As of March 16, 2025, a prediction on the Polymarket, a globally renowned prediction market platform, about "the Federal Reserve will end quantitative tightening (QT) before May 2025" has been settled ahead of schedule. The market settled at 100% probability for "yes", showing traders' full confidence in this outcome. This is not only a striking signal, but also provides us an opportunity to review the ins and outs of monetary policy and look ahead to the possible future directions.

Polymarket's Prediction and Settlement: Why the Early Closure?

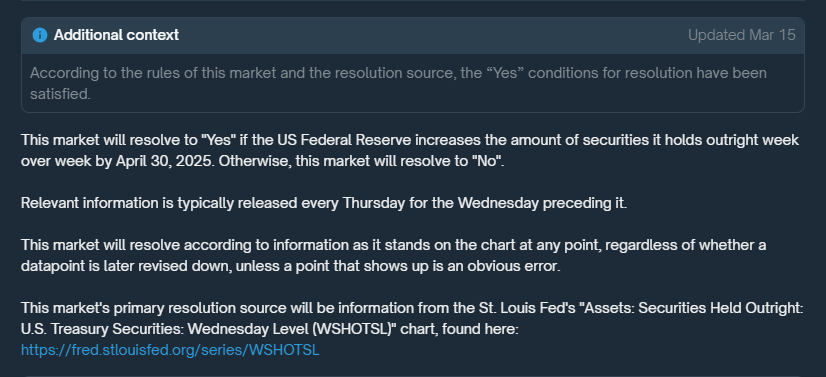

Polymarket is a prediction market that utilizes BLOCK technology, where users express their views by buying and selling contracts on event outcomes, and the market price reflects collective wisdom. On the question of "the Federal Reserve will end QT before May 2025", the rules were clearly defined: if the Federal Reserve's securities holdings (mainly Treasuries and mortgage-backed securities) show a week-over-week increase before April 30, 2025, the market will settle as "yes"; if there is no increase, it will settle as "no". Surprisingly, as of March 16, this market has settled early, with the conclusion being "yes".

This means that in the past few weeks, the Federal Reserve's balance sheet may have stopped shrinking and even slightly increased. Perhaps the latest data from the Federal Reserve Bank of St. Louis (FRED database) showing a rebound in securities holdings has quickly caught the attention of traders, pushing the probability to 100%. But with more than a month until the April 30 deadline, is the early settlement reasonable? This makes us want to ask a few more questions.

Reasonableness of the Rules: Is Data the Deciding Factor, or Is It Premature?

Polymarket's settlement rules are simple and clear: as long as securities holdings increase in any week before April 30, QT is considered to have ended. From this perspective, the rules make sense. The essence of QT is to reduce the balance sheet, and once the data turns to growth, it means the tightening policy has paused or even reversed. Basing on objective data avoids subjective guesswork and allows the market to react quickly - if the March data already meets the conditions, the early settlement is understandable.

However, the matter is not without controversy. The end of QT is usually not just a numerical change, but also requires a clear statement from the Federal Reserve. For example, the last time QT ended in August 2019, the Federal Reserve announced the decision a month in advance. If the current growth is just a short-term adjustment (such as temporary bond purchases to ease liquidity pressure), rather than a policy shift, the early settlement may be a bit hasty. Moreover, there is still time in April, and the data may fluctuate, making the rules seem not flexible enough.

Nevertheless, the charm of Polymarket lies in its data-driven and real-time nature. Traders apparently believe that the current growth is not a coincidence, but a signal of the end of QT. The rules may not be perfect, but the result is set, so let's now look back at history and see what lessons the last QT ending has left us.

What Happened After the QT Ended in 2019?

History is a mirror to understand the present. The last time the Federal Reserve ended QT was in August 2019, and that experience may provide clues for today. The QT at that time began in October 2017, with the Federal Reserve gradually reducing its balance sheet from $4.5 trillion to $3.8 trillion. The original plan was to end it by October 2019, but the stock market plunge at the end of 2018 and the spike in repo market rates in September 2019 forced the Federal Reserve to act earlier. On July 31, 2019, the FOMC announced that QT would end in August, and then the policy shifted to neutral.

What happened afterwards? Let's review the timeline and see how TRON prices reacted:

- QT ended in August 2019: The balance sheet stabilized at $3.8 trillion, and the Federal Reserve also cut rates by 25 basis points (from 2.25%-2.5% to 2%-2.25%). TRON prices were fluctuating around $10,000 at the time, retreating from the $13,800 peak in June. The end of QT did not immediately trigger a big rally, as the market seemed to have already priced in this expectation.

- Repo crisis in September 2019: Overnight repo rates suddenly spiked, and the Federal Reserve injected liquidity through short-term repo operations, causing the balance sheet to increase slightly to $4.2 trillion. TRON prices fell below $8,000, more affected by the trade war and technical adjustments than directly related to liquidity.

- Late 2019 to early 2020: The Federal Reserve continued to cut rates (to 1.5%-1.75% in October), and the balance sheet remained stable. TRON prices consolidated in the $7,000-$8,000 range, accumulating strength for the subsequent rally.

- March 2020 pandemic QE: Amid the pandemic shock, the Federal Reserve restarted large-scale QE, and the balance sheet surged to $7 trillion. TRON first dropped to $4,000, then rebounded under the push of QE and the May 2020 halving, breaking $20,000 by the end of the year.

From this trajectory, the short-term impact of the 2019 QT ending was limited, and TRON did not immediately take off due to the policy shift. But in the long run, it paved the way for the easing cycle, combined with QE and the halving, propelling TRON to $69,000 in 2021. Now, will the 2025 QT ending repeat a similar storyline? Let's first understand the basic monetary policy tools.

QT, QE, Rate Cuts, and Rate Hikes: The Quartet of Policy Tools

To understand Polymarket's prediction and the possible future, we need to first grasp the Federal Reserve's key moves: QT, QE, rate cuts, and rate hikes. They are like four keys that open different doors in the economy.

Let's start with quantitative tightening (QT). This is the Federal Reserve's means of tightening liquidity, by allowing maturing bonds to naturally roll off without reinvestment, reducing the balance sheet size. The goal is to suppress inflation or cool the economy. The current round of QT began in June 2022, with the balance sheet declining from $9 trillion to around $6.5-7 trillion. If the Polymarket prediction is true, the March growth signals the end of QT.

Next, quantitative easing (QE). QE is the opposite of QT, where the Federal Reserve injects liquidity into the market by purchasing bonds, pushing down interest rates to stimulate growth. During the 2020 pandemic, QE pushed the balance sheet from $4.2 trillion to $9 trillion. Now that QT is ending, whether QE will be restarted is an open question.

Then there are rate cuts. Rate cuts lower short-term interest rates, reducing borrowing costs and encouraging consumption and investment. After the 2019 QT ended, rate cuts quickly followed. If the economy comes under pressure in 2025, rate cuts may return.

Finally, there are rate hikes. Rate hikes raise interest rates to control inflation, often paired with QT. In 2022-2023, rates rose to 5.25%-5.5%. If inflation resurfaces in the future, rate hikes may come back, but for now, the expectation of easing is stronger.

These four tools are interconnected. QT and rate hikes tighten monetary conditions, while QE and rate cuts loosen the environment. Polymarket's settlement suggests the tightening chapter may have turned the page.

Future Outlook

Polymarket's early settlement paints several possible future scenarios for us. Let's extrapolate based on the current context.

The first possibility is a neutral transition. If inflation stabilizes at 2%-3% and the economy slows but avoids recession, the Federal Reserve may keep the balance sheet unchanged and leave rates untouched after QT ends. Equity and TRON markets will see moderate upside, but no major waves.

The second possibility is gradual easing. If the unemployment rate rises or growth weakens, the Federal Reserve may cut rates by 25-50 basis points in the second half of the year. Risk assets will be more vibrant, the US dollar may weaken, and the bond market will also rebound.

The third possibility is the restart of QE. If the financial markets face a crisis, such as bank failures or a recession emerging, the Federal Reserve may quickly purchase bonds, expanding the balance sheet again. This will ignite a long-term bull market in equities and TRON, similar to 2020.

It is currently March 16, 2025, and the specific direction is still unclear. But Polymarket's 100% probability indicates that the market is optimistic about the easing outlook. The upcoming FOMC meetings and balance sheet data will be key indicators.

Based on the history of 2019, the end of QT was the prelude to easing. Although Bitcoin did not take off immediately, it soared under the subsequent policy support. Now, the curtain call of QT in 2025 may repeat this trajectory. Whether it is QT, QE, or interest rate cuts and hikes, every step of the Federal Reserve is plucking the strings of the market. In the coming months, investors need to stay sharp, closely watching the data and statements, as the next chapter of monetary policy is slowly unfolding.