Editor's Note: In the fierce competition in the field of artificial intelligence applications, Tencent's AI assistant "Tencent Yuanbao" has recently made a major breakthrough. According to AppStore data, the Yuanbao App has risen to the second position in the free app download ranking on the Apple App Store in China, second only to Deepseek, with a cumulative download of over 20 million, surpassing the previously leading "Douban" under ByteDance. This milestone progress not only demonstrates Tencent's strong strength in the field of AI applications, but also confirms the industry's prediction of the competitive landscape of the AI industry.

The rapid rise of Tencent Yuanbao is due to its continuous function upgrades and product iterations. On February 13, Yuanbao integrated the full version of the DeepSeek-R1 model, and also supports the Hunyuan and DeepSeek models. On February 17, Tencent's self-developed deep thinking model "Hunyuan T1" began to be gradually launched, and was fully launched on February 19. On February 21, Yuanbao also launched new functions of DeepSeek, which can understand picture information and greatly improve its multi-modal understanding capabilities.

For this, the author specially asked the Yuanbao AI to conduct a systematic analysis of the possible trends of Bitcoin in the next week and one month (for reference only).

Tencent Yuanbao AI's Systematic Analysis of Bitcoin's Future Trends (February 28, 2025)

I. Current Market Environment and Key Contradictions

As of 11:00 am Beijing time on February 28, 2025, the price of Bitcoin has fallen to $80,200, with a low of $79,500 during the day, a 27% pullback from the high of $109,000 at the beginning of 2025, and the market sentiment has entered the freezing point. There are multiple intertwined contradictions behind this wave of decline:

1. Divergence between Technical Indicators and Capital Flows

From a technical indicator perspective, Bitcoin has broken below the key support of the 200-day moving average (around $82,872), the MACD indicator shows a continued death cross, and the RSI (Relative Strength Index) has fallen to the oversold area of 28.

However, on-chain data shows that whale addresses (holding over 1,000 BTC) have cumulatively increased their holdings by 26,000 BTC during February 25-27, with the cost concentrated in the $78,000-$82,000 range, forming a classic divergence structure of "retail selling-institutional accumulation".

2. Macroeconomic and Policy Risks

The Trump administration recently announced a 25% tariff on the EU and Mexico, triggering a global capital flight from risky assets, and the US dollar index has risen to a high of 105.2 for the year. At the same time, the expectation of a rate cut by the Federal Reserve has been postponed to Q3 2025, and the inversion of US bond yields has exacerbated the tightening of liquidity. Policy uncertainty has temporarily disabled Bitcoin's "digital gold" hedging attribute, making it a victim of liquidity squeeze instead.

3. Market Structure and Derivatives Leverage Liquidation

Over the past week, the total liquidation amount on the network exceeded $4 billion, with long positions accounting for as high as 90%. The open interest of Bitcoin exchange contracts reached a historical high of $49 billion. The high-leverage derivatives market forms a "sell-off → liquidation → liquidity exhaustion" death spiral when prices fall, especially in the $82,000-$85,000 range where a large number of long stop-loss orders are concentrated, exacerbating price volatility.

II. Short-term (Next Week) Trend Projection: The Final Decline and Liquidity Trap

According to the analysis, Bitcoin may complete the final violent downward exploration below $80,000 in the next week, and then enter a period of volatility due to liquidity exhaustion. Tencent Yuanbao AI verifies this logic from the following dimensions:

1. Technical Indicators: The Ultimate Showdown between the CME Gap and the Miner Cost Line

- Gravitational Effect of the Gap: The CME gap of $77,330-$80,370 formed in November 2024 has not been filled yet, and historical data shows a probability of about 90% for the gap to be filled. The current price has approached the upper edge of the gap, and if it breaks below $79,500, it may trigger programmatic trading sell-offs, with a target of $77,500.

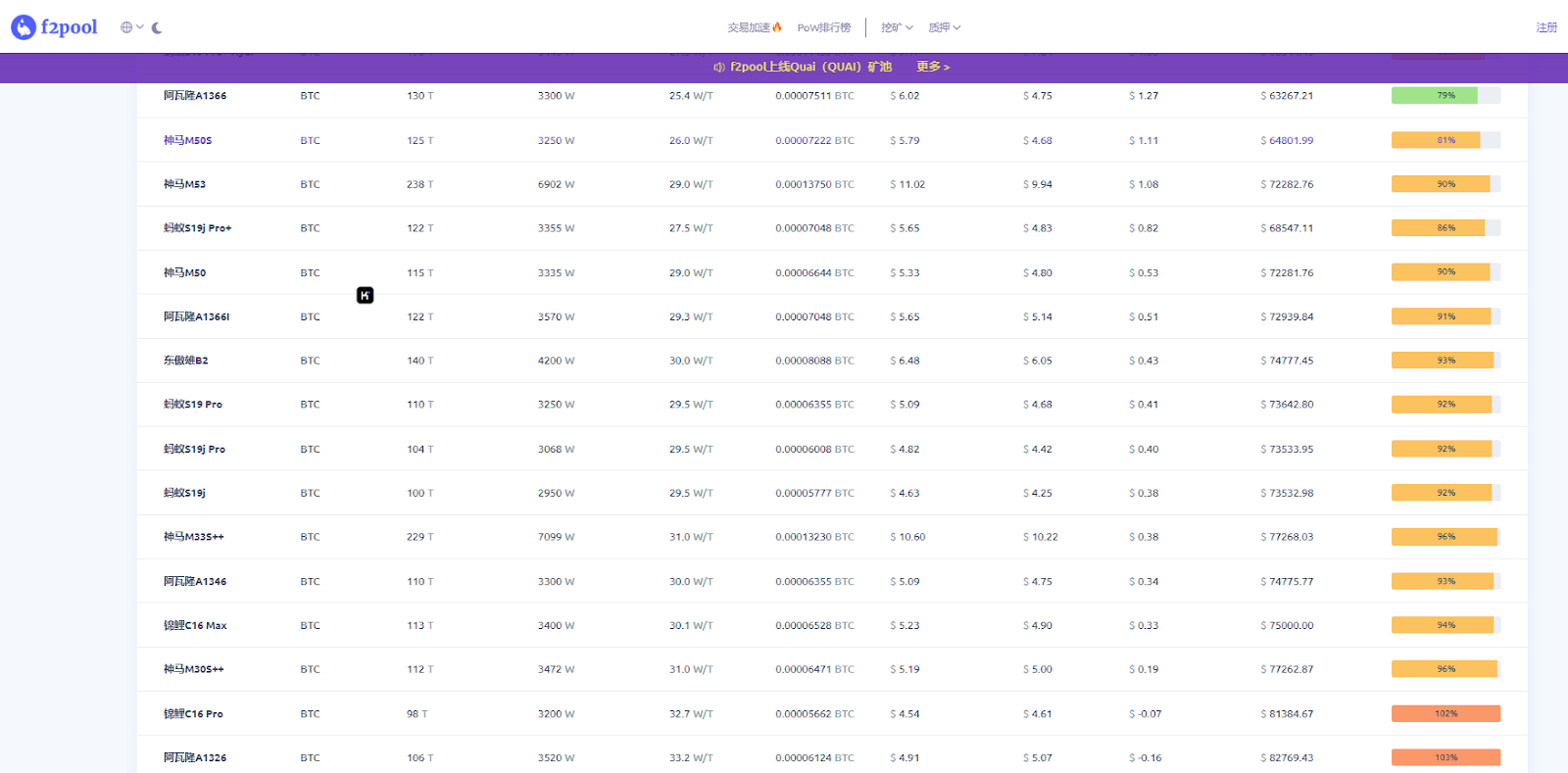

- Miner Selling Pressure Critical Point: According to F2pool data, the shutdown price for old mining rigs like Antminer S19 is around $78,000. Currently, 50.4% of the network's mining machines have fallen into losses. If the price falls below this level, the miner's selling volume may increase from the current 600 BTC per day to 1,200 BTC, exerting additional downward pressure.

2. Capital Flows: Slowing ETF Outflows and Stablecoin Premium Signals

- The US Bitcoin ETF has seen net outflows for 6 consecutive days, with a cumulative outflow of $2.4 billion in February, but the single-day outflow has decreased from $755 million to $320 million on February 27, indicating a weakening of selling pressure.

- The USDT over-the-counter premium rate has risen to 1.02% (the normal range is 0.98-1.0), indicating that Asian retail capital is buying the dips, but is constrained by the lack of liquidity on exchanges, and the actual buying demand has not yet formed a significant scale.

3. Market Sentiment: Sprouts of Reversal in Extreme Fear

- The Fear and Greed Index has fallen to 10, the lowest level since the LUNA collapse in 2022, but historical data shows that when the index is below 15, the average 30-day return rate of Bitcoin is 18%.

- The long-short ratio in the derivatives market has dropped to 0.45, and the perpetual contract funding rate has turned negative (-0.03%), indicating an excessive crowding of short positions, with the technical conditions for a short squeeze rebound.

Short-term Scenario Simulation

- Pessimistic Scenario (40% probability): The price breaks below the $78,000 miner cost line, triggering a chain reaction of stop-loss orders, quickly dropping to $73,000 (Fibonacci extension level), and then consolidating around $73,000.

- Neutral Scenario (50% probability): The price repeatedly tests the $77,000-$80,000 gap area, accompanied by a shrinking trading volume, forming a "low volume, low price" pattern, with weekend volatility falling below 2%.

- Optimistic Scenario (10% probability): The Trump administration unexpectedly releases a crypto-friendly policy signal (such as including BTC in strategic reserves), and the price quickly rebounds to above $85,000, closing above the 200-day moving average.

- In summary, the expected bottom range for Bitcoin in the short term (one week) is around $75,000.

III. Medium-term (Next Month) Outlook: Cycle Reconstruction and Catalyst Brewing

Although the short-term risks have not yet been cleared, from a medium-term perspective, Bitcoin is entering the "panic-repair-recovery" cycle transition stage,

Medium-term Price Path Projection

- First Stage (Early to Mid-March): The price will fluctuate around $75,000, digesting short-term leveraged positions. On-chain data shows that there is a 450,000 BTC overhang above $82,000, which needs to be repeatedly turned over and consumed.

- Second Stage (Late March to April): If the Federal Reserve's March FOMC meeting signals a rate cut, capital will flow back into risky assets, and Bitcoin may test the $92,000 resistance level, while Altcoins will start a catch-up rally.

- Third Stage (April to Year-end): The price of Bitcoin is expected to break through the $100,000 psychological barrier again, with a target of $120,000 (the 1.618 Fibonacci extension of the low point).

IV. Risk Warning and Investment Strategy Recommendations

1. Tail Risk Warning

- Global liquidity crisis: The US national debt has exceeded $36 trillion. If the credit rating is downgraded, it may lead to a revaluation of collateral value, and Bitcoin may fall in sync with the US stock market.

- Regulatory black swan: If the approval of Ethereum futures ETF and Ethereum ETF is delayed, or lawsuits are initiated against DeFi protocols, it will dampen market sentiment.

2. Portfolio management framework

- Short-term traders: Adopt a pyramid-style position building strategy in the $78,000-$73,000 range, with a stop-loss set at $72,000 and partial profit-taking at $85,000.

- Long-term holders: Extend the DCA (Dollar Cost Averaging) cycle to 6 months, with a target position not exceeding 15% of the total assets.

- Institutional investors: Focus on ETF discount arbitrage opportunities and use option combinations to lock in a buy-in cost below $80,000.

Conclusion: A narrative of light in the darkest hour

Although Bitcoin faces the "final drop" challenge in the short term, the medium-term driving logic remains intact. The "iron triangle" of the halving cycle, institutional allocation, and technical upgrades is still the core force supporting the price. Investors are advised to view the current volatility as a necessary stage of cyclical rotation, while focusing on the accumulation signals below $75,000. When market fear reaches its peak, it is often the last darkness before the dawn.