Author: 0xjs@Jinse Finance

The crypto summit announced by the White House a week in advance was officially held at the White House on March 8.

Within this one-week period, the crypto market has staged multiple "door-opening" events under the performance of US President Trump. There were social media posts announcing SOL, XRP, ADA, BTC and ETH as the US crypto reserves, as well as pre-heating of the crypto summit guests, and the signing of an executive order on "Strategic BTC Reserves and US Digital Asset Reserves".

Because many key information about the White House crypto summit was pre-revealed by Trump's executive orders, there was not much new information added during the summit. Therefore, during the summit, the Bitcoin price fell from $90,000 to around $86,000.

Jinse Finance has summarized some important information about the White House crypto summit as follows:

Trump's Speech: Exploring New Paths to Accumulate More Bitcoin, Accelerating Dollar Stablecoin Legislation

I know many of you have been fighting for this for years.

In 2024, I promise to make America the world's Bitcoin superpower and the global capital of cryptocurrencies, and we are taking historic action to fulfill this promise.

Bitcoin reserves will become the digital gold of the US Treasury, a virtual Fort Knox.

My administration is working to end the bureaucracy's "Operation Chokepoint 2.0" war on cryptocurrencies.

The federal government has become one of the largest holders of Bitcoin, having acquired up to 200,000 bitcoins through civil and other legal actions and law enforcement actions. These assets currently held will form the basis of the new reserves. Unfortunately, most of the BTCs were sold during the Biden administration in recent years.

From today on, the US will follow a very clear principle: never sell your Bitcoin.

The government is currently compiling an inventory of crypto assets, which will be stored in a new US Digital Asset Repository and properly managed. I also want to express my strong support for the efforts of lawmakers and Congress, as they are drafting legislation to provide regulatory certainty for the dollar stablecoin and digital asset markets. They are working very hard on this. This is a huge opportunity for economic growth and innovation in our financial sector.

The Treasury and Commerce Departments will explore new ways to accumulate more Bitcoin for the crypto reserves, without costing taxpayers anything. I have ordered federal agencies to take inventory of the digital assets currently held by the US government and determine how to transfer them to the Treasury, where the digital assets will be stored in a new US Digital Asset Reserve.

Hoping to pass stablecoin legislation before the August recess, as well as advance federal government regulation of cryptocurrencies, with the hope of keeping the US dollar "in the long run as the dominant reserve currency".

Treasury Secretary Scott Besent: In-Depth Thinking on the Stablecoin System

We will think deeply about the stablecoin system, as President Trump has directed, and we will maintain the US's position as the world's leading reserve currency, using stablecoins to achieve this. Technology is the foundation of the Trump administration, and we will use technology to drive America forward.

The Trump administration will end the "weaponization of regulation" against digital assets.

We will position America as the leader in the digital asset strategic domain. It is very important that America recognizes this fact and leads other countries in the digital age.

The US dollar will remain the primary reserve currency, and we will use stablecoins to help achieve this.

US Commerce Secretary Howard Lutnick: Using Bitcoin, Digital Assets and Blockchain to Drive America Forward

Technology is the foundation of President Trump's tenure. This administration will use Bitcoin, digital assets and blockchain to drive America forward and maintain its global economic leadership. I am proud to work with President Trump and other leaders in the cryptocurrency field to advance our country in this new domain.

MicroStrategy CEO Michael Saylor Shares Document: $60-100 Trillion in Interests Repaying National Debt

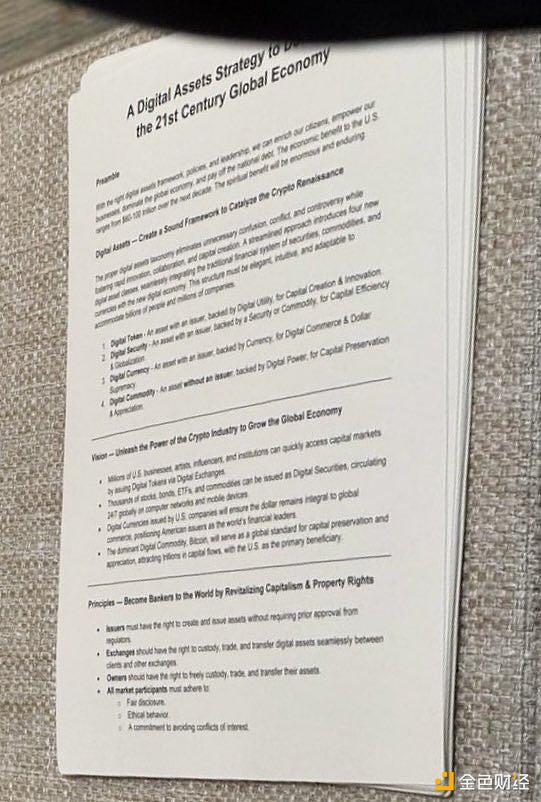

Topic: A Digital Asset Strategy for the 21st Century Global Economy.

Foreword: With the right digital asset framework, policies and leadership, we can unlock the economy, empower businesses, stimulate the traditional economy and repay national debt. Over the next decade, the economic benefits to the US will be $60-100 trillion. The spiritual benefits will be immense and lasting.

Digital Assets - Creating a Sound Framework to Catalyze the Crypto Renaissance

A proper digital asset framework can eliminate unnecessary confusion, conflict and controversy, while balancing competition, cooperation and capital creation. A streamlined social, economic model and regulatory category system that can easily integrate the traditional financial system, intuitive and applicable to digital asset categories, is the guarantee of the economy. This structure must be elegant to achieve capital creation and innovation, accommodate billions of people and millions of companies.

1. Digital Tokens - Assets with an issuer, supported by digital utilities, used for commodities, used for capital efficiency.

2. Digital Securities - Assets with an issuer, supported by securities or commodities.

3. Digital Currencies - Assets with an issuer, supported by currency, used for digital commerce and dollar hegemony.

4. Digital Commodities - Assets without an issuer, supported by digital rights, used for capital preservation.

Vision: Unleash the Power of the Crypto Industry to Promote Global Economic Development

Millions of American businesses, artists, influencers and institutions can issue digital tokens through digital exchanges, quickly accessing capital markets.

Thousands of stocks, bonds, ETFs and commodities can be issued as digital assets, circulating on global computer networks and mobile devices.

Digital currencies issued by US companies will ensure the dollar remains indispensable in global trade, making US assets the world's financial leaders.

The dominant digital commodity Bitcoin will become the global standard for capital preservation and appreciation, attracting billions of dollars in capital flows, with the US as the primary beneficiary.

Principles: Becoming the World's Banker by Revitalizing Capitalism and Property Rights

Issuers must have the right to create and issue assets without prior approval from regulators.

Exchanges should have the right to seamlessly custody, trade and transfer digital assets between clients and other exchanges.

Owners should have the right to freely custody, trade and transfer their assets.

All market participants must comply with: fair disclosure. Ethical conduct. Commitment to avoid conflicts of interest.

No one has the right to engage in fraudulent behavior, and everyone must be civilly and criminally responsible for their actions.

The industry should be responsible for disclosure and compliance, allowing the market to function organically.

Digital assets should flow freely on the internet, as fast as the computational process allows, without censorship or regulatory impediments.

By establishing superior financial protocols, America can lead the world in digital finance, attract global capital, and lay the foundation for the future economy.

The Urgent Task - Ending the Crypto War and Driving the Digital Transformation of the Economy

Hostile and unfair tax policies towards crypto miners, holders and exchanges hinder industry growth and should be eliminated, while arbitrary, capricious and discriminatory regulations should be repealed.

The government should encourage and support major banks to custody, trade and finance Bitcoin assets. Crypto industry participants should not be allowed to operate outside of banks.

In order for the industry to fully realize its potential, it needs to be recognized as legitimate and treated fairly by traditional banks, insurance and financial institutions, as well as government agencies.

Opportunities - Economic Transformation and Development in the US Over the Next Decade

Digital Tokens - Expand the capital base of US companies by $10 trillion, dominate global products and services. We export our ideas to the world.

Digital Security - Grows the value of US securities by $20 trillion, establishing a leadership position in the global stock, bond, and derivatives markets. We export securities around the world.

Digital Currency - Increases US national debt by $10 trillion, consolidating our dominance in the global banking, credit, and monetary markets. We export our currency globally.

Digital Commodities - Adds $20 trillion in long-term capital assets, increasing the wealth of American households and businesses. We export our values to the world.

Over the period 2025-2035, acquire 5-25% of the Bitcoin network trust for the nation through sustained programmatic daily purchases, by which time 99% of BTC will have been issued.

The Strategic Bitcoin Reserve (SBR) could create $16-81 trillion in wealth for the US Treasury by 2045, providing a viable path to offset national debt.

Never sell your Bitcoin! By 2045, the Bitcoin reserve should generate over $10 trillion in annual income, growing perpetually as a lasting source of prosperity for future generations of Americans.