Author: Ken Alabi, CoinTelegraph; Translator: Tao Zhu, Jinse Finance

Every four years, just a few months after the Bitcoin halving, the blockchain ecosystem comes under close public scrutiny. This period typically lasts over a year, driven by the fundamental economic principle: when the supply of an asset decreases while demand remains stable or increases, its value usually rises. Historically, this supply shock has triggered a market appreciation led by Bitcoin, sparking increased interest and participation from users, developers, investors, and policymakers.

During these post-halving periods, the blockchain industry showcases its projects, technological innovations, and potential utilities. None of the previous cycles have produced a blockchain application that clearly outperforms existing technologies in any specific domain. However, the core advantages of blockchain - immutability, data transparency, and user asset sovereignty enabled by private key cryptography - continue to attract innovators. These features have been creatively applied to numerous areas, including borderless payment systems, DeFi, Non-Fungible Tokens, gaming systems with in-game asset records, fan and loyalty tokens, transparent grant and charitable spending systems, agricultural subsidies, and loan tracking.

While past cycles have highlighted the potential of blockchain, the next period is expected to trial new use cases, as described below.

Lessons from Past Halving Cycles

The period after the 2012 halving highlighted the potential of disintermediated, borderless payment systems. Prior to Bitcoin, intermediated payments and slow cross-border transactions were the norm - international transfers took days, and check clearance was equally slow. Bitcoin hinted at a future of seamless payments, with early adopters tracking the number of businesses accepting Bitcoin. However, scalability issues and rising transaction costs limited this utility. Ironically, many blockchain networks prevented their success through fee structures that impeded growth. This cycle ended with security breaches, particularly the Mt. Gox hack 20 months after the halving.

The 2016 cycle sparked an explosive growth in Initial Coin Offerings (ICOs), democratizing access to venture capital. Ordinary individuals could now invest in early-stage projects - an opportunity previously reserved for large financial institutions. However, the market was flooded with tokens backed only by whitepapers. Lack of investor protection and accountability led many ICOs to collapse quickly. Most projects from that era are now obsolete, with even the largest ICOs no longer among the top 100 blockchain projects.

In 2020, three major trends dominated: DeFi protocols, Non-Fungible Tokens, and Play-to-Earn (P2E) games. DeFi projects promised unsustainable yields - sometimes over 100% - by minting more tokens to provide returns without any underlying economic activity. Similarly, NFT valuations were high, with some being just pixel art with no store of value. As the anticipated mass virtual adoption failed to materialize, the hype around the metaverse also gradually subsided. P2E games relied on inflationary token economics, and when growth stagnated, they collapsed, exposing the fragility of these models.

The 2024 post-halving cycle begins with the approval of a US Bitcoin ETF, formally integrating cryptocurrencies into the traditional financial markets. This move, along with the blockchain community increasingly influencing the democratic process, marks a significant shift.

This is the first time crypto assets are inside the financial system rather than outside it, which could lead to balanced regulation rather than outright hostility towards the technology. People are seeing its practical utility and discussing it from first principles. The US being poised to take a leading role in blockchain technology adoption is a positive sign, given the country's role in previous technological innovations and advancements. The next question is: how far will this integration go? Will we see more countries adding crypto assets to their national reserves, not just the one or two that already have? In addition to regulatory progress, this cycle also has several blockchain applications ready for scrutiny.

The tokenization of real-world assets and the decentralization of their financing have gained attention. RWA allows asset owners to directly benefit from blockchain-based financing. Key areas include real estate and housing finance, equities, bonds, Treasuries, agricultural finance, DePIN, and DePUT.

Blockchain-AI Synergies

The combination of AI and blockchain is emerging as a powerful force. Decentralized management of AI models and secure data processing provide new solutions, especially in privacy. AI can go beyond solutions like ZK-SNARK by managing encrypted data, disclosing data or data proofs only to their owners (based on their owners' instructions) or to authorized law enforcement (depending on the blockchain's constitution).

Micropayments

Traditional financial systems cannot support micropayments due to high operational costs. With low-cost transaction models, blockchain is naturally suited for micro-payments, especially in content consumption. This could eliminate outdated bundling practices in media and drive a new era of seamless payments.

Memecoins and Celebrity Tokens

Memecoins have surged, with nearly 10 of the top 100 tokens by market cap, but with almost no real utility. Low-cost blockchains and user-friendly token creation tools have fueled this trend. Tokens launched by or around famous public figures are also gaining popularity, but most similarly lack practicality.

Stablecoins

Stablecoins continue to bridge traditional finance and blockchain. As faster, cheaper blockchains lead this cycle, stablecoins are being widely used for payments, challenging traditional systems like slow check settlements and expensive cross-border transfers. Regulatory clarity may drive mainstream adoption of stablecoins.

What Early Data Reveals

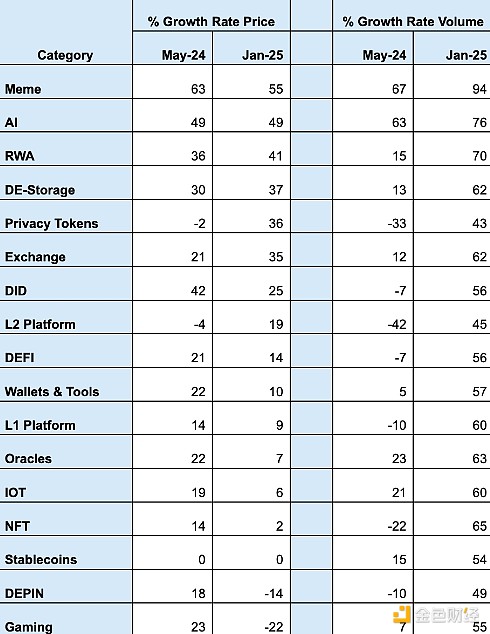

Toronet Research tracked the performance of various token categories from January to May 2024, predicting trends for December. The findings:

Data sorted by price growth rate as of January 2025. Source: Toronet Research, January 2025.

The data shows that memecoins, AI-related tokens, and RWA tokens are early growth leaders. Other observations include that all categories saw trading volume growth, which is common during periods when blockchain project interest and participation seem to increase every four years. DePIN projects may not have experienced much growth at the start of the cycle, although one or more innovative projects could make some breakthroughs. Layer 2 projects grew faster than Layer 1 projects, or absorbed much of the growth that the latter would have experienced. The January 2025 results are presented in the chart below.

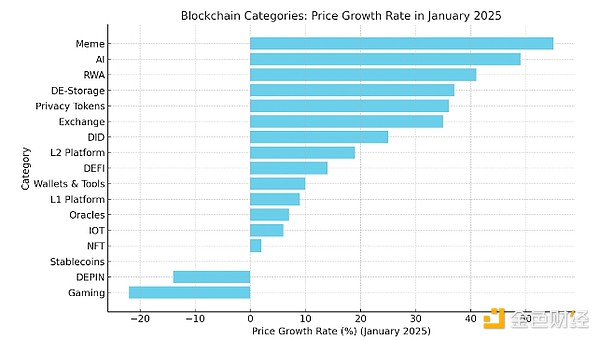

Bar chart showing price growth trends as of January 2025. Source: Toronet Research.

CoinGecko's Q3 2024 Crypto Industry Report also reviewed the popular categories by network traffic, with similar findings to the top three categories in the Toronet Research report. Another observation from the Toronet Research report is that, as we've seen in past cycles, the impractical applications that fueled frenzy in the previous cycle, such as ICOs in 2017 and Non-Fungible Tokens in 2021, tend to be discredited in the next cycle. Developers and industry leaders should strive to guide new adopters towards sustainable, utility-driven projects to reduce market volatility and minimize investor disillusionment. This will lower the intensity of the four-year boom-and-bust cycle, as well as the degree and number of disillusioned individuals who have already lined up to chase memecoins and ultimately turn worthless airdrops into futile efforts.

Will we break this cycle?

The current cycle has provided the blockchain industry with the most important opportunity to date to generate lasting impact. With increasing institutional integration, more thoughtful regulatory commitments, and a shift towards real-world utility, the industry is poised for meaningful growth. The increasing acceptance and integration of blockchain solutions within the broader economy, as well as the potential of forthcoming thoughtful regulatory frameworks, may lead to better outcomes in this cycle than in the past.