US Tariffs Exacerbate Bit Volatility, but BTC Price May See a Glimmer of Hope

In the first three months of President Trump's term, he triggered trade tensions by announcing tariffs on Canada, Mexico, and China, leading to unexpected turmoil in the US and global markets.

The impact of the tariffs has been swift and has already spilled over into the Cryptocurrency market. As of March 8, the US President has somewhat backed off on plans to impose tariffs on some Mexican and Canadian goods - adding more uncertainty to the already volatile US trade policy and continuing to shake the markets.

Singaporean Cryptocurrency trading firm QCP Capital said in a report: "The Cryptocurrency markets have been a rollercoaster this week. As the macroeconomic environment continues to evolve, the Crypto markets remain closely correlated to equities, with price action reflecting broader economic shifts."

The violent market fluctuations highlight the uncertainty surrounding the future of Cryptocurrencies. As high-risk assets, the Crypto market has experienced severe turbulence as the Trump administration continues to test the limits of economic and foreign policy, becoming a cautionary tale of heightened market uncertainty.

Former US Treasury Secretary Lawrence Summers posted on the X platform that "tariff policies have wiped out $2 trillion in US market capitalization." He believes these measures are "ill-conceived" and will undermine US competitiveness.

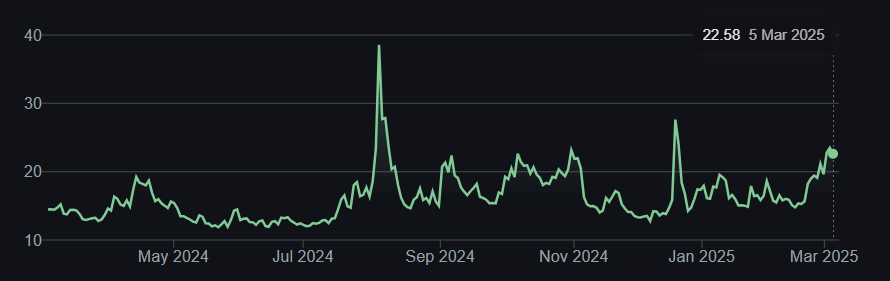

"No wonder the fear index on Wall Street has risen by a third."

Volatility index (VIX) price action. Source: Yahoo! Finance.

Although tariffs and Trump's policy statements that have roiled the markets may give a sense of impending doom, their impact on the future of the Cryptocurrency industry remains uncertain.

Moneycorp's Head of Trading and Structured Products, Eugene Epstein, said that if a trade war leads to inflation eroding the US Dollar, Bit could actually benefit. Investors may turn to Cryptocurrencies if fiat currencies depreciate, and countries hit by tariffs may choose currency devaluation as a countermeasure, making Bit a potential tool for capital flight.

Unlike traditional markets, Bit trades 24/7 and reacts immediately to macroeconomic changes, making it highly susceptible to risk-off sentiment. Moneycorp's Head of Trading and Structured Products, Eugene Epstein, said: "From a market sentiment perspective, the main drivers for Cryptocurrencies will still be the status of the Federal Crypto Reserve and overall risk sentiment. If US equities continue to decline, it's hard to imagine the Crypto markets staging a strong rebound in the short term."

Many Crypto community members had hoped that Trump's return to the White House would drive Bit to soar, and it did initially - Bit surged from $69,374 on election day to a historic high of $108,786 on inauguration day. However, the BTC price has since declined, falling below $80,000 by the end of February and retreating again in March. Despite the government's pro-Crypto policies, such as developing a strategic Crypto reserve plan and market structure reforms, Bit prices remain weak.

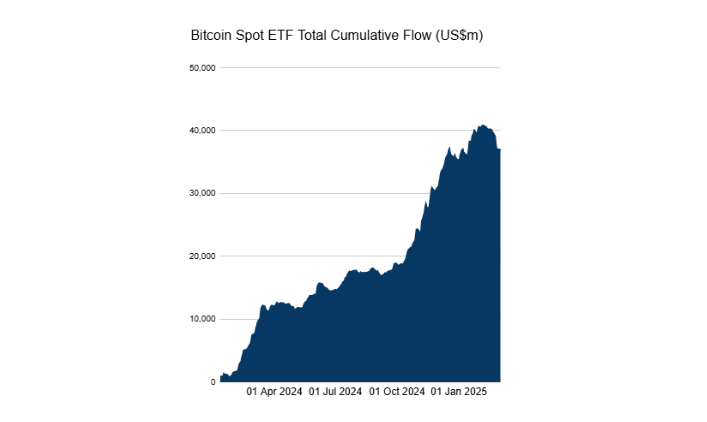

Data from Farside Investors shows that after Trump's victory, the inflow of funds into Bit spot ETFs reached a record high, with investors pouring over $10 billion into these products after the election. However, market concerns about a potential tariff war seem to have impacted overall market sentiment and indirectly weighed on Cryptocurrencies.

Since early February, Bit ETFs have seen massive outflows, while safe-haven assets like Gold have performed strongly in the tariff war.

Spot Bit ETF flows. Source: Farside Investors.

This is not the first time President Trump has used tariff threats as a negotiating tactic, and some traders believe the market will eventually shift its focus to fundamentals rather than overly focusing on the short-term impact of tariffs on US allies.

As a result, some industry traders do not entirely rely on tariffs to formulate their trading strategies. Abra's Head Trader, Bob Walden, said that tariffs are "just a headline" that will affect short-term investor sentiment but not change the underlying market fundamentals.

"In my view, tariffs are just a sleight of hand. They are Trump's bargaining chip, and I don't think they have a substantive impact on Cryptocurrencies. Initially, the tariffs triggered a market pullback - the market was at high levels, and the long positions were over-leveraged, expecting a big move. But this is just correlation, not causation."

Walden pointed out that Trump's fiscal tightening plans are the real drivers of the Cryptocurrency market.

"That's what everyone in traditional finance is focused on. Tariffs are just one part of the global market's ongoing fiscal tightening trade, and the real impact on Cryptocurrencies is from the fiscal tightening itself, as it means less liquidity in the market and less cash available for investment."