I. 40x Leveraged Short Squeeze: $379 Million "Death Position" Tops Out

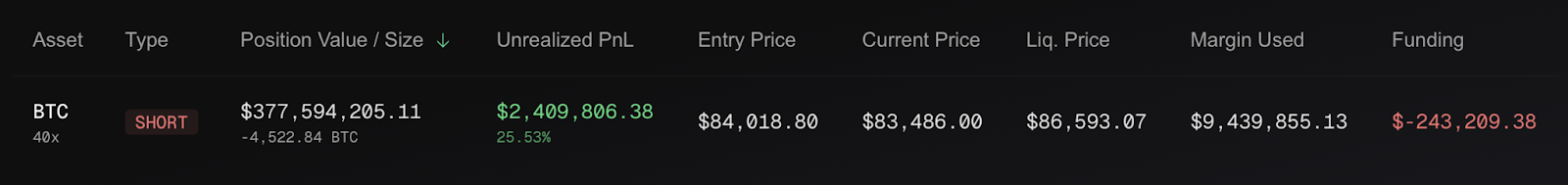

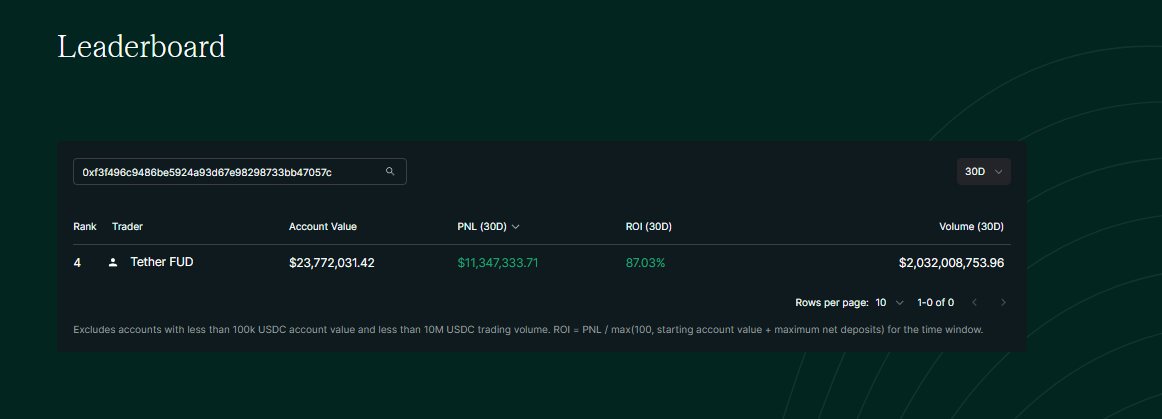

On March 16, 2025, a whale hunting battle that will go down in crypto history unfolded on the decentralized derivatives exchange Hyperliquid. A trader with the account name "0xf3f" used a $16.2 million margin to leverage 40x, establishing a $379 million nominal value Bitcoin short position, with a liquidation price of $86,593.

The trader later renamed the account to "Tether FUD", hinting at stablecoin risks, pushing Bitcoin into the volcano of a bull-bear squeeze.

Life and Death 1.8%: Market Manipulation Doubts and Liquidation Crisis

In the early hours of March 17, the Bitcoin price briefly surged to $85,059, just 1.8% away from triggering the liquidation of this short position. The community hotly debated whether market makers engaged in targeted "hunting" behavior, trying to force the whale into liquidation through pumping. But BTC price quickly fell back to $83,906, and as of the time of writing, Bitcoin has dropped to $82,000, causing the position to not realize the profit surge to $11.34 million.

This battle has exposed three major market issues:

- Leverage Out of Control: 40x leverage far exceeds the limits of traditional financial products, with a single position accounting for 17% of the open interest in Hyperliquid's BTC perpetual contracts, significantly increasing systemic risk.

- Stablecoin Trust Crisis: The trader renamed to "Tether FUD" directly pointed to the potential risks of USDT, whose market cap has exceeded $200 billion, accounting for 83% of the stablecoin market. Any de-pegging rumors will trigger a massive contraction in the on-chain stablecoin market value.

- Technical Breakdown Anxiety: After the critical $84,000 support on the Bitcoin weekly chart was breached, the $76,000-$78,000 zone has become a battleground for bulls and bears, where the "cost fortress" formed by institutional inflows in September 2024 is concentrated.

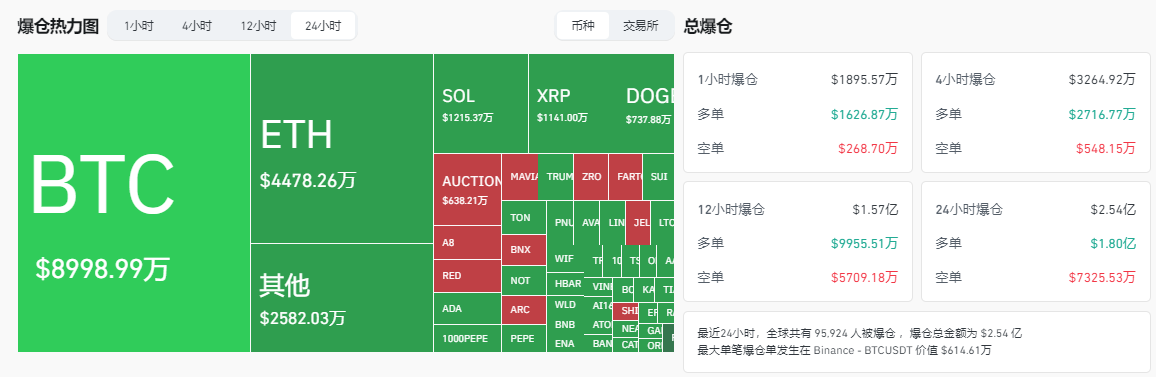

According to Coinglass data, the total network liquidation amount reached $254 million in the past 24 hours, of which $180 million were long liquidations, accounting for 71%. The emergence of leveraged positions reflects the pessimistic short-term expectations of some investors, while also exposing the risk of the amplification effect of the derivatives market on spot prices.

Controversy and Speculation: Insider Information or Market Manipulation?

Some community members suspect that the trader may have had access to unpublished information, such as predicting the potential risks of the Tether stablecoin (hinted by the user name "Tether FUD"), or anticipating policy headwinds. However, more views consider this to be a high-risk speculative behavior, and the current lack of market liquidity has exacerbated the magnitude of price fluctuations.

Institutional Withdrawal Wave: Bitcoin ETFs Net Outflow for 5 Consecutive Weeks, $5.4 Billion Exodus

Expanding Outflow from Bitcoin ETFs

Bitcoin spot ETFs are facing the most severe crisis of confidence since their approval in January 2024.

SosoValue data shows that over the past five weeks, there has been a net outflow of $5.4 billion, with a single-week outflow of $921.4 million last week. The two leading giants, BlackRock's IBIT and Fidelity's FBTC, saw outflows of $338 million and $307 million respectively. Although Grayscale's GBTC recorded a net inflow of $55 million, it was unable to reverse the overall downward trend.

Ethereum ETFs Also Encounter Chill

The Ethereum spot ETF market is also sluggish, with a net outflow of $189.9 million last week, and a cumulative outflow of $645 million over the past three weeks. BlackRock's ETHA saw a weekly outflow of $63.3 million, reflecting the short-term lack of confidence in the Ethereum ecosystem among institutions. The current total assets under management of Ethereum ETFs is $6.72 billion, accounting for only 2.9% of the ETH market cap.

Underlying Reasons for Capital Withdrawal

The analysis suggests that the ETF capital outflow has formed a negative feedback loop with the recent market adjustment: Bitcoin price has fallen nearly 30% from its year-to-date peak (reaching a low of $77,000), dampening the willingness of institutions to hold. Meanwhile, the delayed expectations of Fed rate cuts, geopolitical risks, and the high volatility of the crypto market itself have further exacerbated the risk-averse sentiment of institutional investors.

Intensifying Policy Controversy: U.S. Crypto Strategic Reserve Faces Public Opposition

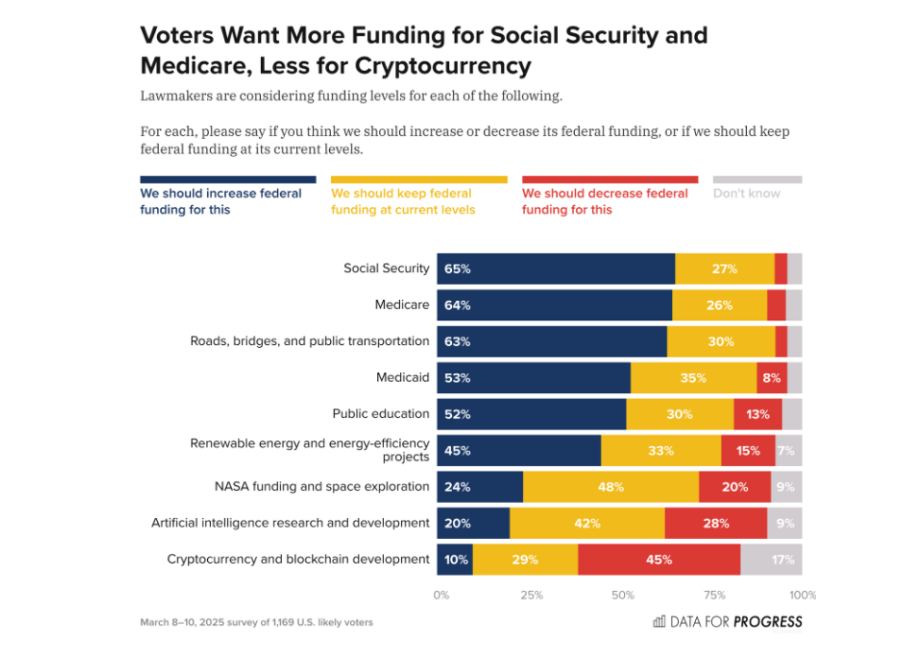

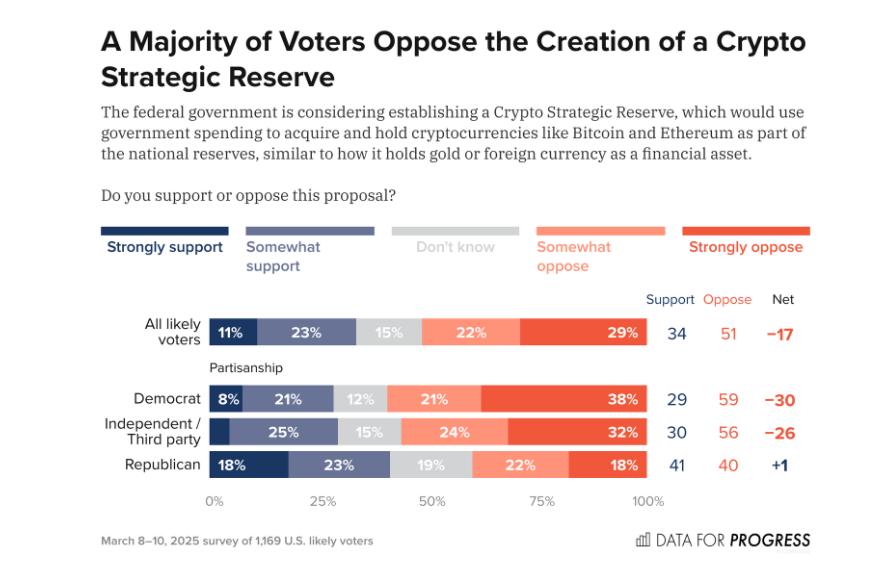

The crypto currency strategic reserve plan pushed by the Trump administration is facing a severe public opinion challenge.According to a national survey conducted by the advocacy organization Data for Progress from March 8 to 10, 2025, among 1,169 surveyed U.S. voters, 51% clearly opposed the government using public funds to establish a digital asset strategic reserve, while only 34% supported it, and 15% were uncertain. This result is in stark contrast to Trump's political promise to "make America the world's crypto capital".

Partisan Divide: Cracks Emerge within the Republican Party

Although the plan is seen as a key reform to fulfill Trump's campaign promises, its support rate varies significantly across different parties:

- Democratic Voters: 59% oppose the plan, with only 29% in support, with the opposition rate more than double the support rate. In terms of federal funding allocation, 52% of Democrats demand cuts in crypto-related spending, while only 9% support increasing investment.

- Republican Voters: Even within Trump's "base", the ratio of support to opposition is only 41% vs 40%, revealing a lack of consensus within the party. Although 12% of Republicans support increasing allocations to the crypto sector, 36% still advocate for spending cuts.

- Independent Voters: 56% expressed opposition to the strategic reserve, with a support rate of 30%, highlighting the skepticism of the centrist group towards the policy's feasibility.

Funding Controversy: Crypto Becomes the "Least Favored" Fiscal Option

The survey further reveals that in the federal budget priority areas, the crypto sector is facing an unprecedented public opinion chill:

- Calls for Spending Cuts Soar: 45% of respondents demand a reduction in fiscal investment in blockchain and cryptocurrencies, the highest among the nine areas surveyed.

- Significant Generational Differences: 18% of the under-45 group support increased allocations, compared to only 6% in the over-45 group, reflecting the younger generation's greater tolerance for technological innovation.

- Controversy over Policy Wording: Although the Trump administration has emphasized that the strategic reserve will adopt a "budget-neutral" model - using the 200,000 confiscated Bitcoins (about $16.4 billion) held by the government as the reserve base - the survey question's wording of "using government funds" may have amplified the public's aversion.

Policy Dilemma: The Chasm between Ideals and Reality

The results of this poll expose the deep-seated contradictions in the national crypto strategy:

- Lack of value recognition: The majority of voters have not yet accepted the legitimacy of cryptocurrencies as a national reserve asset, with a 51% opposition rate indicating that the concept of a "digital dollar" has not yet broken through the cognitive barrier.

- Misalignment of regulatory priorities: Only 10% of the public support increased investment in the cryptocurrency field, far lower than emerging technologies such as AI research and development (27%), suggesting that the public is more concerned with the practicality of technology than financial innovation.

- Increasing political risks: As the price of Bitcoin has fallen 22% from its peak during the Trump administration to $82,837, supporters of the policy are facing the public pressure of "dashed bull market expectations," and opponents may take the opportunity to question the asset-preserving ability of the strategic reserve.

This public opinion survey sounds the alarm for the Trump administration's cryptocurrency ambitions. If the public's concerns about fund use, asset risk, and policy transparency cannot be effectively addressed, this strategy aimed at consolidating the United States' digital finance leadership may become a victim of partisan struggle.

Technical lifeline: A multi-dimensional analysis of the $76,000 defense battle

The price of Bitcoin has retreated 25% from its annual high of $109,000, and the $76,000 level has now become a crucial battleground for bulls and bears. An analysis from four dimensions:

On-chain data perspective

- Holder distribution: The $76,000-$78,000 range has accumulated 860,000 BTC, most of which are held by institutional cold wallets, with a relatively low willingness to sell.

- Exchange flows: Coinbase has seen a net outflow of 19,000 BTC in the past three days, which may indicate that large holders are accumulating at lower levels.

- Miner capitulation index: The hash price has fallen to $0.08/TH/day, close to the critical point of miners shutting down, which may trigger a hash rate clearance.

Derivatives market signals

- Volatility surface: The 1-month implied volatility (IV) has risen to 98%, and the put/call ratio has reached 1.7, indicating a surge in hedging demand.

- Basis structure: The annualized premium of the quarterly contract remains at 4.5%, but the funding rate of the perpetual contract has turned negative, suggesting a divergence between the long and short sides of the derivatives market.

Macro policy resonance

- Fed's move: If the March 19 rate decision signals a rate cut, it may boost risk appetite; conversely, if the Fed maintains a hawkish stance, the $76,000 defense may be breached.

- Fiscal cliff: The US government's debt ceiling negotiations have reached an impasse, and a technical default could lead to another "failed safe-haven" event for Bitcoin.

Technical pattern breakout

A head-and-shoulders top pattern is emerging on the weekly chart, and if the neckline at $76,000 is breached, the measured target could be $70,000. However, the daily RSI has entered the oversold zone, suggesting potential for a technical rebound in the short term.

Conclusion

Bitcoin is experiencing a triple whammy of "whale hunting - institutional withdrawal - policy retreat," and $76,000 is both a critical technical support and a psychological defense line. The "triple window overlap" of the March 19 Fed decision, the US government shutdown countdown, and the Hyperliquid position liquidation event, investors are advised to keep their positions below 40% of total assets and avoid using leverage above 4x.