Author: Kevin, the Researcher at Movemaker

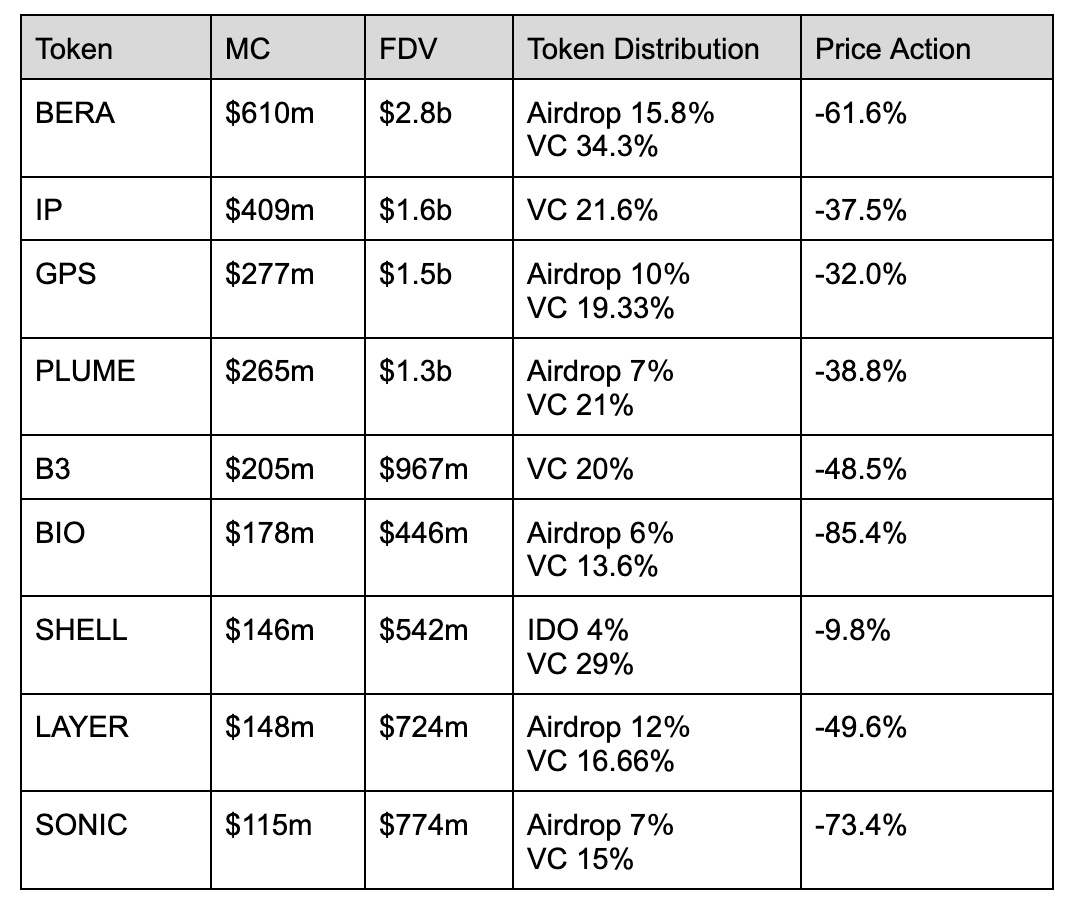

The VC share in the above projects is generally between 10% and 30%, with little change compared to the previous cycle. Most projects choose to distribute tokens to the community through Airdrops, which they see as a reasonable community distribution method. However, in reality, users do not hold the tokens received from Airdrops for a long time, but tend to sell them immediately. This is because users believe that the project party often hides a large number of tokens in the Airdrops, so there is a huge selling pressure in the market after the TGE. The concentration of token holdings is not conducive to the effectiveness of Airdrops. This phenomenon has existed for the past few years, and the token distribution method has not changed much. The performance of token prices shows that VC-driven token prices perform very poorly, often entering a unilateral downward trend after token issuance.

Among them, $SHELL is slightly different. It allocated 4% of the tokens through an IDO, and the IDO market capitalization of the project was only $20 million, which is quite different from the many VC-driven tokens. In addition, Soon and Pump Fun chose to distribute more than 50% of the total token supply through a fair launch, and combined with a small number of VCs and KOLs to raise a large proportion of community funding. This way of giving back to the community may be more acceptable, and the proceeds from community fundraising can be locked up in advance. Although the project party no longer holds a large number of tokens, they can repurchase the tokens in the market through market making, which not only sends a positive signal to the community, but also allows them to recover the tokens at a lower price.

The End of the Memecoin Bubble Frenzy: Liquidity Vortex and the Collapse of Market Structure

The transition from a market balance state dominated by VC-driven Builders to a pure "pump" token issuance bubble model has led to the inevitable zero-sum game scenario for these tokens, ultimately benefiting only a few, while the majority of retail investors are more likely to suffer losses and exit. This phenomenon will exacerbate the collapse of the primary and secondary market structure, and the rebuilding or accumulation of holdings may take longer.

The atmosphere in the Memecoin market has plummeted to the extreme. As retail investors gradually realize that the essence of Memecoin is still inseparable from the control of the conspiracy group - including DEXs, capital parties, market makers, VCs, KOLs, and celebrities - the issuance of Memecoin has completely lost its fairness. The severe short-term losses will quickly affect users' psychological expectations, and this token issuance strategy is approaching a stage-wise end.

Over the past year or more, retail investors have made the largest profits in the Memecoin track. Although the Agent narrative has driven market enthusiasm by promoting a culture of open-source community innovation, it has been proven that this wave of AI Agent hype has not changed the essence of Memecoin. A large number of Web2 individual developers and Web3 shell projects have quickly occupied the market, leading to the emergence of a large number of AI Memecoin projects disguised as "value investments".

Community-driven tokens are controlled by the conspiracy group and manipulated through malicious price manipulation to "speed through". This approach has seriously negatively impacted the long-term development of the project. The former Memecoin projects used religious beliefs or the support of minority groups to alleviate the selling pressure of the tokens, and achieved an acceptable project exit process through the operation of market makers.

However, when the Memecoin community is no longer protected by religion or minority groups, it means that the market sensitivity has declined. Retail investors are still expecting to get rich overnight, they are eager to find tokens with certainty, and hope to see projects with deep liquidity from the opening, which is a fatal blow to retail investors by the conspiracy group. The bigger the bet, the more lucrative the returns, and this return has begun to attract the attention of teams outside the industry. After these teams have obtained the benefits, they will no longer use stablecoins to buy cryptocurrencies, because they lack faith in Bitcoin. The drained liquidity will be permanently lost from the cryptocurrency market.

The Death Spiral of VC Coins: Inertial Traps and Liquidity Strangulation under Short Selling Consensus

The strategies of the previous cycle have become ineffective, but there are still a large number of project parties relying on inertia to use the same strategies.

Releasing a small portion of tokens to VCs, maintaining high control, and letting retail investors buy on exchanges. This strategy has become ineffective, but the inertial thinking makes project parties and VCs unwilling to change easily.

The biggest drawback of VC-driven tokens is the inability to gain an early advantage at the TGE, as users no longer expect to get ideal returns by buying the tokens after issuance, because they feel that the project party and the exchange have a large number of tokens, and the two parties are in an unfair position. At the same time, the VC return rate has dropped significantly in this cycle, so the VC investment amount has also begun to decline, coupled with the unwillingness of users to take over the tokens on the exchange, the issuance of VC coins faces great difficulties.

For VC projects or exchanges, going public may not be the best choice from the beginning. Because the liquidity drained by the teams of celebrity tokens or political tokens has not been injected into other tokens, such as Ethereum, SOL, or other Altcoins. Therefore, as soon as the VC coins are listed on the exchange, the contract fee rate will quickly become -2%. The team will not have the motivation to prop up the market, because the goal of going public has been achieved, and the exchange will not prop up the market either, because short-selling new coins has become a market consensus.

When a token enters a unilateral downward trend as soon as it is issued, the more this happens, the more the market users' mentality will be constantly reinforced. This will lead to the phenomenon of driving out good coins with bad coins. Assuming that in the next TGE, the probability of project parties dumping the market as soon as the token is issued is 70%, and the willingness to prop up the market is 30%. Under the influence of consecutive market-dumping projects, retail investors will take revenge by short-selling, even if they understand the huge risk of short-selling as soon as the token is issued. When the short-selling situation in the futures market reaches its extreme, the project parties and exchanges will also have to join the short-selling ranks to make up for the unrealized target returns through market-dumping. When 30% of the teams see this situation, even if they are willing to provide market-making, they are unwilling to bear the huge price difference between futures and spot to prop up the market. The probability of project parties dumping the market as soon as the token is issued will start to rise from 70%, and the teams that can create a wave of prosperity after the issuance are gradually decreasing.

Unwilling to lose control of the tokens, a large number of VC coins have not made any progress or innovation compared to 4 years ago at the TGE. Inertial thinking has a greater grip on VCs and project parties than imagined, due to the dispersion of project liquidity and the long cycle of VC unlocking, and the constant turnover of project parties and VCs, this TGE method, although it has always had problems, VCs and project parties have become numb to it. Because a large number of project parties may be establishing a project for the first time, they tend to have a survivor bias towards difficulties they have not experienced before, believing that they can create different value.

The strategies of the previous cycle have become ineffective, but there are still a large number of project parties using the same strategies due to inertia. Releasing a small portion of tokens to VCs and maintaining high control, letting retail investors buy on the exchange. This strategy has become ineffective, but the inertial thinking makes project parties and VCs unwilling to change easily. The biggest drawback of VC-driven tokens is the inability to gain an early advantage at the TGE, as users no longer expect to get ideal returns by buying the tokens after issuance, because they feel that the project party and the exchange have a large number of tokens, putting the two parties in an unfair position. At the same time, the VC return rate has dropped significantly in this cycle, so the VC investment amount has also begun to decline, coupled with the unwillingness of users to take over the tokens on the exchange, the issuance of VC coins faces great difficulties.

For VC projects or exchanges, going public may not be the best choice from the beginning. The liquidity drained by the teams of celebrity tokens or political tokens has not been injected into other tokens, such as Ethereum, SOL, or other Altcoins. Therefore, as soon as the VC coins are listed on the exchange, the contract fee rate will quickly become -2%. The team will not have the motivation to prop up the market, because the goal of going public has been achieved, and the exchange will not prop up the market either, because short-selling new coins has become a market consensus.

Here is the English translation:When a token is issued and immediately enters a unilateral downward trend, the higher the frequency of this phenomenon, the more the market users' cognition will be strengthened, and the "bad money drives out good money" situation will occur. Assuming the next TGE, the probability of a project that issues tokens and immediately crashes the market is 70%, and the willingness to support the market is 30%. Under the influence of consecutive project crashes, retail investors will engage in retaliatory short-selling behavior, even if they are fully aware of the extremely high risks of issuing tokens and then shorting. When the short-selling situation in the futures market reaches its extreme, the project parties and exchanges also have to join the short-selling ranks to make up for the unrealized target returns that cannot be achieved through crashing the market. When 30% of the teams see this situation, even if they are willing to provide market-making, they are unwilling to bear such a huge price difference between the futures and spot markets. Therefore, the probability of projects that issue tokens and immediately crash the market will further increase, and the teams that can create a positive effect after token issuance will gradually decrease.

Unwilling to lose control of the tokens, a large number of VC tokens have made no progress or innovation compared to four years ago at the time of TGE. The inertial thinking is more powerful in restraining VCs and project parties than imagined. Due to the dispersion of project liquidity, the long VC unlocking cycle, and the constant turnover of project parties and VCs, although this TGE method has always had problems, VCs and project parties have shown a numb attitude.

Dual-drive paradigm migration: on-chain transparent game breaks the deadlock of VC token pricing

Why choose the VC+community dual-drive model? The pure VC-driven model will increase the pricing error between users and project parties, which is not conducive to the price performance of tokens in the early stage of issuance; while the completely fair launch model is easy to be maliciously manipulated by the conspiracy group behind it, resulting in the loss of a large amount of low-priced tokens, and the price fluctuates through a cycle in a single day, which is a devastating blow to the subsequent development of the project.

Only by combining the two, with VCs entering the project in the early stage, providing reasonable resources and development plans for the project parties, reducing the financing needs of the team in the early development stage, and avoiding the worst-case scenario of losing all the tokens due to fair launch and only getting low-certainty returns.

Over the past year, more and more teams have found that the traditional financing model is becoming ineffective - the routine of giving VCs a small share, maintaining high control, and waiting for the market to be pumped up is difficult to continue. With VCs tightening their pockets, retail investors refusing to take the bait, and the listing threshold on major exchanges rising, a new set of strategies more suitable for the bear market is emerging: teaming up with top KOLs and a small number of VCs, and launching the project with a high proportion of community distribution and low market cap cold start.

Projects represented by Soon and Pump Fun are opening up a new path through "high-proportion community distribution" - teaming up with top KOLs to endorse the project, directly distributing 40%-60% of the tokens to the community, and launching the project at a valuation as low as $10 million, realizing hundreds of millions of dollars in financing. This model builds consensus FOMO through the influence of KOLs, locks in returns in advance, and exchanges high liquidity for market depth. Although it gives up the short-term advantage of token control, it can repurchase tokens at low prices through a compliant market-making mechanism during the bear market. Essentially, this is a paradigm shift in the power structure: from the VC-led game of "passing the drum" (institutional takeover - exchange listing and dumping - retail investors buying) to the transparent game of community consensus pricing, where project parties and the community form a new symbiotic relationship in the liquidity premium.

Recently, Myshell can be seen as a breakthrough attempt between BNB and the project party. 4% of its tokens were issued through IDO, with an IDO market cap of only $20 million. To participate in the IDO, users need to purchase BNB and operate through the exchange wallet, and all transactions are recorded on the chain. This mechanism brings new users to the wallet while allowing them to obtain fair opportunities in a more transparent environment. For Myshell, the operation of market makers ensures a reasonable price increase. Without sufficient market support, the token price cannot be maintained in a healthy range. As the project develops, from low market cap to high market cap, and with the continuous enhancement of liquidity, the project gradually gains market recognition. The contradiction between the project party and VC lies in transparency. After the project party issues tokens through IDO, they no longer rely on exchanges, which can solve the contradiction in transparency between the two parties. The token unlocking process on the chain becomes more transparent, ensuring that the conflicts of interest that existed in the past are effectively resolved. On the other hand, the dilemma faced by traditional CEXs is that the token price often crashes after issuance, causing the trading volume of the exchange to gradually decline, while the transparency of on-chain data allows the exchange and market participants to more accurately assess the real situation of the project.

It can be said that the core contradiction between users and project parties lies in pricing and fairness. The purpose of fair launch or IDO is to meet users' expectations for token pricing. The fundamental problem of VC tokens lies in the lack of buying power after listing, and pricing and expectations are the main reasons. The breakthrough point is the project party and the exchange. Only by fairly sharing the tokens with the community and continuously promoting the construction of the technical roadmap can the value growth of the project be realized.

As a decentralized community organization, Movemaker has obtained multi-million dollar level funding and resource support from the Aptos Foundation. Movemaker will have autonomous decision-making power, aiming to efficiently respond to the needs of developers and ecosystem builders in the Chinese-speaking area, and promote the further expansion of Aptos in the global Web3 field. Movemaker will first build the Aptos ecosystem in a community+VC dual-drive model, including the deep integration of DeFi, artificial intelligence and blockchain, innovative payments and stablecoins, and RWA.

About Movemaker

Movemaker is the first official community organization authorized by the Aptos Foundation and jointly initiated by Ankaa and BlockBooster, focusing on promoting the construction and development of the Aptos Chinese-speaking ecosystem. As the official representative of Aptos in the Chinese-speaking area, Movemaker is committed to building a diverse, open and prosperous Aptos ecosystem by connecting developers, users, capital and many ecosystem partners.

Disclaimer: This article/blog is for reference only, representing the author's personal views and not representing the position of BlockBooster. This article does not intend to provide: (i) investment advice or investment recommendations; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Holding digital assets, including stablecoins and NFTs, is extremely risky, with large price fluctuations, and may even become worthless. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. For specific issues, please consult your legal, tax or investment advisor. The information provided in this article (including market data and statistics, if any) is for general reference only. Reasonable care has been taken in compiling these data and charts, but no responsibility is accepted for any factual errors or omissions contained herein.