Author: 0xLouisT, L1D Partner; Translation: Jinse Finance xiaozou

Why do Altcoins crash? Because of high FDV (Fully Diluted Valuation)? Or because of CEX (Centralized Exchange) listing? Should Binance and Coinbase invest their treasury funds in new Altcoins through TWAP (Time-Weighted Average Price) strategy?

The real culprit is not something new; everything can be traced back to the crypto VC (Venture Capital) bubble of 2021.

In this article, we will analyze how we got to this point.

1. ICO Boom (2017-2018)

The crypto industry is essentially a liquidity industry - projects can issue tokens representing anything at any stage. Until 2017, most activities were concentrated in the public market, where anyone could buy directly through CEX.

Then came the ICO bubble, an era of crazy speculation, a moment hijacked by scammers. Its end was like all beautiful bubbles: lawsuits, fraud, and regulatory impact. The U.S. Securities and Exchange Commission (SEC) intervened, making ICOs effectively illegal. Founders wanting to avoid the U.S. court system had to seek alternative fundraising methods.

2. VC Boom (2021-2022)

With retail investment cut off, founders turned to institutional investors. From 2018 to 2020, crypto VC gradually grew - some companies were pure VCs, others were hedge funds allocating a small portion of AUM to VC investments. At the time, investing in Altcoins was contrarian - many believed their value would eventually go to zero.

Then 2021 arrived. The bull market caused VC portfolios (book value) to skyrocket. By April, funds had grown 20 to 100 times. Crypto VC suddenly looked like a money printing machine. LPs (Liquidity Providers) flooded in, eager to catch the next opportunity. Companies raised new fund sizes 10 or even 100 times their previous size, all believing they could replicate those massive returns.

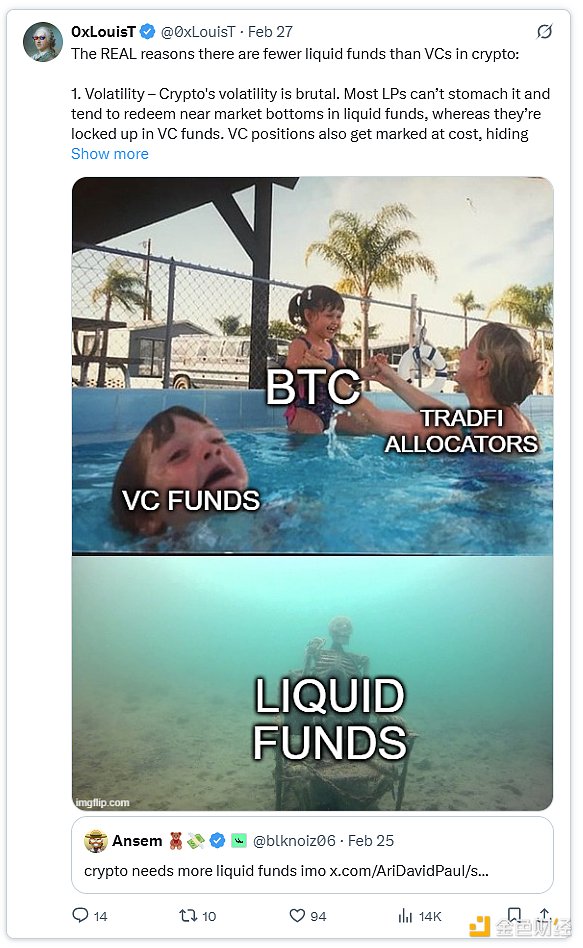

Of course, there are psychological reasons explaining why VCs were so popular with LPs, which I have discussed in previous articles.

3. Aftermath (2022-2024)

Then came 2022: Luna, 3AC, FTX, and other events caused billions of dollars in book gains to evaporate overnight. Contrary to popular belief, most VCs did not sell at the top. They experienced the crash like everyone else. Now, they face two huge challenges:

● Frustrated LPs: LPs who once cheered for 100x returns now demand exits, forcing funds to reduce risk and realize early profits.

● Excess Capital: VCs have more idle funds than quality projects. Many funds did not return funds to LPs but instead invested in projects without economic meaning, just to deploy remaining funds to meet threshold requirements and potentially raise funds for the next fund.

Most crypto VCs are now in trouble - unable to raise new funds, holding a pile of low-quality projects destined to "go to zero with high FDV". Under LP pressure, VCs have transformed from long-term vision holders to short-term exit seekers, constantly selling large VC-backed token (Alt L1, L2, infrastructure tokens) at unreasonable valuations they helped create.

In other words, the motivations and timeframes of crypto VCs have significantly changed:

● In 2020, VCs were contrarian, cash-poor long-term thinkers.

● In 2024, they are crowded, cash-rich, and short-term profit-oriented.

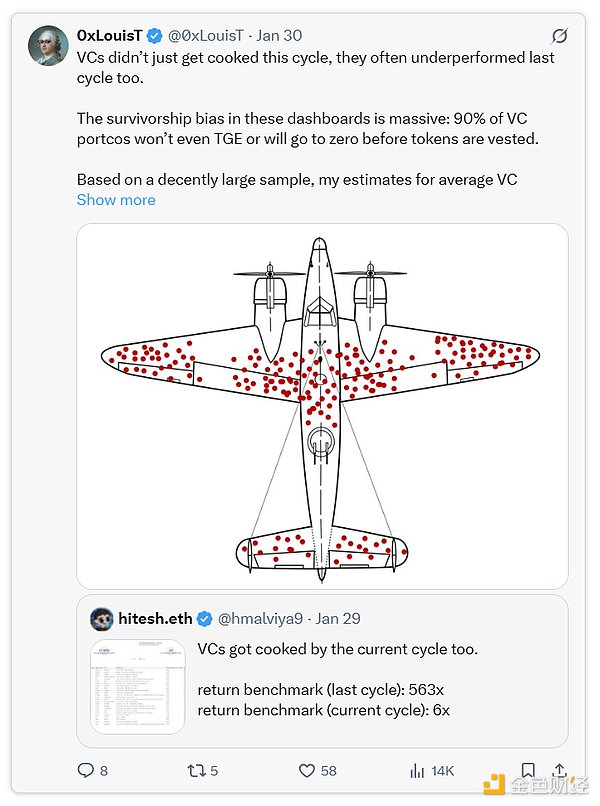

I believe most VC investments from 2021-2023 performed poorly. VC returns follow a power-law distribution, with a few winners making up for losers. But being forced to sell early will distort the final outcome, leading to overall weaker performance.

If you want to know more about average VC returns, I have written the following article:

No wonder founders and communities are increasingly skeptical of VCs. Their incentives and timelines are misaligned with founders' goals, leading founders to turn to community-driven fundraising and liquidity funds supporting tokens long-term, rather than choosing VCs.

4. Evaluating Liquidity/VC Cycle

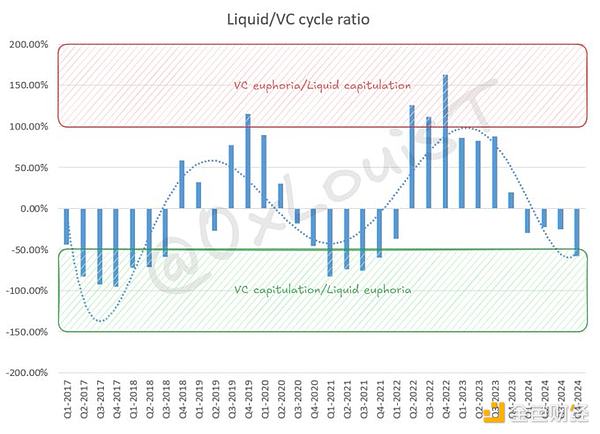

Tracking fund flows between VC and liquidity markets is crucial. I use an indicator to assess the state of the VC market. This indicator is not perfect but very useful.

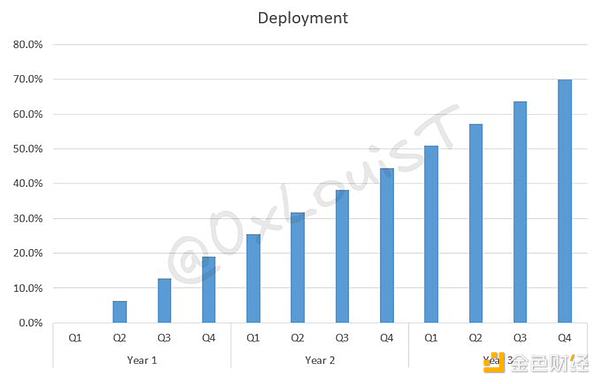

I assume VCs linearly deploy 70% of their funds within three years - which seems to be the trend for most VCs.

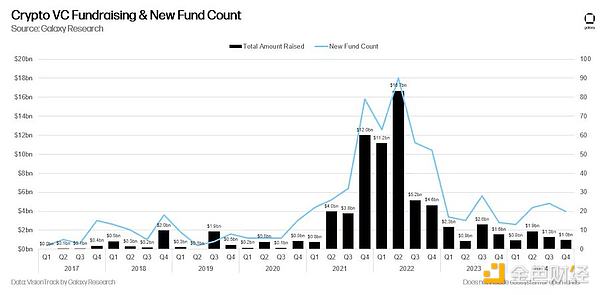

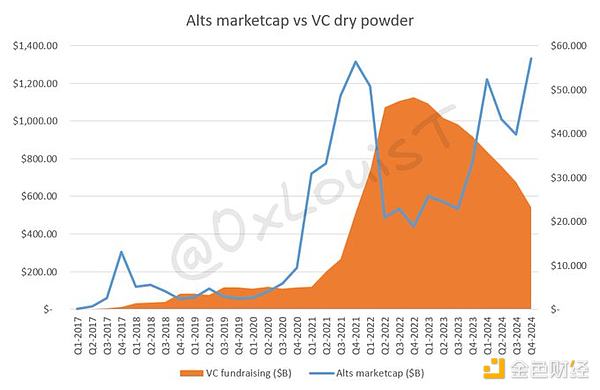

Using Galaxy Research's VC fundraising data, I apply a weighted sum method, considering the deployment rate over 16 quarters. This method can assess the remaining idle funds in the system. In the fourth quarter of 2022, about $48 billion in VC funds were idle.

Next, I compare the quarterly remaining VC idle funds with TOTAL2 (crypto market cap excluding Bitcoin). Since VCs typically invest in Altcoins, this is the best assessment method. If there are too many idle VC funds relative to TOTAL2, the market will not be able to absorb future Token Generation Events (TGEs). Normalizing this data reveals the cyclicality of the liquidity/VC ratio.

Usually, being in the "VC euphoria" area indicates that the risk-adjusted returns of the liquidity market outperform VCs. The "VC capitulation" area is more complex - it may signal VC withdrawal or an overheated liquidity market.

Like all markets, crypto VC and liquidity markets follow cyclical patterns. The excess capital of 2021/2022 is rapidly depleting, making fundraising more difficult for founders. Cash-strapped VCs are becoming more selective in deals and terms.

5. Conclusion

● VCs have performed poorly in recent investments and are turning to short-term selling to return funds to LPs. Many well-known crypto VCs may not survive in the coming years.

● The misalignment between VCs and founders is driving founders to seek alternative funding sources.

● Oversupply of VC capital has led to poor fund allocation.