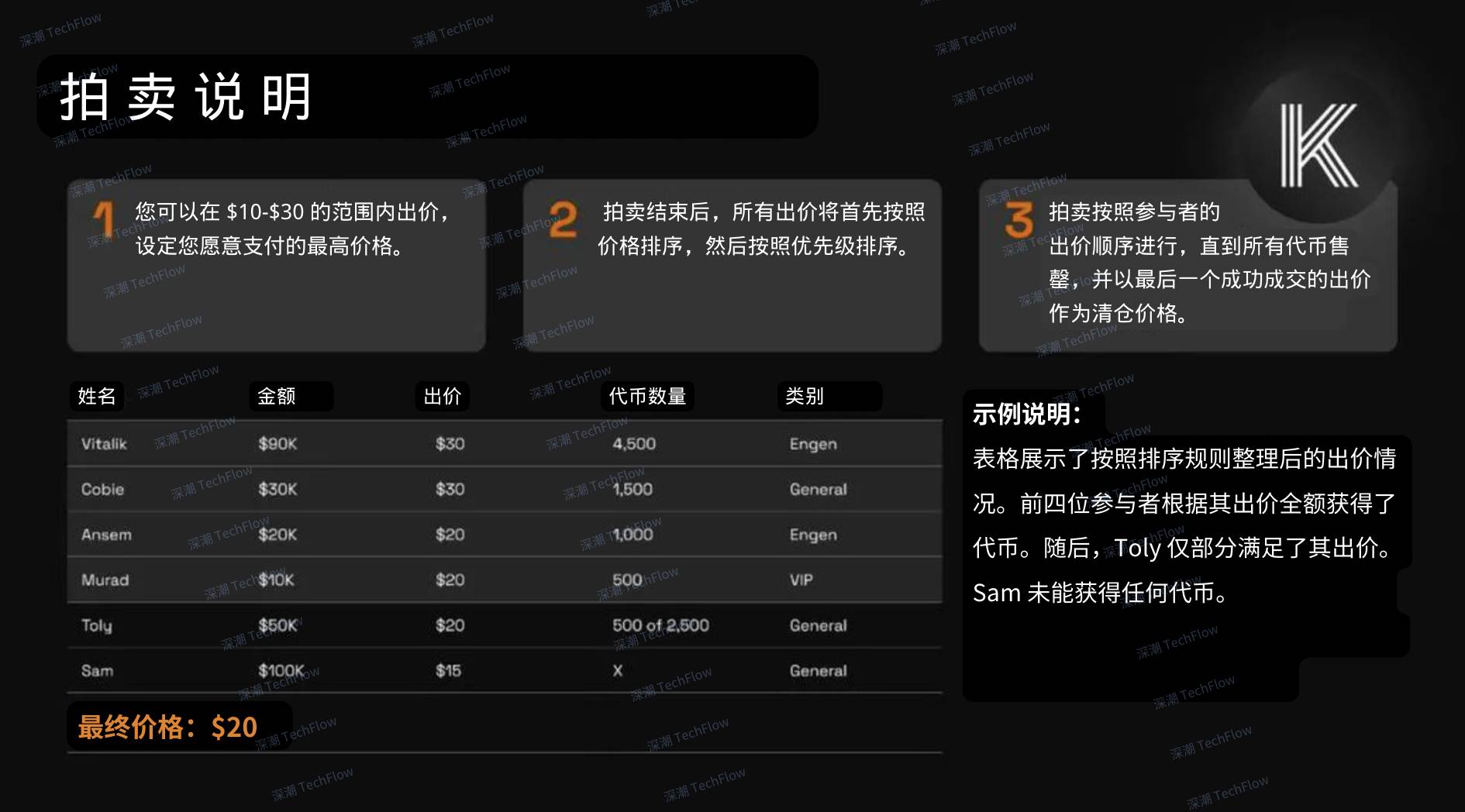

The design of the token issuance.

Our core task is to answer the following three key questions:

Does the project launch with an FDV that can support short-term growth?

Are there any factors that may cause selling pressure after the token is launched (e.g., airdrops, public or whitelist pre-sales, advisor or ambassador tokens, etc.)?

Considering the actual use of the token, does it make sense to hold the token in the medium term?

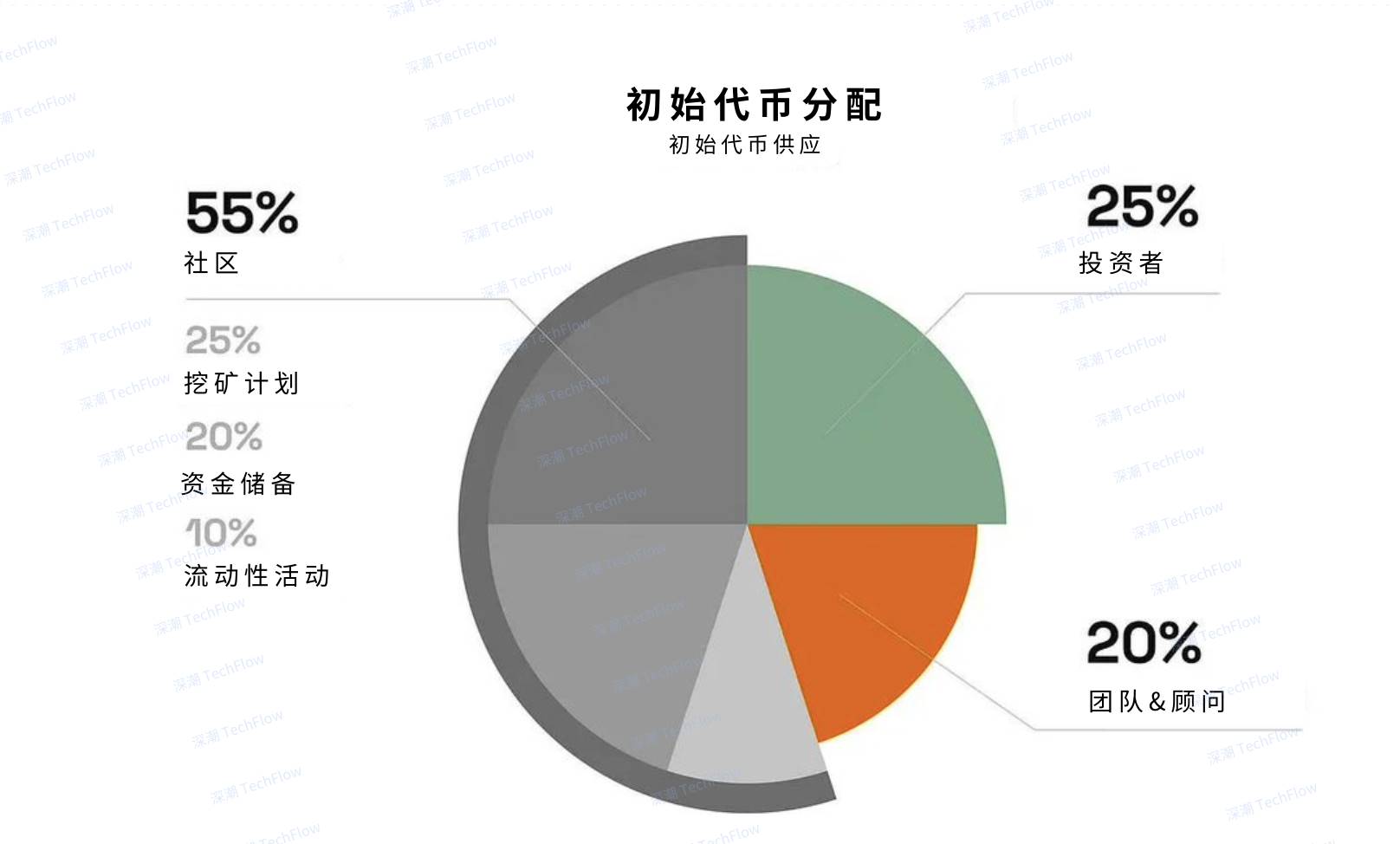

The following is the analysis of Kinto's token economics, which I have divided into two parts.

(Original image from Stacy Muur, compiled by TechFlow)

Positive Factors:

The design of the auction mechanism allows users to set their preferred purchase price, which helps with a fairer FDV discovery.

70% of the total token supply will be allocated to the community, indicating the project's emphasis on decentralization.

The team's token release schedule is set for 3 to 4 years, reducing short-term selling pressure.

There is no lock-up period for token issuance participants, which increases the token's liquidity.

The transparency of the venture capital rounds is relatively high: the token price in Kinto's latest financing round was $10 (corresponding to a $100M FDV).

According to market expectations, the auction price may be between $20 and $30, which would make Kinto's FDV reach $300M, relatively reasonable.

The $K token is not just a governance token, but also has functions such as paying for account recovery fees and expanding wallet insurance. Furthermore, all protocol revenue will go to the treasury, and token holders can manage these funds through on-chain governance.

Concerns:

The auction price mechanism may limit the upside potential of the token price after TGE.

Airdrops may increase selling pressure.

The token will not be immediately transferable; to achieve transferability by March 31, at least two of the following three conditions must be met:

At least 20% of the tokens are in circulation: To avoid the project launching with low liquidity and high FDV, at least 20% of the tokens need to be fully unlocked and distributed to participants.

Governance enters the second stage: The first Nios election has been held, and the Roll-up has reached Stage 1 (which is about to be completed, expected to be achieved before March 31).

TVL reaches $100 million: The network's total locked value (TVL) must exceed $100 million and be sustained for more than four weeks.

(Original image from Stacy Muur, compiled by TechFlow)

My rating for Kinto's token economics: 3.25 points.

Step 4: Community

When researching a token launch, the last aspect that needs to be analyzed is the activity, loyalty, and scale of the protocol's community. A loyal and active community, combined with a successful product, can lead to extraordinary results, as seen with Hyperliquid. Therefore, this aspect is worth our close attention.

We need to consider the following aspects:

The number of high-quality users: the number of community members who have real influence and contribution capabilities.

Community activities: the interaction, discussion, and participation of community members.

Product activities: by analyzing the actual usage of the product by users, evaluate the user retention rate and token demand after TGE.

Demand related to the token launch platform: some token launch platforms (such as Coinlist) have very active investor communities, which may directly affect token demand.

How to track this information?

Analyze the authenticity of the participation data: for example, if a tweet has a high number of retweets but almost the same number of likes, it may be fake data or caused by activities like Galxe tasks. Typically, the ratio of retweets to likes will not exceed 1:5.

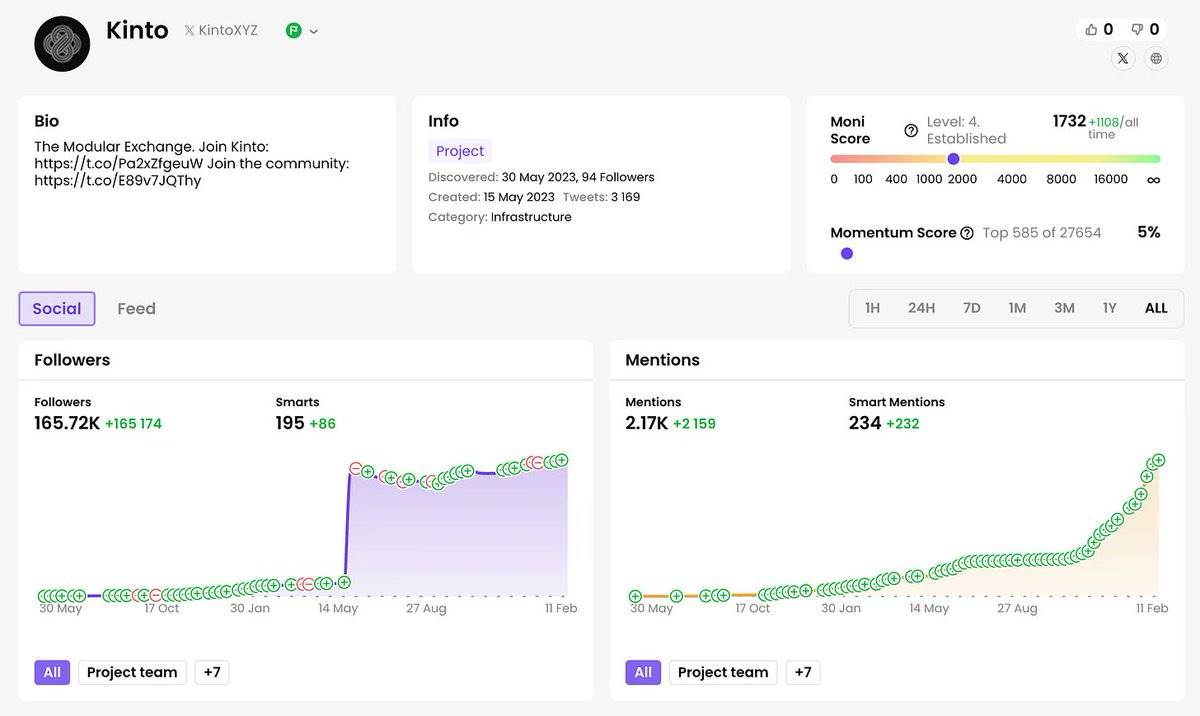

Use analysis tools: you can use tools like Moni Discover, TweetScout, or Kaito to track the community's attention and the number of high-quality users. These tools can help you understand the actual activity and potential of the community more efficiently.

On the Moni platform, Kinto's number of followers has shown significant growth. This phenomenon is usually related to one of the following two situations:

Fake followers (bots)

Activities or giveaway promotions similar to Galxe or Zealy

Therefore, we can infer that the number of Kinto's real and active followers on the X platform is around 35,000. This number is reasonable compared to other indicators.

The "Smart Mentions" chart shows a good performance. Therefore, I give Kinto's community a final score of 3.75 points.

What's next?

The analysis work done so far is crucial for evaluating the reasonableness of the project's FDV launch, analyzing growth potential, and deciding whether the project is worth paying attention to.

Next, you need to calculate the final score of the analyzed protocol and make a decision based on the score results. Here are the scoring criteria I usually use:

Below 2.5 points: Skip directly, not recommended to participate.

2.5 - 3 points: Only consider participating if the project has significant advantages (such as an innovative trigger point or high Kaito platform attention and an active community).

3 - 3.5 points: If you decide to participate, it is only recommended to invest a small amount of funds, as the risk is relatively high.

3.5 - 4 points: This type of project may be a third-line protocol; if it has multiple favorable factors, it may be a good opportunity, but it is not recommended to invest too much capital.

4 - 4.5 points: It belongs to a high-quality product and is worth participating in the token issuance.

4.5 - 5 points: This is a rare high-quality project and is very worth paying attention to.

My average score for Kinto is 3.71 points.