In the Asian trading session on Tuesday, spot gold once again broke through the critical $3,000 level, reaching a new all-time high of $3,028. As a traditional safe-haven asset, since Trump's inauguration in January, the escalating global trade tensions have led to strong safe-haven buying, causing gold prices to hit new highs 14 times. After a 27% cumulative increase in 2024, gold has risen more than 15.19% so far this year.

Heightened Trade Concerns and Surging Safe-Haven Demand

Tariff policy threats are one of the driving factors behind this round of gold price surge. The US's volatile trade policy has made gold a preferred asset for investors amid geopolitical and economic turmoil.

This year, the US has repeatedly imposed tariffs on its major trading partners such as China, Mexico, and Canada, and imposed a 25% tariff on all steel and aluminum imports to the US. The US government's "tariff stick" has led to a fierce backlash in global trade policy. The European Commission said on the 12th that "strong retaliation" has become the only "remedy", and will impose tariffs on $26 billion worth of US goods starting next month. Canada has reacted even more quickly, stating that it will impose retaliatory tariffs on $29.8 billion worth of US goods starting March 13.

There are no winners in a trade war, and the global economy is the first to suffer, with increased fragility and a dimmer economic outlook. Global stock markets have plummeted, and market participants have turned to safe-haven assets, with gold being the top choice for capital inflows.

At the same time, Trump has used tariff threats as a bargaining chip, and his erratic policy actions and statements have been constantly eroding global market confidence. The market is not afraid of bad news, but hates uncertainty. The upward trend in gold prices this year has been highly coincident with the escalation of trade conflicts, highlighting the direct driving force of tariff policy uncertainty on gold prices.

Heightened Concerns about US Recession, Undermining Market Confidence

The weakening momentum of US economic growth has also provided an upward impetus for gold. Data released by the US Department of Commerce on Monday showed that US retail sales in February fell far short of expectations, adding to the signal that consumers are cutting back on various expenditures and deepening market concerns about the slowdown in consumer spending. Previous data also showed that the US consumer confidence index has declined for three consecutive months. As for the service sector, which is crucial to the US economy, the US released a preliminary February service PMI of 49.7 last week, not only far below market expectations, but also fell below the boom-bust line for the first time since January 2023, indicating an even bleaker economic outlook.

At the same time, the trade war has further fueled inflation expectations by pushing up the prices of imported goods, while the US government's implementation of layoff plans has also exacerbated market concerns about the economic growth outlook. Investors have developed a "high-risk" risk awareness towards US stocks, and capital with nowhere to go has flocked to gold.

Safe-Haven and Rate Cut Support, Gold Prices Expected to Continue Rising

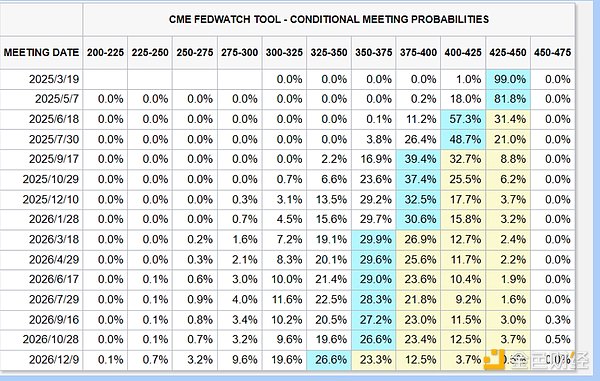

The US economy is facing a "triple whammy" of tariffs, government layoffs, and consumer contraction, shaking the confidence of businesses, consumers and workers, and increasing the risk of recession. The market generally expects the Fed to implement multiple rate cuts in 2025 to stimulate economic growth, and the latest FedWatch forecast shows that the next rate cut may come as early as June. Expectations of ample liquidity and a declining US dollar index will support a strong rise in gold prices.

In addition, since the Russia-Ukraine conflict, the West has frozen the assets of the Russian central bank, and central banks around the world have begun to deliberately move away from US dollar reserves and shift their attention to gold. The demand for gold purchases from central banks has continued to grow, breaking the 1,000-ton mark for three consecutive years.

All signs indicate that the gold market is entering a new cycle dominated by risk premiums, and many market institutions generally expect that the strong buying power may drive gold prices to continue rising in the medium to long term.

4E, as the global partner of the Argentine national team, provides investors with convenient and flexible gold trading options. Through 4E, investors can enjoy up to 500 times leverage for both long and short positions, and trade with USDT, with a minimum of less than 6 U to open a position. 4E also supports cryptocurrencies, forex, US stocks, indices, crude oil, silver and over 600 other trading pairs, providing investors with a wide range of opportunities.