I. Introduction

The Layer1 blockchain field has long been dominated by Ethereum, but various Layer1 public chains have emerged, with Solana, BNB, Sui and others rising to try to grab a share. As a new public chain built on the Cosmos SDK and compatible with the Ethereum Virtual Machine (EVM), Berachain stands out with its unique incentive-based pre-deposit vault activity and innovative PoL mechanism, as well as a three-token system. This not only fundamentally improves the on-chain liquidity utilization rate, but also builds a win-win incentive system for the entire ecosystem, quickly becoming the sixth largest blockchain network in terms of TVL and occupying a place in the emerging public chain track.

However, in the context of increasingly fierce competition among Layer1 public chains, can Berachain's popularity be sustained? Can the PoL mechanism bring a qualitative leap in on-chain security and liquidity? How will the performance of various protocols and tokens in the ecosystem affect the development prospects of the entire chain? This article will conduct a comprehensive analysis from the perspectives of technological innovation, on-chain data, ecosystem token inventory, market opportunities and challenges, and explore the growth potential and future development path of Berachain.

II. Berachain's Market Performance and Innovative Mechanism

Berachain mainnet was launched on February 6th, and despite the turbulence and downturn in the cryptocurrency market, the on-chain TVL of Berachain has been steadily increasing. According to DefiLlama data, as of March 6th, Berachain's on-chain TVL has reached $3.484 billion, making it the sixth largest public chain ecosystem, following Ethereum, Solana, Bitcoin, BSC, and TRON.

The most notable aspect of Berachain is that it has reconstructed the traditional public chain economic model through multiple innovations, enabling liquidity, governance and security to interact positively within the same system. Its main innovations can be summarized in the following three aspects:

1. Pre-deposit Activity: Building a Sustainable Liquidity Support System

During the testnet phase, Berachain launched an incentive-based Boyco market pre-deposit vault activity, aiming to provide users with maximum reward opportunities before the mainnet launch. Berachain has deeply collaborated with protocols such as Concrete, Lombard, StakeStone, Ethena, and Etherfi, launching incentive-based pre-deposit Vaults, allowing users to lock in future BERA, BGT and other ecosystem token rewards in advance before the official launch. The key value lies in:

Aggregating Liquidity Before Mainnet: Reducing the problem of "lack of funds" in the early stage of a new public chain, and naturally combining with the PoL mechanism, laying a solid foundation for security and economic vitality.

Multi-party Collaborative Distribution of Incentives: Through cooperation with multiple DeFi protocols, users can obtain more diverse token rewards; at the same time, the protocols can also use this opportunity to gather attention and capital.

Consolidating Community Consensus: The "pre-deposit" model has attracted a large number of users and funds, driving continuous discussion and secondary creation in the community, laying the foundation for the prosperity of Berachain's ecosystem after the official launch.

For DeFi users, this is a low-threshold participation method with multiple rewards; for the protocols themselves, it is an excellent opportunity to quickly attract attention and funds. The Boyco "pre-deposit + mining + ecosystem airdrop" model has also further stimulated community discussion and enthusiasm, with the highest number of active addresses reaching tens of millions during the testnet period, and the liquidity of the pledged crypto assets reaching $1.57 billion, forming a considerable scale of funds and user base.

Source: https://dune.com/zero_labs/berachain-pree-deposit-overview

2. Three-Token Mechanism: Balancing Security and Liquidity

To further achieve role separation and incentive balance, Berachain has adopted a three-token model:

BERA:As the core Gas token, used to pay transaction fees, staking operations and ecosystem internal incentives. Similar to Ethereum's ETH or BNB Chain's BNB, it is mainly used to pay transaction fees and ensure network security. Validators need to stake BERA to ensure the operation of the network and receive block rewards.

BGT: BGT is mainly used for on-chain governance, proposal voting and reward distribution. The acquisition of BGT depends on users providing liquidity to the ecosystem, and the holding amount directly determines the user's voice in network governance. BGT can be exchanged for BERA at a 1:1 ratio, but BERA cannot be exchanged back for BGT. In other words, BGT cannot be bought and sold, but can only be obtained by contributing liquidity, and is the "voting right + reward points" of the ecosystem.

HONEY:Berachain's native stablecoin, pegged to the US dollar at a 1:1 ratio. Users can mint HONEY by pledging other assets on the Berachain platform. As the on-chain stablecoin, HONEY provides a stable medium of exchange for decentralized applications, increasing the usability and attractiveness of the platform.

The advantages of this three-token model are:

Optimizing Network Security and Liquidity: Through the staking mechanism of $BERA, network security is ensured; at the same time, the design of $BGT incentivizes users to provide liquidity, avoiding the potential problem of lack of liquidity in traditional PoS systems.

Refined Governance Structure: The non-transferability of $BGT ensures a fairer distribution of governance rights, truly empowering users who have made contributions to the ecosystem, improving governance efficiency and decision quality.

Enhancing the Stability of the Ecosystem: As a stablecoin, $HONEY provides a stable value measure for transactions and applications within the platform, reducing user transaction costs and risks.

3. PoL Mechanism: Building a Liquidity-Driven Consensus Model

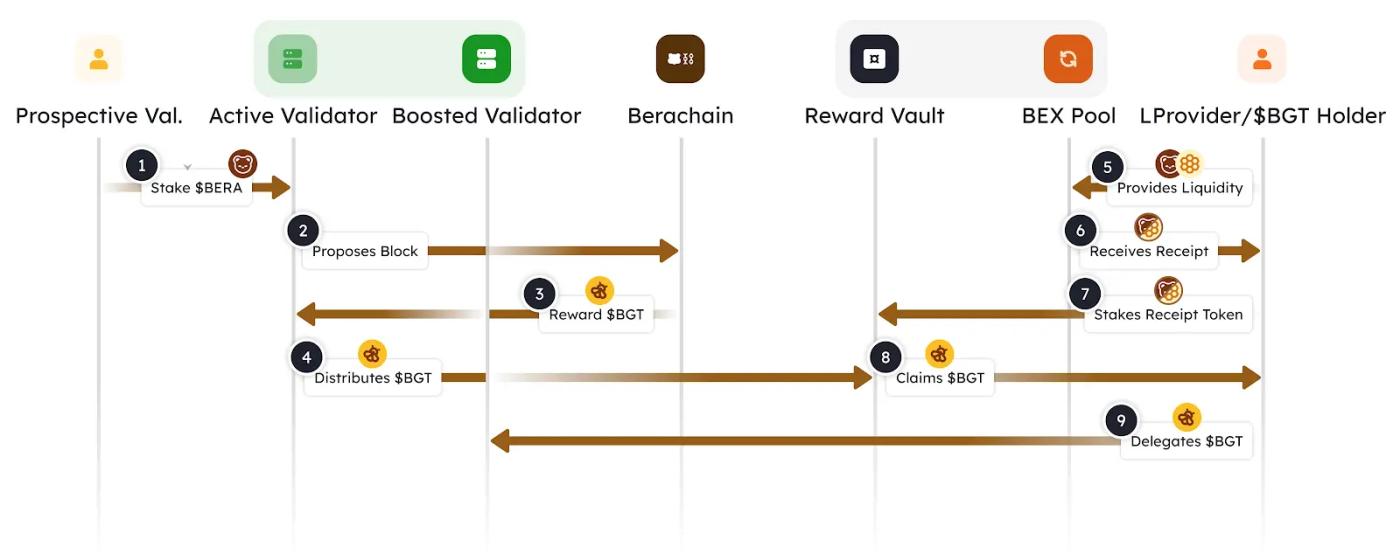

Traditional public chains mostly adopt Proof-of-Stake (PoS) or Proof-of-Work (PoW) mechanisms to ensure network security. Berachain, on the other hand, has pioneered the Proof-of-Liquidity (PoL) mechanism, where the core idea is "liquidity is security", allowing the security and liquidity of the chain to grow synchronously, avoiding the problems of traditional blockchains being "secure but unused" or "used but not secure". The PoL mechanism works as follows:

Validators: Validators first stake at least 250,000 $BERA to become candidate nodes. The more $BERA staked, the higher the probability of being selected to produce blocks (similar to a lottery weight). For each block produced, the validator will receive a fixed reward and a floating reward, with the fixed reward being a direct share of $BGT, and the floating reward being distributed based on the proportion of BGT delegated to the validator by users.

Users: Users deposit liquidity into on-chain applications and receive LP tokens, which they then deposit into the official "reward pool" to earn BGT on a daily basis proportional to their deposit.

Voting: Users use the earned BGT to vote for their preferred validators, directly increasing the Boost value of the validators, which in turn will receive more $BGT rewards when proposing blocks. To attract more $BGT delegation, validators will share the incentives obtained from the reward pool with users, forming a positive feedback loop and enhancing the synergistic effect of the entire ecosystem.

- Here is the English translation of the text, with the specified terms translated as requested:

The core design idea is that validators want to make more money → they need to attract users to stake $BGT with them → users will only vote for validators who can help them earn more money → validators must distribute the earnings to users and ecosystem applications → ultimately, users, validators, and applications form a community of shared interests.

III. Overview of Potential Projects in the Berachain Ecosystem

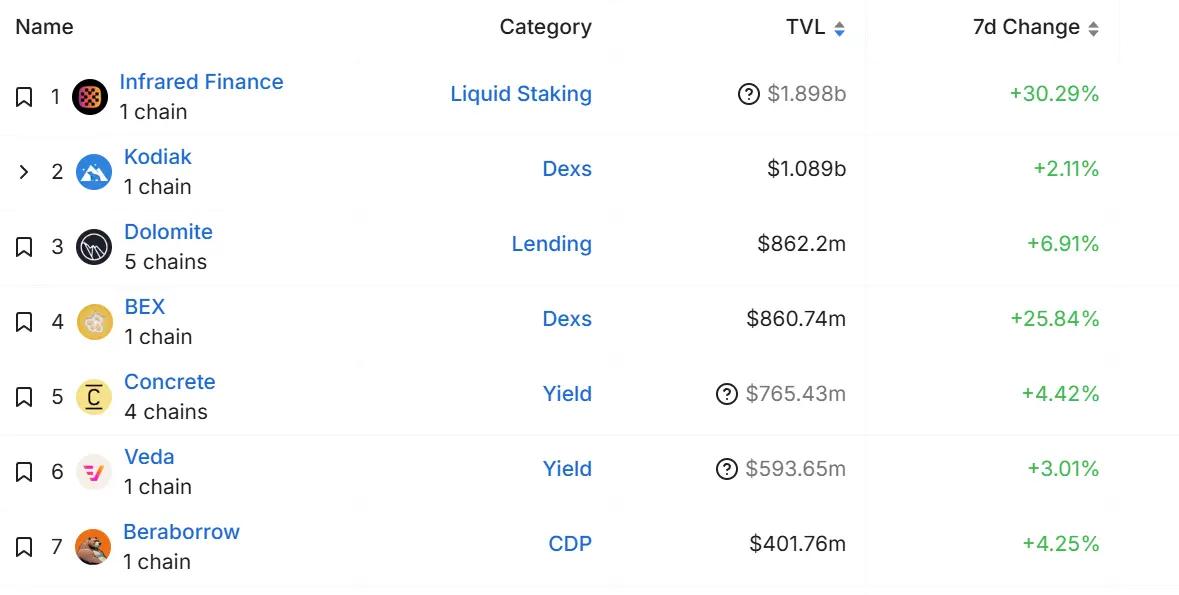

Although the Berachain ecosystem has released few projects so far, its impressive asset scale and user base have laid a good foundation for the future development of ecosystem projects. The following is an analysis of the top projects in the Berachain ecosystem by TVL:

1. Infrared Finance

As the liquidity and staking infrastructure platform of the Berachain ecosystem, Infrared Finance utilizes its proprietary Proof of Liquidity (PoL) mechanism to issue iBGT (liquid version of BGT) and iBERA, providing users with a simple and efficient liquidity staking and yield optimization solution. The platform can participate in governance and receive high rewards by staking various liquidity assets. Currently, Infrared manages over $1.8 billion in TVL and plays the role of a "value capture" in the ecosystem. In the future, with the maturity of the mainnet and the expansion of the ecosystem, Infrared is expected to further release greater growth potential by introducing more innovative products and cross-protocol incentives.

2. Kodiak

Kodiak is the native liquidity hub of the Berachain, utilizing the "Island" mechanism to achieve centralized liquidity management, reducing risks while improving capital efficiency. Through collaboration with projects like Infrared and Boyco, Kodiak can introduce large-scale liquidity from the very beginning of the mainnet launch. Its managed asset scale is around $1 billion, and the xKDK, its non-circulating governance token, is expected to be unlocked upon the future mainnet launch, supporting community governance. As an important platform for trading and liquidity provision, Kodiak's design and cross-project incentives will continue to attract users, with relatively high growth potential.

3. Dolomite

Dolomite is a new lending and leveraged trading platform on Berachain, drawing on traditional lending protocols and combining the PoL mechanism to provide users with diversified financial services. Dolomite has already shown market attention by participating in the ecosystem incentive program, with a current TVL of $860 million. In the future, with the promotion of the mainnet and the expansion of user scale, Dolomite plans to issue governance or incentive tokens to attract more lending and leveraged trading demand, thereby realizing a greater appreciation potential.

4. BEX

BEX is the flagship decentralized exchange of Berachain, with low slippage and high liquidity, becoming an important entry point for user trading. Recent data shows that BEX's trading volume has been continuously rising, and its deep liquidity has contributed a considerable TVL of around $860 million to the ecosystem, attracting users. The platform may launch a dedicated incentive token in the future and integrate deeply with core products like Infrared, jointly promoting the prosperity of Berachain's trading ecosystem.

5. Concrete

Concrete focuses on efficient lending and liquidity optimization, and its innovative mechanism has maintained a stable TVL performance of around $760 million while reducing liquidity loss. Through collaboration with Kodiak and Infrared, Concrete has built a complementary and efficient DeFi ecosystem.

6. Veda

As a new project, Veda is dedicated to asset management and lending services, relying on Ether.fi's technical support, and featuring multi-asset integration and leveraged trading. Currently, Veda's TVL is around $600 million. In the future, by introducing governance tokens and cross-chain advantages, Veda is expected to achieve steady growth by leveraging the demand for cross-asset management, further consolidating its market position on Berachain.

7. Beraborrow

Beraborrow is the first CDP collateralized debt vault protocol on Berachain, allowing users to pledge various assets to borrow the NECT stablecoin. Its innovation lies in the adoption of the Continuous Protocol Incentive (CPI) mechanism, which not only rewards liquidity providers one-time, but also distributes rewards based on long-term user participation. Currently, Beraborrow's TVL exceeds $400 million, and NECT has become the second-largest stablecoin in the ecosystem.

IV. Opportunities and Challenges of the Berachain Ecosystem

Opportunities

First-mover Advantage from Technological Innovation: Berachain has provided new solutions for on-chain security and liquidity through the PoL mechanism, three-token model, and incentivized pre-deposit treasury activities. Compared to traditional PoS chains, Berachain's "liquidity is security" concept can not only effectively improve capital utilization, but also attract many high-quality projects in DeFi, NFT, GameFi, and other fields to land on the chain, forming an early ecosystem advantage.

Cross-chain Collaboration and Ecosystem Interconnection: Berachain has unique advantages in cross-chain asset circulation, having collaborated with mainstream public chains like Ethereum and Solana to build cross-chain bridges and multi-chain liquidity pools. This cross-chain interoperability not only helps improve the user experience, but also creates opportunities to attract more liquidity and capital to the ecosystem.

Strong Community and Developer Support: Berachain has attracted a large number of developers and community members to actively participate, thanks to its open, transparent technical roadmap and innovative incentive mechanisms. During the testnet phase, the number of independent addresses and daily active users have achieved exponential growth, demonstrating the strong community vitality and user stickiness, laying a solid foundation for the rapid expansion of the ecosystem after the mainnet launch.

Capital Backing and Strategic Cooperation: In terms of financing, Berachain has received investments from well-known institutions such as Polychain Capital, OKX Ventures, and Framework Ventures, along with strategic cooperation with leading protocols like Stakestone, Ethena, and Lombard, providing strong financial and resource guarantees for ecosystem building. These capital and collaborations will help facilitate the smooth implementation and expansion of various incentive mechanisms within the ecosystem.

Challenges

Gap in Ecosystem TVL Compared to Mature Chains: Although Berachain's TVL reached $3.4 billion as of March 2025, it still lags behind mature public chains like Ethereum and Solana. How to attract more DeFi protocols and users to participate, further increasing the locked asset scale, will be a major task facing Berachain in the future.

Technical and Security Risks: As an emerging consensus mechanism, the security and stability of PoL and the three-token model need to be tested by the market and time. Potential vulnerabilities in the technical deployment process, whether the liquidity incentive design can be effective in the long run, and the cross-chain interoperability, all need to be continuously optimized and improved during actual operation.

Market Competition and User Education: Facing existing mature ecosystems like Ethereum, Solana, and BNB Chain, Berachain needs to invest a lot of effort in user habits, developer tools, community governance, and other aspects. In particular, the concepts and advantages of the new mechanism need to be recognized by the market through user education and transparent communication, avoiding market volatility or FUD due to misunderstandings.

Token Inflation and Investor Selling Pressure Risks: The long lock-up period and large supply release of tokens held by early private investors, combined with the increased circulating supply under the incentive mechanism, may lead to certain selling pressure in the market. How to balance the distribution of incentives and market circulation, and ensure the interests of long-term holders, is a problem that Berachain urgently needs to solve.

V. Outlook and Summary of the Potential of the Berachain Ecosystem

In the process of continuous exploration and innovation, the future development of Berachain is full of both opportunities and challenges. The following is an outlook on the major development directions:

Ecological Diversity and Application Expansion: In the future, Berachain will continue to attract high-quality application projects in fields such as DeFi, Non-Fungible Token, and GameFi, promoting the diversified development of the ecosystem. At the same time, through continuous improvement of the incentive-based pre-deposit treasury activities and cross-chain cooperation mechanisms, Berachain is expected to break the situation of short-term liquidity dispersion of funds, and achieve efficient integration and long-term settlement of capital.

Capital Market Connection and Strategic Cooperation: Berachain will continue to deepen cooperation with leading blockchain projects and traditional financial institutions, build a cross-chain liquidity network, and enhance market competitiveness. Strategic cooperation not only brings more TVL and users to the ecosystem, but also helps to promote the recognition of Berachain in the global financial market, and promote the long-term stable growth of token value.

Economic Model Optimization and Incentive Balance: In response to the current potential risks of inflation and selling pressure, Berachain will explore the introduction of innovative designs such as iBGT liquidity certificates in the future to further balance the incentive distribution within the ecosystem. Through technical means and governance mechanism optimization, ensure that the token economic model maintains healthy long-term operation, and enable participants to form a stable consensus and cooperation mechanism.

Community Building and Expansion: Building an open, inclusive and technology-driven community is the key to the long-term success of Berachain. In the future, the project team will increase user education efforts, eliminate market doubts through transparent governance processes and active communication mechanisms, and attract more retail and institutional investors to participate, thereby enhancing the overall activity and innovation of the ecosystem.

Conclusion

In summary, Berachain, with its original PoL mechanism, three-token model, and incentive-based pre-deposit treasury activities, is redefining the relationship between security and liquidity within the blockchain ecosystem. Although it still lags behind mainstream public chains such as Ethereum and Solana in terms of TVL and market maturity, its potential in capital utilization rate, incentive transmission, and ecosystem diversity is not to be ignored. As its whitepaper states: "Berachain is not another EVM chain, but a new continent of economic cooperation."

About Us

As the core investment and research center of the Hotcoin ecosystem, Hotcoin Research focuses on providing professional in-depth analysis and forward-looking insights for global cryptocurrency investors. We have built a "trend judgment + value mining + real-time tracking" three-in-one service system, through in-depth analysis of cryptocurrency industry trends, multi-dimensional evaluation of potential projects, and 24/7 market volatility monitoring, combined with weekly double updates of the "Hotcoin Selection" strategy live broadcast and the "Blockchain Headlines" daily news digest, to provide accurate market interpretation and practical strategies for investors at different levels. Relying on advanced data analysis models and industry resource networks, we continue to empower novice investors to establish a cognitive framework, and help professional institutions capture alpha returns, so as to seize the value growth opportunities in the Web3 era together.

Risk Warning

The cryptocurrency market is highly volatile, and investment itself carries risks. We strongly recommend that investors fully understand these risks and invest within a strict risk management framework to ensure the safety of their funds.