Author: flowie, ChainCatcher

Editor: TB, ChainCatcher

If you still expect Altcoins, the data you see may make you lose some illusions.

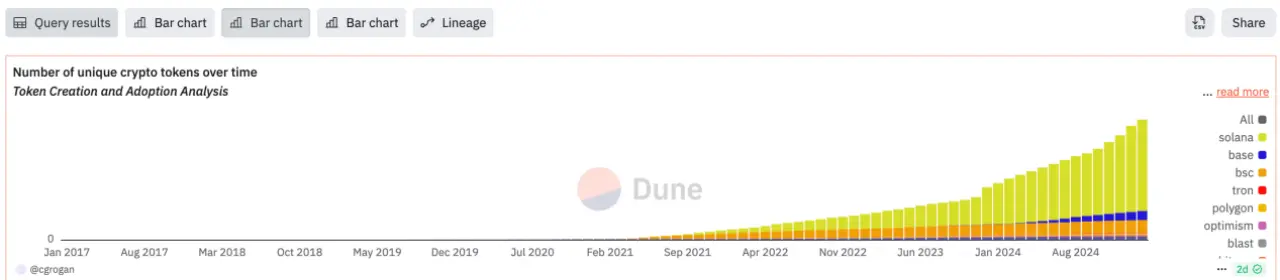

According to the Dune panel data created by @cgrogan, the number of crypto tokens has increased from over 3.4 million in 2022 to over 39 million in 2025. The crypto market created over 10.09 million and 18.7 million new tokens in 2024 and 2023 respectively.

In stark contrast to the explosive growth of Altcoins in this bull market, the number of crypto developers has actually decreased. The Electric Capital Crypto Developer Report shows that the total number of crypto developers decreased by 7% and 24% in 2024 and 2023 respectively.

The crypto market has long been an unabashedly huge "token factory", where apart from the token issuance model and the emergence of new casinos, there is basically no new paradigm innovation to be seen.

Behind the facade of fairness and overnight wealth, there is an extremely low cost of malice and a large number of defrauded ordinary users. In the long-term PvP, all the important participants, including users, have been educated to become smart short-term opportunists.

Withdraw or wait for a turnaround

Yesterday, the Crypto Fear and Greed Index fell to 10, the lowest level since June 2022. @ZKSgu refuted the externalities of Crypto, saying, "The people inside are all about to leave."

Exchanges and VCs, as the most criticized participants in this bull market, are looking for opportunities to exit or being forced to do so.

The veteran crypto derivatives exchange BitMEX is seeking to sell, and according to insiders, the largest crypto options exchange Deribit has already completed its sale, with a potential acquisition price of up to $5 billion.

It's not just the exchanges, the entire crypto field is experiencing a wave of mergers and acquisitions. According to RootData, in the first 2 months of 2025, there have been more than 20 M&A events in the crypto field, averaging more than 10 crypto M&As per month.

A large number of VCs are also facing elimination. YettaS's biggest impression at Consensus HK was the lamentations of VCs: some VCs couldn't raise funds for the next round, some VCs lost half their staff, some VCs turned to strategic investing instead of independent investing, and some VCs even considered issuing MEMEs to raise funds.

Investor @26x14eth has started to urge young people not to focus their most precious time on crypto mining, and to intern in industries with potential, such as AI and robotics, as this is no longer the money-making cycle of 2017-2021, and the most valuable asset now is time.

But some are waiting for a turnaround. Crypto KOL @cmdefi is not so pessimistic. He feels that the current market is like 2018-2019, when everyone thought the market had no hope and was all a scam after the ICO bubble burst.

"But then the DeFi Summer came in 2020, with less speculative capital and the market more focused on application innovation. Stay in the game. (Wait for a turnaround)."

The crazy "bloodsucking" of the token production line

This bull market is indeed hell-level difficult.

There is almost no crypto construction that is surprising. From Trump driving the celebrity coin "harvest" craze, to the recent Safe hack, everyone has just woken up to realize how absurd and vulnerable the crypto system is.

The current state of the crypto ecosystem depicted by overseas KOL @sherlock has resonated with the market, with the crypto construction being so flimsy and the conspiracy groups being ubiquitous.

It's also harder to make money in this bull market.

Players who have been through the previous bull market may be particularly painful. Exchanges like Binance, once the wealth creation myth, have become the dumping ground for on-chain meme tokens, and the so-called alpha listing is the peak. Presto Research found that 100% of the tokens listed on Binance in the first month of 2025 have dropped by more than 70%.

If you are a diamond-handed holder of the top 20 tokens by market cap, you are no longer rewarded either. From July 2024 to now, the top 20 tokens have generally fallen by more than 60%. And the shearers also sigh that even with more effort and upgrades, they still can't escape being sheared.

The seemingly fairer on-chain PVP is also a mess.

As of February 26, the Pump.fun platform has issued more than 8.1 million tokens, with nearly 32 MEME coins worth over $100 million and only 154 worth over $10 million. Now, after the celebrity coin scandals like Libra, on-chain PVP is also coming to an end.

Without real crypto construction, most people can't make money either, so where did the money go?

Conflux co-founder He Yi may have revealed the truth - apart from a few lucky ones, the vast majority of the money has flowed to the various beneficiaries of the "token production line".

He Yi shared on Twitter that "the 'token factory' not only has VCs, serial entrepreneurs, market makers, OL Agencies, studios, whales, and exchanges, but a complete production line that greedily sucks the lifeblood of this industry and the sheeple."

In the crypto market, token issuance and selling is the biggest business model.

In He Yi's view, under the "token factory" model, the wealth creation process of projects is mainly concentrated in the two core links of token allocation and listing. And the token production line model is:

Secure low-cost tokens from core circles (such as Vitalik, a16z, Binance, etc.) or influential meme leaders as backers

Fabricate a beautiful narrative and use artificial data (TVL, on-chain data, node scale, etc.)

Bind interests with KOL groups to complete Twitter shilling

Hunt down the core decision-makers influencing the listing (such as He Yi) to complete the final push

After listing, start dumping through market makers, and repeat the above steps to create the next project.

An investor who has experience in both Web2 and Web3 also told ChainCatcher that since there is no R&D investment and the team only needs to maintain a few people, as long as they complete the token listing and cash out without dying, "the market elimination mechanism has completely failed, with more and more shit coins and tokens."

But when ordinary users are no longer easily fooled by the "narrative" collusion between project parties and VCs, an even more brutal meme token model has taken the stage. The same methodology, just without the VCs.

Behind the seemingly fair token issuance with almost no threshold, is an extremely low cost of malice. Primitive Crypto partner @YettaSing believes that the Meme model is essentially a darker on-chain world than the VC model. Due to the lack of product and technical support, "absolute fairness" is often just a facade. The Libra celebrity coin scandal has unveiled the last veil of meme.

Where should the first shot of revolution be fired?

The wealth effect is failing everywhere, and the industry has started collective reflection and accountability.

Recent public opinion has again targeted the shearing studios. Crypto KOL @mscryptojiayi believes that Altcoins can't hold their heads up, and the first shot of industry revolution should be fired at the rampant "bribery system".

In her view, the studios have "colluded" with project parties to construct an industry "false prosperity", not only diluting the expected returns of ordinary users, but also weakening users' long-term loyalty to projects, causing the community to degenerate from a value community to a transaction market, and also laying mines for the secondary market crash.

She criticized that there are even many studios without bottom lines that are in cahoots with fraudulent projects, implementing the shameless acts of co-building old rat traps, deceiving exchanges and users.

However, the KOL Ice Frog@Ice_Frog666666 in the airdrop track refuted this. He believes that "false prosperity" is the result of industry distortion, but not the cause. Studios are not the biggest beneficiaries and rule makers, if the knife is not aimed at the biggest beneficiaries and not aimed at the rule makers, the reform is doomed to be ineffective.

In addition to the hair-pulling studios, this bull market is believed to be related to the collusion between the project parties and the two major beneficiaries, VC and CEX, which have been attacked many times.

During the Hong Kong Consensus Conference, regarding the chaos of shit coins flying around, a Crypto VC even criticized that "90% of VCs should be closed down".

The rise of VC coins is also due to the fact that there were too many crypto scams after the ICO, and the projects screened and endorsed by VC were gradually recognized by retail investors.

However, the leader of these retail investors has already lost trust. Retail investors believe that VCs can acquire chips at a lower cost and have information advantages, colluding with project parties to dump tokens and harvest users.

In this bull market, VC coins are generally overvalued and have low liquidity, causing the market to be dumped as soon as they are listed, which is also the root cause of the dissatisfaction of community users.

He Yi also directly stated in last year's AMA response to the listing controversy that "some VCs are indeed the core reason for the artificially high prices."

The ordinary retail investors are always the ones who get hurt.

As the most powerful link in wealth creation, the exchange is naturally also considered by the general market to be difficult to shirk responsibility.

Mainstream exchanges such as Binance and Coinbase have been frequently attacked by listing controversies in the past year. The sky-high listing fees of CEX were once seen by Moonrock Capital CEO Simon as the biggest reason for the project parties' inability to bear and the loss of market liquidity.

Although He Yi later denied the sky-high "listing fees", the listing mechanism of CEX, the "inner circle" insider trading, etc. have always been questioned as one of the culprits of harvesting and sucking blood from shit projects.

Although He Yi has repeatedly stated that Binance has a transparent and complex listing process, the meme TST on the BNB chain has recently been listed quickly and immediately dumped, and even CZ has begun to question Binance's listing issues.

Not only exchanges and VCs, but any beneficiary in the "token factory" can almost be "revolutionized". Crypto KOL @CyberPhilos believes that the three major pests in the Crypto world, in addition to CEX, are KOL Agency and market makers.

A common view is that the major participants in this bull market have become too path-dependent, without enough native innovation, and everything becomes invalid after there is no new external liquidity inflow. But is this the cause or the result? Why might every party in the chain become a "pest"?

Overseas KOL Murtaza reflected that "wealth came long before utility, not just a small mistake that will be solved by itself over time. This actually poses a fatal threat to the technology realizing its potential."

Murtaza mentioned that the market capitalization of the global cryptocurrency industry exceeds $2 trillion. Usually, an industry of this scale is only formed after something useful to society has already been developed.

Bill, the co-founder of Cypher Capital, and @0x_Todd, a partner at Nothing Research, have similar views in reflecting on the dilemma of VCs and exchanges.

Bill said that Web3 VCs and Web2 VCs follow completely different logics, with the former emphasizing "early fame is the key", and the mode of quickly creating wealth drives founders to chase trends, focus on marketing and rush to list on exchanges.

In Bill's view, Web3 actually needs more "patient capital" - VCs who adopt the Web2 style approach and support founders in establishing long-term value in the mainstream market, so that teams can focus on product development instead of rushing to cash out.

The CEX listing dilemma may also stem from the premature realization of wealth by project parties. @0x_Todd believes that compared to the traditional Web2 market's public offering, the problem with Crypto protocols is that they enjoy the benefits of traditional listing: investor exit/employee incentives, but do not bear any of the obligations of traditional listing.

The lack of crypto regulation is also a key issue. @0x_Todd said that "bribery, fraud, brushing, cheating" and all other tricks should be fully exposed, because there will be no punishment.

Currently, the crypto panic sentiment has reached an extreme point, and although everyone is held accountable and reflects, they are also collectively trapped. Whether the industry can truly "scrape the bone and heal the wound" and usher in a moment of clearing is still unknown.