VC is indeed dead, Web2 venture capital is unwilling to take risks, only investing after government-led industry funds, Web3 Seed rounds are not well-received, VC and FA are further reversely integrated, facing Binance startups has become an industry consensus, and all Insights and Memos have become Info in exchange for Yap.

From an overall perspective, more and more large VCs are starting to enter projects by issuing tokens, building the dreams of the primary market with the secondary market, which is different from the early equity investment, initial token offering (IXO), and equity/token dual-mode. The market is rapidly entering a mature stage, but it still needs to further sacrifice small VCs.

After CZ's comeback, with investment-oriented, education-as-slogan, and tweeting as the core, All In on BNB Chain Meme as the main business, Binance Labs was renamed YZi Labs on January 23, increasingly feeling like a Family Office.

The aversion to risk and the preference for investment stability are not only in the post-investment and mature stages, but also in the increasingly faded exploration color of the projects. Taking YZi Labs as an example, we can see the investment style of turning new money into old money, and learn in advance how to change the style after getting rich.

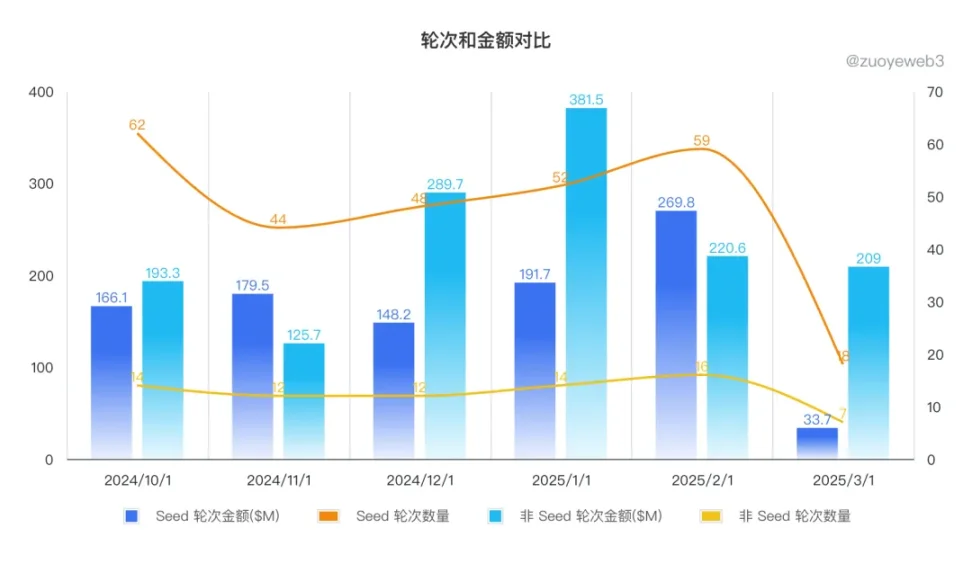

Data source: Decentralised Co., chart: @zuoyeweb3

Under normal circumstances, the seed round should have a large number, and the subsequent rounds should have larger amounts.

But from the data of the past half year, the number of seed rounds is not overwhelming compared to A/B/C rounds, and the amounts are also highly similar. The disappearance of crypto rounds is a reality, those who can get small money will continue to get small money, and those who cannot get money will never get it.

Investing in the AI cold season, speculating in the Meme on-chain season

Whether Web2 or Web3, AI is currently a bit cold, but CZ feels it's not enough and hopes it will continue to cool down before taking action, leaving only the most devout builders.

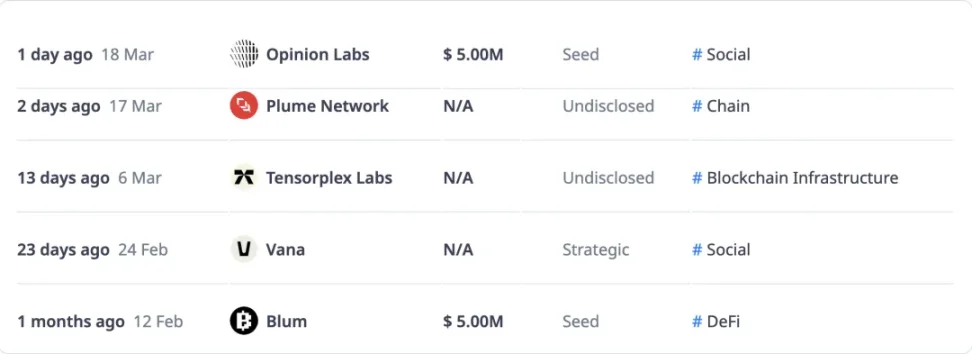

Caption: YZi's investment targets, image source: CryptoRank

However, YZi's direction does have AI. In fact, most projects can be connected to AI, so they can be divided into "using Crypto to do AI" like Vana and Tensorplex Labs, and "using AI to do Crypto" like Plume Network, Blum, and Opinion Labs.

Of course, this is a forced classification and has no guiding significance. In the era of AI-assisted postpartum care for mother pigs, there is no need to be too concerned about the necessity of AI.

In chronological order, let's review the characteristics of each project one by one.

1. Opinion Labs = Kaito + Polymarket

Opinion Labs is a so-called human opinion-driven prediction market. I boldly guess that the future development direction is based on the prediction and trading of Twitter KOLs, which can ride the InfoFi concept and the enduring trading attributes.

2. Plume Network = Everything is RWA

RWA is not a new concept, but Plume Network's experience is quite legendary. It received $30 million in financing from top institutions like Galaxy, and then chose to conduct an IEO on Gate in January this year, before receiving YZi's investment, causing a price surge.

Calm and flexible is the style honed in the crypto world, getting ahead with token issuance and subsequent financing is the opportunity given by the times.

3. Tensorplex Labs = LSD + AI

First, I believe decentralized AI is a false concept. Tensorplex Labs wants to use LSDfi to ensure the decentralization of LLM training and datasets, which has little productivity significance, but in the crypto world's eagerness to do something for AI, getting investment from institutions is not uncommon.

This has meaning for the future token price, after all, the product is the product, and the token price is the token price. Otherwise, ADA and XRP would be ashamed.

4. Vana = AI concept token that transcends cycles

It successfully landed on Binance Launchpool, having received investments from Polychain in 2021, Paradigm in 2022, Coinbase in 2024, and YZi Labs in 2025.

A very typical VC token from the previous cycle, it has no reference for current and future projects, we can only say that it's enviable.

5. Blum = The only seed player + trading

This is the most typical Binance Labs investment style, a trading-oriented DeFi product, and it is also a rare seed round player. The most surprising thing is that OKX and YZi have jointly invested, which can be said to be brothers who have gone through all the hardships, working together to go overseas.

Please forgive me for not providing too much introduction to the project mechanism and token economics, as it has no meaning. The basic elements of Meme, the difference between community and speculation group, and the role of token economics, I call them the three great unsolved mysteries of the crypto world.

Welcoming the family office aesthetics, stability above all

YZi is a typical case, and the domestic community is also quite familiar with it. But after the wealth creation wave of 17-21, Crypto New Money has gradually transformed into a family office-like Old Fashion financing institution, not pursuing super-high returns, but more concerned about project stability.

Two years earlier than CZ, the original contract king BitMEX founder Arthur Hayes established his own family office Maelstrom, with funds from Arthur's personal assets. Similar to CZ's recall of Ella Zhang, Maelstrom's daily operations are handled by former BitMEX executive Akshat Vaidya.

It turns out that Arthur Hayes can develop perpetual contract products more suitable for the constitution of crypto babies, and his investment aesthetics are also unique, such as the post-UST era stablecoin Ethena, which officially opens the first step of on-chain product rebate of exchange fees, and the DeFi cross-era product Pendle.

The complete story of Arthur Hayes will be presented in a later article, as he is more worth learning from than Sun Yuchen and CZ.

Similar to YZi, Maelstrom also pursues stability, such as not investing in Meme, but more in Meme-related tools and infrastructure like Time.Fun, highlighting that success is not judged by ROI, but by adhering to the stability-first style.

However, YZi's style is not yet fixed. In Binance Labs' past track record, getting projects listed on the Binance main site is an extremely attractive barrier, but now the landlord's pantry is also empty. By the end of 2024, they have started to transfer the invested project tokens to Gate, which ultimately bears all the responsibility.

Unlike Arthur Hayes, who can serve as the spokesperson for Ethena, CZ has not yet formed a deep bond with any project, and YZi has not formed its own investment aesthetics either. As mentioned earlier, Binance Labs is very fond of investing in trading-oriented products, but in the post-DeFi profiteering era, Ethena and Pendle will only be a minority, and most will be Crypto+AI sell-token projects, the leftovers of Web2 AI, the small pride of Web3 AI.

As it increasingly departs from the Binance ecosystem, YZi's true strength still needs to be tested by the market, and this particularly tests CZ's personal investment level. From his AI not yet cooled down, to the development of the $TRUMP and BNB Chain Meme ecosystem, I feel it's not as ingenious as his guidance of Ben Zhou in rejecting user withdrawals and precisely occupying the OKX DEX market share.

But this may also be because CZ really doesn't do trading, only trading platforms.

Conclusion

The world of yesterday is gone forever.

Crypto venture capital truly set sail in the IXO era, reaching its peak before the FTX collapse (I have to mention SBF every time, as he single-handedly changed the industry trend), and now it is only completing the exit process of its established investment projects, enduring the curses of retail investors, trying to finish issuing the tokens.

There was no crypto VC in the first place, but as more capital was invested, risks also emerged.