In the early hours of March 4th, the "harrowing night" in the crypto market made investors deeply experience the cruelty of the crypto market. The market data shows that BTC plummeted from the weekend high, falling below $86,000, with a 24-hour drop of 4.39%; ETH even lost the $2,200 mark, with a drop of over 6%. This crash not only filled the $77,000 gap in the CME Bitcoin futures, but also tore open the deep-seated contradictions under the surface of the market prosperity - when policy incentives, technical rules, and capital games intertwine, who is really steering the direction of the market?

The Illusion of Prosperity: The "Paper Bull Market" on March 2nd

Looking back at the scene on March 2nd when Trump announced the inclusion of XRP, SOL, and ADA in the US strategic reserve, the 10,000 USD surge in BTC within 3 hours seems like a distant memory. However, on-chain data reveals the essence of this frenzy: This was a "castle in the air" driven by futures leverage.

- Spot market is illusory: Although major exchanges recorded a net inflow of 13,000 BTC, the trading volume on Binance spot was only 65,000 BTC (about $59.7 billion), far lower than the 104,000 BTC ($77 billion) during the same level of price increase last November. What really drove the price was the surging futures positions on CME and Bybit - the total open interest exceeded $53.8 billion, with $14.3 billion concentrated on CME.

- The "Reverse Signal" of Stablecoins: The on-chain reserves of USDT and USDC decreased by $580 million in 24 hours, and the USDT/BTC trading pair ratio soared to 67%. This seems to be an influx of funds into the crypto market, but it is actually the "musical chairs" of existing capital under the leverage effect.

- The Precise Harvesting of Whales: Addresses holding 1,000+ BTC increased their holdings by 42,000 BTC during the surge, but 3 anonymous addresses each received over 10,000 BTC in a single transaction. On-chain traces show that most of these coins came from the activation of cold wallets, implying that the "smart money" with early layouts took the opportunity to cash out.

This surge without real capital support has already laid the groundwork for the subsequent crash.

Recommended reading: Recap of Bitcoin's One-Day Surge of $10,000, Turns Out to Be Dominated by the Futures Market

Macroeconomic Recession Clouds Loom over the Market

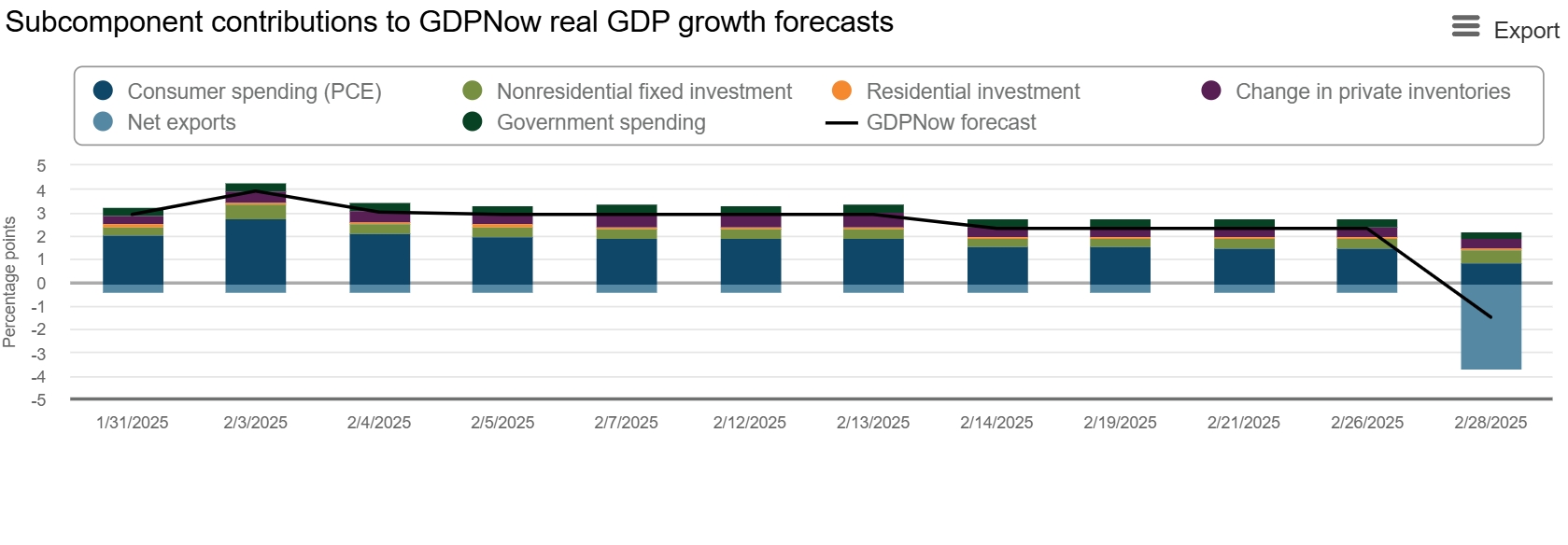

Currently, the global macroeconomic situation is exerting significant pressure on the cryptocurrency market. Taking the US as an example, the GDPNow model of the Atlanta Fed forecasts that by the end of the first quarter of 2025, US GDP will contract by 2.8%, a disastrous reversal compared to the previous forecast of 3.9% growth four weeks ago. This recessionary outlook has made investors more cautious towards risk assets, and cryptocurrencies, as high-risk assets, are naturally the first to be affected.

Since the approval of the Bitcoin ETF, the connection between the cryptocurrency and traditional financial markets has become increasingly close. During periods of economic prosperity, this integration may attract more capital inflows to the crypto market; but under recessionary expectations, its drawbacks are exposed. Once the US economy falls into a trough, the turmoil in the traditional market will quickly transmit to the crypto market, undermining investor confidence. The violent fluctuations in Bitcoin prices in the past few days are a reflection of this trend - although there was a brief rise over the weekend, the gains were quickly wiped out, and the market sentiment is clearly depressed.

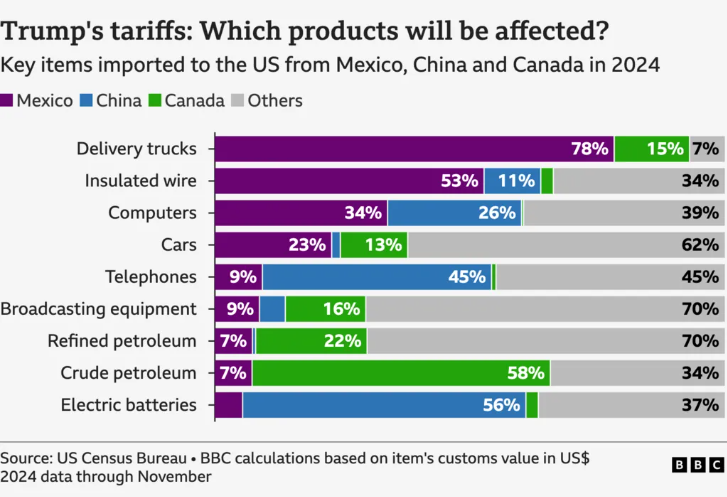

Trade War: Tariff Policies Shatter the Illusion

The escalation of the trade war has further exacerbated market uncertainty. US President Trump recently announced tariffs on Mexico, Canada, and made it clear that there is "no room for negotiation". Subsequently, he announced on Truth Social that "reciprocal tariffs" will be implemented against the EU, Japan, and South Korea from April 2nd, based on their tariff levels against the US. This tough stance has exceeded market expectations. Previously, many believed that Trump's tariff policy might just be a bargaining chip with some flexibility. However, the latest statements indicate that the tariff war has fully begun, and the market must face this reality.

The imposition of tariffs will drive up the prices of imported goods, further exacerbating inflationary pressures in the US. In a high-inflation environment, the Fed's room for rate cuts will be compressed, and high interest rates may persist for a longer period. This not only increases the risk of economic recession, but also puts pressure on the cryptocurrency market, which relies on liquidity and risk appetite. The market crash on March 4th is a direct reflection of this expectation adjustment.

In addition, the ongoing Russia-Ukraine conflict also casts a shadow over the market. Ukrainian President Zelensky stated that the war will not end soon, shattering the market's expectation of a short-term resolution. The combination of geopolitical risks and tariff policies has further weakened investors' risk appetite.

This series of policies not only strikes US stocks, but also affects the crypto market through the linkage effect with US stocks. Crypto market maker Efficient Frontier pointed out that if US stocks continue to weaken, the crypto market may face greater adjustment pressure.

Filling the Futures Gap: Technically Driven Correction

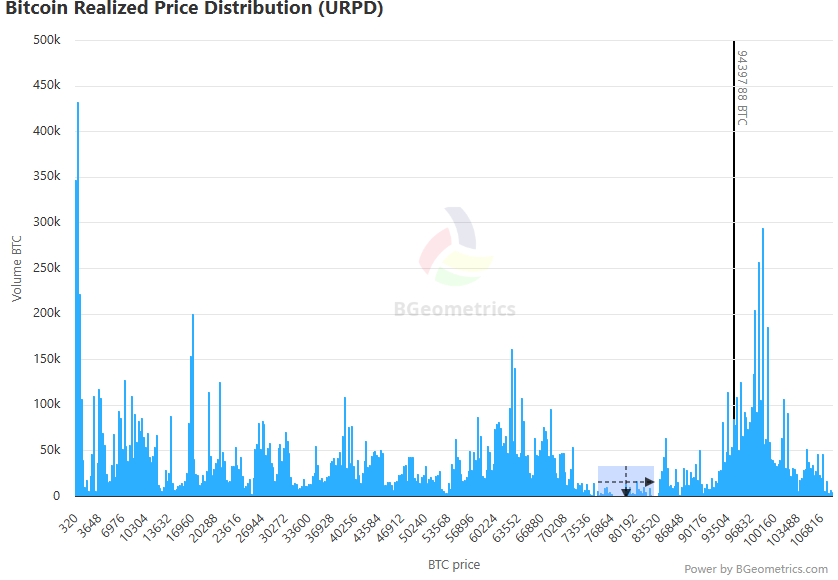

From a technical analysis perspective, the filling of the CME (Chicago Mercantile Exchange) Bitcoin futures gap is one of the important triggering factors for this decline. The CME gap refers to the difference between the CME Bitcoin futures price and the spot price, which usually forms on weekends or holidays. Historical data shows that the probability of filling the CME gap exceeds 90%, and the URPD (Unrealized Profit/Loss Distribution) indicator also shows a significant gap around $77,000. Historically, URPD gaps have always been filled.

Recently, the market price quickly fell to this level and then rebounded rapidly, a pattern that is highly consistent with the characteristics of gap filling. In the context of depressed market sentiment and intensified technical selling pressure, gap filling often amplifies price volatility, forming the technical basis for the "door painting" market. Although the timing of the filling is uncertain, the probability and impact of its occurrence cannot be ignored.

Outlook: Regulation and Capital Flows Become Key

Looking ahead, the trend of the crypto market may be driven by the following factors:

- Market Differentiation Under Regulatory Pressure The US SEC has established a "Crypto Regulatory Task Force" and is clearly cracking down on speculative tokens without practical value (such as Altcoins), while DeFi and GameFi may also face scrutiny due to excessive narratives. Additionally, the EU's MiCA regulation will come into full effect in January 2025, which may further constrain the survival space of Altcoins.

- Capital Concentration on Compliant Assets The Trump administration's "Strengthening American Leadership in Digital Finance Technology" executive order and the "Stablecoin Clarity Act" have sent positive signals. However, capital may prioritize assets supported by policies (such as BTC, ETH, and stablecoins) rather than broadly boosting the Altcoin market.

- Opportunities in Short-Term Volatility Although macroeconomic risks have not yet dissipated, events such as Ethena's $100 million financing and the launch of the Ethereum Pectra testnet upgrade have injected local vitality into the market. If the "Crypto Summit" on March 7th by Trump can provide clear policy direction, it may become a catalyst for a new round of market trends.

Conclusion: When the Tide Goes Out

The filling of the CME gap has completed the technical self-correction, but the real test of the market is just beginning. The White House Crypto Summit on March 7th may bring new policy sparks, but investors need to be vigilant: against the backdrop of macroeconomic headwinds, unclear regulatory frameworks, and the game of capital stock, any positive news could become a catalyst for both bull and bear markets. For ordinary investors, maintaining rationality is particularly important in this "painting the door" market. Focusing on compliant and fundamentally sound assets may be a better strategy to navigate the cycle.