Author: Azuma, Odaily

This morning, we just released the market update article "The market is accelerating its decline, is BTC really going to $70,000?". We thought we were psychologically prepared for the market to continue to decline, but we did not expect the new round of accelerated decline to come so quickly.

Around 15:30, BTC once again fell below the $90,000 mark for the first time in nearly a month and a half. OKX market data shows:

BTC hit a low of $88,189 USDT, and as of 15:50 it is temporarily reported at $89,204 USDT, a 24-hour drop of 6.80%;

ETH hit a low of $2,315 USDT, and is temporarily reported at $2,378.01 USDT, a 24-hour drop of 12.5%;

SOL hit a low of $132.8 USDT, and is temporarily reported at $136.5 USDT, a 24-hour drop of 15.12%;

Other Altcoins and on-chain meme coins need not be mentioned, with generally more than 10% or even 20% declines.

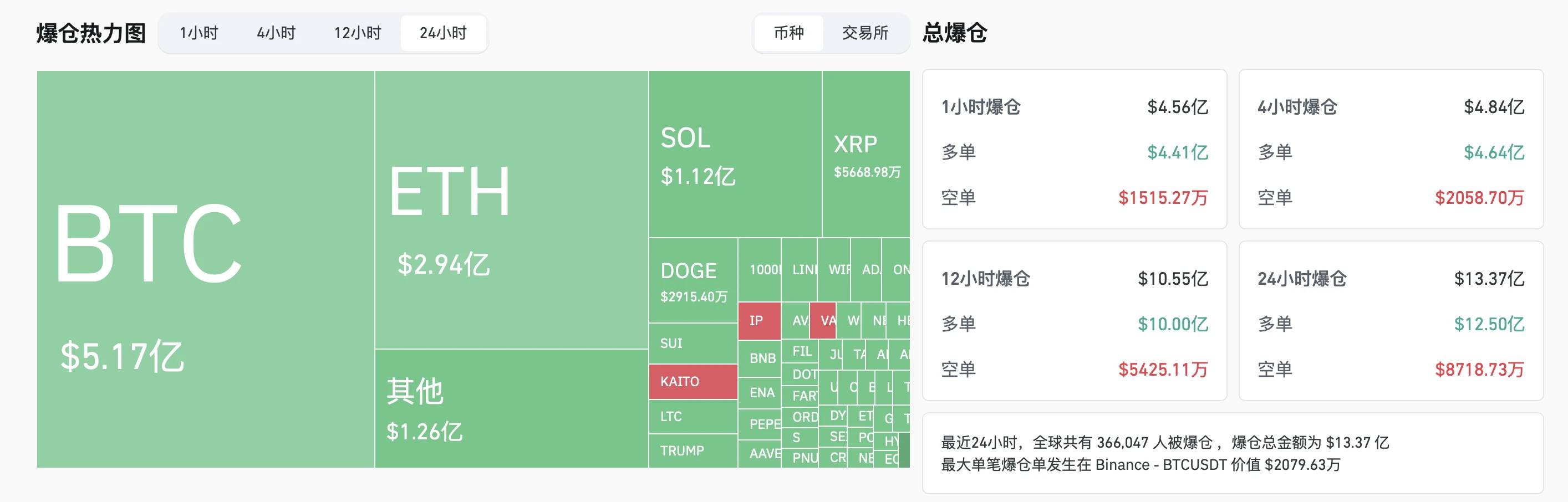

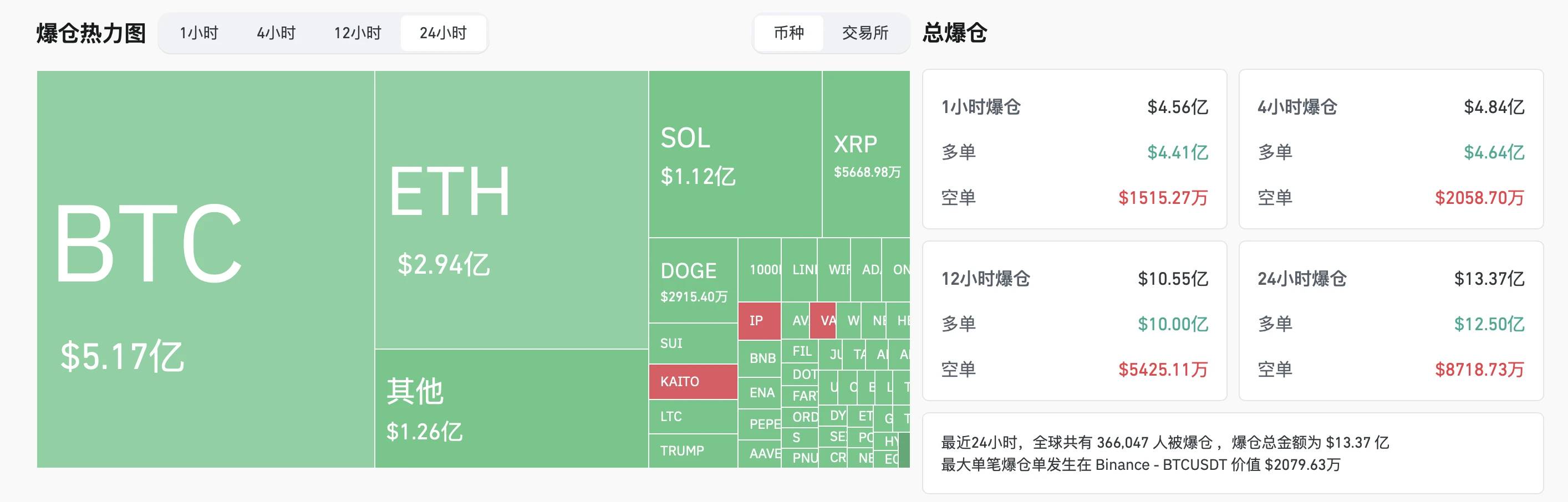

In terms of derivatives data, Coinglass data shows that $1.337 billion was liquidated across the network in the past 24 hours, with the vast majority being long liquidations, amounting to $1.25 billion. In terms of currencies, $517 million in BTC and $294 million in ETH were liquidated.

Targeting a large contract holder?

Regarding the reasons for this sharp decline, some community members interpreted it as a targeted attack by a large trading group on a BTC long contract holder on a CEX (nicknamed "First target 10 big ones").

Community screenshots show that the user had an average opening price of $100,320.8 USDT, with a position of 5,184.527 BTC, and an estimated liquidation price of $82,592.68.

However, as the market accelerated its decline, the large holder seems to have closed their position in advance. On-chain analyst Ai Aunt monitored that the BTC long contract user had taken losses and stopped out, and in the past 5 minutes had taken losses at an average price of $89,138 on 1,783.48 BTC, totaling $159 million.

At the same time, the user X suspected to be the large holder, jasonleo, also responded to the situation of this position. jasonleo admitted to "recognizing the mistake and withdrawing", but also clarified that he did not "take losses and withdraw the principal", because the actual position was entered later, causing the on-chain data platform to not account for the previous profits.

The large holder finally said: "From a profit of 7 billion to 0 profit, just one shot away from the 10 billion target, what a pity."

What do the big shots/institutions think?

In the morning article, we briefly covered the views of BitMEX co-founder Arthur Hayes and Placeholder partner Chris Burniske on the future market - Arthur Hayes still sees a downside to $70,000, while Chris Burniske believes this is just a mid-bull correction.

To help everyone judge the future market more clearly, we have again sorted out the views of more big shots/institutions, with details as follows.

OKX: Multiple factors triggered this round of decline, the key to the future market is the inflow of incremental capital

OKX Research Institute senior researcher Zhao Wei analyzed that global trade tensions, the plunge in US stocks, deleveraging, the withdrawal of institutional capital, the frequent occurrence of security incidents, and the ebbing of the SOL ecosystem hype have all contributed to this round of market decline.

At the macro level, the continued tightening of liquidity is putting pressure on risky assets. The expectation of interest rate hikes by the Bank of Japan has pushed the yen against the US dollar above the 149 mark, directly impacting the largest carry trade vehicle globally. At the same time, the Nasdaq index has fallen more than 4% for three consecutive days, with tech stock valuations falling, market risk appetite declining, further affecting high-beta assets like Bitcoin.

In the crypto market, internal vulnerabilities were amplified in this decline. First, the reversal of institutional capital flows has become a key pressure point. Recently, Bitcoin and Ethereum spot ETFs have seen continuous net outflows, and some institutional positions have been hit, triggering programmatic selling. Secondly, in the derivatives market, the large institutional long positions in Ethereum futures have decreased significantly, indicating a change in their market expectations. In addition, the SOL ecosystem is facing liquidity difficulties, on-chain Memecoin trading volume has declined, and the withdrawal of speculative capital has led market makers to reduce quote depth, triggering a surge in on-chain liquidations and a decline in protocol revenue, which may lead to a reconstruction of the SOL ecosystem valuation model. The wave of deleveraging has further exacerbated market volatility, with some crypto asset prices breaking through, triggering cascading DeFi liquidations. At the same time, the recent security incidents have exacerbated the market's crisis of confidence, with users' concerns about asset security rising, further undermining confidence in the crypto market.

The future market trend will be affected by both macro environment and internal factors, but the core will still depend on the continuous inflow of incremental capital. However, the current global economic situation is uncertain, with increased tariff pressure leading to a decline in risk appetite, while the recovery of the crypto market still needs to wait for the return of institutional capital and the driving of new killer applications to reconstruct the narrative and achieve a healthy market adjustment. Currently, the crypto market is bearing the triple pressure of macro liquidity contraction, internal ecosystem adjustment, and exposure of market structural vulnerabilities. Users should focus on the industry's technical innovation cycle, the performance of US tech stock earnings, and the pace of global central bank policy adjustments. Only when the on-chain stablecoin inflows resume positive growth, futures positions bottom out and rebound, and the major currencies stabilize at the weekly level, can the market repair cycle be confirmed.

Matrixport: Further downside is likely, limited buying demand

Matrixport stated in its market update today: "Bitcoin has broken below the rising expanding wedge, which, although not what we hoped for, typically signals downside risk, unless the price can quickly rebound and return within the wedge. The possibility of further Bitcoin decline is greater, especially since this breakdown has occurred during a period of low trading activity, limiting the demand for buying the dip."

"Although we expect prices to have upside room in the second half of the year, this technical breakdown has made the market sentiment more cautious. In addition, not only has Bitcoin broken down, but Ethereum has also fallen below the key $2,600 to $2,800 support zone."

Raoul Pal: Just a correction, learn to tune out the noise

Real Vision co-founder and CEO Raoul Pal on the decline said: "Be patient. The current market structure is very similar to 2017. BTC has had 5 corrections greater than 28%, lasting 2-3 months before hitting new highs, while Altcoins generally fell more than 65%. The market is full of noise, go do something more meaningful than staring at the charts."

Ansem: Focus on the recovery of 96,500, beware of subsequent stock market decline

Renowned trader Ansem stated on X that the key going forward is to see if BTC can reclaim the 96,500 level, but the more important issue is that if cryptocurrencies are pre-reflecting the overall market risk aversion trend, and the stock indices also experience a collapse in the next few weeks, then this is more likely the start of a downtrend, rather than just a small hiccup in an uptrend.

CoinDesk Analyst: Nasdaq decline + Japan rate hike triggered the crash

CoinDesk's market analysis team editor Omkar Godbole released a market analysis stating that the expectation of a rate hike by the Bank of Japan and the decline in Nasdaq futures triggered the latest crypto market crash. Market data shows that Nasdaq futures fell 0.3%, indicating that the trend of three consecutive days of declines will continue, with the tech-heavy index down more than 4% since February 18.

The yen exchange rate against the US dollar, a safe-haven currency, is 149.38, and it is expected to challenge the near-three-month high of 148.84 set on Monday. As the market bets that the Bank of Japan will raise interest rates, the yen has risen by nearly 6% in six weeks. The Bank of Japan's rhetoric on interest rate hikes and the strength of the yen evoke memories of the situation in July last year: at that time, due to the central bank's interest rate hike, the yen soared, ultimately triggering widespread risk aversion, causing Bit to plummet from around $65,000 to $50,000 in a few days.