This article was created by the exclusive Korean partner of GIG DAO, Notch Ventures, analyzing the structural advantages and regulatory challenges of listing on the two major exchanges in Korea, and exploring potential market trends through recent successful listing cases.

When it comes to the Korean cryptocurrency market, what comes to your mind? Is it the $LUNA crash in 2022, or the huge arbitrage opportunities brought by the "kimchi premium"? I think for industry practitioners, the most anticipated thing is hoping that one day their project can be listed on the Korean exchanges, and the coin price can take off 🚀

1. Overview of the Korean Cryptocurrency Market: A Duopoly Market with 98% Market Share

1.1 Why is the Korean market so attractive?

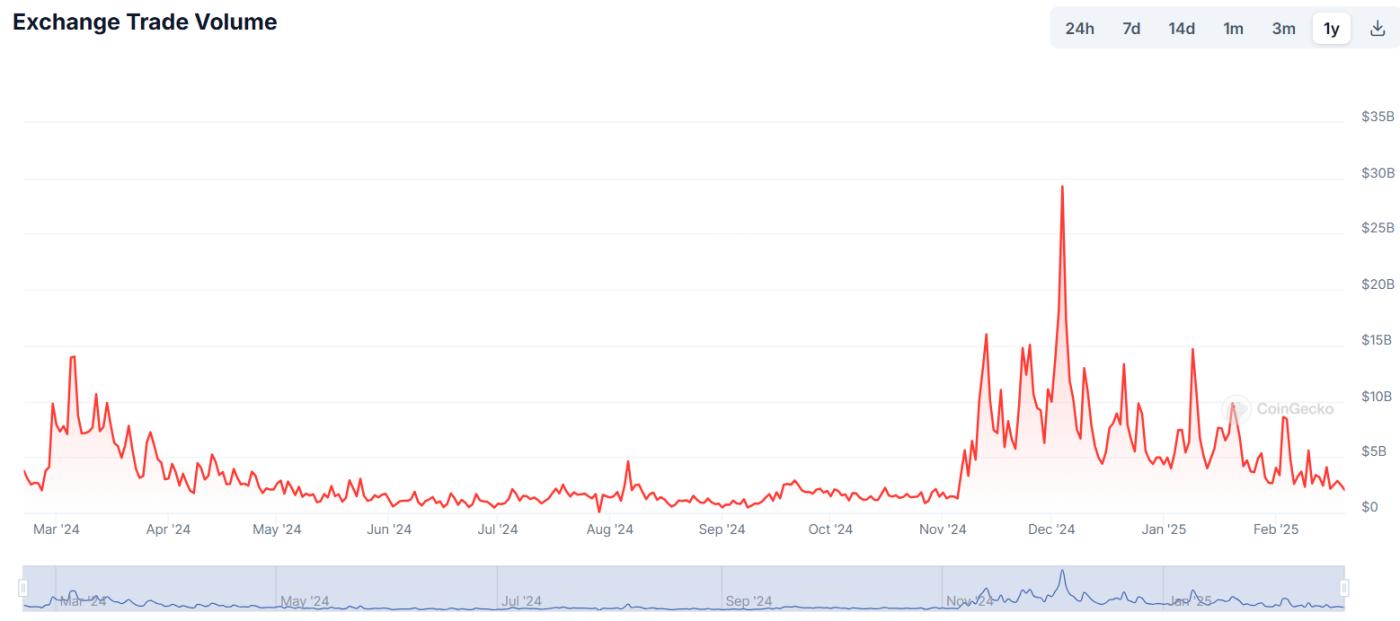

Due to the emergency martial law issued by Korean President Yoon Seok-yeol on the evening of December 3, 2024, the financial market was highly tense, and the trading volume of the Korean cryptocurrency market reached a historical peak the next day, with Upbit's KRW trading volume reaching ₩51.2 trillion (about $387 billion), far exceeding its usual ₩10 trillion benchmark, accounting for 80.5% of Korea's cryptocurrency trading volume. This made Upbit rank second globally in daily retail trading intensity, second only to Binance, although its global influence is relatively small.

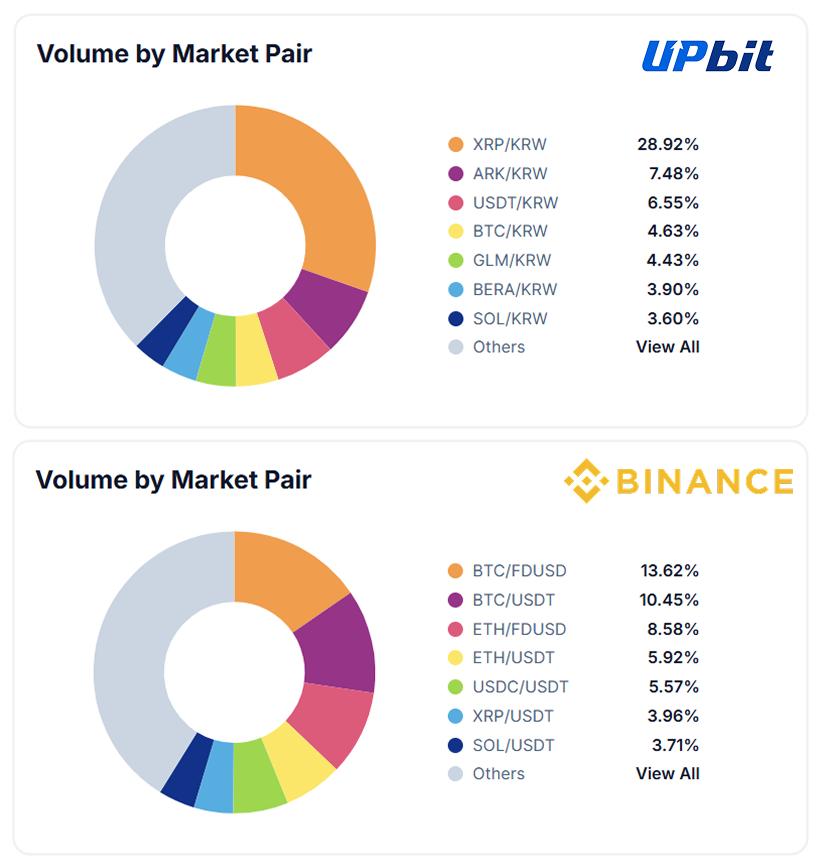

As of February 2025, Upbit's market share in the domestic Korean market has stabilized at 59%, and it continues to rank among the top 10 Altcoin exchanges with the strongest liquidity globally. It is worth noting that, unlike the global CEX, which mainly uses BTC as the main trading pair, the trading volume of the Korean cryptocurrency market is mainly concentrated in Altcoins (such as XRP). This has great appeal to project founders, so once a project announces a listing on the Korean exchange, the coin price will have an amazing surge in a short period of time.

1.2 Competition between Upbit and Bithumb

The Korean market presents a duopoly, with 98% of the trading volume monopolized by the two major platforms, Upbit and Bithumb.

- Upbit is more popular, especially during bull markets

Upbit was established in 2017 and incubated by the Korean fintech company Dunamu, which has close ties with the "Korean WeChat" Kakao, which owns more than 20% of Upbit's shares. When the market is bullish, Korean retail investors tend to use Upbit more because of its stronger liquidity and higher security. In December 2024, as BTC approached a new all-time high, Upbit's market share soared from 56.5% to 78.2%, while Bithumb's market share fell from 41.2% to 19.3%.

- Bithumb adopts a more aggressive competitive strategy

Bithumb was established a few years earlier than Upbit and was once the largest exchange in Korea, but due to multiple million-dollar hacking incidents from 2018 to 2019, it lost users and was surpassed by Upbit. However, in order to grab users, Bithumb is more aggressive than Upbit in terms of listing and funding rates:

- Zero transaction fees: Bithumb eliminated transaction fees in October 2024, which caused a 32% increase in daily active users in the short term, but this strategy is not sustainable, and users flowed back to Upbit after the event ended.

- Listing of Altcoins and MEME tokens: Bithumb listed 7 MEME coins (such as $PONKE, $SUNDOG) in 2024, attracting young traders seeking high-risk, high-return opportunities. For example, after the listing of the $TRUMP token, Bithumb accounted for 41% of the trading volume.

Although Upbit is known for its conservatism, it also had to join the MEME coin craze. From August 2024 to February 2025, Upbit listed 5 MEME tokens ($PEPE, $BRETT, $BONK, $MEW, $TRUMP) to counter the erosion of Bithumb's market share.

2. Why do projects want to list on Upbit?

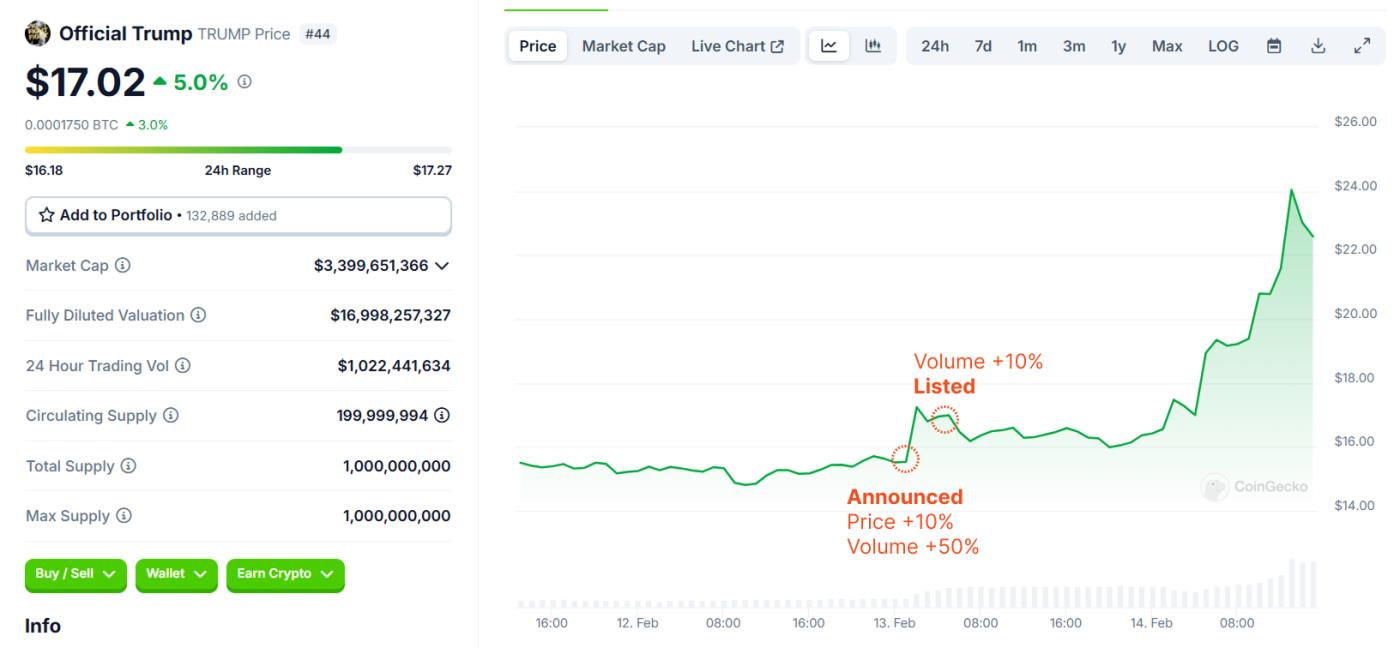

"Seokwoo Beam" is a term created by Korean traders, referring to the sudden price surge of certain tokens when they are listed on Upbit. But historical data shows:

- For most tokens, the 5-minute candlestick chart after Upbit listing shows either a brief rise followed by a decline, or an immediate decline.

- Taking $TRUMP as an example, after Upbit announced the listing:

- The price rose by 10%, and the trading volume increased by 50%.

- Within 24 hours of listing, the trading volume soared from $1 billion to $6 billion.

Although not all tokens will experience the "Seokwoo Beam" effect, Upbit's listing is still the most ideal liquidity exit, so project teams are still willing to strive for the opportunity to be listed on this exchange.

3. Analysis of Recent Upbit Listings

We have compiled the performance of tokens listed on Upbit in early 2025:

| Token | Listing Announcement Time | Listing Time | Increase within 1 hour of Listing | Trading Volume Growth after Listing |

|---|---|---|---|---|

| $TRUMP | 2025.02.13 15:24 KST | 2025.02.13 18:00 KST | +11% | +100% |

| $LAYER | 2025.02.12 08:30 KST | 2025.02.12 09:00 KST | +40% | +101% |

| $BERA | 2025.02.06 13:56 KST | 2025.02.06 23:50 KST | -7% | +70% |

| $VIRTUAL | 2025.01.31 17:17 KST | 2025.01.31 20:00 KST | +14% | +117% |

| $ANIME | 2025.01.23 18:36 KST | 2025.01.24 10:00 KST | +4% | +58% |

| $SONIC | 2025.01.07 16:31 KST | 2025.01.08 14:00 KST | -8% | +24% |

Although there is no public data, it is rumored that after a token is listed on Upbit, the project team can, without affecting the coin price, conservatively estimate that they can sell at least several million dollars through market makers, fully covering the listing fee.

4. Increasingly Strict Regulatory Policies

Although the two major exchanges have liquidity advantages, their listing procedures still face strict government regulation. Many intermediaries or project teams try to secure listing slots by bribing key personnel. Although this phenomenon does exist, since Upbit and Bithumb are licensed onshore exchanges, the level of regulation is much higher than offshore exchanges like Binance and Bybit, and there have been past incidents of exchange insiders being jailed for accepting bribes.

4.1 Anti-Money Laundering (AML) and KYC Regulations

- Korea Financial Intelligence Unit (FIU) is investigating whether Upbit has been trading with unregistered exchanges, focusing on the risks of suspected money laundering and terrorist financing.

- The Korean government believes that some unregistered offshore exchanges providing Korean language services may pose money laundering risks, and these exchanges can transfer cryptocurrencies with onshore exchanges through the "travel rule".

4.2 Market Monopoly Issues

- The duopoly monopoly of Upbit (78.2% market share) and Bithumb (19.3% market share) has raised concerns among Korean lawmakers, and the government plans to promote relevant policies toenhance market competition.

- Coinone and Korbit are the other two major exchanges in Korea, but their market shares have been squeezed to single digits, so not many projects are willing to list on these two exchanges.

5. How to List on Upbit or Bithumb?

Due to the increasingly strict regulations in Korea, the way to obtain exchange listing through intermediaries has become extremely high-risk, and many so-called "listing brokers" are actually scammers.

The correct listing strategy should include:

- Establish brand awareness in the Korean market:

- Develop a local community in Korea, and increase visibility through KOL marketing and offline events.

- Publish articles in authoritative Korean crypto media to increase exposure and credibility.

- Improve project compliance:

- Have been listed on at least one or more top global exchanges (Binance, Coinbase, OKX, Bybit) and have relatively high trading volume.

- Transparent operations, meet KYC and AML regulatory requirements, anonymous projects are less likely to be listed (except for meme coins).

Conclusion

The Korean market provides high liquidity and strong retail capital for global crypto projects, but the listing process is full of challenges due to strict regulations. For projects looking to enter the Korean market, having tokens listed on top exchanges and building a local community are the keys to success. Welcome projects looking to expand into the Korean market to contact Notch Ventures to answer questions about the listing strategy.

- Establish brand awareness in the Korean market: