Source: glassnode; Compiled by Tao Zhu, Jinse Finance

Summary

In recent weeks, digital assets have experienced significant selling pressure, with Bitcoin dropping 28% and the prices of Ethereum and Solana plummeting over 50% from their cycle highs.

With the market selloff, realized losses have increased significantly, marking the second-largest loss event of the cycle, highlighting the severity of the adjustment.

Following President Trump's announcement of a strategic cryptocurrency reserve, the major digital assets did see a brief rebound. However, this turned into another "sell the news" event, with prices continuing to decline and falling below pre-announcement levels.

The strong convergence between price structure and key on-chain indicators suggests that $92,000 remains a critical level for Bitcoin to re-establish an upward momentum, while the $70,000 level appears to be a key area for bulls to establish support (if reached).

Violent Volatility

The ongoing contraction in overall market liquidity, as evidenced by the sustained uptrend in the US Dollar Index (DXY) over the past several months, is a clear indication. As all-weather trading assets, the prices of digital assets tend to be among the first to react to this liquidity contraction, providing a leading signal for other markets.

Last weekend, President Trump announced that he is developing a strategic cryptocurrency reserve plan, including BTC, ETH, SOL, ADA, and XRP. This triggered a brief but strong recovery in market forces, with prices surging significantly.

However, over the subsequent days, each asset has retraced a large portion of this move, turning into a classic "sell the news" event, as prices fell back below pre-announcement levels.

Bitcoin remains the most resilient in the basket, with its deeper liquidity conditions and market size making large market swings more difficult to achieve. However, the second and third-largest digital assets, Ethereum and Solana, have both experienced quite substantial devaluations, falling over 50% from their cycle highs.

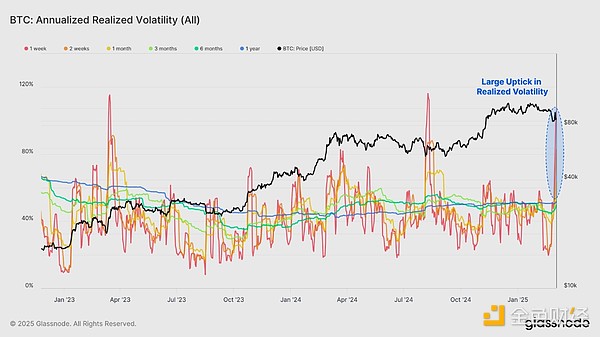

Volatility Release

As the violent price swings have indicated, the past two weeks have seen a very turbulent environment against the backdrop of political uncertainty.

We can observe that Bitcoin's realized volatility has spiked significantly across several time frames. From this perspective, the 1-week and 2-week rolling windows have recorded the highest volatility values of the cycle so far, exceeding 80%.

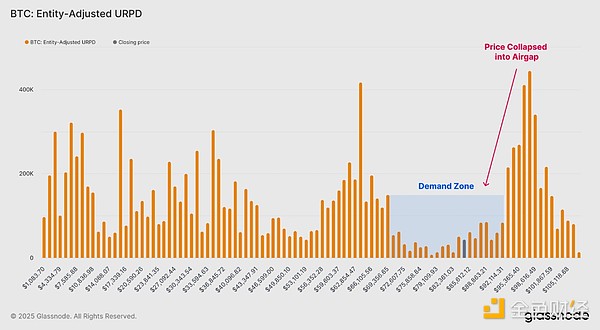

On-chain data can provide a relatively clear understanding of the acquisition patterns of market participants. The URPD metric is a useful tool, providing us with insights into the cost basis clusters of the BTC supply.

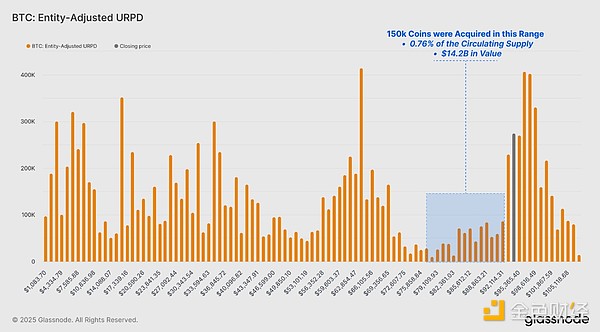

Notably, the initial price plunge has pushed the market below the $86,000 level, where relatively few tokens had previously changed hands. To some extent, the market is testing whether bulls are willing to provide demand support in this area, especially given that so many tokens were acquired at prices above $90,000 and are now holding unrealized losses.

Between February 26 and March 3, over 150,000 tokens (0.76% of the circulating supply, equivalent to $14.2 billion) were purchased in this "gap" area below $86,000.

As prices begin to recover towards the upper bound of this area, it remains to be seen whether investors from the large clusters above $90,000 will view this rebound as an opportunity to exit liquidity and reduce their losses.

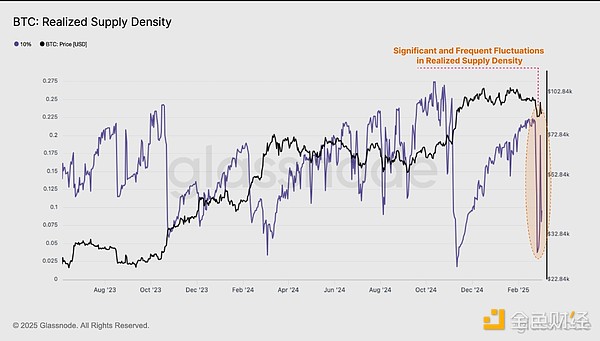

The Realized Supply Density metric quantifies the supply currently concentrated within a ±10% price range around the spot price. When supply is highly concentrated near the spot price, small price movements can significantly impact investor profitability, further exacerbating market volatility.

Under these assumptions, we can observe how the previously concentrated supply within a narrow price range has responded to the heightened volatility.As prices have declined, the Realized Supply Density has dropped significantly, indicating a substantial shift in investor profitability.

This metric highlights the violent volatility experienced by the market, which may impact investor sentiment going forward.

Losses

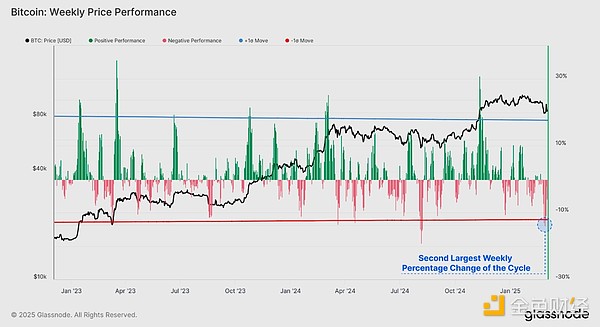

While Bitcoin has performed relatively better than other major assets, the recent selloff is still the second-largest weekly decline of the cycle. Last week, the market fell -13.9%, second only to the Japanese Yen carry trade unwind event on August 5, 2024.

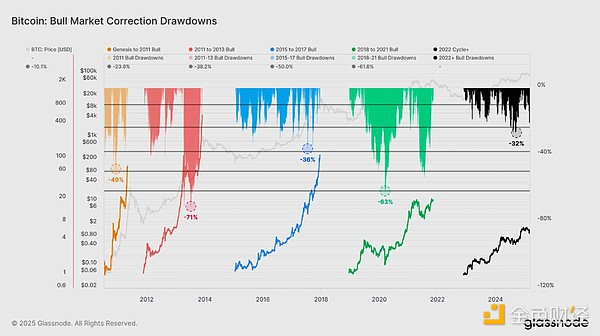

Despite the magnitude of this adjustment, the decline is still consistent with previous cycle drawdowns, with Bitcoin's trading price now 28% below its all-time high. This highlights the relatively robust demand conditions for Bitcoin within the 2023-25 uptrend, which is characterized by smaller drawdowns compared to previous cycles.

While a 28% decline in 2023-25 is a significant pullback, the typical drawdowns in 2017 exceeded 30%, while the 2019-21 cycle saw multiple 50% declines.

Challenging Environment

When the Bitcoin market experiences a selloff, studying the reactions of investors can yield valuable insights. This helps us better understand the changing behavioral patterns and overall sentiment.

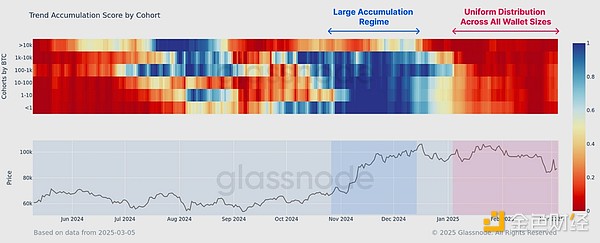

We can observe a clear consistency in the accumulation and distribution behavior across different wallet size cohorts. Over the past two months, all wallet size groups have engaged in significant distribution, exerting substantial selling pressure on the market.

The intensity of this selling pressure has intensified since mid-January, contributing to the recent market weakness.

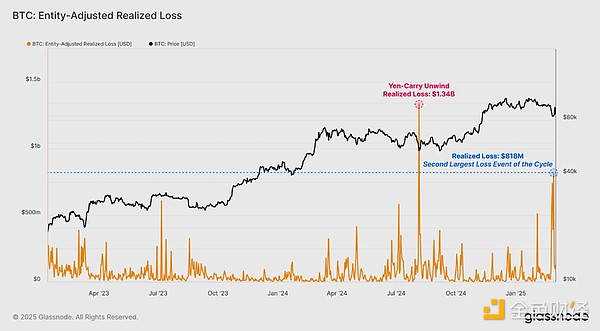

A significant portion of the selling pressure comes from tokens locked in losses. This week, the total realized losses across all market participants reached $8.18 million per day, second only to the Japanese Yen carry trade unwind event on August 5, 2024 ($13.4 million).

This indicates that the current market downturn is a challenging environment for investors, with many exiting the market at prices below their cost basis under the pressure of losses.

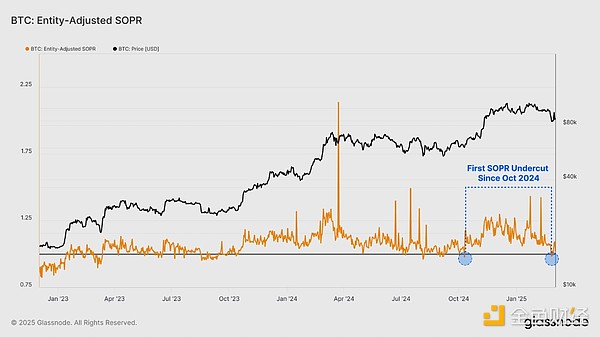

From the SOPR metric's (evaluating the average profit/loss multiple of locked-in investor positions) perspective, we note that this is the first loss-dominant period since October 2024.

However, if the SOPR finds support at the breakeven level of 1.0, the structure would still be constructive.A swift and brief dip below the 1.0 equilibrium level suggests that investors are buying and defending their cost basis, which is a typical characteristic of a bull market.

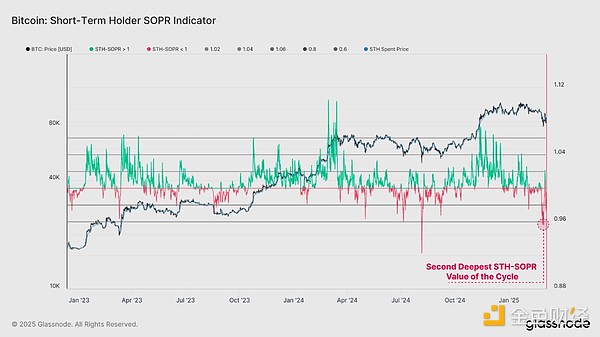

Furthermore, the short-term holder group, representing new market demand, has recorded the second-largest negative SOPR of the cycle, further highlighting the exceptionally challenging market environment faced by new investors.

This indicates that new investors have locked in massive losses this week, which may be a sign of a major turning point in investor sentiment.

Maintaining Momentum

Now we will use on-chain data to assess price behavior and market trading conditions relative to key cost basis levels.

Evaluating the price structure over the past few months, we notice three key pricing points:

November 2024, the initial breakout above $70,000.

As the market broke above $80,000, prices saw a significant rally.

During the consolidation phase, the low end of the range was around $90,000.

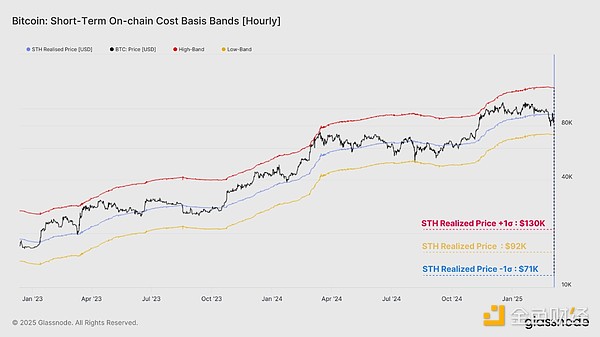

Historically, the short-term holder cost basis has been an important reference level in the uptrend of a bull market. We have calculated the ±1σ range of the short-term holder cost basis, which typically serves as the upper and lower bounds for local price behavior.

Currently, the trading prices for these levels are:

Short-term holder cost basis +1σ: $130,000

Short-term holder cost basis: $92,000

Short-term holder cost basis -1σ: $71,000

This week, the spot price has fallen below the short-term holder cost basis and is currently trading within this level and the lower -1σ range.

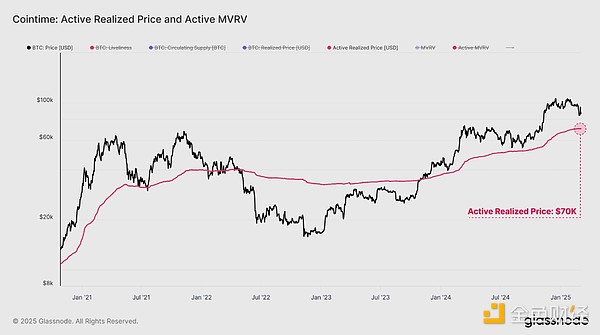

The Realized Price helps support this assessment. The Realized Price provides a more realistic cost basis estimate for active investors. Since 50% of trading days are above and below the Realized Price, this level can be viewed as a key threshold to distinguish between bull and bear markets.

The Realized Price is trading at $70,000, consistent with the lower bound of the STH-CB and the previous discussion of the air gap lower bound in the URPD metric. Given the significant convergence between several key cost basis indicators, this price area becomes a zone of interest, perhaps the last line of defense for the bulls in a full capitulation scenario.

Conclusion

The increased volatility over the past few months has led to widespread price declines across all digital assets. This has triggered a significant loss event, which is the second-largest capitulation event in our current cycle.

For the Bitcoin market, the decisive response around the $92,000 short-term holder cost basis seems to be a key level to monitor local momentum. If the market deteriorates further, the $71,000 area will become a critical zone of focus. It is consistent with multiple technical and on-chain indicators, and if reached, this would be an important level for the bulls to defend.