Introduction

Today, BTC briefly fell below $89,000, reaching a low of $88,200, while ETH and SOL also fell below $2,400 and $135 respectively. Within just 1 hour of the crash, the total liquidation amount reached $454 million across the network.

In such extreme market conditions, investor sentiment and decision-making become crucial. The KOLs (key opinion leaders) with large fan bases on social media often unconsciously influence market trends. During today's crash, these KOLs reacted differently. Some published in-depth market analysis and took a bearish stance; some expressed patience and willingness to wait; while others chose to protect their capital through decisive stop-loss strategies. These different voices and strategies reflect the KOLs' diverse approaches to dealing with the market's violent fluctuations, providing investors with various references.

Top-Selling Type

Accurately identifying the market top and selling in time to avoid subsequent losses is the dream of every investor. By closely observing market data and conducting in-depth analysis, some KOLs have successfully achieved this, accurately identifying the signs of market overheating and making corresponding decisions.

For example, Mr. Beg (@market_beggar) issued a warning as early as January 13, using on-chain data such as "Realized Profit", AVIV heatmap, and Cointime Price Deviation to indicate that the market was in an overheated state. His core view is that the market top usually experiences two distinct "distribution" phases. Each bull market sees a large number of investors quietly accumulating positions at low levels, and the distribution of these positions is a signal that the bull market is gradually coming to an end. When market sentiment reaches its peak and participants generally hold positions at high costs, once the price can no longer continue to rise, selling pressure will gradually emerge, ultimately triggering a price decline and the beginning of a bear market.

Two Rounds of "Distribution" Signals

Mr. Beg's top identification model, using multiple on-chain data points, dynamically adjusts, including Realized Profit, AVIV Heatmap, and Cointime Price Deviation.

- Realized Profit: When the market price broke through $70,000, there were clear profit-taking signals, marking the beginning of the first round of distribution. As the price broke through $100,000, the second round of distribution appeared, and the market began to see more selling pressure.

- AVIV Heatmap: This heatmap can help us observe whether the market is in an overheated stage. As the market reached its peak, the AVIV indicator showed signs of overheating, and this phenomenon reappeared when it broke through $100,000, indicating that the pressure from the second round of distribution had accumulated.

- Cointime Price Deviation: By tracking historical tops, Mr. Beg found that each cyclical top was accompanied by two obvious peaks, and the current market is also in the second peak stage, with signs of a turnaround.

Similarly, Calm Calm Calm (@hexiecs) made a similar judgment on January 20. He pointed out that the issuance of cryptocurrencies by the wife of former US President Trump was a clear signal of a local market top, so he decisively cleared his positions, selling 90% of his BTC and exiting his TRUMP position. In retrospect, he said that without this signal, he might not have made such a decisive decision.

Arthur Hayes has also expressed similar views in his recent articles and tweets. He believes that due to the lack of fundamental changes in the US political environment despite Trump's election, the price of cryptocurrencies may retrace to the level of Q4 2024. He pointed out that many IBIT holders are actually arbitrage funds, who profit by going long on ETFs and short on CME futures. Once BTC price declines, they will sell IBIT and buy back CME futures, which may further drive down BTC price, even to $70,000. Hayes believes that only through monetary easing policies by the Federal Reserve, the US Treasury, or other countries can the current market conditions be effectively improved.

Through in-depth market analysis and keen insights into the macroeconomic environment, these KOLs successfully avoided the top-end risks of the market, providing investors with important signals about market changes.

Stop-Loss Type

When the market is declining, timely stop-loss is a key strategy to protect capital. Although stop-loss often means short-term losses, being able to execute this operation decisively can effectively reduce losses by avoiding greater risks, demonstrating the investor's ability to remain calm in turbulence.

先定10个大目标 is a typical example. When the market was declining, he quickly closed his long positions, although this resulted in the loss of billions of funds. It is worth noting that he had set clear stop-loss lines a few days earlier, and once the market reached those lines, he immediately executed the liquidation. This strict risk management approach reflects his high emphasis on trading discipline. He mentioned on social media that although stop-loss resulted in immediate losses, he believes that acknowledging failure and stop-loss in time is the necessary path to protect capital and avoid greater losses. The most dangerous thing in the market is not failure, but ignoring the signals of failure and clinging to the hope of luck, ultimately leading to more severe losses.

In his analysis, he emphasizes a core principle of trading: rapid response and decisive action. Faced with the violent market fluctuations, only by calmly responding and quickly adjusting strategies can the risks be minimized. This calm decision-making ability also stems from a deep understanding of market trends and self-awareness.

Calm and Unruffled Type

In the violent market fluctuations, some KOLs choose to remain calm, as they usually take a longer-term view and believe that short-term volatility is a normal phenomenon in the market cycle, not requiring an excessive reaction. For these KOLs, patience and determination are the keys to success, and they are often able to maintain clear judgment amidst the market noise.

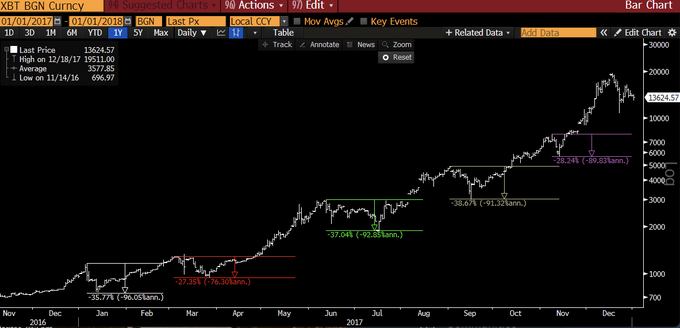

Raoul Pal recently tweeted a reminder to investors: "You need to learn patience... It's like 2017, where Bitcoin experienced five corrections, each over 28%, and most lasted 2-3 months before the market made new highs. A lot of what you're worried about is just noise." By reviewing historical trends, he tells investors that market corrections are normal and there is no need to panic excessively, as patience and waiting are the wise choices.

Kevin Svenson also shared a similar view. He pointed out that although the current market sentiment is leaning towards panic, the trading volume of Bit has been declining since November last year, and he believes this indicates that the market may be approaching the bottom, and the next breakthrough in trading volume is likely to occur during the rebound period. "The current panic sentiment has caused people to overlook an important signal - the trading volume has not increased with the drop in prices, which indicates that the selling pressure in the market may have peaked."

Ansem also believes that although Bit has currently fallen below the support level for the bottom, and has broken through the trading range of the high time frame, there is still no obvious breakdown of the bearish range, so he believes that this round of decline may only be part of the market adjustment, and the overall trend has not changed. His analysis is more cautious, but he also mentioned that if the stock market also experiences a decline in the next few weeks, this is likely to mean that the market's risk aversion sentiment is spreading, which may lead to a larger market downturn.

Finally, CZ retweeted a post emphasizing the necessity of long-term investment. The post mentioned: "On the same day last year, the price of Bit was $54,000, ETH was $3,178, BNB was $401, and SOL was $109. Now, all of these coins have risen, and three of them have recently hit new highs. The short-term perspective often makes us only see the fluctuations in prices, but if we extend the perspective, we can see more opportunities." CZ used this to remind investors not to be disturbed by short-term price fluctuations, but to take a broader view of the market and seize long-term investment opportunities.

Summary

In extreme market conditions, the reactions of KOLs (Key Opinion Leaders) are different, but whether it is successfully escaping the top, decisively cutting losses, or remaining calm and unruffled, their decisions reflect a deep understanding and unique judgment of the market. The KOLs who escaped the top avoided the market risks through precise data analysis, the KOLs who decisively cut losses protected their principal through stop-loss, and the KOLs who remained calm and unruffled stabilized their investment rhythm through patience and a long-term perspective.

For ordinary investors, the most important thing is to always remain vigilant and avoid blindly following the crowd due to short-term fluctuations. The violent fluctuations in the market may cause us to make emotional decisions, but no matter what, maintaining calm, rationality, setting a stop-loss line and strictly executing it is the key to avoiding greater losses. If you encounter situations like liquidation, you should also immediately stop trading to avoid further expanding losses due to a momentary impulse. The future is full of uncertainty, and any investment decision requires more caution. Do not make exaggerated reactions due to short-term ups and downs. Only in calmness can you make decisions that truly fit your risk tolerance.