Author: Heechang : : FP, Four Pillars Co-Founder

Compiled by: TechFlow

TL;DR

Korean investors currently hold over $100 billion worth of US stocks. Trading volume has grown 17-fold since January 2020.

The current infrastructure for Korean investors to trade US stocks has various limitations, including high fees, lengthy settlement times, and slow withdrawal processes, creating opportunities for tokenized or mirrored on-chain stocks.

In the issuance space, Backed Finance holds a 90% market share, but its total value locked (TVL) is only $18 million, minuscule compared to the traditional stock market. Additionally, @Injective recently released a whitepaper on iAssets, proposing a new on-chain stock model.

Each tokenized/mirrored project is issued on different networks, from L2 to L1, and even private L1s. Interoperability protocols like @LayerZero_Core and chain abstraction protocols like @UseUniversalX will play a crucial role.

As the infrastructure and platforms supporting the on-chain US stock market continue to improve, more Korean traders will enter the market, presenting a massive opportunity.

Boring Korean Market Drives Them to Trade Altcoins

What investment opportunities are available in Korea? Including stocks, real estate, bonds, funds, and Altcoins.

Real estate prices are high.

Bond/fund yields are only slightly higher than savings accounts.

The Korean stock market index KOSPI is jokingly called "Box-PI" because its chart has hardly grown in the past 20 years. People often say, "Intelligent people don't trade Korean stocks." Imagine if the price of ETH remained the same for 20 years - who would still invest in it?

*The candlestick chart is the Nasdaq index, and the magenta line at the bottom is the KOSPI index since 2008.

Source: NAS100 and KOPSI

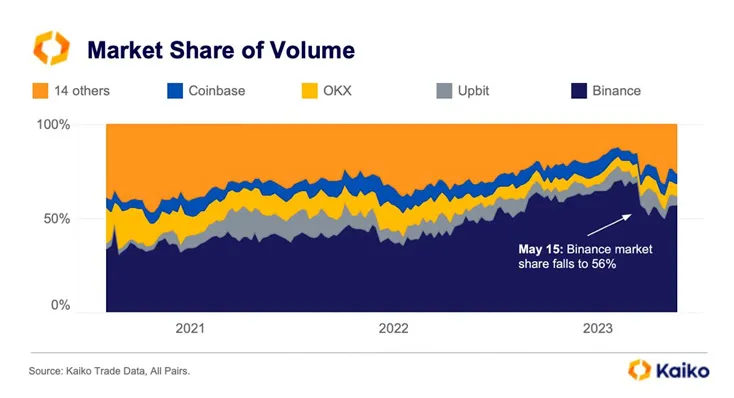

From this, we can see where traders are heading. With a population of 50 million, Korea accounts for 0.6% of the global population, yet its Altcoin trading volume accounts for 10% of the global total. Every project issuing tokens sees Korea as an important market.

Source: Anthony Pompliano's "The State of Crypto Market Structure"

In the absence of alternatives, the trading volume and interest in Altcoins will not disappear. However, anything related to Altcoins, blockchain, tokens, and MEME is seen as a scam.

Case 1: @terra_money left the worst impression. People think Tether is a scam. (The sentiment has recently changed, and we (@FourPillarsFP @FourPillarsKR) are working to accelerate this shift.)

Case 2: The token projects led by Korea in 2021-2022 were simply scams. Retail investors saw large institutions issuing tokens, but these projects were just empty promises. They were even worse than MEME coins.

People Who (Don't) Trade Altcoins Trade US Stocks

According to data from the Korea Securities Depository, as of the end of 2023, the value of US stocks held by Korean investors reached $111.18 billion, up 70% from the beginning of the year ($67.61 billion). This milestone marks the first time the holdings have surpassed $100 billion. Korean investors hold $12.9 billion in Tesla stock, $12.9 billion in Nvidia stock, $4.8 billion in Apple stock, and so on.

The market has shown significant growth, with trading volume (total buy and sell) up 20% year-over-year and trading value up nearly 80%. Compared to 50 trillion won in January 2020, it has grown 18-fold in five years. Notably, 96% of the outflow of foreign stocks was caused by domestic investors.

What Altcoin Projects Can Do - Issuing Tokens and Interoperability

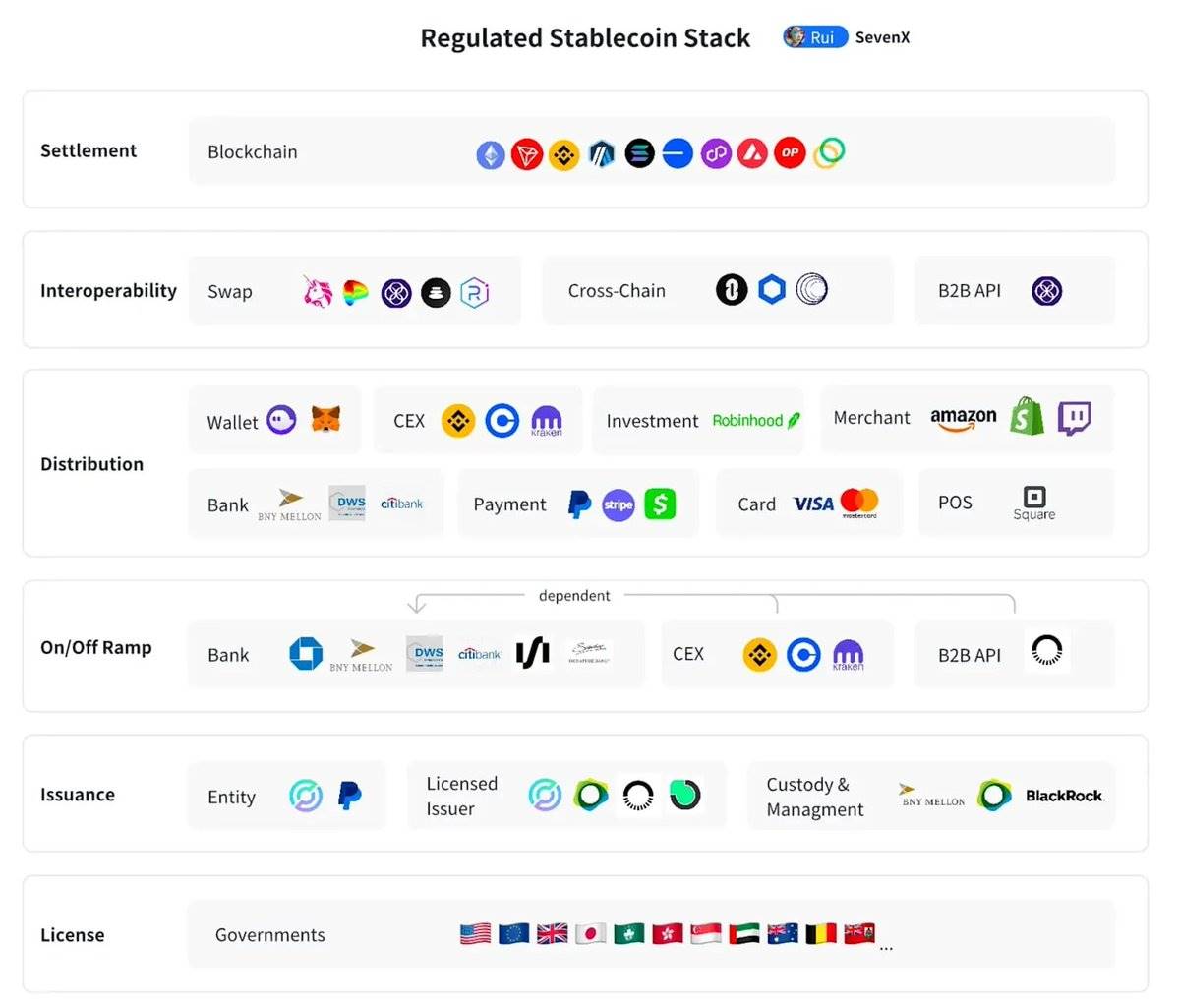

Drawing on Rui's "Regulated Stablecoin Stack" framework proposed on sevenx, and applying it to tokenized/mirrored stocks, two core infrastructure components are crucial:

Issuance of stocks

Interoperability of these assets

3.1 Issuance - Current Market Size is Small, Need to Focus on Injective's iAsset

The market size of tokenized stocks in Altcoins is very small. The peak total value of tokenized stocks was around $17 million. Compared to the traditional stock market, this figure is negligible, as the market capitalization of individual companies often reaches billions or even trillions of dollars. Additionally, most of the value is concentrated on a few assets, such as Backed Finance's bCSPX (tokenized S&P 500 index) and bCOIN (tokenized Coinbase).

Source: RWA.xyz | Stocks

The number of issuers of tokenized stocks is limited:

Backed Finance leads with a market value of $13.82 million, accounting for about 90% of the market share.

Other issuers like Dinari ($890,000), Swarm X ($710,000), and a Japanese company ($249.98) have significantly smaller market values.

The total market value of all issuers is less than $16 million.

Source: RWA.xyz | Stocks

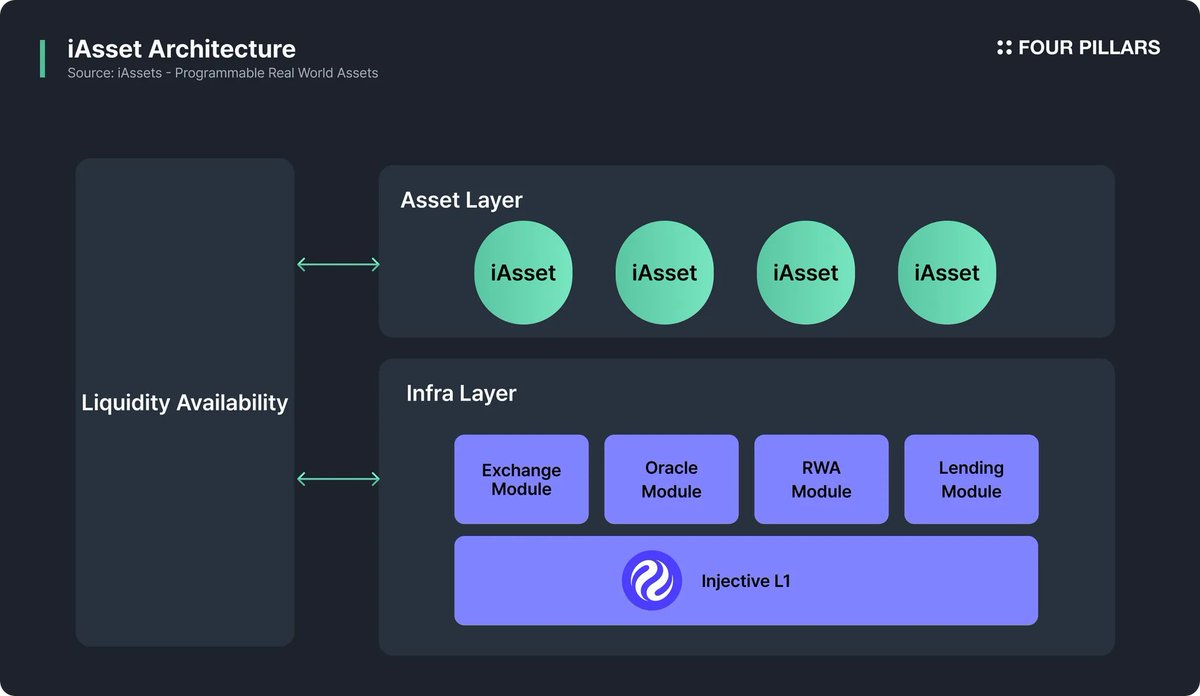

Recently, Injective introduced a concept called iAssets, aiming to overcome the inefficiencies of traditional finance and early DeFi models. Unlike traditional tokenized assets, iAssets do not require pre-collateralization, but rather operate as composable on-chain tools.

What is "Non-Custodial"? In traditional finance, the tokenization of real-world assets typically requires users to pre-lock a significant amount of collateral. For example, if a user wants to mint synthetic stocks, they must deposit and lock a certain amount of collateral.

Source: iAssets_Paper.pdf

Unlike traditional tokenization methods, iAssets do not require excessive collateral or locked capital. They leverage Injective's shared liquidity network to dynamically allocate liquidity based on real-time market demand. (Four Pillars will soon release a detailed article.)

iNVDA is already tradable, and iTSLA and other stocks will soon be traded on-chain on Injective.

3.2 Interoperability - LayerZero and Chain Abstraction Will Solve Decentralized Issuance

The number of projects issuing tokenized assets is increasing, with major fintech companies/institutions also participating:

@OndoFinance is launching its own L1

@noble_xyz L1 is issuing more RWA tokens

@coinbase is considering issuing its $COIN stock on Base

@RobinhoodApp's CEO @vladtenev publicly advocates for the tokenization of real-world assets to democratize private market investments traditionally limited to accredited investors. (They may launch their own private L1)

Apollo is launching its on-chain private credit fund Apollo Diversified Credit Securitize Fund (ACRED), which can be used on Solana, Link, Ethereum, Aptos, Avalanche and Polygon.

These tokens will be issued across 30+ or even hundreds of networks. I believe two providers will solve the "fragmentation" problem:

@LayerZero_Core - OFT and DVN: OFT is doing for tokens what stablecoins did for fiat. It liberates the constraints of being isolated in a single environment. OFT will allow tokenized assets to be sent and managed across different networks. But how about security? DVN can be customized, and issuers can handle cross-chain interactions. For example, Ondo Finance and Tether run their own DVN for their tokens.

@ParticleNtwrk and @UseUniversalX: Ultimately, assets will be issued in a decentralized manner. Some will be issued across Ethereum, Solana, Monad, L2s, Sui, etc. This will provide a fragmented experience for users. I think UniversalX may be the best platform. Tokenized stocks, funds, indices will be issued in a decentralized manner, and Particle Network and UniversalX seem best positioned.

With this infrastructure, users will be able to trade stocks on-chain without having to cross different networks.

Grow and Accept Regulation

However, token-based and mirrored stocks are still in early stages. Building infrastructure to support multiple assets and large-scale trading will take time. Yet, there is potential to attract new retail traders interested in more cost-effective stock trading.

For South Koreans trading US stocks, the current system involves high fees, lengthy settlement times and slow withdrawal processes. As the infrastructure and platforms supporting the US stock market continue to improve, new user groups may enter the market.

If this market grows significantly, the South Korean government will intervene with regulation. I hope this space can develop to the point of warranting such regulation.