“The United States will become the world’s Bitcoin superpower. America’s Golden Age has begun.”

Crypto Market Summary

1. Trump signed an executive order to establish the United States' strategic Bitcoin reserve, which is very beneficial to the development of crypto from a long-term perspective.

2. The data in the first half of this month is favorable to the short-term trend of crypto, but due to the impact of tariffs and turbulent situation, the market is still in a volatile range.

3. In the next few months, there will be more favorable regulatory releases, including: ETH pledge ETFs, more crypto ETFs, clarification of DeFi financial regulatory bills, and tax rate legislation for Bitcoin and crypto tracks.

1. Market Overview

1.1 Analysis of FMG RWA and AI Index

In the first half of March 2025, among the many indexes monitored by FMG, the RWA Index still performed well, with monthly returns rising from about 16% in late February to about 19% at present. This is due to the fact that the altcoin season is delayed, Web 3 investment opportunities are few and over-concentrated on BTC and stablecoins. OTC funds are turning their attention back to DeFi, asset management and strategy sectors. However, DeFi in a single Web 3 market is also highly risky, so products with real-world asset anchoring and DeFi attributes are currently gaining favor.

1.2 Crypto Market Data

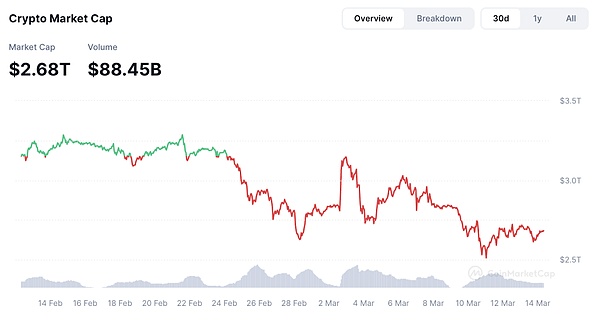

As of March 14, 2024, the total market value of cryptocurrencies was $2.68 trillion, down 6.2% from $2.86 trillion in the second half of February.

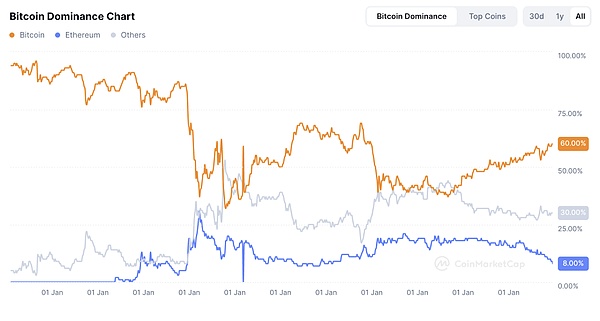

BTC Dominance Index: As of March 2, the current BTC dominance index is 60.1%, which is the same as in the first half of February.

Altcoin Season Arrival Index: As of March 15, the current Altcoin Season Arrival Index is 14, which has further declined compared to 22 in late February. This means that there are fewer opportunities for Altcoin at present, and funds are mainly concentrated in BTC and other stablecoins, but it also means that Altcoin have bottomed out.

ETFs and Contract Indices

BTC ETF: In the past 15 days, BTC ETF has seen a net outflow of $2.678 billion.

ETH ETF: In the past 15 days, the ETH ETF has seen a net outflow of $221 million.

1.3 CPI and other data and market reactions to judge the market

At 8:30 AM (EST), the US CPI data was released, showing a significant decline in inflation. The CPI report showed a monthly decline of 0.2% in February 2025, the lowest level since April 2021 (Source: US Bureau of Labor Statistics, March 12, 2025). This positive inflation data immediately caused a reaction in various asset markets, including the cryptocurrency market.

After the release of the US CPI data, crypto assets rose overall, once again confirming the huge and direct impact of the US macro environment on the crypto market: Although, after the data was released, the market further raised expectations for the #Federal Reserve to cut interest rates in September and November, and discussions began to emerge on whether the #Bitcoin price would break through previous highs in June and July.

However, the Fed has remained on hold on interest rate actions for six consecutive times. Especially considering the stubbornness of inflation, the Fed’s overall stance is “Wait And See”. Before the inflation problem is effectively controlled, the Fed will not send a clear signal of rate cuts, and the trend of the crypto market will most likely continue to fluctuate.

2. Hot Market News

2.1 White House Cryptocurrency Chief: Trump signs executive order to establish strategic Bitcoin reserves

David Sacks, White House AI and Cryptocurrency Director, said, “Just minutes ago, President Trump signed an executive order to establish a strategic bitcoin reserve. The reserve will be capitalized with bitcoins owned by the federal government that are part of criminal or civil asset forfeiture proceedings. This means it will not cost taxpayers a penny. It is estimated that the U.S. government owns approximately 200,000 bitcoins; however, a full audit has never been conducted. The executive order requires a full accounting of the federal government’s digital asset holdings.

The U.S. will not sell any of the Bitcoin that is deposited into the reserve. It will be kept as a store of value. The reserve is like a digital Fort Knox for the cryptocurrency often referred to as “digital gold.” Premature sales of Bitcoin have cost U.S. taxpayers more than $17 billion. Now the federal government will develop a strategy to maximize the value of its Bitcoin holdings.

Coinbase co-founder and CEO Brian Armstrong commented on social media about "Trump is advancing the cryptocurrency reserve plan" and said that in terms of asset allocation for strategic reserves, BTC may be the best choice. As the successor to gold, BTC has the simplest and clearest narrative. If people want more variety, they can index crypto assets by market capitalization to maintain fairness. But it may be the simplest to just choose BTC.

2.2 French crypto market maker Flowdesk completes $52 million in additional round B financing, led by HV Capital

French crypto market maker and liquidity provider Flowdesk has completed a $52 million Series B financing, of which 80% is equity financing and about 20% ($10.2 million) is debt financing. This round of equity financing was led by European investment institution HV Capital, with participation from Eurazeo, Cathay Innovation and ISAI VC, and the debt financing was provided by funds managed by BlackRock. HV Capital also obtained a seat on the board of directors of Flowdesk this time.

Flowdesk plans to use this round of funds to expand its business, including launching a dedicated crypto credit business and setting up an office in the UAE. Guilhem Chaumont, the company's co-founder and global CEO, said that debt financing is a strategic choice for the company to optimize its balance sheet while maintaining sustainable growth and avoid equity dilution. Flowdesk previously completed a $50 million Series B financing in January 2024, with a valuation of more than $250 million at the time.

2.3 Metaplanet completes approximately $87 million in financing to increase Bitcoin holdings

According to Metaplanet's announcement, the company completed the large-scale exercise of the 13th and 14th series stock subscription rights through a third-party private placement, raising a total of approximately 12.97 billion yen (approximately 87 million US dollars). This financing was supported by EVO FUND, and part of the funds have been used to redeem the previously issued 7th ordinary bonds in advance. Metaplanet plans to use the funds to continue to increase its holdings of Bitcoin to strengthen its digital asset investment strategy.

III. Regulatory Environment

Trump: Treasury and Commerce Departments will explore new ways to accumulate more Bitcoin

U.S. President Trump spoke at the White House Crypto Summit and said that the Treasury and Commerce Departments will explore new ways to accumulate more Bitcoin for reserves. They do not want taxpayers to pay any price. They will order federal agencies to take inventory of the digital assets currently held by the U.S. government and determine how to transfer them to the Treasury Department. The digital assets will be kept in a new U.S. digital asset reserve.

IV. Summary

The long-term trend remains positive:

1. Regulatory compliance : This year's crypto legislation is gradually benefiting the entire crypto track, especially after Trump signed the US Bitcoin Strategic Reserve, the moat is more solid and the general direction is more certain. In the next few months, there will be more favorable regulatory releases, including: ETH pledge ETFs, more crypto ETFs, clarification of the DeFi financial regulatory bill, and tax rate legislation for Bitcoin and the crypto track.

2. Interest rate cut cycle : We are currently in an interest rate cut cycle, and it is obvious that this interest rate cut cycle will be particularly long-lasting, because the Federal Reserve will adjust or not cut interest rates according to specific economic conditions, affecting the capital market. The United States is still in a period of high interest rates, and there is still a long way to go before low interest rates or even zero interest rates. It may last for 2-3 years. QE may also be opened at the required time. From the perspective of the economic cycle, this bull market has just begun.

3. Track benefits : The three main core tracks in the long term: DEFI, stablecoins and US stock tokenization will lead crypto to a new height in line with the globalization of US finance. Hype track: The combination of AI, depin and crypto is also a hype track point worthy of attention in this cycle.