Today, the crypto community was hit by a heavy hammer and was dizzy. Binance issued an announcement, exposing that a market maker of the Movement (MOVE) project illegally sold 66 million tokens, making a net profit of 38 million USDT, and directly froze its profits and kicked it out. A few hours later, the Movement Network Foundation jumped out to respond, saying that it had no knowledge of the matter, had recovered the money, and promised to buy back MOVE on Binance in the next three months to save the situation. These two statements were like a double whammy, pushing MOVE to the forefront.

But the community didn’t buy it. Long before that, the KOL“Ice Baby” threw out “Seven Questions to Movement”, using on-chain data to nail the project to the pillar of shame. What happened? Today, we sort out the timeline, review Binance’s iron fist, Movement’s response, and the community’s anger, and see how much shady dealings this storm has revealed and how many questions it has left.

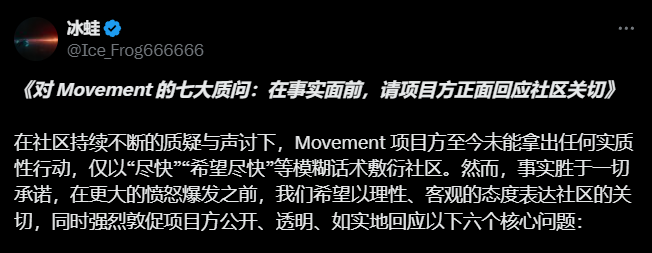

Bingwa's manifesto: the flashpoint of community anger

In the early morning of March 24, an article titled "Seven Questions to Movement: In the Face of Facts, Please Respond Positively to Community Concerns" on the X platform went viral in the crypto community. The author "Bingwa" listed seven "sins" like a detective with Dune data and on-chain addresses: airdrop shrinkage, short claim time, online ticket delay, OTC selling, new wallet anomalies, cross-chain bridge lockup, and evasive response. Each one of them was like a knife stabbing into the heart of the community.

The airdrop reduction was the trigger. Movement promised an initial release of 10%, but the actual amount received was only 0.6%, and more than 90% of wallets received nothing. Bingwa threw out the data and asked: "Is this promise a scam or a deliberate trick?" The claim time was even more outrageous, opening at 19:35 on December 9 and closing at 10:00 on the 10th, only 10 hours, and adding a gas fee threshold in the middle, which was shorter than the industry practice and seemed like a joke. Bingwa suspected that this was a trick by the project party to deliberately issue fewer tokens. What's even more infuriating is that he found out that the related addresses were frantically claiming, buying tens of thousands of tokens, and the evidence on the chain was clearly there.

Delayed launch has become commonplace. From January 15 to the end of March, there were four delays, and the price of the currency plummeted after each announcement, with the worst drop of 37%. Bingwa asked angrily: "Is the technology not good enough, or is it intentional fraud?" OTC selling is also not clean. He listed 17 addresses, and more than 100 million US dollars of tokens flowed to market makers before the airdrop. New wallet anomalies, cross-chain bridge locked 40 million US dollars, and only said "as soon as possible" in the face of doubts, all of which made the community explode. At the end of the manifesto, Bingwa shouted: "We want the truth, don't be perfunctory!" This fire directly pushed Movement to the cusp of the storm.

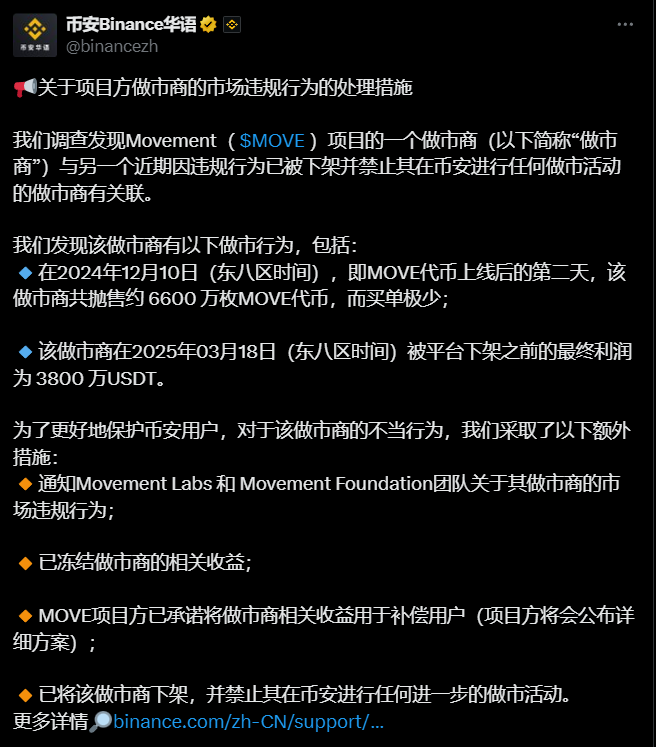

Binance’s Big Punch: Market Maker Scandal Blows Up

Less than 24 hours after Bingwa's post was published, Binance delivered a heavy blow on March 25. The announcement stated that they had found a market maker that violated regulations, which not only harmed MOVE but also other tokens. This guy sold 66 million MOVE on December 10, 2024 (the day after TGE), and almost never placed buy orders, making a net profit of 38 million USDT until he was kicked out by Binance on March 18. The exchange took decisive action: freezing the earnings, delisting the market maker, prohibiting it from operating again, and requiring Movement to use the money to compensate users.

This announcement was like a stamp of approval for Bingwa's manifesto. The OTC sell-off and the questioning of the abnormality of the new wallet were seamlessly connected with the illegal operations disclosed by Binance. Someone on X joked: "Is Bingwa a prophet, or did Binance take action after reading his post?" In any case, Binance's hammer escalated the storm from a community quarrel to a major industry case. The community applauded, but some people squinted their eyes: Who is this market maker? How did the 38 million come from? Movement really doesn't know?

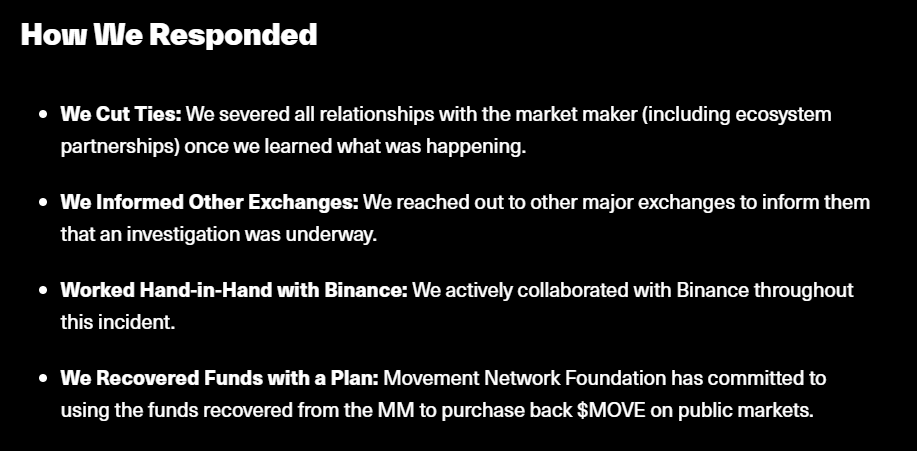

Movement responds: 38 million buybacks to save the day

Faced with the double attack, Movement could not sit still. On March 25, the Movement Network Foundation issued a statement, busy putting out the fire. They first distanced themselves from the matter, saying that they only learned from Binance on March 11 that the market maker violated the rules, and they were completely in the dark. This guy sold off a lot after the TGE, violating the two-way liquidity agreement. As soon as the foundation found out, it cut off contact, cooperated with Binance in the investigation, and notified other exchanges.

The highlight is the solution. The foundation recovered $38 million and promised to repurchase MOVE on Binance in the next three months to build a "Movement Strategic Reserve". The purchased tokens will be transferred to the official wallet (address: 0xA14C8e3eBb2Da43d027dC2c1b763387B9D59cACe), and the whole process is transparent. They also thanked Binance for the investigation and vowed that the technology, team, and vision have not changed, and they want to create a "trustworthy ecosystem." This statement is like a fire-fighting notice, which wants to appease the community while leaving a way out for themselves. But this response only touched on "OTC selling" among Bingwa's seven questions, and the other six seemed to be ignored. The community directly called it "avoiding the important and focusing on the trivial."

Community outcry: Web3port is the bullseye

After Bingwa's post and Binance's announcement, the community was completely blown up, and new clues surfaced. Someone summarized the information and named the market maker as Web3port, which not only messed up MOVE, but also Goplus and Myshell. The community was stunned: How did this guy sign so many projects? He made 38 million from MOVE alone, how many more have not been exposed? Some people lamented that the entire crypto seemed to be working for market makers, and the 38 million profit sounded like an extra zero. Binance's move this time seemed to be sharpening its knife to deal with the big players, and retail investors clapped their hands and hoped to get some "land".

Some people even compared Web3port to a vampire, saying that it only sold and did not buy after the TGE, making a lot of money, while retail investors watched the price of the currency plummet. They contacted the Movement team, and they shouted "shocked", but the community did not buy it, pointing out that this market maker is a habitual offender and has used this trick in other projects before.

What’s even more shocking is that on March 22, the Shenzhen Meetup of Movement was questioned by the police. The co-founder @coopsmoves explained on the spot that the delay of the mainnet and the low price of the coin made the community angry, and some people threatened to call the police. Someone broke the news that the market maker on the surface was GSR, but behind it might be a shadow market maker in Singapore with strong funds. After being blacklisted by Binance, it changed its vest and continued to work. The community called on Binance to conduct a strict investigation and dig out these "worms", otherwise the Altcoin market will always be in a mess.

Timeline and doubts: the fog behind the chaos

Let’s take a look at the timeline:

- On December 9, 2024, the MOVE airdrop was launched, with a 10-hour window and a 0.6% claim rate. The community started to complain;

- On December 10, market makers sold 66 million MOVE tokens and earned 38 million USDT.

- From January to March 2025, the mainnet was delayed four times and the price of the coin collapsed;

- On March 11, Binance notified of the violation;

- On March 24, Bingwa's post sparked public opinion;

- On March 25, Binance’s announcement and Movement’s response were released.

In this scene, Bingwa lit the fire, Binance added fuel, and Movement put out the fire, but the fog has not yet dissipated.

Question 1: Did Movement really not know about it? Market makers sold 66 million and earned 38 million, but the project side didn’t hear anything? The community suspects it was a double act.

Question 2: Is 38 million repurchases enough? More than 400,000 per day for three months, can it save the price of the currency or just stabilize sentiment?

Question 3: How far does Web3port’s evil hand extend? MOVE is just the tip of the iceberg, how many other projects are there yet to be exposed?

Question 4: What should we do with Bingwa’s other questions? The airdrop has shrunk, the cross-chain bridge has locked 40 million, and Movement has turned a deaf ear to it. How long can the community tolerate this?

Industry response and the crossroads of MOVE

This storm is not just a one-man show for MOVE. Binance's iron fist has won the community's applause, but also sounded the alarm: market maker chaos, airdrop fraud, project dishonesty, the old problems of the crypto circle have been exposed again. Some people called on Binance to strictly investigate the projects that Web3port has served and rectify the VC Altcoin market, otherwise the "altcoin bull market" will always be a dream. Retail investors are holding their breath, hoping that the exchange will take another heavy punch to drive out the vampires.

What about MOVE? The road ahead is not easy. The 38 million repurchase is like a tranquilizer, which can give a short-term breath, but if the mainnet is not launched, the technology is not strong, and the transparency is not enough, the fire in the community will burn again sooner or later. Bingwa's manifesto is like a sword hanging over his head. Trust cannot be restored until the seven major questions are answered. Bingwa started this drama, Binance pushed it, and Movement is still playing it. But whether the ending is a turnaround or a car crash depends on whether the project dares to lift the lid and expose the truth to the sun. Let's hold the melon and watch it, it's still early for this big drama.