Four.Meme Security Incident: Undercurrents in the Meme Frenzy

On March 18, 2025, the core Meme issuance platform of the BNB Chain ecosystem, Four.Meme, was hit by a sandwich attack, resulting in a loss of assets worth $120,000.

On March 18, Four.Meme posted that after checking and resolving the security issues, its functionality has been restored. It had previously suspended the function to conduct an investigation, stating that it "was attacked".

The attacker pre-calculated the liquidity pool address and transferred unreleased tokens to it before the token launch, then exploited the price fluctuations during liquidity injection to profit.

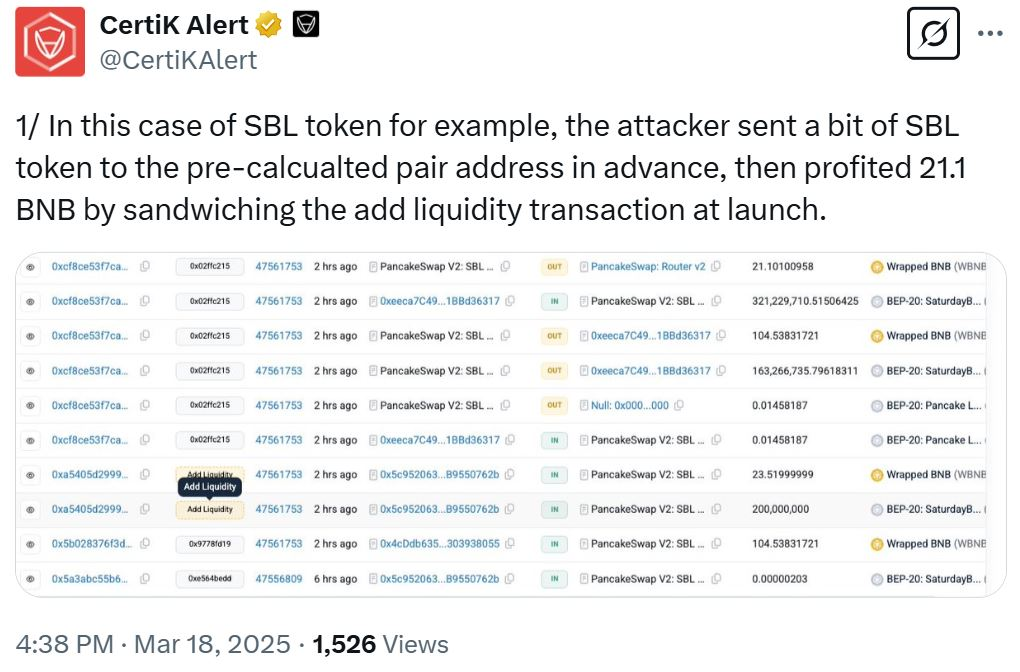

Blockchain security company CertiK stated that the attacker transferred a large amount of unreleased tokens to the currency pair address before the creation, then manipulated the price during the launch and sold to profit. Taking the SBL token as an example, the attacker pre-sent some SBL tokens to the pre-calculated pairing address, and then made a sandwich trade to increase liquidity and profit 21.1 BNB.

According to CertiK, the attacker used this strategy to take away at least 192 BNB, worth about $120,000, and sent it to the decentralized cryptocurrency exchange FixedFloat.

This incident exposed the security vulnerabilities of the BNB Chain in the rapid expansion of the Meme sector: the contradiction between the high-frequency token issuance mechanism and the transparency of on-chain transactions has become a fatal loophole exploited by hackers.

It is worth noting that this is the second major security incident for Four.Meme after the $183,000 attack on February 11. Although the team quickly suspended the function, fixed the vulnerability, and launched user compensation, the event reflects deeper problems:

- Technical iteration lags behind ecosystem expansion: As a core carrier of the surging traffic on the BNB Chain (325% growth in weekly users), Four.Meme's security audit mechanism has not kept up with the high-frequency token issuance demand;

- Evolution of arbitrage automation tools: Attackers used AI-driven trading bots to predict liquidity pool behavior, which is consistent with the Chainalysis report on "professional criminal groups using AI technology";

- Centralization risk in ecosystem governance: Four.Meme was incubated by the BinaryX team and did not issue a platform token, leading to ambiguity in the security responsibility entity, and users' reliance on the centralized team's emergency response.

The Rise of Meme on the BNB Chain: Dual Drivers of the CZ Effect and Technical Upgrades

Despite the frequent security incidents, the Meme ecosystem of the BNB Chain experienced explosive growth in the first quarter of 2025. The core driving forces come from two aspects:

(I) CZ's "Traffic Nuclear Explosion" Strategy

The return of Binance founder CZ became a turning point for the ecosystem. He manufactured FOMO market sentiment through high-frequency Twitter interactions and controversial decisions:

- TST Token Experiment: A test token in a tutorial video, under CZ's "unofficial but tacit" attitude, its market cap surged 100-fold to $500 million in 3 days, directly driving the BNB Chain's weekly trading volume to $29.5 billion, surpassing Solana to top the public chain rankings;

- Gas Fee Subsidy Plan: Reducing user transaction costs through a sponsorship model, combined with "sub-second block confirmation" technology (block time < 1 second), making the Meme trading experience on the BNB Chain approach that of centralized exchanges;

- Ecosystem Brand Reshaping: CZ's "Liberating the BNB Chain" declaration and the 2025 roadmap positioned Meme as the core entry point for attracting incremental users, rather than a pure speculative tool.

- Mubarak Went Viral: Mubarak's breakthrough of $200 million in 3 days ignited the BNB ecosystem meme craze.

(II) Underlying Technological Revolution

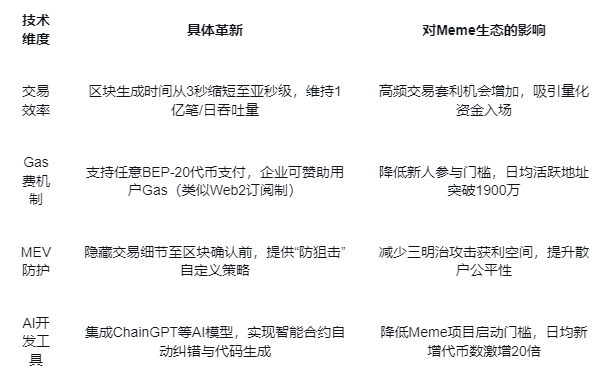

BNB Chain's technological upgrades in 2025 provided differentiated advantages for its Meme ecosystem compared to Solana:

These changes have formed a "low threshold + high speed + strong propagation" Meme incubation closed loop on the BNB Chain. Taking the pet dog-themed token Broccoli as an example, its launch caused the on-chain Gas fee to soar to $0.43, a new high since 2022, indicating that the retail participation has reached a frenzy state.

The Dilemma of Security and Growth: The Survival Law of the Meme Ecosystem

The Four.Meme incident revealed the survival law of the Meme sector that cannot be avoided - the positive correlation between traffic and risk. BNB Chain's response strategies present three contradictions and balances:

(I) The Cost of Prioritizing Efficiency over Delayed Security

To compete for Solana's market share, the BNB Chain chose to prioritize optimizing the trading experience over comprehensively strengthening the security foundation. Data shows that while its MEV protection mechanism has been deployed, it still lacks effective defense against pre-release token liquidity pool prediction attacks. This "expand first, govern later" strategy, while temporarily boosting ecosystem data (Four.Meme's weekly trading volume grew 40%), has sown the seeds of long-term trust crisis.

(II) The Dilemma of Decentralized Ideals and Centralized Rescue Reality

Although the BNB Chain advocates decentralized governance, it still relies on centralized forces in crisis management:

- The Four.Meme team directly suspended contract functions and manually compensated users, violating the "Code is Law" principle;

- CZ's personal Twitter attitude towards projects like TST significantly impacted the token price, forming a "celebrity effect" dependence;

- The $4.4 million liquidity plan was led and distributed by the official foundation, rather than a community DAO voting decision.

This hybrid model, while improving crisis response efficiency, weakens the ecosystem's resistance to single-point failures.

(III) The Upgraded AI-Powered Attack and Defense Game

Both attackers and defenders are using AI technology to reshape the battlefield:

- Attack Side: Using machine learning to predict liquidity injection patterns and automatically generate attack contracts (e.g., pre-placing tokens 10 minutes in advance in the SBL token incident);

- Defense Side: BNB Chain introduced an AI real-time monitoring system to automatically intercept abnormal transaction patterns (such as creating similar tokens in a short period of time).

The outcome of this technological arms race will determine the sustainability threshold of the Meme ecosystem.

Ecosystem Competition and Cooperation: The "Meme Hegemony" Battle between BNB Chain and Solana

The rise of the BNB Chain is reshaping the Meme sector landscape. Compared to Solana, its competitive advantages and weaknesses coexist:

(I) Advantages

- Exchange Ecosystem Synergy: The speed of Binance listing BNB Chain Meme tokens is much faster than Solana projects (TST went from community hype to listing in just 3 days);

- Technical Compatibility: EVM compatibility allows Ethereum developers to migrate seamlessly, while Solana's Rust development threshold limits project supply;

- Capital Reserve Advantage: The BNB Chain Foundation provides targeted subsidies for Gas fees and liquidity, while Solana relies more on the venture capital market.

(II) Challenges

- Cost of trust repair: The collapse of MEME coins related to CZ has made the market confidence fragile, and BNB Chain needs to avoid similar events;

- Infrastructure bottleneck: Although the Block speed has been improved, the daily transaction capacity of BNB Chain is still lower than the historical peak of Solana;

- Cultural identity difference: The "tech geek" community of Solana and the "exchange traffic" group of BNB Chain have conflicts in value perception.

Future Outlook: From MEME Frenzy to Ecological Value Deposition

BNB Chain's 2025 strategy reveals its grand ambition - to use MEME as a traffic entrance, and ultimately lead to an AI+DeFi ecological closed loop. The feasibility of this path depends on three key transformations:

User transformation: Can more than 20% of the "new people on the chain" attracted by MEME be retained to the AI data platform Alaya or the DeFi protocol PancakeSwap?

Technical transformation: Can the sub-second transaction capability be extended from the MEME scenario to high-frequency derivative trading and other high-end financial applications?

Capital transformation: Can the MEME speculative capital be channeled into the construction of ecological infrastructure (such as the Greenfield storage network) through DAO governance and other mechanisms?

If these transformations are successful, BNB Chain may become the first public chain to realize the "MEME-infrastructure-business application" value cycle, otherwise it may fall into the periodic collapse of traffic bubbles.