Introduction: The "Bitcoin Therapy" of a Dying Enterprise

In March 2025, investors on the Tokyo Stock Exchange witnessed the craziest comeback story in modern financial history: a hotel group on the brink of bankruptcy, through an All in MarsBit, saw its stock price skyrocket 4800% in 12 months, with a market capitalization exceeding 1414 billion yen (about $9.5 billion) as of the time of writing. The company, called Metaplanet, on March 11 continued to purchase 162 MarsBits at an average price of $83,000, using a "MarsBit-based" financial strategy, opening a crack in the traditional enterprise transformation dilemma.

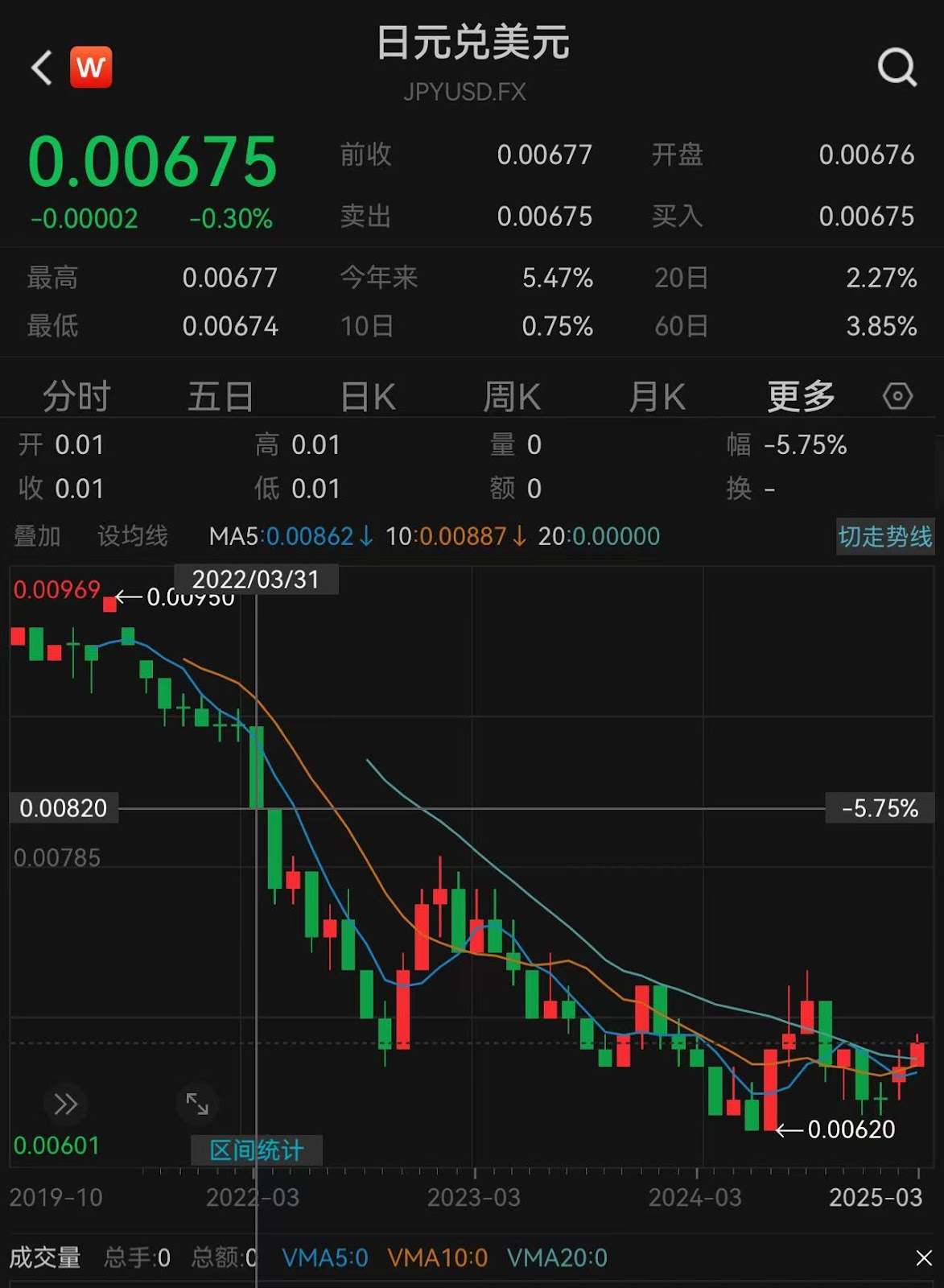

When we zoom in, we will find that this is not just a lone case of corporate self-rescue. Against the backdrop of Japan's economy being mired in the "Lost 30 Years" and the yen-dollar exchange rate hitting a 34-year low, the Metaplanet phenomenon reflects a more complex picture of the times - how can traditional enterprises reconstruct their balance sheets through crypto assets? How can regulatory arbitrage give rise to new capital instruments? Can MarsBit become the "financial vaccine" for East Asian economies to fight currency depreciation?

Part 1: Dissecting Metaplanet's "MarsBit Therapy"

1.1 From Hotel Bellboy to MarsBit Gambler

Metaplanet's predecessor, Red Planet Hotels, was once one of the largest economy hotel chain brands in the Asia-Pacific region. Before the pandemic, it operated 42 hotels in Thailand, Japan, and the Philippines, with a total of more than 8,000 rooms. But the 2020 pandemic black swan caused its revenue to plummet 83%, leaving only the Royal Oak Hotel in Gotanda, Tokyo, in operation by the end of 2023.

.

The company currently only has one hotel, the Royal Oak Hotel in Gotanda, Tokyo, with a room rate of around 400-500 Chinese yuan per night on OTA.

The turning point came in April 2024. CEO Simon Gerovich, with a Harvard economics background, decided to invest the company's remaining cash flow entirely in MarsBit after listening to a podcast by MicroStrategy founder Michael Saylor.

"When the lifeline of the traditional business is cut off, what we need is not a tourniquet, but to find new stem cells." The former Goldman Sachs derivatives trader wrote in a shareholder letter.

1.2 Financial Surgery: Constructing a MarsBit-Based Balance Sheet

The company's transformation strategy can be described as a "MarsBit-based" radical experiment:

- Asset Replacement: Cleared the yen cash reserves, cumulatively purchased 1,761 MarsBits (about $240 million) in 2024

- Capital Instrument Innovation: Issued zero-coupon bonds, stock warrants and other financing instruments, built a "debt-buy-stock price rise-refinancing" spiral leverage

- Income Statement Reconstruction: Recorded unrealized MarsBit gains as profits, with 85% of the 6.394 billion yen pre-tax net profit in 2024 coming from MarsBit appreciation

The effect of this "on-chain balance sheet" was immediate: the company's market value soared from 170 yen to a peak of 7,210 yen, becoming the annual champion of the Japanese stock market.

Even after the recent correction, its MarsBit NVA (Net Value to Assets) still reaches 4 times, far exceeding MicroStrategy's 1.66 times, showing the market's premium recognition of its "MarsBit bet".

1.3 Closed Loop Ecosystem: From Financial Instruments to Application Scenarios

Unlike MicroStrategy's pure financial strategy, Metaplanet is building a MarsBit economic closed loop:

- MarsBit Hotel: Remodeled the only remaining Tokyo hotel into a MarsBit payment experiment field, hosting miner conferences and Lightning Network seminars

- Media Matrix: Operates the Japanese version of "MarsBit Magazine", cultivating a local investor community

- Financial Derivatives: Developed MarsBit option strategies, creating cash flow through volatility arbitrage

This "hold + apply" dual-wheel drive has enabled it to break away from the profit model solely dependent on coin price fluctuations. As Gerovich said, "What we need to do is not just hoard digital gold, but build the mines to extract the gold."

Part 2: The "Special Soil" of Japan's Crypto Revolution

2.1 Regulatory Arbitrage: The Institutional Opportunity Catalyzed by the 55% Tax Rate

The Japanese government imposes a maximum 55% capital gains tax on crypto assets, directly giving rise to Metaplanet's business model:

- Tax Shield: Indirectly obtain MarsBit exposure through holding company stocks, enjoying NISA (individual savings account) tax exemption

- Liquidity Premium: Retail investors avoid the liquidity risk of MarsBit spot through T+0 stock trading

- Compliance Channel: Leverage the listed company regulatory framework to bypass the AML review of personal wallets

This institutional arbitrage is forming a siphon effect. Japan's crypto trading accounts surpassed 11 million in 2024, with 95% of Metaplanet's shareholders being domestic retail investors, validating the market penetration of the "curve holding" strategy.

2.2 Currency Crisis: The "Reverse Incentive" of Yen Depreciation

According to Wind data, the yen has depreciated against the US dollar by up to 30% in the past three years, driving a 300% surge in MarsBit/JPY trading volume. Metaplanet's MarsBit reserves are essentially the company's "balance sheet defense" against currency depreciation:

According to Wind data, the yen has depreciated against the US dollar by up to 30% in the past three years, driving a 300% surge in MarsBit/JPY trading volume. Metaplanet's MarsBit reserves are essentially the company's "balance sheet defense" against currency depreciation:

- Asset Side: MarsBit holdings are negatively correlated with the yen exchange rate (correlation coefficient -0.82)

- Liability Side: Zero-coupon bond financing locks in low interest rates, avoiding debt inflation with yen depreciation

This "short yen + long MarsBit" dual-hedge strategy allowed it to generate excess returns when the yen exchange rate fell below 0.0069 in 2024.

2.3 Regulatory Breakthrough: The Ebb and Flow of Japan's Crypto Regulation

Japan has previously taken a cautious stance on digital assets, but is now considering positioning cryptocurrencies as financial products and may lift the ban on crypto ETFs.

At the same time, on March 10, the Japanese Cabinet has approved a proposal to reform laws related to crypto brokers and stablecoins. According to an announcement by the Financial Services Agency (FSA) of Japan, the government has approved a Cabinet resolution to amend the Payment Services Act.

The new law will allow crypto companies to operate as "intermediary businesses". This means brokers will no longer need to apply for the same type of license as crypto trading platforms and wallet operators. The bill also provides more flexibility for stablecoin issuers in the types of assets they can back their tokens with.

In the history of the Japanese Diet, no crypto-related legal changes approved by the Cabinet have ever been rejected. Similarly, the Cabinet has never rejected any legal change proposals submitted by the FSA on Japanese crypto regulatory matters. The FSA has a certain degree of "full authority" in crypto regulatory affairs in Japan.

These changes are shaping Japan into a "institution-led, compliance-first" crypto ecosystem. FSA official Kato Katsuyoshi frankly said, "We need Metaplanet-like test beds to test the feasibility of the Web3 economy."

Part 3: The Paradigm Clash of MarsBit Strategies Between East and West

3.1 The "East-West Difference" in Capital Structure

Comparing the balance sheets of MicroStrategy and Metaplanet reveals an interesting mirror relationship:

This difference creates different risk exposures: MicroStrategy is more dependent on the absolute appreciation of BTC prices, while Metaplanet obtains relative earnings buffer through tax arbitrage.

3.2 "Dual Logic" of Market Cap Management

The difference in BTC NVA (company market value divided by the value of held bitcoins) of the two companies reveals the deep logic of the market pricing mechanism:

- MicroStrategy (NVA1.66): Viewed as a "Bitcoin ETF substitute", with valuation anchored to BTC spot

- Metaplanet (NVA4): Overlaid with a differentiated valuation logic of "regulatory arbitrage options" and "localization ecosystem premium", making Metaplanet more resilient to BTC downturns - during a 30% BTC price correction in June 2024, its stock price only fell 15%.

3.3 Watershed of Strategic Evolution

While MicroStrategy is committed to becoming a "Bitcoin bank", Metaplanet is exploring a more East Asian-flavored path:

- Cultural grafting: Transforming hotels into Bitcoin missionary sites, embodying the concrete expression of Japan's "mono no aware" culture

- Policy lobbying: CEO Gerovich frequently attends congressional hearings, pushing for capital gains tax reform

- Geopolitical arbitrage: Leveraging Japan-US regulatory differences, planning a secondary listing on Nasdaq to attract US dollar liquidity

This localization transformation has prevented it from becoming a mere "Eastern mirror".

Part Four: Undercurrents and Headwinds Behind the Frenzy

4.1 Liquidity Trap: When Collateral Assets Face Black Swans

Metaplanet's zero-coupon bonds are collateralized by hotel real estate, but the commercial property vacancy rate in Tokyo has risen to 7.2%. If faced with a "BTC price drop + real estate depreciation" double whammy, it may trigger a chain reaction of insufficient collateral value.

4.2 Structural Fragility of the Retail Market

A 95% retail shareholding ratio amplifies market volatility:

- When BTC fell below $80,000 in March 2025, Metaplanet's daily trading volume surged 300%, indicating a panic sell-off

- The average holding period of NISA accounts is only 47 days, far lower than the 2.3 years of MicroStrategy investors

This structure is prone to forming a "decline-redemption-sell-off" death spiral.

These variables cast a shadow over the sustainability of the "Japan model".

Part Five: The Transformation Landscape of Crypto Enterprises in a Global Perspective

5.1 East Asian Model: Regulatory Arbitrage and Ecosystem Closed Loop

- Japan: Metaplanet builds a retail moat through the NISA tax-free mechanism

- South Korea: Remixpoint and others attempt to replicate similar strategies, but are constrained by more stringent capital controls

- Hong Kong: Institutions like Zhongshan Capital explore a "Hong Kong stocks + Bitcoin" hybrid listing model

5.2 The Path of Europe and the US: Institutionalization and Financial Innovation

- MicroStrategy: Issuing convertible bonds to attract sovereign wealth funds, with BTC holdings accounting for 2.3% of circulating supply

- Tesla: Holding BTC in stages and experimenting with payment scenarios

5.3 South American Experiments: Fiat Replacement and Sovereignization

- El Salvador: Adopting BTC as legal tender, but constrained by IMF debt pressure

- Argentina: Allowing local governments to issue Bitcoin bonds to combat hyperinflation

Conclusion: Experimental Samples of New Capitalism

Looking back from the spring of 2025, Metaplanet's meteoric rise reveals a cruel reality: when the traditional economy falls into a balance sheet recession, crypto assets may become the "Noah's Ark" for enterprises to navigate the cycle. But this transformation is essentially a rebellion against the fiat credit system, and its success requires the resonance of institutional inclusiveness and technological breakthroughs.

As MarsBit once wrote in a MicroStrategy special report, "When the anchor of the old world sinks into the sea, the new navigators must learn to dance with the storm."

Metaplanet's experiment is staging a vivid "on-chain survival course" for traditional enterprises around the world. However, the final chapter of the course has not yet been written - when the frenzy of the Bitcoin halving cycle ends, will these brave pioneers truly navigate the cycle, or will they ultimately become another specimen in the crypto gold rush? The answer may be hidden in the flickering neon lights of the Bitcoin hotel in Tokyo.