Here is the English translation of the text, with the specified terms retained and not translated:

On the early morning of March 20th Beijing time, Jerome Powell, the Chair of the Federal Reserve, delivered a speech at the post-FOMC (Federal Open Market Committee) meeting press conference, revealing the latest monetary policy developments to the market. At the same time, a bombshell news came: US President Donald Trump will deliver a speech at the Digital Asset Summit (DAS) tomorrow (March 20th), and according to intelligence at 4:34 am, he will announce a "major update" to his cryptocurrency strategy at the event. This will be the first appearance of the current US President at a cryptocurrency conference. Driven by this series of events, the price of Bitcoin surged 5% today, breaking through $87,000, and the market sentiment has shifted from cautious observation to enthusiastic anticipation. So, what did Powell say yesterday that ignited the market's hope? And how will Trump's upcoming appearance add further fuel to Bitcoin's rally?

FOMC Meeting: Steady Interest Rates, Slower Balance Sheet Reduction Ignites Market Confidence

Yesterday's FOMC meeting was the focus of the week, with global investors eagerly awaiting the Federal Reserve's latest decision. As expected, the federal funds rate remained unchanged at 4.25%-4.50%, a range that has not been adjusted since the end of last year and has already been fully digested by the market. However, what really caught the market's attention was Powell's announcement of a key adjustment in his subsequent speech: from April, the Federal Reserve will slow the pace of quantitative tightening (QT), reducing the monthly asset balance sheet reduction from $25 billion to $5 billion.

Powell provided a detailed explanation for this adjustment. He stated that this change is not a shift in monetary policy, but a "technical decision" aimed at making the balance sheet reduction cycle longer and more sustainable. In simple terms, the previous high-speed balance sheet reduction could have reduced the balance sheet to the target level within half a year, while the slower pace will now extend this process to around 15 months. He particularly emphasized that the Federal Reserve has no intention of conveying a dovish signal by pausing or stopping the balance sheet reduction, but rather hopes to maintain its "deterrence" to the market and avoid investors mistakenly believing that the policy will be significantly loosened.

For high-risk assets like Bitcoin, subtle changes in liquidity often trigger violent reactions. Since the Federal Reserve launched QT in 2022, the hundreds of billions of dollars withdrawn from the market each month have tightened the financial environment, putting pressure on the prices of assets like Bitcoin. Now, with the balance sheet reduction scale dropping from $25 billion to $5 billion, it means that the monthly withdrawal volume has been reduced by four-fifths, equivalent to injecting a moderate "liquidity supplement" into the market. Although Powell downplayed the policy implications of this adjustment, investors clearly view it as a positive signal. The Federal Reserve seems to be exploring a strategy: while maintaining high interest rates to curb inflation, it will support the economy by slowing the tightening of liquidity. This "high interest rate + mild easing" combination is precisely the environment that risk assets have been longing for, and Bitcoin naturally senses the opportunity for a rally.

Powell's Economic and Inflation Outlook: The Art of Balance in Caution

When discussing the US economy, Powell's tone was cautiously optimistic. He stated that the US economy and labor market continue to show resilience, with the unemployment rate remaining low, and employment growth, although slowing, is still robust. However, he also acknowledged that some worrying signs have emerged in recent data: consumer spending is slowing, and business and market confidence have declined. He used the phrase "the uncertainty around the economic outlook is increasing" to summarize the situation, indicating his concern about the slowdown in growth. At the same time, he did not show any signs of being eager to take action, but rather reiterated the Federal Reserve's stance of "patient observation and data-driven" policy adjustments, based on future economic data.

Inflation was the central focus of Powell's speech. He directly stated that the current inflation level is still higher than the Federal Reserve's long-term 2% target, and recent short-term inflation indicators have even shown signs of rising. More notably, he explicitly attributed part of the inflationary pressure to trade policy. The tariff measures recently introduced by the Trump administration are believed to have pushed up the prices of imported goods, which have then been passed on to consumers. Powell acknowledged that the impact is difficult to quantify precisely, but it is undoubtedly an important driver of the rise in inflation. However, he did not adopt a hawkish stance, such as hinting at rate hikes to combat inflation, but rather chose a neutral tone, emphasizing that the Federal Reserve needs to find a balance between controlling inflation and supporting economic growth.

This "two-handed" stance is a subtle positive for Bitcoin. On the one hand, rising inflation may push up real interest rates, exerting some pressure on risk assets; on the other hand, Powell has not closed the door to future easing, and even hinted that he will intervene in a timely manner when the economy is weak. This flexibility avoids the market falling into panic due to hawkish expectations, paving the way for Bitcoin's rally. More importantly, the inflationary concerns caused by tariffs may exacerbate the risk of stagflation - a combination of slow economic growth and rising prices. This environment often enhances Bitcoin's appeal as a "digital gold" hedge, providing additional support for its price.

Dot Plot and Future Expectations: Smooth Descent Path, Underlying Divisions

The economic forecasts and Dot Plot released at the meeting were another focus for investors. The Dot Plot shows that Federal Reserve officials' expectations for two rate cuts in 2025 and 2026, each by 25 basis points, for a total of 100 basis points, remain unchanged from previous projections. This result indicates that the Federal Reserve has not significantly adjusted its long-term policy path due to inflationary pressures or economic slowdown. However, Powell mentioned in his speech that the number of officials supporting a more cautious stance has increased, and internal divisions over the timing of rate cuts are widening.

The source of this division is not difficult to understand. On the one hand, signs of slowing economic growth may require earlier or more monetary stimulus; on the other hand, the persistence of inflation and the upward push from tariffs make the Federal Reserve reluctant to ease too easily. The hawkish tone reflected in the Dot Plot - Powell clearly stated that there is no intention to cut rates before the fourth quarter - suggests that the possibility of significant easing in the short term is not high. However, for Bitcoin investors, the fact that rate cut expectations have not been reduced is enough to avoid the selling pressure from a hawkish shift, while the actual benefit of slower balance sheet reduction further ignites market confidence.

It is worth noting that although the Dot Plot maintains the expectation of two rate cuts, the market's tug-of-war with the Federal Reserve seems to have ended in "market defeat" once again. Some analysts point out that if the Federal Reserve had followed the market's expectations and predicted three rate cuts and a pause in balance sheet reduction, Bitcoin could have directly surged to $90,000 today. However, the reality is that the Federal Reserve has chosen a more conservative path, showing that it prioritizes inflation control over economic stimulus. This neutral-to-hawkish stance has limited the momentum for a Bitcoin reversal in the short term, but the "step back" of slower balance sheet reduction has still injected a glimmer of optimistic sentiment into the market.

Trump's Crypto Conference Speech: Policy Expectations Ignite the Market

Just as the FOMC meeting has just ended, Bitcoin is once again seeing positive news: Trump will announce a "major update" to his cryptocurrency strategy in tomorrow's DAS speech. This is the first time the current US President has participated in a cryptocurrency conference, which is of great significance. Since his 2024 campaign, Trump has been a staunch supporter of the crypto industry, promising to make the US the "crypto capital". After taking office, he quickly took action: on March 6, he signed an executive order to launch a strategic Bitcoin reserve plan based on seized assets; at the White House Crypto Summit on March 7, he further released positive signals. Now, his DAS speech is seen as a key node for policy implementation.

This "major update" may involve the expansion of national crypto reserves, the optimization of the regulatory framework, and even the integration of cryptocurrencies into the economic recovery plan. Trump mentioned Bitcoin, Ethereum, XRP, and others as reserve options in a Truth Social post on March 2, which had already triggered a round of price increases at the time. If he fulfills his promise tomorrow, such as clarifying the scale of the reserves or introducing tax incentives, it will inject long-term upward momentum into Bitcoin.

However, given Trump's history of "empty talk", the market should not have overly high expectations, as it remains to be seen whether the promises will be fulfilled.

Why Did Bitcoin Surge 5%? The Resonance of Liquidity and Confidence

Today's 5% increase is the result of the resonance of multiple factors. First, the FOMC meeting's slower balance sheet reduction has relieved the market. The reduction from $250 billion to $50 billion means a significant decrease in monthly liquidity withdrawal, easing liquidity pressure. Powell's neutral stance avoided hawkish panic, and the inflation concerns caused by tariffs strengthened Bitcoin's safe-haven properties. Secondly, the expectation of Trump's DAS speech has ignited speculative enthusiasm. Investors are looking forward to policy dividends and believe that the US may take a historic step in the crypto field.

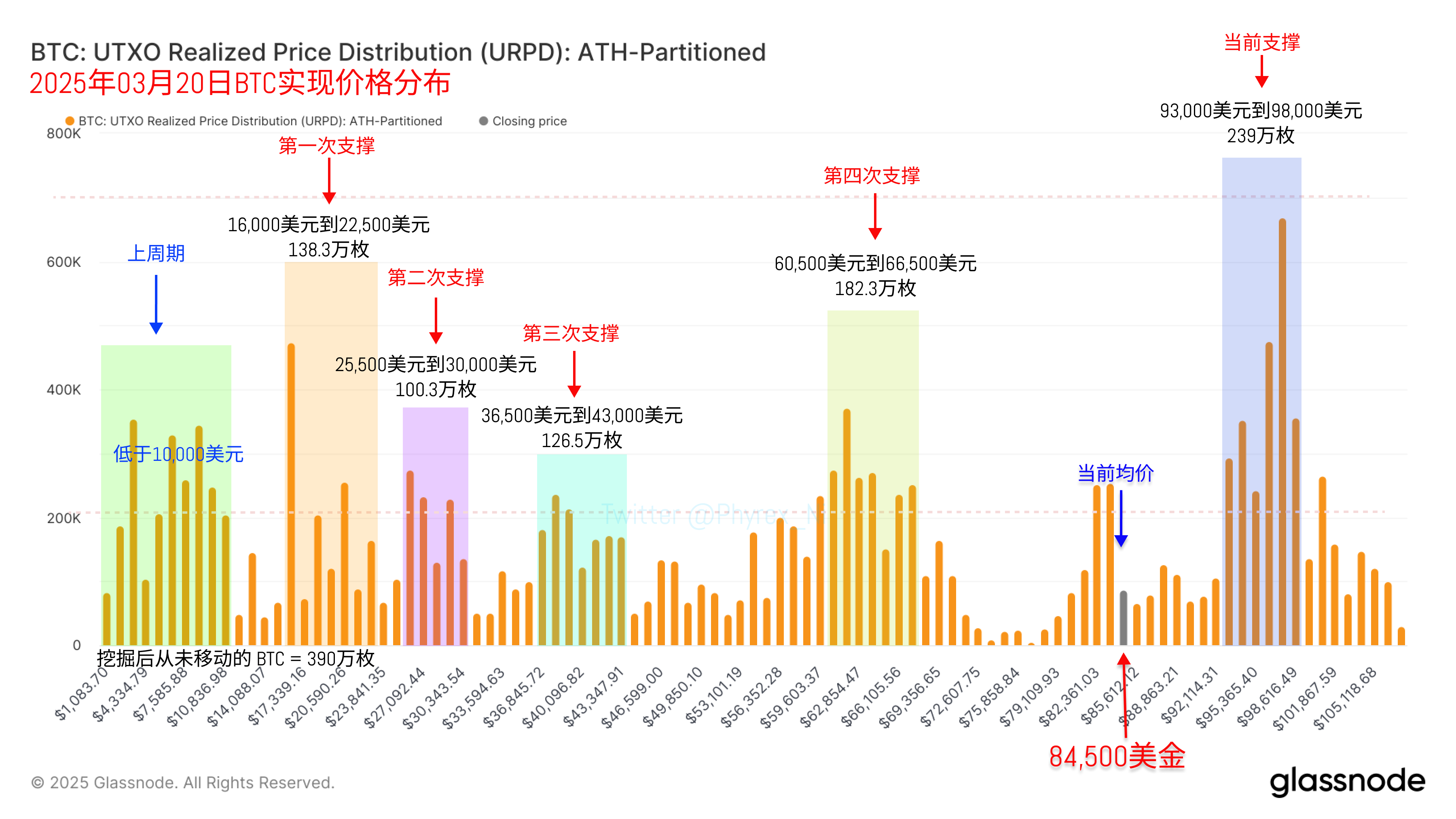

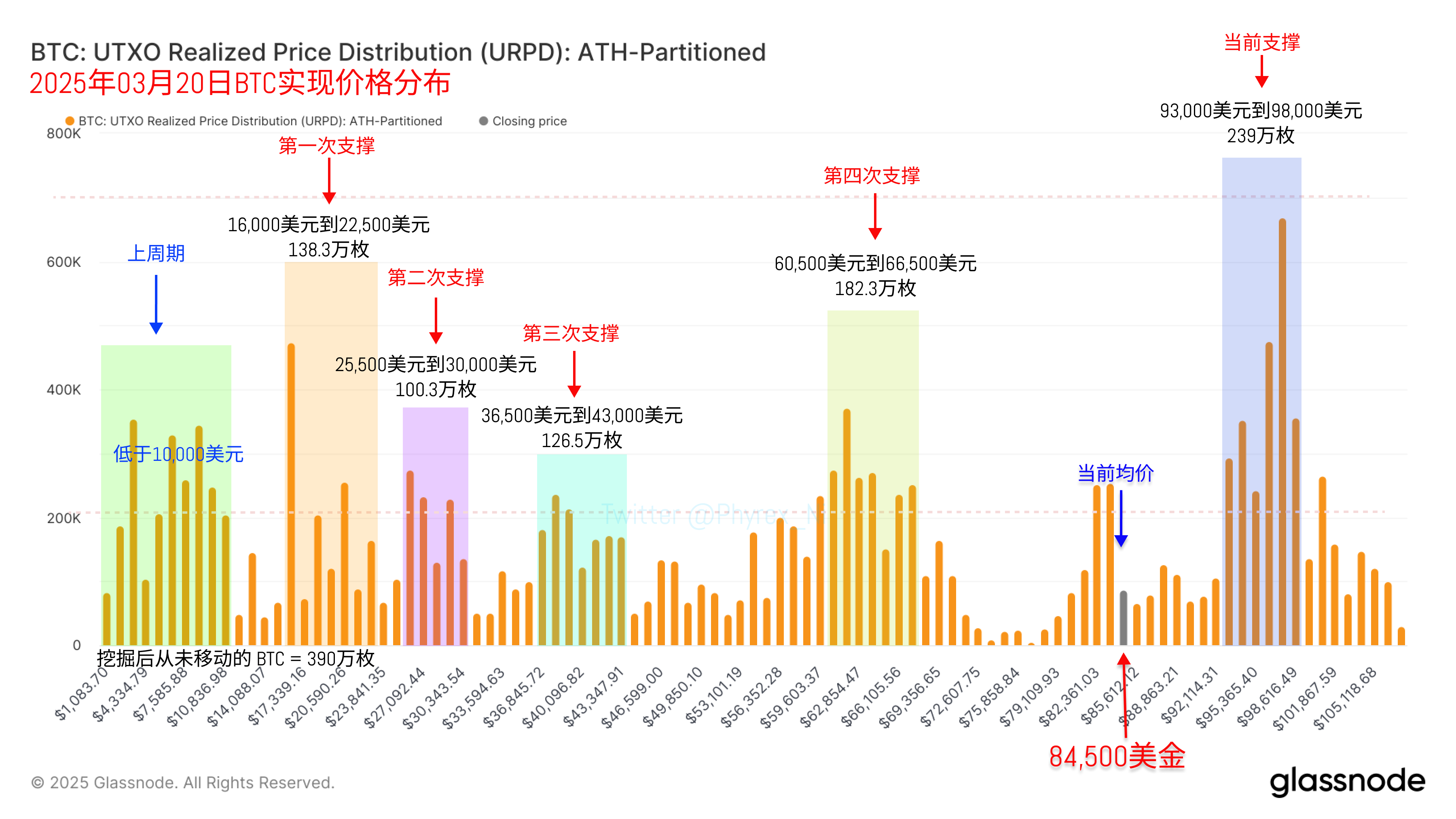

However, the data also reveals some calm signals. In the past 24 hours, Bitcoin's turnover rate has not increased but decreased, indicating that many investors are still waiting and are not rushing to trade on a large scale. The market seems to be waiting for the dual confirmation of the FOMC and Trump's speech, and short-term capital is maintaining restraint. The concentration area of $93,000 to $98,000 has not been threatened, and the sentiment of loss-making investors is also relatively stable. This suggests that the 5% increase is more driven by sentiment than the starting point of a full reversal.

source:@Phyrex_Ni

From a broader perspective, Bitcoin's "digital gold" property is fermenting. Tariffs pushing up inflation and slowing economic growth, these "stagflation" signs are precisely Bitcoin's stage. Coupled with Trump's policy endorsement, Bitcoin is both a speculative asset and a safe-haven choice, and today's rise is just a preliminary manifestation of this logic.

How Far Can the Rally Go? April Becomes a Key Node

This 5% rally is driven by the dual push of the FOMC and Trump's expectations, but whether it can be sustained remains uncertain. In the short term, the slowdown in balance sheet reduction and the potential positive impact of Trump's speech may continue the momentum of the rebound. If the speech tomorrow fulfills major commitments, such as clarifying the scale of Bitcoin reserves, Bitcoin may challenge higher levels. However, the market also needs to be wary of risks: if inflation gets out of control beyond expectations, the Fed may be forced to tighten; if Trump's policies fail, the gains may be quickly given back.

In the medium to long term, April will be a key node. The full manifestation of the tariff effect and the first-quarter GDP data will test the resilience of the economy. If growth continues to slow, the Fed may accelerate its easing, providing more room for Bitcoin; if inflationary pressures intensify, policy tightening may suppress risk assets. In addition, Bitcoin's trend has not yet shifted from "rebound" to "reversal". Powell acknowledged the slowdown in growth but was in no hurry to cut interest rates, and the tariff issue still troubles the Fed, which limits the establishment of reversal conditions.

Conclusion: Prelude or Climax?

In general, Powell's cautious balance yesterday gave the market a green light, the slowdown in balance sheet reduction ignited hopes for liquidity, and Trump's DAS speech tomorrow will give Bitcoin imaginative wings. Today's 5% surge is just a prelude, and the real drama will unfold tomorrow. If Trump fulfills expectations, Bitcoin may reach new highs; if it falls short, it may be a brief fireworks display. Regardless, this feast woven by monetary policy and crypto vision has just begun, and the upcoming economic data and policy details will determine Bitcoin's next destination. Let's wait and see.