Table of Contents

ToggleStablecoin Market Growth Momentum is Abundant

1/ Stablecoins are reshaping finance 🏦

Explore all insights, market trends, asset deep dives, and more in "The State of Stablecoins 2025"— a comprehensive report by Dune & @artemis

Link at the end of the thread 🧵 pic.twitter.com/ociR0HJlsX

— Dune (@Dune) March 18, 2025

Stablecoin Trading Volume Exceeds Global Payment Networks

Dune's latest "The State of Stablecoins 2025: Supply, Adoption, and Market Trends" report indicates that while the market capitalization of stablecoins is still far smaller than traditional fiat liquidity (the US M1 money supply is $18.4 trillion), their trading volume has surpassed major payment networks.

In 2024, Visa processed $15.7 trillion, and Mastercard's transaction volume reached $9 trillion in the fourth quarter. In comparison, the annual transfer volume of stablecoins reached $35 trillion, indicating their importance in the global financial infrastructure.

Stablecoin Supply and Trading Volume Surge

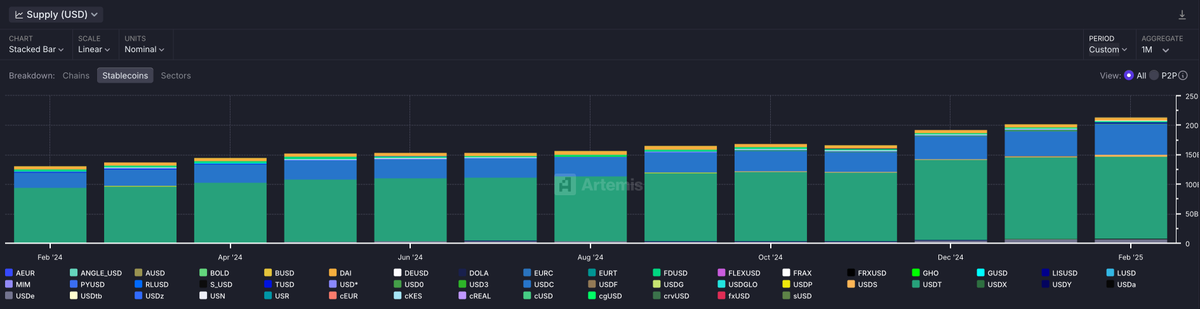

From February last year to February this year, the stablecoin supply grew by 63%, from $138 billion to $225 billion. During the same period, the monthly trading volume jumped from $1.9 trillion to $4.1 trillion, an increase of 115%, and reached a historic high of $5.1 trillion in December 2024.

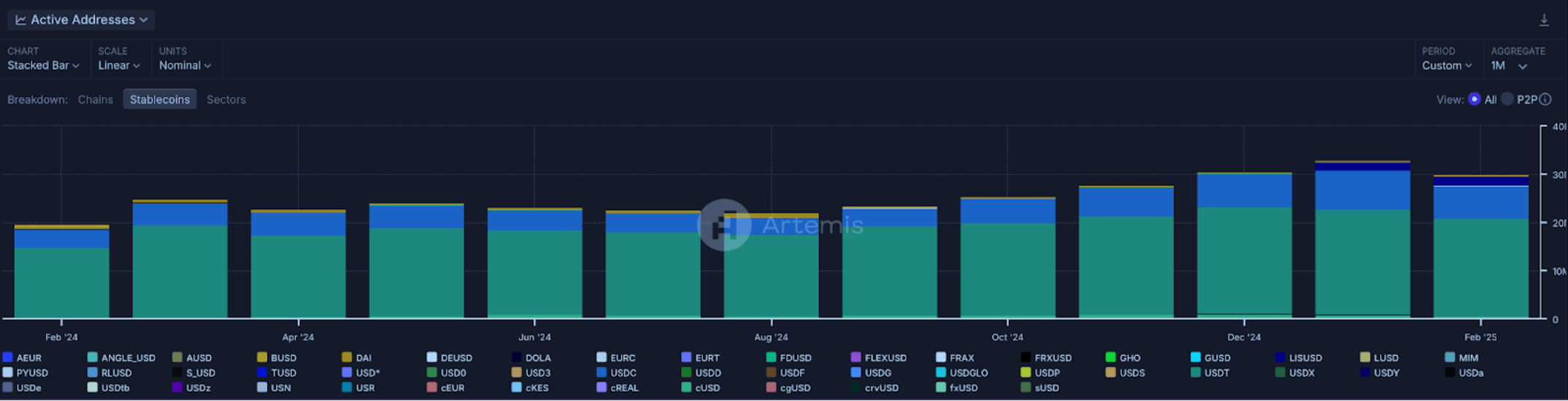

User Numbers Explode: Active Addresses Surpass 30 Million

Last year, the number of active stablecoin addresses doubled along with the total number of transactions, growing from 19.6 million to 30 million, an increase of 53%; however, the average transaction amount remained flat, fluctuating slightly between $676,000 and $683,000. This growth is mainly driven by institutional adoption, increased cross-border payment demand, and the expansion of DeFi applications.

Who is the Stablecoin Market Hegemon?

Supply Ranking

- USDT (Tether): The supply increased from $96 billion to $146 billion, but its market share declined to 64%, shifting its focus to P2P transfers.

- USDC (Circle): Benefiting from the clear MiCA regulation, its market share rose to 24.5%, with its supply doubling to $56 billion.

- USDe (Ethena Labs): Surged 10-fold to $6.2 billion, becoming the third-largest stablecoin.

Trading Volume Ranking

- USDC: Trading volume of $2.7 trillion, with a 66% market share, firmly in the lead.

- USDT: Trading volume of $1.2 trillion, but its market share declined to 26%.

- DAI (Sky): Briefly reached a 24% trading market share in August 2024, but then declined due to the brand change (Sky).

Blockchain Competition: Which Chain is Most Favored by Stablecoins?

- Ethereum: 55% market share, still the dominant chain.

- Tron: Market share declined from 35% to 28%, losing some of its advantages.

- Solana: Rapidly rising, with market share soaring from 1.6% to 5.4%, driven by Meme coin trading.

- Base: Grew remarkably from 0.2% to 1.8%.

Innovative Stablecoin Highlights: Ethena USDe, Sky USDS, PayPal PYUSD

Ethena USDe

- Stabilizes prices through hedging strategies, rather than fiat currency reserves.

- Over 60% of USDe is used for staking (sUSDe), with an annual yield of 9%.

Conor Ryder, the research lead at Ethena Labs, stated, "The next generation of stablecoins must be able to maintain stability under various market conditions."

We have focused on an income-supported stabilization mechanism in the design of USDe to ensure users have a reliable alternative to traditional dollar assets.

(Ethena and Securitize Launch Converge: An EVM Chain Built for Institutional-Grade Asset Tokenization)

Sky USDS

- MakerDAO was rebranded as Sky, launching USDS to replace DAI.

- USDS has a freezing function, sparking controversy in the DeFi community.

- The Sky platform manages $8.6 billion in collateral assets, with 44.5% being USDC.

(Governance Token Sky Underperforms, MakerDAO Proposes Returning to the Maker Brand)

PayPal PYUSD

- Launched on Solana in May 2024, with a 271% increase in trading volume.

- PayPal recently plans to use PYUSD for business payments, further driving adoption.

- In March 2025, Mesh raised $82 million, becoming the first investment case settled in PYUSD.

(Fireblocks and Paxos Launch a $1 Million Grant Program to Accelerate the Adoption of PayPal Stablecoin PYUSD)

Stablecoins Entering a New Era

The stablecoin market experienced explosive growth from 2024 to 2025, with trading volume surpassing major payment networks and a significant increase in institutional adoption. However, the market still faces challenges from regulatory policies and technological innovations. The rapid rise of emerging blockchains like Solana and Base may further reshape the flow of stablecoins.

As Rob Hadick, a general partner at Dragonfire, stated:

Stablecoins are the lifeblood of cryptocurrencies and the superconductor of the financial world. They have opened up new markets, capabilities, and financial opportunities that were previously inaccessible.

(Trump Tariffs Driving Stablecoin Market Cap to Break $500 Billion? 'Bell Curve': Binance's $2 Billion Investment Case, RWA, and Institutional Participation Energizing the Market)

Risk Warning

Cryptocurrency investments carry a high degree of risk, and their prices may fluctuate dramatically. You may lose your entire principal. Please carefully evaluate the risks.