Key Points

– Understanding derivatives and risks: Crypto derivatives such as futures, options, and swap contracts offer profit opportunities, but come with high volatility, leverage risk, and liquidity challenges.

– Implementing effective risk management: Reduce liquidation risk from market volatility through position sizing, stop-loss orders, hedging strategies, and asset diversification.

– Ensuring compliance and security: Stay informed on regulatory changes, choose compliant exchanges, and use cold wallets and secure trading measures to protect assets.

– Maintaining trading psychology: Avoid impulsive decisions driven by FOMO (fear of missing out) or panic, follow your trading plan, and keep records to optimize your strategy.

Cryptocurrencies are rapidly entering the mainstream, offering unique opportunities for investment, speculation, and hedging. In this emerging market, crypto derivatives based on digital assets like Bitcoin or Ethereum have become an important part of the landscape. These derivatives include futures, options, swap contracts, and perpetual contracts, allowing traders to profit from market price fluctuations without holding the underlying assets.

However, high volatility, complex product structures, and an unregulated market can turn trading opportunities into significant risks. Effective risk management is therefore crucial for all crypto derivatives traders. This guide will provide:

– An overview of mainstream derivatives

– Analysis of key risk factors

– Practical risk management strategies

to help traders and investors navigate market challenges and improve trading security and stability.

Table of Contents

Understanding Crypto Derivatives

Key Risks of Crypto Derivatives

– Position Sizing and Leverage Control

– Stop-Loss Orders and Risk/Reward Ratio

– Hedging Strategies (Options and Arbitrage Trades)

– Asset and Strategy Diversification

– Collateral and Margin Management

– Continuous Monitoring and Adjustment

Legal and Compliance Considerations

Technical and Operational Risk Mitigation

Trading Psychology and Emotional Management

– Avoiding FOMO (Fear of Missing Out)

– Overcoming Loss Aversion

– Maintaining Trading Records

– Sticking to Your Trading Plan

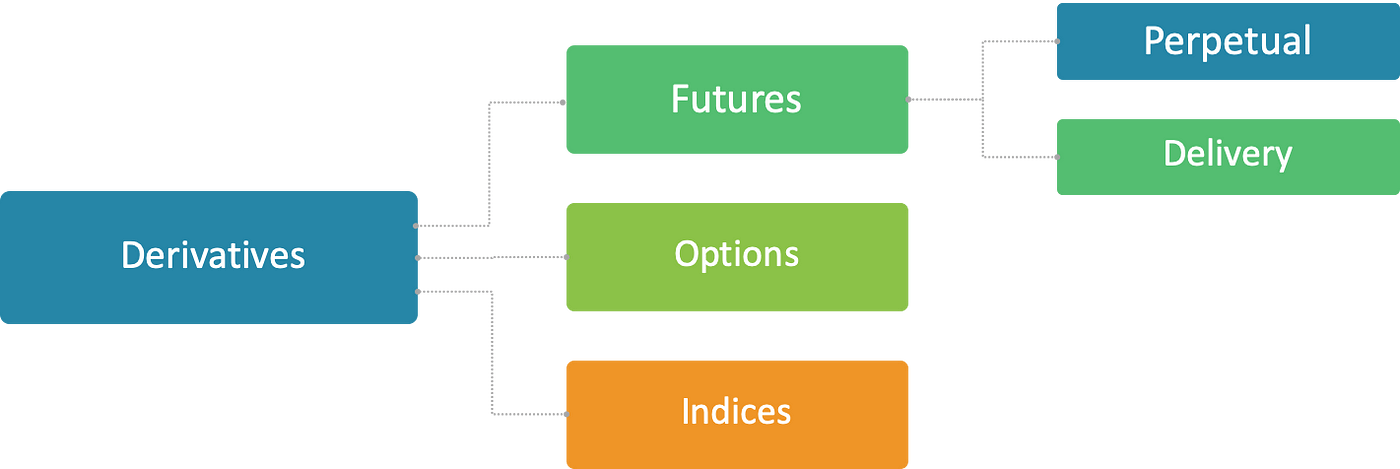

Understanding Crypto Derivatives

Crypto derivatives allow traders to gain market exposure or execute hedging strategies without directly holding Bitcoin or other digital assets. These tools can amplify returns, but also come with higher risks. The main categories are:

Futures

Definition: A contract where the buyer and seller agree to trade an asset at a predetermined price on a future date.

Trading Platforms: Regulated exchanges (e.g., CME) and crypto exchanges (e.g., Binance, XT.COM).

– No expiration date: Funding rates keep the contract price close to the spot market.

– Target audience: Suitable for traders who want to hold long-term leveraged positions without the need to roll over contracts.

– Fixed expiration date: Positions are settled in crypto or stablecoins upon contract maturity.

– Target audience: Suitable for institutional investors or traders who want a defined settlement time.

Stablecoin-Backed vs. Coin-Backed Contracts

– Stablecoin-Backed (e.g., BTC/USDT): Use USDT, USDC, etc. as collateral to reduce volatility risk in leveraged positions.

– Coin-Backed (e.g., BTC/USD): Use cryptocurrencies as collateral, where position profits/losses and collateral value fluctuate with the market.

Options

Definition: Contracts that give the holder the right, but not the obligation, to buy (call option) or sell (put option) a cryptocurrency at a predetermined price before a specific date.

Use Cases:

– Hedging: Protecting large crypto holdings from market downturns.

– Income Generation: Earning additional revenue by selling options (e.g., covered calls).

– Speculation: Leveraging options to profit from market direction without holding the underlying asset.

Swaps

Definition: Contracts where two parties exchange specific financial cash flows or obligations.

Perpetual Swaps:

– No expiration date: Funding rates keep the price close to the spot market.

– Popular Platforms: Binance, OKX, Deribit, etc.

Structured Products

Structured products combine derivatives to offer customized risk/return profiles, appealing to institutional investors.

Dual Investment (Coming Soon to XT.COM)

– No principal guarantee: Users can earn higher returns if the target price is not reached at maturity.

– Mechanism: If the price is below the target, the investor receives the original asset plus additional interest; if the price exceeds the target, the investor's position is converted to another asset (e.g., BTC → USDT), potentially missing out on further upside.

– Partial capital protection: Payoff depends on whether the price remains within a predetermined range.

– Target Audience: Suitable for investors seeking stable returns but willing to take on some risk.

Image Credit: Medium

Key Risks of Crypto Derivatives

The risks in the crypto derivatives market are interconnected, and understanding these risks can help traders develop effective protection strategies.

Volatility Risk

– Cryptocurrency prices can fluctuate dramatically, with daily swings exceeding 80% not uncommon.

– Leverage amplifies market volatility, and unfavorable market conditions can easily trigger forced liquidations (margin calls).

Counterparty Risk

– Traders rely on the financial stability and security mechanisms of the exchange.

– If the exchange is hacked or goes bankrupt, traders may lose their collateral and unrealized profits.

Liquidity Risk

- The market liquidity is dispersed, especially for small-cap assets, and insufficient trading depth may lead to execution difficulties.

- Low liquidity can easily cause slippage, and when the market is highly volatile, closing positions becomes more difficult, which may even lead to greater losses.

Regulatory and Legal Risk

- Global cryptocurrency regulations change frequently, and policies vary across different regions.

- Regulatory adjustments may affect leverage ratios, margin requirements, or even result in trading restrictions or bans in certain regions.

Technology and Operational Risk

- Trading platforms may be subject to hacker attacks, system failures, or server overloads, affecting trading experience and fund security.

- High-frequency trading strategies may fail due to API connection delays or malfunctions, impacting trading execution efficiency and profitability.

Identifying these risks and their severity is key to developing effective risk management strategies.

Image Credit: Insurance Risk Services

Risk Management Strategies

Effective risk management requires a combination of quantitative tools, disciplined trading methods, and market research. Here are some common strategies:

Position Planning and Leverage Control

Position Planning

- Allocate only a portion of capital per trade to withstand market fluctuations and control individual risk exposure.

- Excessive capital allocation may lead to a rapid portfolio loss, especially in extreme market conditions.

Leverage Management

- High leverage (such as 20x, 50x) can amplify profits, but also increases the risk of losses.

- Experienced traders often use medium to low leverage to reduce the risk of liquidation.

Stop-Loss Orders and Risk/Reward Ratio

Stop-Loss Orders

- Set stop-loss levels to automatically close positions when the market price reaches the predetermined level, limiting losses.

- Reasonable stop-loss mechanisms help traders maintain discipline and prevent losses from escalating.

Risk/Reward Ratio

- Maintain a healthy risk/reward ratio (e.g., 1:3) to ensure long-term profitability.

- Even if some trades fail, profitable trades can still offset the losses.

Hedging Strategies

Using Options

- When holding a large amount of crypto assets, you can buy put options to hedge against market crashes.

- If you are bearish on the market but concerned about price increases, you can buy call options to reduce the risk.

Arbitrage Trading

- Arbitrage trading involves holding offsetting positions (such as going long and short simultaneously) to reduce risk.

- This strategy can minimize overall market exposure and focus on price differences between assets.

Diversification

Asset Diversification

- Hold a variety of cryptocurrencies or stablecoins to reduce the impact of a single asset's sharp decline.

- For example, if Bitcoin crashes, but Ethereum remains stable, the overall loss will be reduced.

Strategy Diversification

- Use different trading strategies (such as trend trading, mean reversion, volatility arbitrage) to adapt to market changes.

- Some strategies are effective in unidirectional markets but may fail in volatile markets, so a multi-strategy portfolio can help achieve long-term stable profits.

Margin Management

Over-Collateralization

- Depositing additional margin can prevent forced liquidation during extreme market volatility.

- However, allocating too much capital to a single exchange may increase the risk of exchange bankruptcy or hacking.

Stablecoin Margin

- Using stablecoins (such as USDT, USDC, DAI) as margin can reduce the additional risk caused by margin value fluctuations.

- This strategy ensures that the trader's risk is only related to their positions, and not affected by market turmoil.

Continuous Monitoring and Adjustment

Dynamic Risk Adjustment

- As market conditions constantly change, leverage and stop-loss levels should be adjusted based on current volatility.

- For example, during periods of extreme volatility, reducing leverage and tightening stop-loss ranges can mitigate potential losses.

Risk Analysis and Stress Testing

- Use simulation tools to conduct stress tests, evaluating the impact of worst-case scenarios, such as market crashes or exchange failures.

- Adjust position sizes, hedging strategies, and margin management plans based on the test results.

These strategies provide a basic risk management framework for traders, but true success depends on disciplined execution and flexible adjustments based on market changes.

Regulatory and Compliance Considerations

The regulatory environment for crypto derivatives is constantly evolving, affecting their trading methods and compliance. The US allows regulated Bitcoin futures (CFTC-regulated), but strictly limits retail leverage, while some countries completely ban or severely restrict crypto derivatives trading.

Compliance in the Trading Region

- Understand the legal requirements in the exchange's jurisdiction to avoid penalties, asset freezes, or legal disputes due to non-compliance.

- Regulations on crypto derivatives vary across different countries, so it is important to stay up-to-date on policy changes.

Exchange Due Diligence

- Confirm that the exchange holds the necessary licenses and is supervised by regulatory authorities.

- Assess the exchange's financial stability and ensure it has sufficient liquidity and security measures.

- Investigate the exchange's security track record and any past hacking incidents or asset loss events.

Tax and Transaction Reporting

- Maintain complete trading records (including entry prices, exit prices, profits, and losses).

- Many countries treat crypto gains as taxable income, so accurate reporting can help avoid potential legal issues.

KYC and AML Requirements

- Compliant exchanges typically require identity verification (KYC) and transaction monitoring to prevent illicit activities.

- Adhering to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations can help avoid account freezes or regulatory investigations.

By proactively managing compliance, traders can mitigate legal risks and ensure stable and sustainable long-term trading.

Image Credit: Financial Crime Academy

Technical and Operational Security

Crypto trading relies on robust security measures and sound operational management to safeguard fund security and trading stability.

Fund Security

- Leading exchanges store the majority of user funds in cold wallets to prevent hacker attacks.

- Multi-signature mechanisms can enhance security, requiring multiple parties to authorize large withdrawals.

Platform Stability

- Exchanges should have backup servers and failover mechanisms to ensure system stability.

- Traders using automated trading tools should check the API's stability to avoid transaction failures due to system delays or malfunctions.

Operational Risk Management

- Exchanges with comprehensive risk controls should be able to respond quickly to hacker attacks or system crashes, and restore operations promptly.

- Transparent exchanges often provide proof of reserves and undergo third-party audits to build user trust.

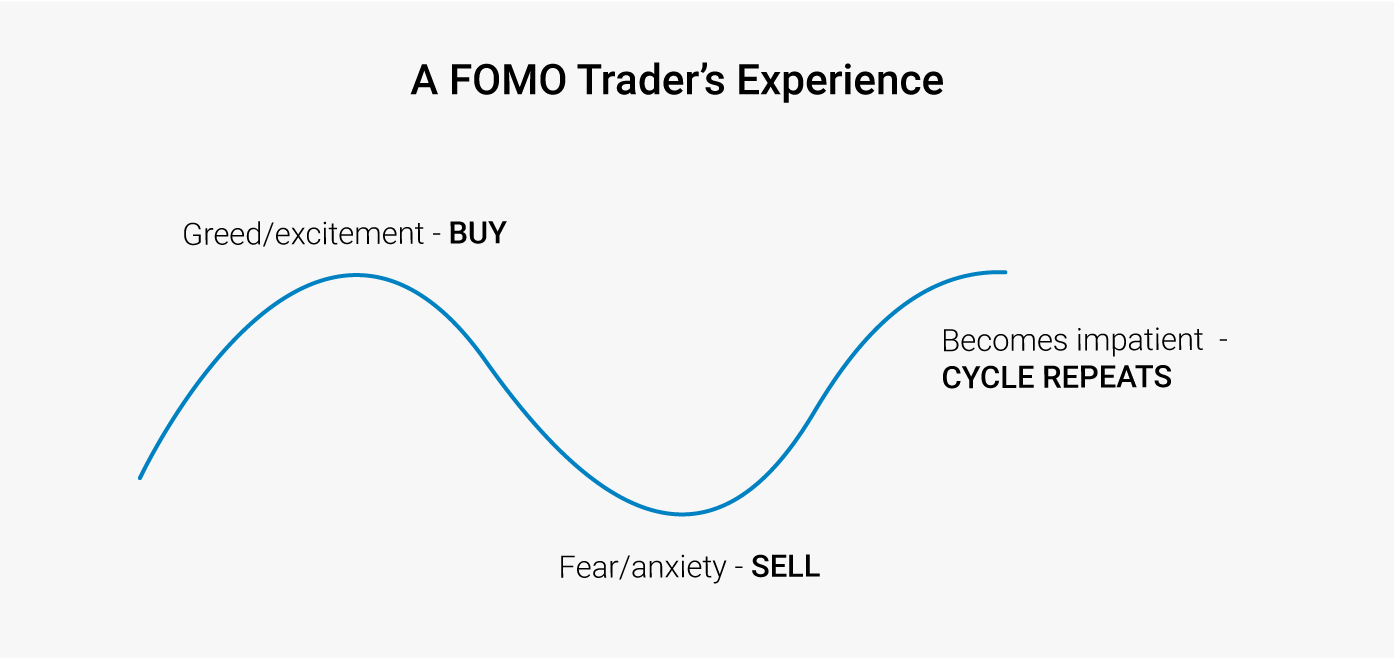

Emotional Management in Trading

Even with good technical capabilities and trading strategies, if affected by emotions, it may still lead to serious losses. The cryptocurrency market is often driven by market hype and panic sentiment, which can easily lead to trading decisions based on fear (Fear) or greed (Greed). Maintaining emotional discipline can ensure that traders execute trades according to the plan, rather than being driven by impulses.

Avoid FOMO

- - When the price surges, traders may impulsively enter the market, ignore risk control, and even heavily buy in after the best entry point has passed.

- - Adhere to the established trading rules and position limits, and avoid over-leveraging or missing good entry points due to FOMO.

Overcome Loss Aversion

- - Many traders are unwilling to admit losses, leading to prolonged holding positions and missing better trading opportunities.

- - Early control of small losses can help preserve capital for subsequent more favorable trades.

Maintain a Trading Journal

- - Record the decision-making process of each trade (entry/exit price, trading rationale, emotional state at the time), which can help identify error patterns.

- - Regularly reviewing the trading journal can help optimize the trading strategy and improve discipline.

Adhere to the Trading Plan

- - Before entering a trade, clearly set profit targets and stop-loss ranges, ensuring that each trade has a clear risk management strategy.

- - Avoid impulsively adjusting the trading strategy due to short-term market fluctuations, and any necessary adjustments should be based on rational analysis, not emotional reactions.

Emotional control is the key to distinguishing stable profitable traders from losing traders. Maintaining calm, strictly executing the trading plan, and overcoming psychological barriers are the keys to long-term survival and profitability in the cryptocurrency market.

Image Credit: Carl Fajardo

Conclusion

Cryptocurrency derivatives offer opportunities for high returns, but also come with high volatility and complexity. Successful traders need to effectively manage risks in the following key areas:

- - Product Knowledge: Thoroughly understand the mechanisms of futures, options, and swap contracts before trading.

- - Risk Control: Use stop-loss orders, reasonable leverage, and hedging strategies to reduce potential losses.

- - Trading Security: Ensure the security of the exchange and trading platform to mitigate counterparty risk.

- - Regulatory Compliance: Stay up-to-date on KYC (Know Your Customer), AML (Anti-Money Laundering), and tax compliance requirements.

- - Emotional Management: Strictly execute the trading plan and avoid impulsive decisions due to market sentiment.

As the market continues to evolve, traders must constantly learn and adjust their strategies. While no strategy can completely eliminate risk, through a sound approach and strict execution discipline, the likelihood of long-term success in the cryptocurrency derivatives market can be greatly improved.