Author: Sam Bourgi, CoinTelegraph; Translator: Bai Shui, Jinse Finance

On February 21, the cryptocurrency exchange Bybit was hacked for over $140 million, making it the largest single crypto hack in the industry's 15-year history. According to Cyvers data, this attack accounts for over 60% of all crypto funds stolen in 2024 by value.

Hacks and scams have become commonplace in the cryptocurrency space, posing a legitimacy crisis for an industry that many believe is unfairly maligned for "enabling crime." However, as Chainalysis data shows, the growth rate of legitimate use cases for cryptocurrencies far outpaces illicit activity.

Nevertheless, the hacking economy continues to thrive, especially as cryptocurrency prices rise. According to Crystal Intelligence, the cumulative value of crypto hacks is expected to reach $1.9 billion by mid-2024.

Here is a list of some of the largest cryptocurrency hacks in history - and how they compare to the latest Bybit vulnerability.

Ethereum prices dropped sharply following the Bybit hack news. Source: Cointelegraph

Ronin Network

Prior to Bybit, the Ronin Network was the victim of the largest cryptocurrency hack in history. In March 2022, the Ethereum sidechain built for the Axie Infinity play-to-earn game was exploited, with over $600 million in Ethereum and USDC stolen. Ronin was only able to recover a small portion of the stolen funds.

The attack was attributed to the Lazarus Group, an organization allegedly linked to the North Korean government. This shadowy group is believed to have stolen $1.34 billion worth of cryptocurrencies in 2024 alone.

Since 2020, the group is believed to have laundered hundreds of millions of dollars' worth of digital assets.

Poly Network

In 2021, hackers exploited the cross-chain protocol Poly Network to steal over $600 million in funds, which cybersecurity firm SlowMist described as a "premeditated, organized" attack.

The attack siphoned $273 million from Ethereum, $253 million from the BNB Smart Chain, and $85 million from the Polygon network. At the time, it was considered the largest decentralized finance vulnerability in history.

Poly Network later reported that the attacker eventually returned nearly all of the stolen funds, except for $33 million.

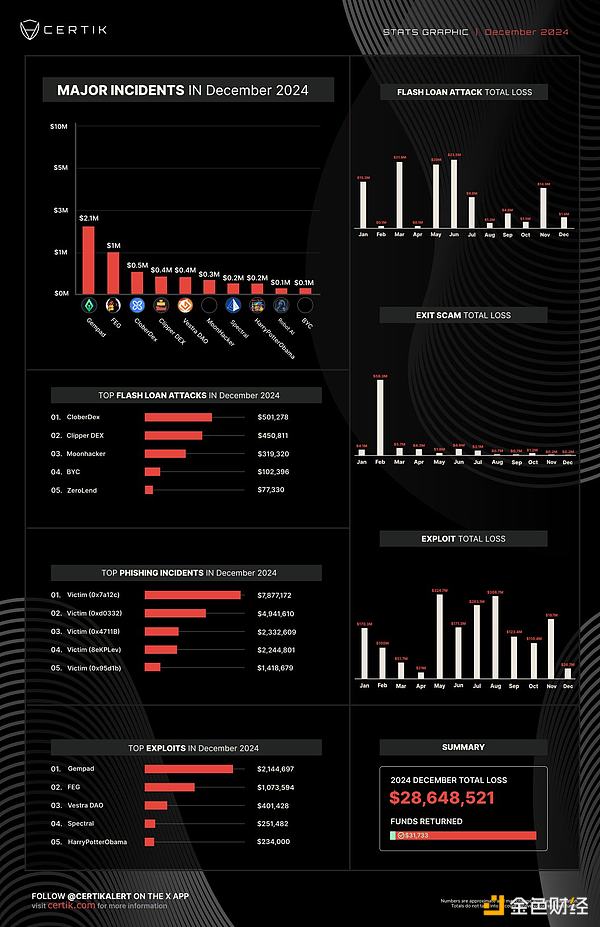

Losses from cryptocurrency fraud have been on a downward trend, hitting their lowest level since 2024 in December, before the latest Bybit hack. Source: CertiK

BNB Chain Bridge

In October 2022, the BNB Chain was hacked for around $568 million. As Cointelegraph reported at the time, the attacker exploited a vulnerability in the cross-chain bridge BSC Token Hub to mint 2 million BNB, immediately bridging $100 million worth of the stolen tokens to other networks.

CZ, the former CEO of Binance, confirmed that the vulnerability "led to the extra BNB." He subsequently announced the suspension of the BNB Smart Chain.

Coincheck

One of the earliest cryptocurrency attacks occurred in early 2018, when the Japanese exchange Coincheck was robbed of $534 million worth of NEM tokens. XEM is the token of the New Economy Movement (NEM), launched in 2015.

The hackers stole the funds by exploiting a hot wallet and conducting unauthorized transactions. All the stolen funds belonged to exchange users. There were later reports that the attack may have been linked to a hacker group that had installed malware on Coincheck employee computers.

The exchange promised to compensate all 260,000 victims of the attack.

FTX

Just as FTX collapsed in November 2022, a series of unauthorized transactions led to the cryptocurrency exchange losing $477 million.

By January 2024, U.S. federal prosecutors had identified and charged three individuals allegedly responsible for the attack.